A San Antonio Texas Writ Second to Financial Institution is a legal document that serves as a lien on a property located in San Antonio, Texas, in favor of a financial institution. It is typically used when an individual or entity owes a debt to a financial institution, and the institution seeks repayment by placing a lien on the debtor's property. The purpose of this writ is to secure the financial institution's interest in the property and ensure that it will be paid if the debtor defaults on their debt obligations. It provides a legal right to the financial institution to enforce the sale of the property and use the proceeds to repay the debt. There are different types of San Antonio Texas Writ Second to Financial Institution, which may include: 1. Mortgage Liens: These are types of writs that are commonly used by banks and other financial institutions when providing loans for the purchase of a property. The financial institution becomes a lien holder against the property, and if the borrower fails to repay the loan, the institution can foreclose on the property to recover the debt. 2. Home Equity Loans: In this scenario, the writ often acts as a lien on a property to secure a home equity loan. Homeowners can borrow against the equity in their property, and the financial institution becomes a lien holder until the loan is fully repaid. If the borrower defaults on the loan, the institution can enforce the sale of the property. 3. Construction Loans: When a borrower seeks funding for the construction of a property, a financial institution may issue a writ to secure the loan. This allows the lender to have a legal claim on the property until the loan is repaid, protecting their investment in case of default. 4. Refinance Loans: If a borrower wishes to refinance an existing loan, a financial institution may require a writ to secure the new loan. This ensures that the institution maintains a lien on the property, replacing the previous lien holder. It is important to note that San Antonio Texas Writ Second to Financial Institution is a legally binding document, and its requirements and procedures may vary depending on the specific laws and regulations in San Antonio, Texas. Therefore, it is advised to consult with a legal professional or real estate expert to ensure compliance with local regulations and understand the specific implications and processes associated with this type of writ.

San Antonio Texas Writ Second to Financial Institution

State:

Texas

City:

San Antonio

Control #:

TX-G0408

Format:

PDF

Instant download

This form is available by subscription

Description

A03 Writ Second to Financial Institution

A San Antonio Texas Writ Second to Financial Institution is a legal document that serves as a lien on a property located in San Antonio, Texas, in favor of a financial institution. It is typically used when an individual or entity owes a debt to a financial institution, and the institution seeks repayment by placing a lien on the debtor's property. The purpose of this writ is to secure the financial institution's interest in the property and ensure that it will be paid if the debtor defaults on their debt obligations. It provides a legal right to the financial institution to enforce the sale of the property and use the proceeds to repay the debt. There are different types of San Antonio Texas Writ Second to Financial Institution, which may include: 1. Mortgage Liens: These are types of writs that are commonly used by banks and other financial institutions when providing loans for the purchase of a property. The financial institution becomes a lien holder against the property, and if the borrower fails to repay the loan, the institution can foreclose on the property to recover the debt. 2. Home Equity Loans: In this scenario, the writ often acts as a lien on a property to secure a home equity loan. Homeowners can borrow against the equity in their property, and the financial institution becomes a lien holder until the loan is fully repaid. If the borrower defaults on the loan, the institution can enforce the sale of the property. 3. Construction Loans: When a borrower seeks funding for the construction of a property, a financial institution may issue a writ to secure the loan. This allows the lender to have a legal claim on the property until the loan is repaid, protecting their investment in case of default. 4. Refinance Loans: If a borrower wishes to refinance an existing loan, a financial institution may require a writ to secure the new loan. This ensures that the institution maintains a lien on the property, replacing the previous lien holder. It is important to note that San Antonio Texas Writ Second to Financial Institution is a legally binding document, and its requirements and procedures may vary depending on the specific laws and regulations in San Antonio, Texas. Therefore, it is advised to consult with a legal professional or real estate expert to ensure compliance with local regulations and understand the specific implications and processes associated with this type of writ.

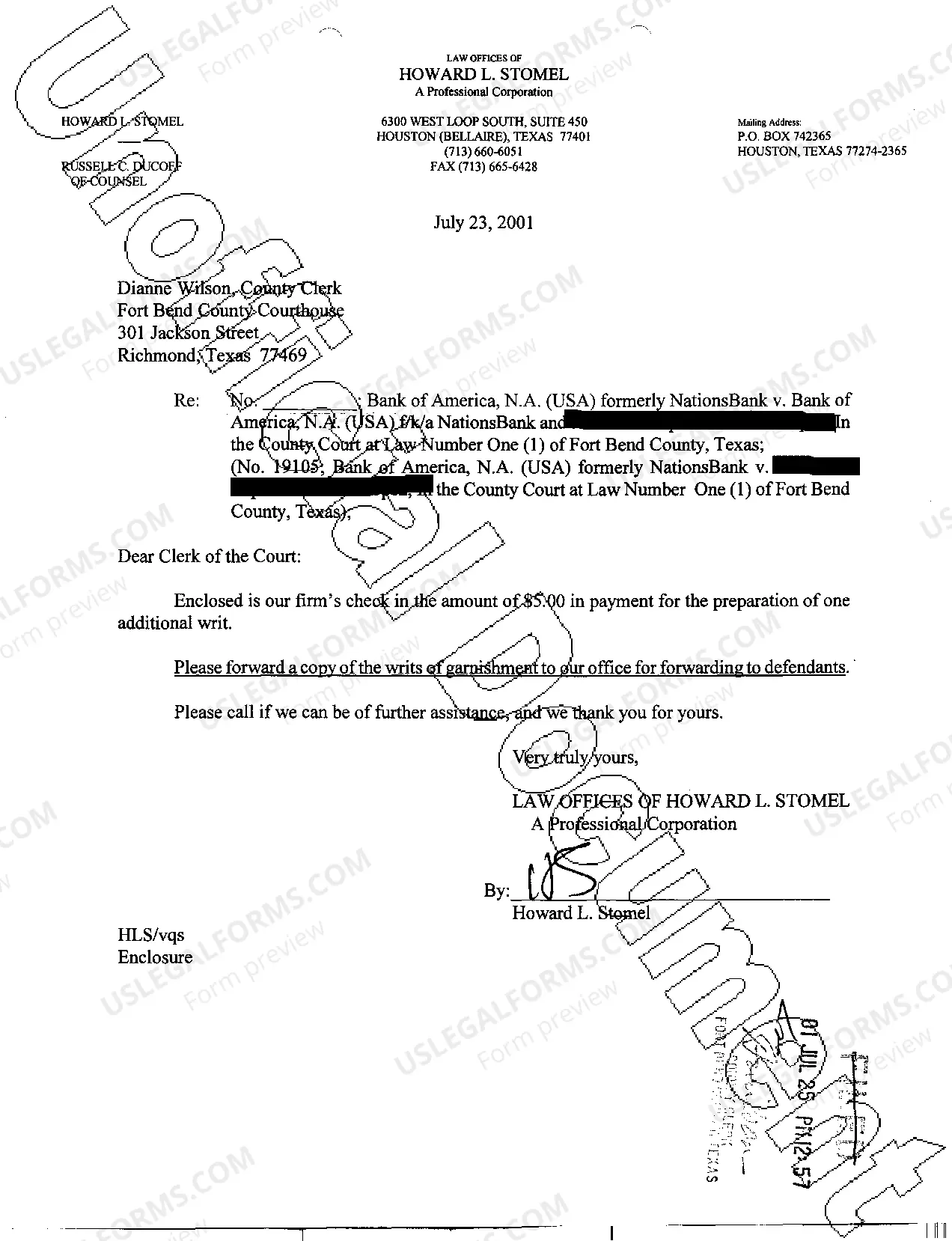

Free preview

How to fill out San Antonio Texas Writ Second To Financial Institution?

If you’ve already used our service before, log in to your account and download the San Antonio Texas Writ Second to Financial Institution on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to get your document:

- Make certain you’ve found the right document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to get the proper one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Obtain your San Antonio Texas Writ Second to Financial Institution. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your individual or professional needs!