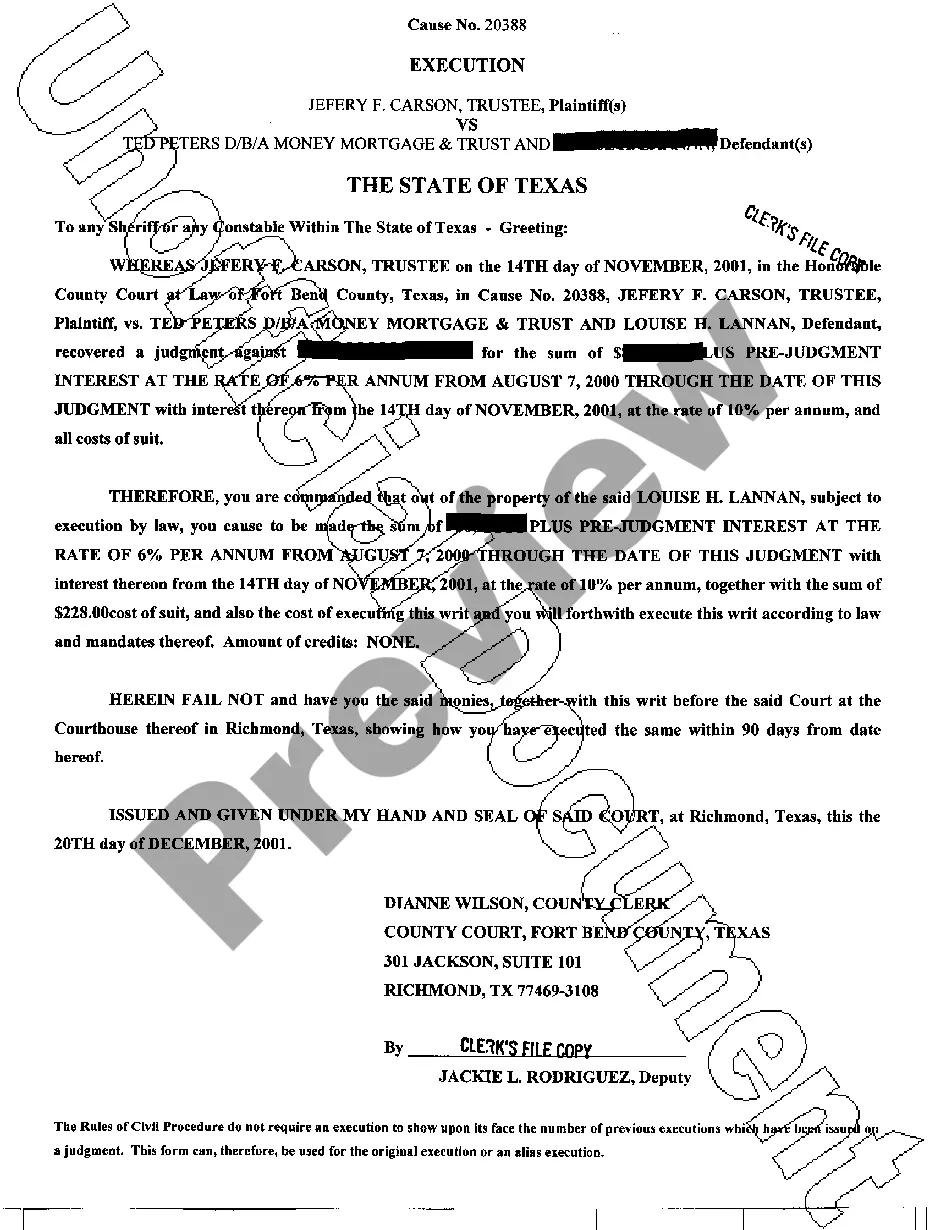

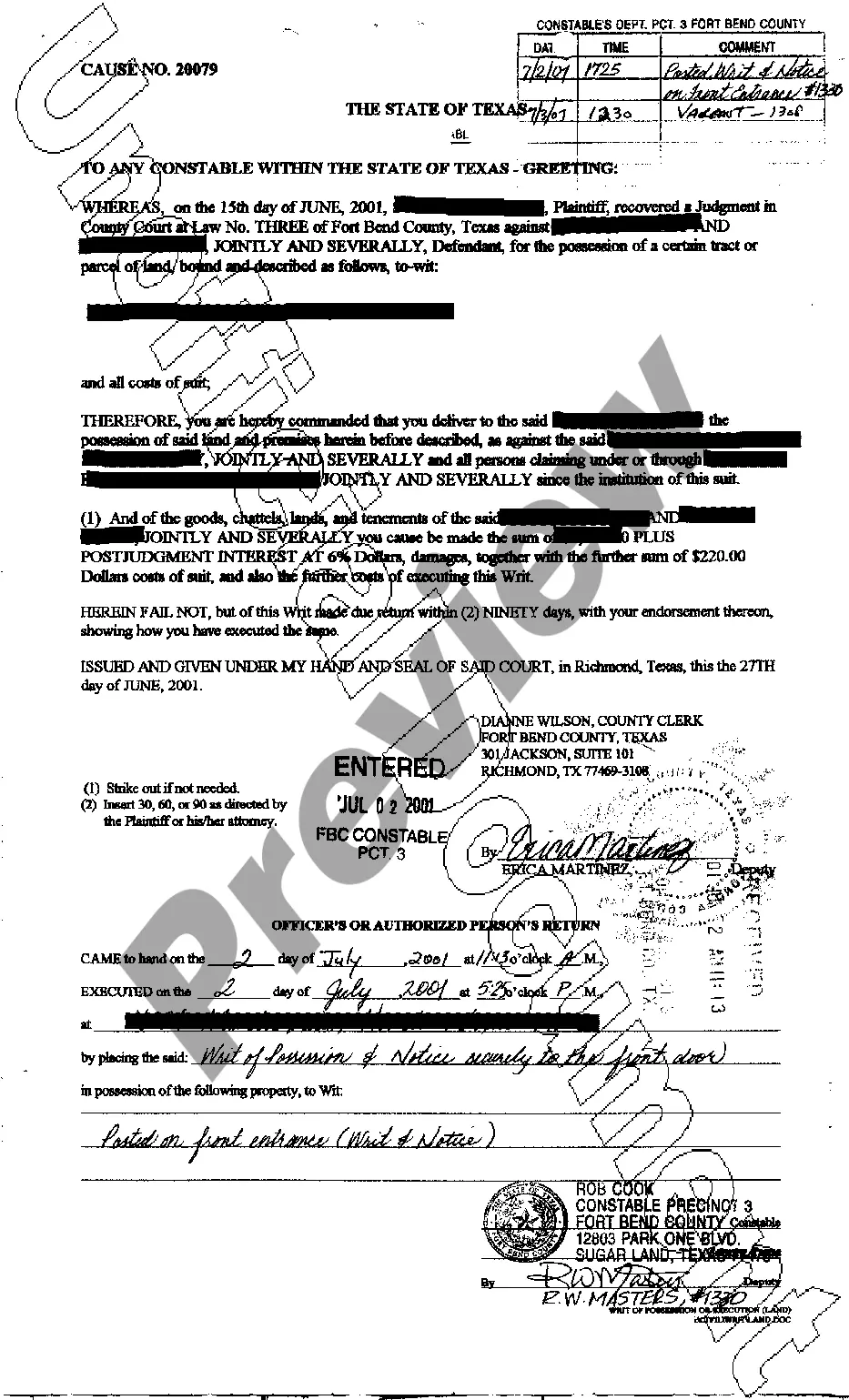

Irving Texas Writ of Execution

Description

How to fill out Texas Writ Of Execution?

We consistently endeavor to reduce or elude legal complications when addressing intricate law-related or financial issues.

To achieve this, we enlist attorney services that, generally speaking, are quite expensive.

Nevertheless, not every legal issue is equally intricate; many can be managed independently.

US Legal Forms is an online repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Simply Log In to your account and click the Get button next to it. If you happen to misplace the document, you can always re-download it in the My documents section. The process is equally straightforward if you're not familiar with the platform! You can set up your account in just a few minutes. Ensure that the Irving Texas Writ of Execution adheres to the laws and regulations of your particular state and locality. It’s also essential to review the form’s description (if accessible), and if you identify any inconsistencies with what you were initially seeking, look for an alternative template. Once you have confirmed that the Irving Texas Writ of Execution is appropriate for you, you can select a subscription plan and proceed with the payment. Afterward, you can download the document in any compatible file format. For over 24 years, we have assisted millions by providing ready-to-customize and current legal documents. Take advantage of US Legal Forms today to conserve time and resources!

- Our platform empowers you to handle your affairs without resorting to a lawyer.

- We provide access to legal document templates that may not always be readily available to the public.

- Our templates are tailored to specific states and regions, which greatly simplifies the search process.

- Benefit from US Legal Forms whenever you need to locate and download the Irving Texas Writ of Execution or any other document with ease and security.

Form popularity

FAQ

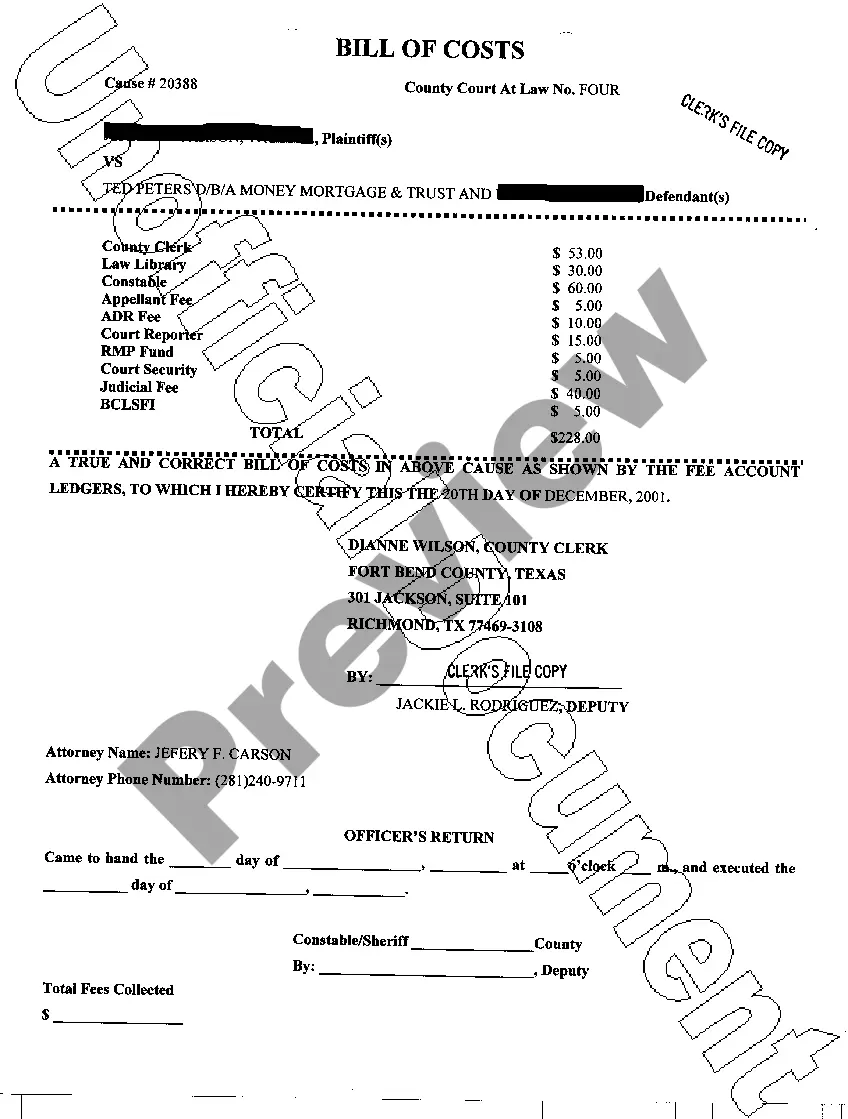

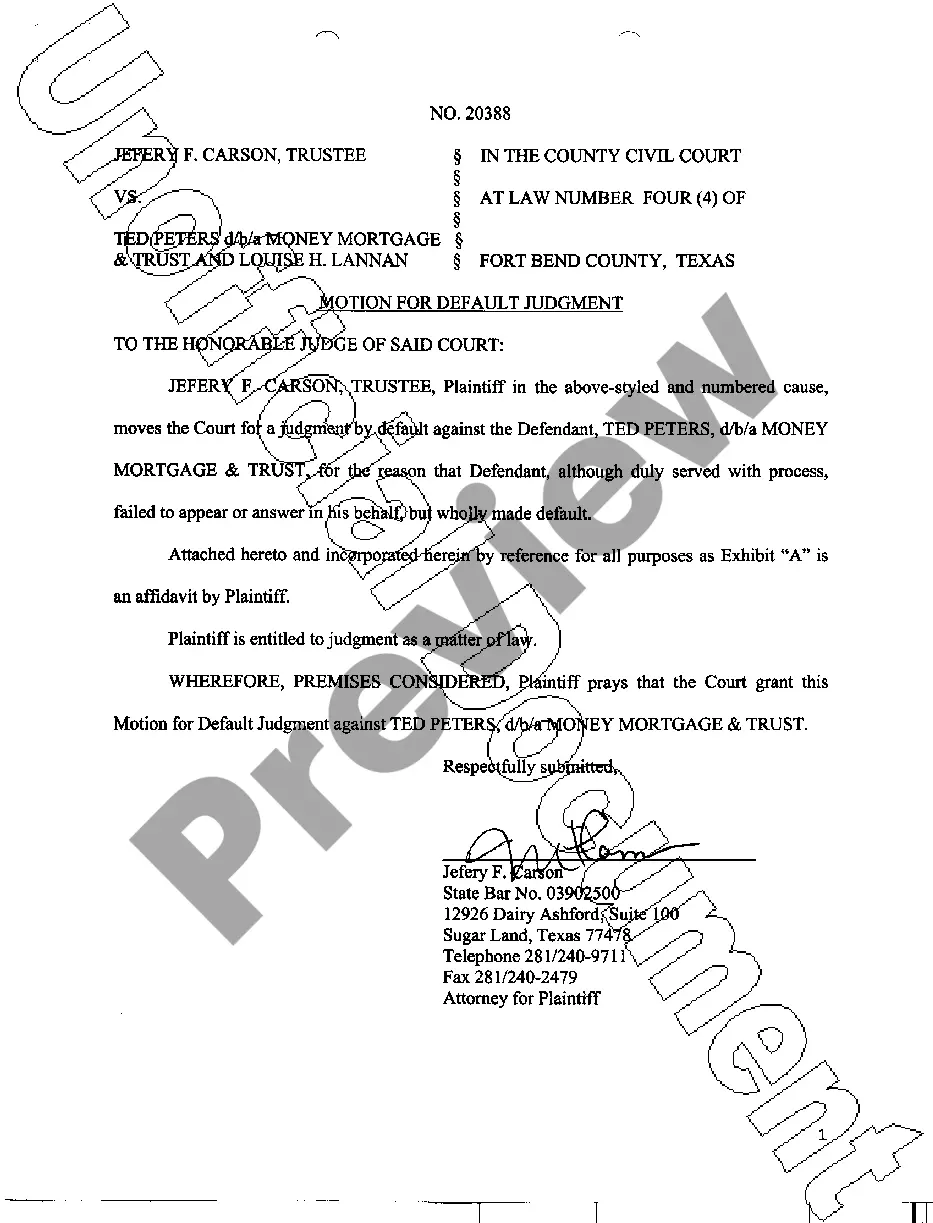

To obtain a writ of execution in Texas, you must first have a valid court judgment. After securing your judgment, you can file a request for the Irving Texas Writ of Execution with the court that issued the initial ruling. Once the court reviews and approves your request, they will issue the writ, allowing you to take necessary actions to enforce the judgment. If you need assistance with the process, consider using uslegalforms, which provides templates and guidance to navigate these legal steps smoothly.

In Texas, a writ of execution can be served by a sheriff, constable, or any person authorized by law to serve legal documents. It is crucial for the individual serving the Irving Texas Writ of Execution to follow specific legal procedures to ensure it is valid. This step is essential for enforcing the court's judgment effectively. Ensuring the right person serves the writ can save you time and potential legal issues.

The time required to execute a writ of possession in Texas can vary, but generally, it takes about 10 to 14 days from the date of issuance. Once the court issues the Irving Texas Writ of Execution, a local law enforcement officer will typically schedule the execution. This officer may also provide you with an estimated timeline to expect their visit. Being prepared can help ensure a smooth process.

To serve a writ of execution in Texas, you must deliver a certified copy of the writ to the local sheriff or constable. They will then carry out the enforcement process, which may include seizing property. It is important to follow the steps outlined in Texas law to ensure compliance. Consulting platforms like US Legal Forms can guide you through serving an Irving Texas Writ of Execution properly.

In Texas, a writ of possession is executed by the sheriff or constable of the county where the property is located. Their role is to ensure that the enforcement of the court's order is carried out lawfully. If you face a situation involving property loss, knowing the role of these officials in executing an Irving Texas Writ of Execution can provide clarity and support in addressing your concerns.

A writ of habeas corpus is a legal action that challenges the legality of an individual's detention or imprisonment in Texas. Though not directly related to a writ of execution, it serves to protect individual rights against unlawful confinement. Understanding the distinctions between these legal terms is important if you are navigating the legal system in situations involving an Irving Texas Writ of Execution.

In Texas, a writ of execution is a court order that allows a creditor to enforce a judgment by seizing a debtor's property. This process typically occurs after a creditor wins a lawsuit and seeks to collect the awarded amount. The writ provides a legal mechanism to ensure that the judgment can be fulfilled. If you face this situation, addressing an Irving Texas Writ of Execution is crucial to understanding your rights.

A writ of execution in Texas is typically valid for 30 days from the date of issuance. However, this period can be extended if necessary by the court. It’s essential to act promptly once you receive a writ, as it establishes a specific timeline for enforcement actions. Understanding this timeframe can help you or your attorney navigate the process of dealing with an Irving Texas Writ of Execution.

In Texas, certain properties are exempt from a writ of execution. Common exemptions include homestead properties, personal belongings, and retirement accounts. Additionally, the law protects certain amounts of personal property, depending on the debtor's situation. This means if you are dealing with an Irving Texas Writ of Execution, some of your assets may not be subject to seizure.

The party that obtained a judgment, usually called the judgment creditor, is responsible for filing a writ of execution in Texas. This process typically occurs after a judgment has been rendered in your favor, allowing you to enforce payment or compliance. You can file the writ at the court where your case was decided, and it must comply with Texas rules to ensure proper execution. Utilizing resources from US Legal Forms can help simplify the filing of a writ of execution in Irving, Texas.