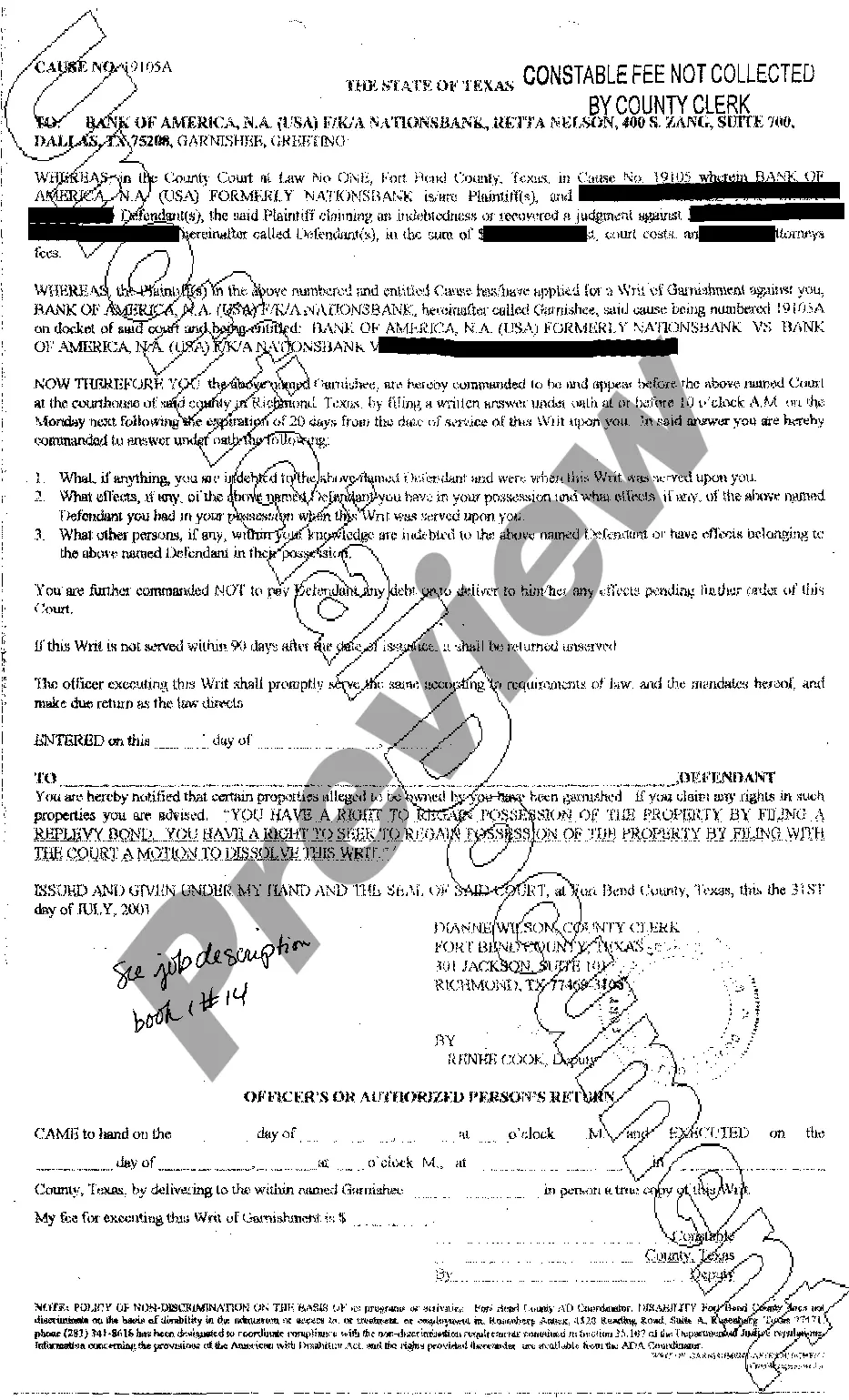

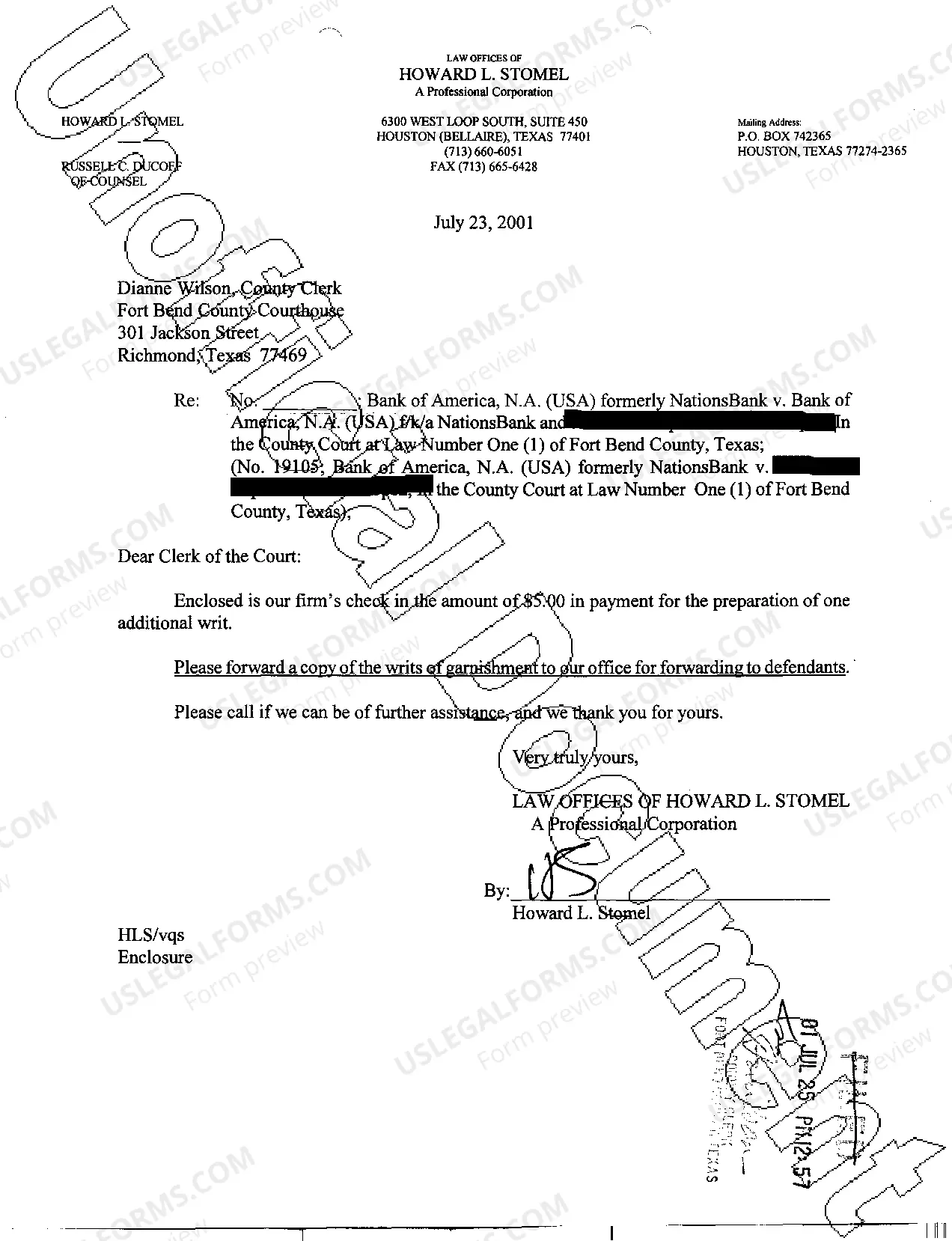

Waco Texas Writ Second to Financial Institution is a legal process that involves the transfer of debt ownership from one financial institution to another. It is an essential mechanism used in the financial industry to manage and trade debts effectively. This detailed description will provide an overview of what Waco Texas Writ Second to Financial Institution entails, its purpose, key players involved, and the different types of this process. Waco Texas Writ Second refers to the legal authorization granted by the relevant judicial body within the state of Texas to transfer debt ownership. This authorization is essential to ensure the validity and enforceability of the debt transfer process. Financial institutions, such as banks, credit unions, and mortgage lenders, seek Waco Texas Writ Second to legally establish their rights over outstanding debts owed by individuals or businesses. The purpose of Waco Texas Writ Second to Financial Institution is to enable financial institutions to manage their portfolio of debts more efficiently. By acquiring debt ownership through this legal process, financial institutions gain control over the collection and repayment of outstanding debts. This mechanism allows them to trade, bundle, or restructure debts, depending on their business strategies and financial goals. Additionally, financial institutions can use the legal authority provided by Waco Texas Writ Second to initiate legal actions and enforce debt repayment if necessary. Several key players are involved in the Waco Texas Writ Second to Financial Institution process. Firstly, financial institutions seeking writ second authorization must apply to the relevant judicial body and provide necessary documentation to support their claim for debt ownership. Legal professionals, such as attorneys and solicitors specializing in debt collection and finance, play a crucial role in preparing and submitting the required documentation for the Waco Texas Writ Second process. Furthermore, court officials and judges are responsible for reviewing and approving the applications for Waco Texas Writ Second. They assess the validity of the claims made by financial institutions and ensure compliance with relevant laws and regulations. Once the authorization is granted, it is recorded in the court registry, and the financial institution is legally authorized to exercise its rights over the transferred debts. There are several types of Waco Texas Writ Second to Financial Institution, including: 1. Mortgage Writ Second: This involves the transfer of mortgage debt from one financial institution to another. Mortgage lenders often utilize this mechanism to trade mortgage-backed securities or restructure mortgage portfolios. 2. Credit Card Debt Writ Second: Financial institutions issuing credit cards can transfer their outstanding debt to another institution through this process. It allows them to streamline their credit card portfolio, mitigate risks, or improve their balance sheet. 3. Commercial Loan Writ Second: In the case of commercial loans, financial institutions can trade or transfer their loan assets to other institutions through this process. It enables them to optimize their loan portfolios, manage risks, and allocate capital effectively. 4. Student Loan Writ Second: Financial institutions involved in student lending can use this mechanism to transfer their student loan portfolio. This allows them to focus on their core operations or reallocate resources. In summary, Waco Texas Writ Second to Financial Institution is a legal process that empowers financial institutions to transfer debt ownership between themselves. It allows them to manage their debt portfolios effectively, trade debts, bundle securities, and initiate legal actions if needed. Different types of Waco Texas Writ Second exist, including mortgage, credit card, commercial loan, and student loan writ seconds, catering to the various needs and activities of financial institutions.

Waco Texas Writ Second to Financial Institution

Description

How to fill out Waco Texas Writ Second To Financial Institution?

Finding verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Waco Texas Writ Second to Financial Institution becomes as quick and easy as ABC.

For everyone already acquainted with our catalogue and has used it before, obtaining the Waco Texas Writ Second to Financial Institution takes just a few clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. The process will take just a couple of more steps to make for new users.

Adhere to the guidelines below to get started with the most extensive online form collection:

- Look at the Preview mode and form description. Make certain you’ve picked the right one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, utilize the Search tab above to find the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Waco Texas Writ Second to Financial Institution. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!