Pasadena Texas Writ Second to Financial Institution is a legal process that allows a creditor to secure payment on outstanding debts owed to a financial institution by placing a lien on the property of the debtor. This lien ensures that the debt will be paid when the property is sold or transferred. Pasadena, Texas, is home to several types of Writ Second to Financial Institution, and these can vary based on the specific circumstances of the debt and the type of financial institution involved. Some common types include: 1. Mortgage Writ Second to Financial Institution: This type of writ is commonly used by mortgage lenders when a homeowner defaults on their mortgage payments. The mortgage lender can file a Writ Second to Financial Institution to secure repayment of the outstanding debt by placing a lien on the property. 2. Auto Loan Writ Second to Financial Institution: When borrowers fail to make payments on their auto loans, the lenders can file a Writ Second to Financial Institution to place a lien on the vehicle. This gives the lender the right to seize the vehicle if the debt is not repaid. 3. Personal Loan Writ Second to Financial Institution: Financial institutions that provide personal loans can also utilize a Writ Second to Financial Institution when borrowers default on their loan payments. This allows the lender to place a lien on the borrower's property, such as their home or other valuable assets. 4. Business Loan Writ Second to Financial Institution: In the context of business loans, financial institutions can file a Writ Second to Financial Institution to secure repayment from businesses that default on their loan obligations. This allows the lender to place a lien on the business assets, such as property, equipment, or inventory. It's important to note that the specific laws and procedures surrounding Writ Second to Financial Institution may vary in Pasadena, Texas, depending on state and local regulations. It is recommended to seek legal advice or consult with a financial institution for detailed information and guidance specific to individual cases.

Pasadena Texas Writ Second to Financial Institution

Description

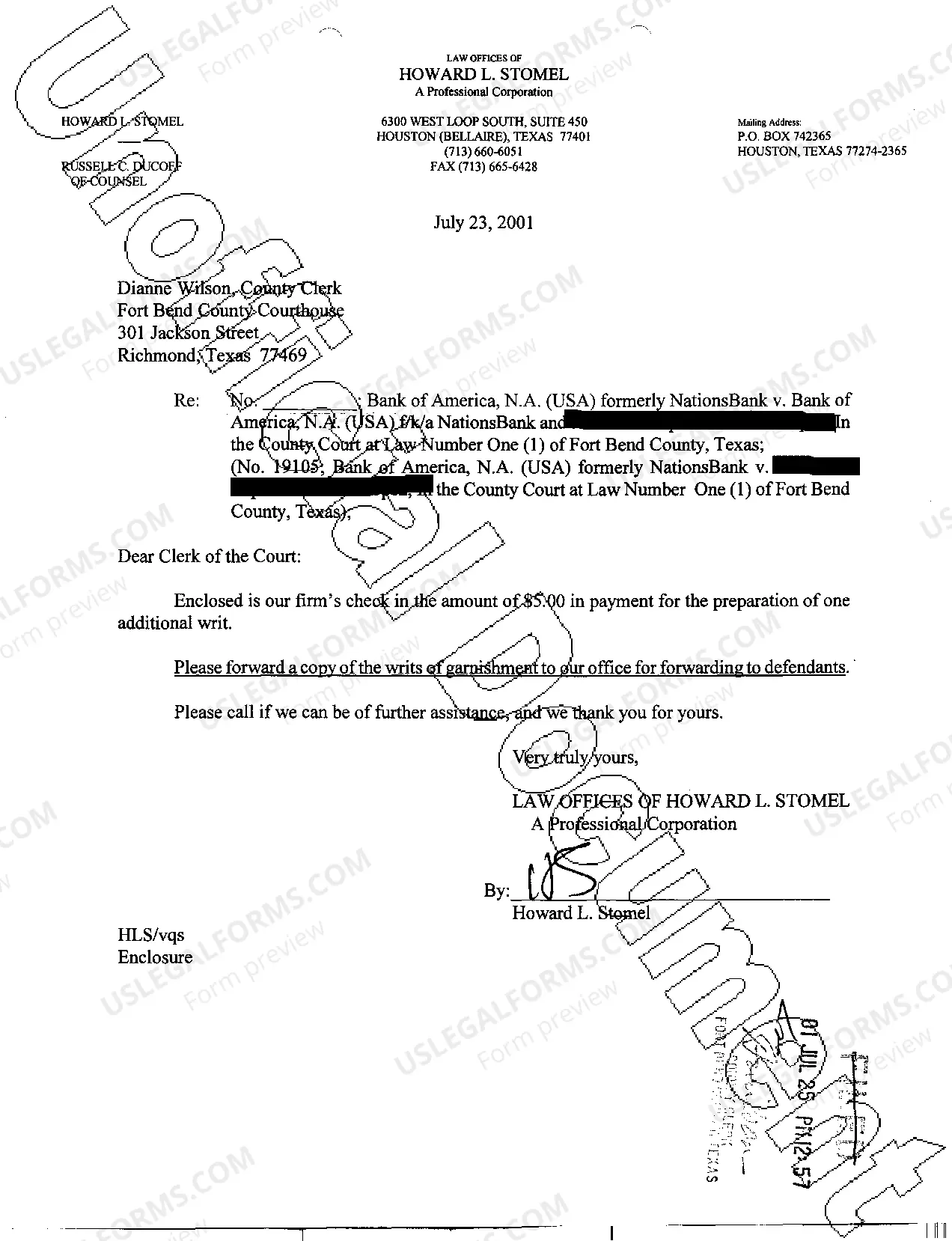

How to fill out Pasadena Texas Writ Second To Financial Institution?

Finding authenticated templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms collection.

It’s an online repository of over 85,000 legal documents for both personal and professional purposes along with various real-world situations.

All the forms are aptly categorized by usage type and jurisdiction areas, making the task of finding the Pasadena Texas Writ Second to Financial Institution as simple as pie.

Maintaining documents organized and compliant with legal standards is extremely important. Utilize the US Legal Forms library to always have crucial document templates for any requirements right at your fingertips!

- Examine the Preview mode and form description.

- Ensure you’ve selected the correct one that fulfills your needs and aligns completely with your regional jurisdiction criteria.

- Look for another template, if necessary.

- If you notice any discrepancies, use the Search tab above to locate the appropriate one. If it meets your needs, proceed to the next step.

- Complete the purchase of the document.

Form popularity

FAQ

In Texas, a bank account can be garnished under a writ of execution, but creditors typically must provide notice to the account holder before doing so. This legal process aims to protect consumers from unexpected financial surprises. If you're concerned about securing your funds, learning more about the Pasadena Texas Writ Second to Financial Institution can help you understand your rights and options better.

In Texas, you typically have a post-judgment timeframe of 10 years to file a writ of execution. This limit allows you to enforce a judgment against a debtor. However, it is important to act promptly to ensure you can recover your funds effectively. For specific cases regarding a Pasadena Texas Writ Second to Financial Institution, consulting with a legal professional can provide guidance tailored to your situation.

Serving a writ of execution in Texas involves delivering it to the appropriate law enforcement officers, who will then carry out the orders. It's vital to follow state laws closely to ensure proper execution. Utilizing platforms like uslegalforms can make this process smoother by providing the necessary forms and guidance related to the Pasadena Texas Writ Second to Financial Institution.

A writ of execution is a court order that allows for the enforcement of a judgment. Essentially, it authorizes law enforcement to seize assets to satisfy a debt. Understanding the Pasadena Texas Writ Second to Financial Institution can help you navigate this process effectively, ensuring that legal protocols are followed and rights are upheld.

To obtain a writ of assistance in Texas, you need to file a motion with the court that issued your original judgment. The court will review your request and may grant the writ if it aligns with the legal criteria. Using resources like uslegalforms can simplify the documentation process and ensure compliance with the Pasadena Texas Writ Second to Financial Institution regulations.

In Texas, a writ of possession is typically served by a sheriff or constable. This process involves delivering the writ to the occupant of the property. When dealing with the Pasadena Texas Writ Second to Financial Institution, it's important to ensure that the legal requirements are met to avoid delays. This method ensures lawful enforcement and helps parties involved understand their rights.

To file a motion for a writ of possession, you need to prepare and file a motion with the court that includes evidence of your ownership and the circumstances leading to your request. The court will then review your motion and may issue the writ if you demonstrate a clear right to possession. Familiarizing yourself with this process is crucial for reclaiming property efficiently. Uslegalforms can assist you in drafting the necessary documents for your motion.

The purpose of a writ of execution is to enforce a court judgment by allowing the creditor to seize property or assets from the debtor. It serves as a legal tool for creditors to ensure they receive payment as ordered by the court. Effective use of this writ can significantly aid in debt recovery. Uslegalforms can provide you with helpful documentation and advice related to the Pasadena Texas Writ Second to Financial Institution.

A writ of garnishment targets a third party, usually a financial institution, to withhold funds from a debtor's account. In contrast, a writ of execution allows for direct seizure of the debtor's property to satisfy a judgment. Understanding these differences can help you choose the right approach for your situation. To clarify these concepts further, consider resources available through uslegalforms.

To serve a writ of execution in Texas, you must provide the document to the appropriate law enforcement agency for enforcement. The agency will then carry out the writ according to the court's order. Following the proper legal channels ensures compliance and smooth execution of the writ. For thorough guidance, uslegalforms offers resources to help you navigate the intricacies of serving a writ of execution.

Interesting Questions

More info

The U.S. banking arm of Swiss bank UBS, Pasadena is one of a handful of places in the U.S. that offer checking accounts as part of the service. One of our picks: UBS Investment Bank PULSE Service () Phone: Fax: Pasadena No ChexSystems Bank. There have been some recent reports in Pasadena that one of our Bank of America accounts was flagged for inappropriate activity. When we called customer service to report the situation, they offered us a 99 fee to resolve the issue. When we applied for the account it was approved in 24 business hours. That said, not everything was 100% free. Our first-rate customer service rep did a great job in assisting us. However, the 150 processing fee was a real deterrent. The key to keeping online banking at Pasadena banks hassle-free is having a good financial advisor. Here are seven great Pasadena financial advisors to check out. (More below.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.