Tarrant Texas Writ Second to Financial Institution is a legal document that enables financial institutions to recover outstanding debts from individuals or businesses in Tarrant County, Texas. This writ acts as a legal enforcement mechanism for the collection of unpaid loans, mortgages, or other financial obligations. Financial institutions, such as banks, credit unions, or lending agencies, may file a Tarrant Texas Writ Second to Financial Institution when all other attempts to collect the debt have been exhausted. This legal action allows the institution to seize funds directly from the debtor's bank accounts or garnish their wages. There are a few different types of Tarrant Texas Writ Second to Financial Institutions that can be filed depending on the specific circumstances. These include: 1. Writ of Garnishment: This type of writ allows the financial institution to collect the debt by seizing a portion of the debtor's wages or salary directly from their employer. The garnishment amount is usually determined by a court order, taking into consideration the debtor's income and necessary living expenses. 2. Writ of Execution: This writ grants the financial institution the authority to seize funds from the debtor's bank accounts or any other valuable assets. The institution may work with a court-appointed sheriff or similar professional to locate and liquidate the debtor's assets to satisfy the outstanding debt. 3. Writ of Attachment: In cases where there is a concern that the debtor may attempt to transfer or hide their assets, a writ of attachment may be filed. This writ allows the financial institution to freeze the debtor's assets temporarily, preventing them from being moved or sold until the debt is resolved. It is important to note that the filing of a Tarrant Texas Writ Second to Financial Institution requires adherence to specific legal procedures and regulations. Financial institutions must follow due process and obtain court approval before executing any action to recover the debt. In summary, a Tarrant Texas Writ Second to Financial Institution is a legal tool used by financial institutions in Tarrant County, Texas, to initiate the enforcement of outstanding debts. The specific type of writ filed depends on the circumstances, with options including garnishment, execution, or attachment. Always consult with a legal professional to ensure compliance with all applicable laws and regulations when pursuing debt recovery through this avenue.

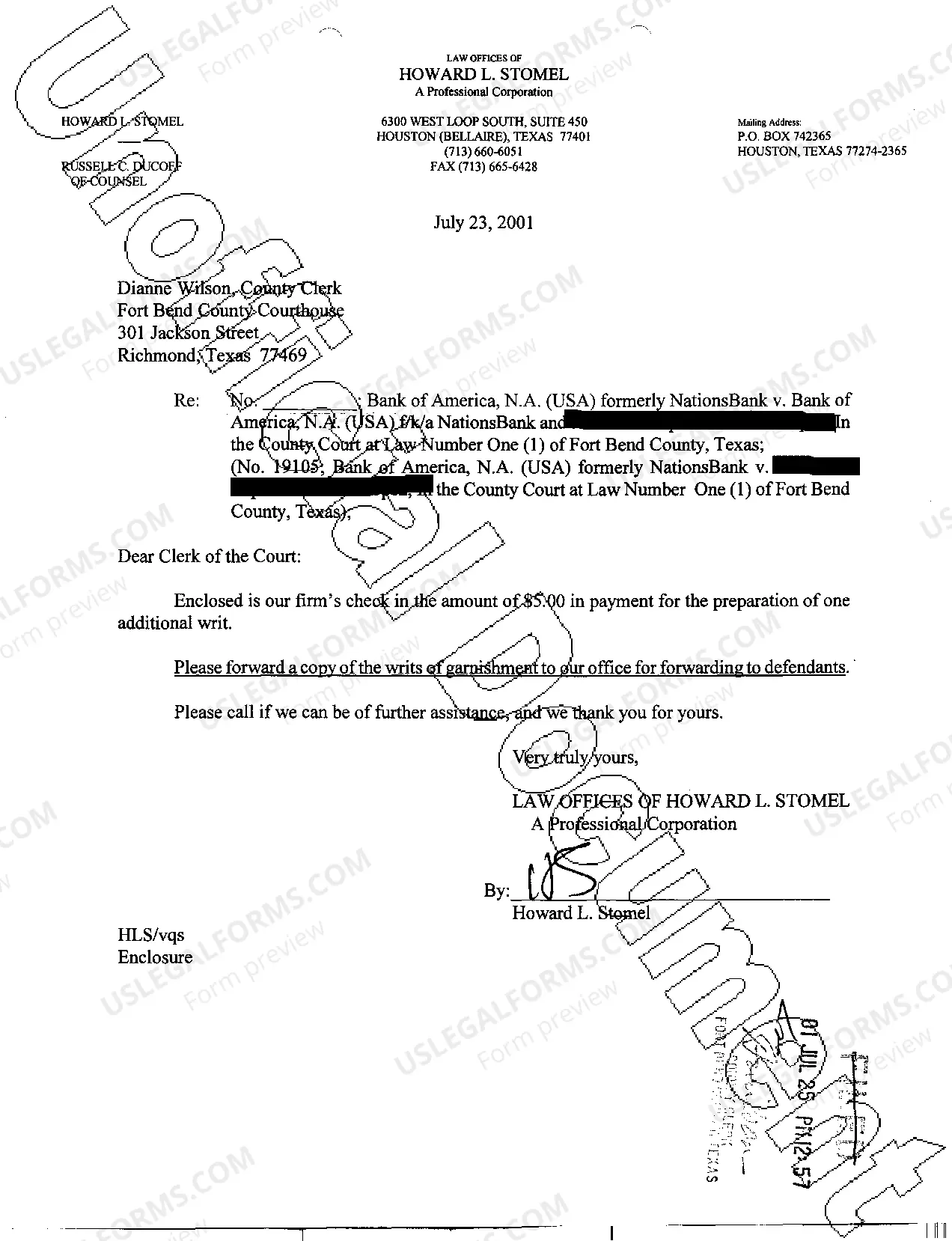

Tarrant Texas Writ Second to Financial Institution

Description

How to fill out Tarrant Texas Writ Second To Financial Institution?

No matter what social or professional status, completing law-related documents is an unfortunate necessity in today’s professional environment. Too often, it’s practically impossible for a person with no law background to draft this sort of papers cfrom the ground up, mostly because of the convoluted jargon and legal nuances they come with. This is where US Legal Forms can save the day. Our platform offers a huge library with more than 85,000 ready-to-use state-specific documents that work for almost any legal scenario. US Legal Forms also serves as an excellent asset for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

Whether you need the Tarrant Texas Writ Second to Financial Institution or any other document that will be valid in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Tarrant Texas Writ Second to Financial Institution quickly using our trusted platform. If you are presently a subscriber, you can go on and log in to your account to download the needed form.

However, if you are new to our library, make sure to follow these steps before downloading the Tarrant Texas Writ Second to Financial Institution:

- Ensure the template you have found is specific to your area because the regulations of one state or county do not work for another state or county.

- Preview the form and go through a brief outline (if available) of scenarios the paper can be used for.

- In case the one you selected doesn’t meet your requirements, you can start over and search for the suitable document.

- Click Buy now and choose the subscription option you prefer the best.

- with your credentials or create one from scratch.

- Choose the payment method and proceed to download the Tarrant Texas Writ Second to Financial Institution as soon as the payment is completed.

You’re good to go! Now you can go on and print the form or complete it online. Should you have any issues locating your purchased documents, you can easily find them in the My Forms tab.

Regardless of what situation you’re trying to sort out, US Legal Forms has got you covered. Try it out today and see for yourself.