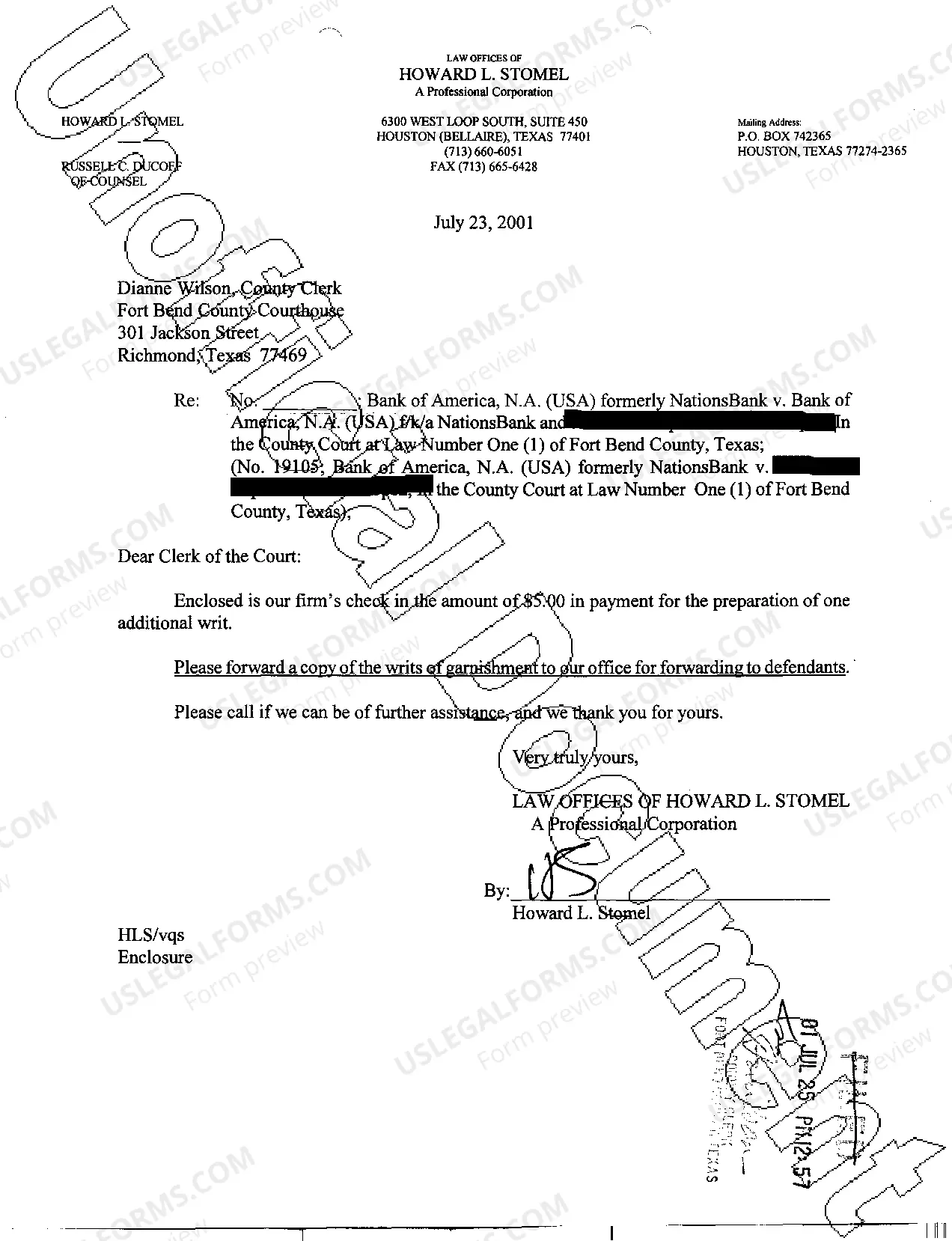

Plano, Texas, located in Collin County, is a vibrant and flourishing city known for its thriving business community and exceptional quality of life. With a strategic location just north of Dallas, Plano has become a magnet for financial institutions seeking a strong presence in an economically powerful region. Plano Texas Writ Second to Financial Institution is an important legal process that allows financial institutions to recover nonperforming loans through the issuance of a writ of garnishment. This legal remedy enables the institution to collect outstanding debts from individuals or businesses who have failed to fulfill their financial obligations. Additionally, this writ can be utilized to seize assets such as bank accounts, real estate, or personal property to satisfy the unpaid loans. There are several types of Plano Texas Writ Second to Financial Institution, each serving a specific purpose in the debt recovery process. These include: 1. Default Writ Second: A default writ second is issued when a debtor has failed to respond or appear in court after receiving notices and summonses. This allows the financial institution to proceed with the legal action, enforcing the debt recovery process. 2. Writ Second with Attachment: This type of writ involves attaching the debtor's property, such as bank accounts or real estate, to secure the unpaid debt. The attachment helps safeguard the financial institution's interests during the legal proceedings. 3. Writ Second for Wage Garnishment: In cases where the debtor is employed, a writ second can be issued to garnish a portion of their wages to satisfy the outstanding loan. This ensures a steady income stream for the financial institution until the debt is fully cleared. 4. Writ Second for Levying Physical Property: When the debtor possesses valuable assets apart from monetary funds, a writ second can be utilized to levy such property. This allows the financial institution to sell or dispose of the assets to recover losses caused by unpaid debts. Plano Texas Writ Second to Financial Institution plays a crucial role in safeguarding the interests of financial institutions and ensuring the fair and efficient enforcement of contractual obligations. By utilizing this legal process, financial institutions can maintain a strong and secure financial ecosystem, promoting economic stability and growth in Plano, Texas. Keywords: Plano Texas, Writ Second, Financial Institution, debt recovery, nonperforming loans, writ of garnishment, assets, bank accounts, real estate, personal property, default writ second, attachment, wage garnishment, levy, contractual obligations, economic stability.

Plano Texas Writ Second to Financial Institution

Description

How to fill out Plano Texas Writ Second To Financial Institution?

Make use of the US Legal Forms and have immediate access to any form sample you need. Our helpful platform with a huge number of documents makes it simple to find and obtain virtually any document sample you need. It is possible to download, complete, and certify the Plano Texas Writ Second to Financial Institution in a matter of minutes instead of surfing the Net for hours looking for the right template.

Utilizing our catalog is an excellent strategy to increase the safety of your document filing. Our experienced legal professionals regularly check all the records to make sure that the templates are relevant for a particular state and compliant with new acts and polices.

How do you get the Plano Texas Writ Second to Financial Institution? If you have a subscription, just log in to the account. The Download button will appear on all the documents you look at. In addition, you can get all the earlier saved files in the My Forms menu.

If you don’t have an account yet, follow the instruction listed below:

- Open the page with the form you require. Make certain that it is the template you were looking for: examine its name and description, and make use of the Preview feature when it is available. Otherwise, make use of the Search field to find the needed one.

- Launch the saving procedure. Select Buy Now and select the pricing plan that suits you best. Then, create an account and pay for your order utilizing a credit card or PayPal.

- Save the file. Select the format to obtain the Plano Texas Writ Second to Financial Institution and change and complete, or sign it for your needs.

US Legal Forms is one of the most significant and trustworthy document libraries on the web. We are always ready to help you in virtually any legal process, even if it is just downloading the Plano Texas Writ Second to Financial Institution.

Feel free to take full advantage of our platform and make your document experience as convenient as possible!