Sugar Land, Texas is a vibrant city located in Fort Bend County, just southwest of Houston. Known for its affluent neighborhoods, excellent schools, and thriving business community, Sugar Land is also home to a number of financial institutions that provide various services to its residents. Writ Second to Financial Institution is a legal process that allows a creditor or a financial institution to reclaim unpaid debts by obtaining a court order. In Sugar Land, there are several types of Writ Second to Financial Institution that financial institutions offer to their clients. These include: 1. Bank loans: Many financial institutions in Sugar Land offer various types of bank loans to individuals and businesses. These loans could be for purchasing a new home, financing a car, starting a business, or even for personal use. The bank becomes a creditor, and in case of non-payment, can file a Writ Second to Financial Institution to recover the outstanding debt. 2. Mortgage services: Sugar Land has a robust real estate market, and financial institutions provide mortgage services to prospective homebuyers. These institutions offer mortgage loans to individuals looking to purchase residential or commercial properties. If the borrower defaults on their payments, the financial institution can seek a Writ Second to Financial Institution to reclaim the unpaid debt. 3. Credit cards: Financial institutions also issue credit cards in Sugar Land, allowing individuals to make purchases and pay later. If a credit cardholder fails to make monthly payments, the institution can utilize Writ Second to Financial Institution to recover the outstanding balance on the credit card. 4. Business loans: Sugar Land boasts a thriving business sector, and financial institutions in the area provide business loans to entrepreneurs and established businesses. In case of non-payment, the financial institution may file a Writ Second to Financial Institution to recover the loan amount. 5. Debt collection: In addition to providing loans and credit services, financial institutions in Sugar Land may also engage in debt collection. If a debtor owes money to a financial institution, and all other attempts to recover the debt have failed, the institution may seek a Writ Second to Financial Institution to collect the outstanding amount. It is important to note that the specific terms and conditions of Writ Second to Financial Institution may vary between different financial institutions in Sugar Land. Each institution will have its own policies and procedures to handle debt recovery. As a debtor or potential borrower, it is important to understand the terms of any financial agreement before entering into it, to avoid potential legal consequences and ensure a smooth financial relationship with the institution.

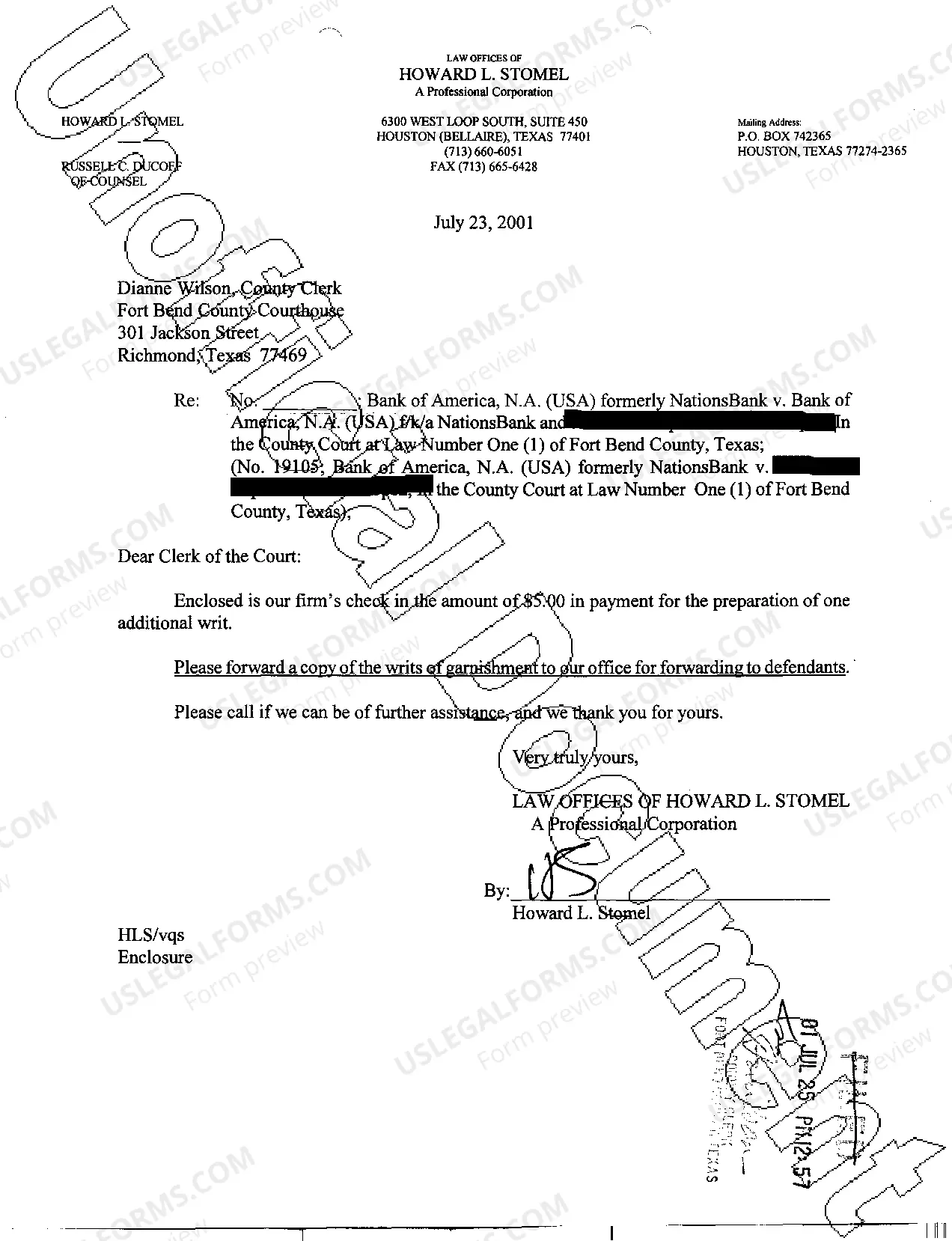

Sugar Land Texas Writ Second to Financial Institution

Description

How to fill out Sugar Land Texas Writ Second To Financial Institution?

Getting verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Sugar Land Texas Writ Second to Financial Institution gets as quick and easy as ABC.

For everyone already acquainted with our catalogue and has used it before, getting the Sugar Land Texas Writ Second to Financial Institution takes just a few clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. This process will take just a few more actions to make for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

- Check the Preview mode and form description. Make certain you’ve chosen the right one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, utilize the Search tab above to obtain the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Sugar Land Texas Writ Second to Financial Institution. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!