Title: Pearland, Texas Writ Second to Financial Institution: A Comprehensive Overview Introduction: Located in the southern part of the Houston metropolitan area, Pearland, Texas is a thriving city known for its diverse economic landscape and strong financial sector. In this article, we will delve into the concept of Pearland's writ second to financial institution, exploring its various types and shedding light on its significance in the local community. Types of Pearland Texas Writ Second to Financial Institution: 1. Mortgage Liens: Pearland homeowners may obtain a writ second to their financial institution in the form of a mortgage lien. This legal document serves as a security interest, allowing financial institutions to claim ownership or sell the property in case of non-payment or default. 2. Judgments and Collections: In Pearland, individuals or businesses encountering legal issues may receive a writ second to financial institutions in the form of a judgment or collection. This writ enforces payment by allowing financial institutions to seize assets or garnish wages to satisfy outstanding debts. 3. Tax Liens: Pearland also implements writs second to financial institutions in the form of tax liens. If individuals or businesses fail to pay their taxes, the government may issue a tax lien, enabling the financial institution to claim the debtor's property or assets to recover the owed amount. Significance of Pearland Texas Writ Second to Financial Institutions: 1. Protection of Financial Interests: These writs second to financial institutions play a vital role in safeguarding the interests of lenders, mortgage providers, and other financial entities. By allowing the enforcement of liens and judgments, financial institutions can protect themselves from potential financial losses. 2. Encouraging Responsible Borrowing: The existence of writs seconds to financial institutions in Pearland encourages individuals to fulfill their financial obligations promptly. This, in turn, stimulates responsible borrowing behavior, promoting stability within the local economy. 3. Ensuring Collection of Unpaid Debts: Writs second to financial institutions enable timely collection of unpaid debts, minimizing the negative impact on financial institutions. This aids in maintaining the financial health and liquidity necessary for the prosperity of Pearland's financial sector. Conclusion: Understanding the various types of Pearland Texas writ second to financial institution is crucial for both individuals and businesses. These legal instruments not only protect the interests of financial institutions but also contribute to responsible borrowing and the overall stability of the local economy. Whether in the form of mortgage liens, judgments and collections, or tax liens, the implementation of these writs reflects Pearland's commitment to a fair and efficient financial system.

Pearland Texas Writ Second to Financial Institution

Description

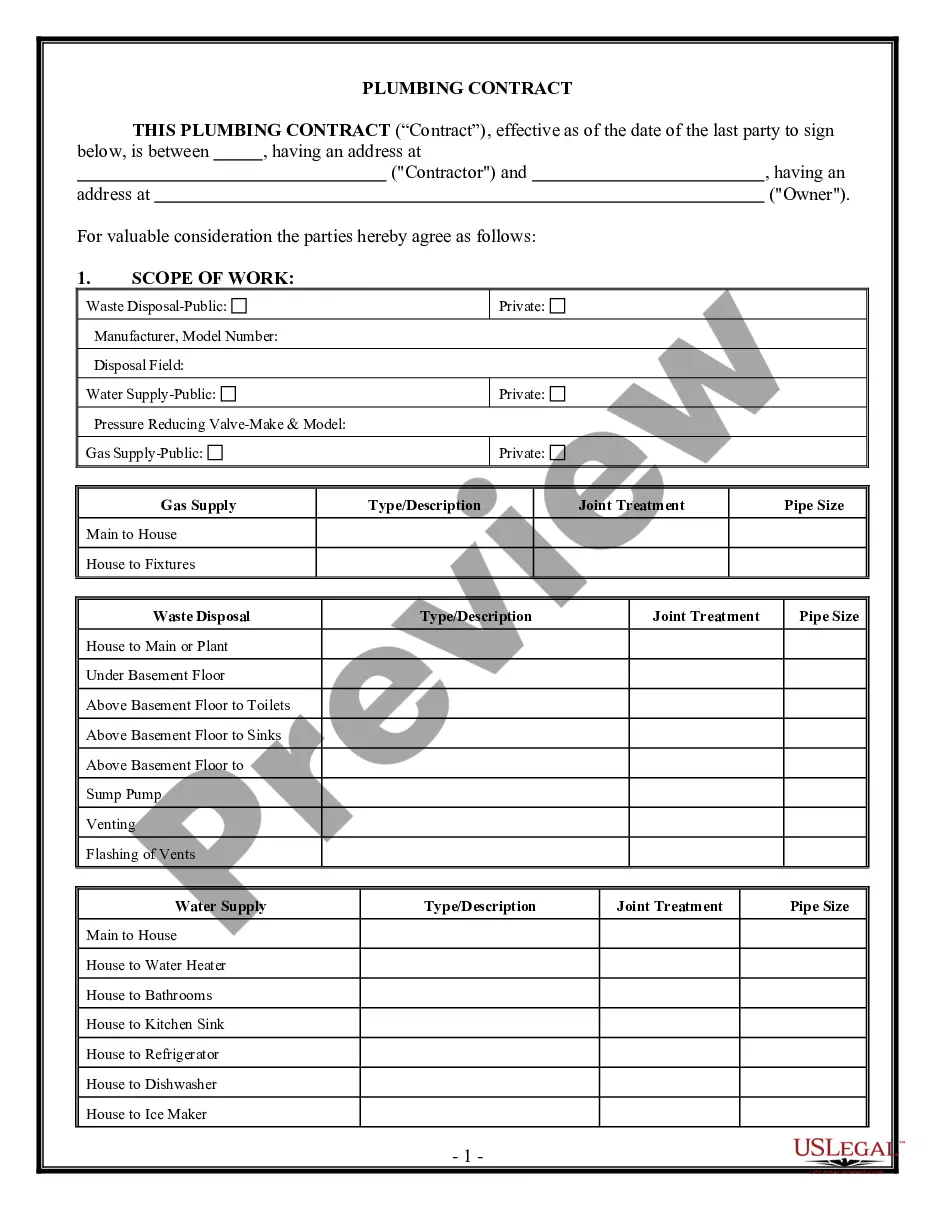

How to fill out Pearland Texas Writ Second To Financial Institution?

No matter the social or professional status, completing legal documents is an unfortunate necessity in today’s world. Very often, it’s practically impossible for a person without any legal education to draft this sort of papers from scratch, mostly due to the convoluted jargon and legal nuances they involve. This is where US Legal Forms comes to the rescue. Our platform offers a huge catalog with more than 85,000 ready-to-use state-specific documents that work for practically any legal scenario. US Legal Forms also is an excellent asset for associates or legal counsels who want to save time using our DYI tpapers.

No matter if you need the Pearland Texas Writ Second to Financial Institution or any other document that will be good in your state or area, with US Legal Forms, everything is on hand. Here’s how to get the Pearland Texas Writ Second to Financial Institution quickly employing our trusted platform. In case you are presently an existing customer, you can proceed to log in to your account to download the needed form.

However, if you are unfamiliar with our library, ensure that you follow these steps prior to obtaining the Pearland Texas Writ Second to Financial Institution:

- Ensure the template you have found is specific to your area since the rules of one state or area do not work for another state or area.

- Preview the form and read a quick outline (if available) of scenarios the paper can be used for.

- If the form you picked doesn’t meet your requirements, you can start again and search for the suitable document.

- Click Buy now and choose the subscription option you prefer the best.

- Access an account {using your credentials or create one from scratch.

- Choose the payment gateway and proceed to download the Pearland Texas Writ Second to Financial Institution once the payment is through.

You’re all set! Now you can proceed to print out the form or complete it online. Should you have any issues locating your purchased documents, you can quickly find them in the My Forms tab.

Whatever case you’re trying to solve, US Legal Forms has got you covered. Give it a try today and see for yourself.