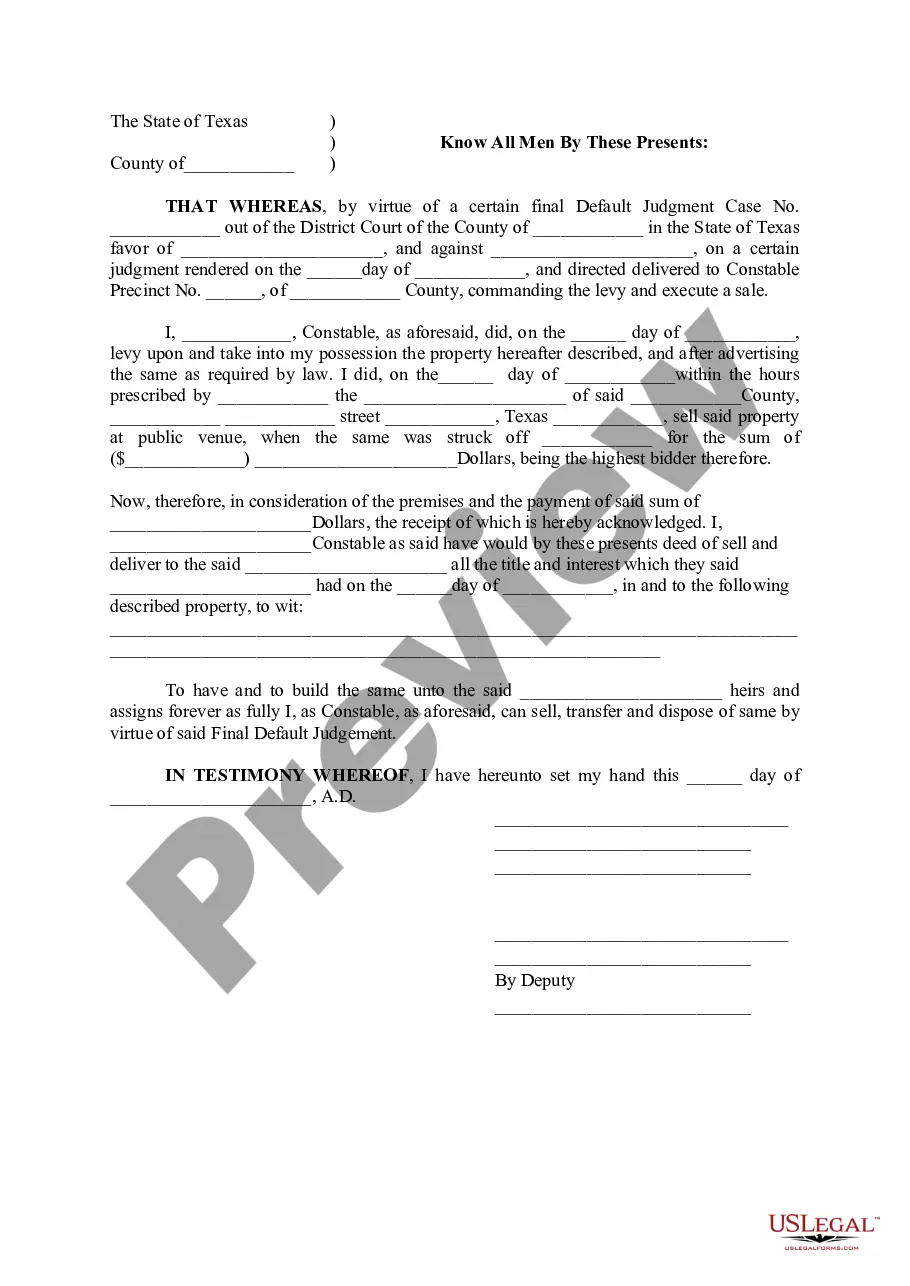

Odessa Texas Writ Second to Financial Institution is a legal process that involves the granting of a secondary lien on a property to a financial institution. This lien is registered with the county clerk's office in Odessa, Texas, and serves as collateral for a loan or financial agreement between the property owner and the institution. The primary purpose of an Odessa Texas Writ Second to Financial Institution is to secure the financial institution's interests in case the property owner defaults on their loan or agreement. By having a secondary lien on the property, the institution has the right to sell or foreclose the property to recover their investment. In Odessa, there are different types of Writ Second to Financial Institution, depending on the nature of the financial agreement. Some common types include: 1. Mortgage Writ Second: This type of writ is typically associated with mortgage loans. It secures the lender's interest in the property as collateral for the loan. If the borrower fails to make payments or defaults on the loan, the lender can initiate foreclosure proceedings. 2. Home Equity Loan Writ Second: Odessa homeowners can obtain a home equity loan using their property's equity as collateral. In this case, the financial institution will file a Writ Second to secure their interest in case of default. This type of writ is popular among homeowners looking to access funds for home improvements or other financial needs. 3. Commercial Property Writ Second: Financial institutions also offer lending solutions for commercial properties in Odessa. A commercial property Writ Second functions similarly to residential mortgages, but it applies to non-residential properties. It gives the lender the right to foreclose or sell the property in the event of default. When considering an Odessa Texas Writ Second to Financial Institution, it is crucial for both the borrower and the financial institution to understand their rights and responsibilities. The process involves legal documentation and compliance with local laws, so it is recommended to seek legal advice to ensure a smooth and legitimate transaction. Overall, an Odessa Texas Writ Second to Financial Institution is a legal mechanism that provides financial institutions with security for their loans by establishing a secondary lien on a property in Odessa, Texas. It serves as protection for lenders in case borrowers fail to meet their financial obligations, and various types of writs exist depending on the specific financial agreement and property type.

Odessa Texas Writ Second to Financial Institution

Description

How to fill out Odessa Texas Writ Second To Financial Institution?

If you are searching for a valid form, it’s difficult to find a more convenient service than the US Legal Forms site – one of the most comprehensive libraries on the web. With this library, you can get a large number of document samples for business and individual purposes by types and states, or keywords. With our high-quality search feature, discovering the most up-to-date Odessa Texas Writ Second to Financial Institution is as easy as 1-2-3. Moreover, the relevance of each document is verified by a team of skilled attorneys that regularly check the templates on our website and update them according to the newest state and county demands.

If you already know about our platform and have a registered account, all you should do to get the Odessa Texas Writ Second to Financial Institution is to log in to your user profile and click the Download option.

If you use US Legal Forms the very first time, just follow the guidelines below:

- Make sure you have opened the sample you need. Check its information and use the Preview option to see its content. If it doesn’t meet your requirements, use the Search option near the top of the screen to get the proper document.

- Confirm your choice. Click the Buy now option. Next, select the preferred subscription plan and provide credentials to sign up for an account.

- Process the financial transaction. Use your bank card or PayPal account to finish the registration procedure.

- Get the template. Pick the format and download it on your device.

- Make changes. Fill out, revise, print, and sign the received Odessa Texas Writ Second to Financial Institution.

Each template you add to your user profile does not have an expiration date and is yours forever. It is possible to gain access to them via the My Forms menu, so if you need to get an additional version for editing or printing, you can return and export it once more at any moment.

Make use of the US Legal Forms professional library to get access to the Odessa Texas Writ Second to Financial Institution you were seeking and a large number of other professional and state-specific templates on one website!