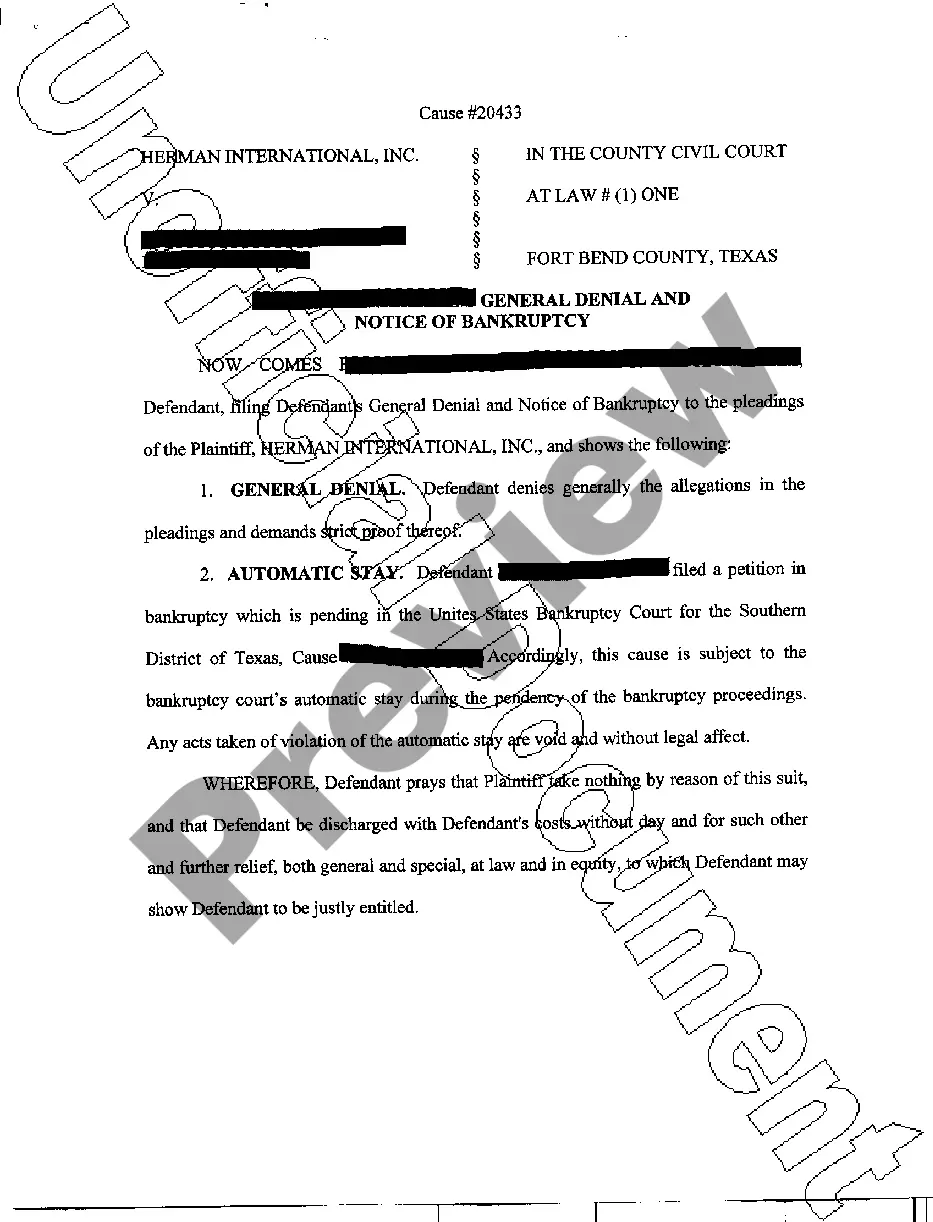

Frisco Texas General Denial and Notice of Bankruptcy are legal documents used in the state of Texas to respond to lawsuits and financial situations. It is essential to understand the purpose, significance, and different types of these documents to navigate the legal processes effectively. A Frisco Texas General Denial is a legal response filed by a defendant in court, typically in response to a lawsuit or legal claim made against them. This document essentially denies all the plaintiff's allegations and demands listed in their complaint, requiring the plaintiff to provide sufficient evidence and substantiate their claims. When filing a Frisco Texas General Denial, individuals are essentially asserting their right to due process and the opportunity to examine the evidence presented against them. This crucial document can help protect their rights and ensure a fair legal proceeding. On the other hand, a Notice of Bankruptcy is a document that notifies creditors and interested parties of a debtor filing for bankruptcy. It informs them of the individual or business's financial situation and triggers an automatic stay that halts all collection attempts, lawsuits, and other legal actions against the debtor. In Frisco, Texas, General Denial and Notice of Bankruptcy can be further categorized into specific types based on the circumstances and legal requirements. Some different types of Frisco Texas General Denials include: 1. General Denial to Plaintiffs' Claims: This type of denial is commonly used when a defendant wants to reject all allegations made against them in a lawsuit. It requires the plaintiff to provide solid evidence to support their claims and continue with the legal proceedings. 2. Special Denial with Affirmative Defense: In certain cases, a defendant may assert specific defenses in addition to denying the plaintiff's claims. This type of denial acknowledges some parts of the claim while providing legal justifications to counter them. 3. Denial Based on Lack of Subject Jurisdiction: This type of denial is used when a defendant believes that the court where the lawsuit was filed does not have the authority to handle the case due to jurisdictional issues. Regarding the Notice of Bankruptcy, there are two primary types commonly filed: 1. Chapter 7 Bankruptcy Notice: This type of notice is submitted when an individual or business files for Chapter 7 bankruptcy, also known as "liquidation bankruptcy." It signifies that the filer's assets may be sold to pay off debts and allows creditors to participate in the bankruptcy proceedings. 2. Chapter 13 Bankruptcy Notice: This notice is filed when an individual or business seeks relief under Chapter 13 bankruptcy, often referred to as a "reorganization bankruptcy." It outlines the filer's intention to create a repayment plan to gradually pay off debts over a specific period. In summary, a Frisco Texas General Denial is a legal document filed by a defendant to refute the plaintiff's claims, while a Notice of Bankruptcy is submitted to inform creditors and interested parties about an individual or business filing for bankruptcy. Understanding the different types of denials and bankruptcy notices can help individuals navigate various legal situations effectively while safeguarding their rights and interests.

Frisco Texas General Denial and Notice of Bankruptcy

Description

How to fill out Frisco Texas General Denial And Notice Of Bankruptcy?

If you are looking for a pertinent document, it’s exceptionally challenging to find a more suitable location than the US Legal Forms site – one of the largest online collections.

With this collection, you can discover thousands of document samples for business and personal uses by categories and areas, or keywords.

With our advanced search feature, locating the latest Frisco Texas General Denial and Notice of Bankruptcy is as simple as 1-2-3.

Finalize the purchase. Use your credit card or PayPal account to complete the registration process.

Obtain the document. Choose the format and save it on your device.Edit as necessary. Complete, modify, print, and sign the received Frisco Texas General Denial and Notice of Bankruptcy.

- Furthermore, the significance of each document is validated by a group of professional attorneys who regularly review the templates on our platform and update them according to the latest state and local regulations.

- If you are already familiar with our system and possess an account, simply Log In to your profile and select the Download option to obtain the Frisco Texas General Denial and Notice of Bankruptcy.

- If you are using US Legal Forms for the first time, adhere to the guidelines below.

- Ensure you have located the form you need. Review its details and utilize the Preview feature (if accessible) to examine its content. If it does not satisfy your requirements, use the Search field at the top of the page to find the correct document.

- Affirm your choice. Click on the Buy now option. Next, select the preferred pricing plan and provide your information to create an account.

Form popularity

FAQ

The typical duration of bankruptcy in Texas can range from three to six months for Chapter 7 filings, while Chapter 13 can take three to five years due to the repayment plan. This timeline can vary depending on various factors, including court schedules, debtor cooperation, and complexity of the case. Involving professionals familiar with the Frisco Texas General Denial and Notice of Bankruptcy will enhance your experience and expedite the process.

The income limit for filing bankruptcy in Texas is based on the median income for your household size, which can fluctuate annually. If your income exceeds these limits, you may need to file for Chapter 13 instead of Chapter 7 bankruptcy. Consulting with uslegalforms can help you navigate the intricacies of the Frisco Texas General Denial and Notice of Bankruptcy, ensuring you make informed choices.

Disqualification from filing bankruptcy in Texas can occur if you have filed for bankruptcy and received a discharge in the past eight years. Additionally, failing to attend mandatory credit counseling or providing inaccurate information can lead to disqualification. Understanding these rules can help you avoid pitfalls in the Frisco Texas General Denial and Notice of Bankruptcy process.

Yes, there are circumstances in which a bankruptcy filing can be denied in Texas. If you fail to meet certain eligibility requirements, such as income limits or filing inaccuracies, the court may reject your petition. It’s essential to understand these criteria thoroughly to increase your chances of a successful filing in the Frisco Texas General Denial and Notice of Bankruptcy context.

The bankruptcy process in Texas generally takes about three to six months from the initial filing to the discharge of debts. However, the duration can vary based on your specific case and any complications that arise. Engaging with a knowledgeable service such as uslegalforms can streamline your experience in navigating the Frisco Texas General Denial and Notice of Bankruptcy.

Yes, you can often keep your car when you file for bankruptcy in Texas, particularly if it is protected under state exemption laws. These exemptions allow you to retain necessary property while discharging debt. It's important to evaluate your situation with an expert in Frisco Texas General Denial and Notice of Bankruptcy to determine the best strategy for protecting your assets.

To receive a bankruptcy notice in Texas, you typically need to file your bankruptcy petition with the court. Once filed, the court will issue a Notice of Bankruptcy, which informs creditors of your filing. This notice is crucial as it protects you from collection actions while your case is processed, helping you understand the next steps in the Frisco Texas General Denial and Notice of Bankruptcy process.

Writing a general denial in Texas requires clarity and adherence to legal standards. Begin with the heading and the case number, followed by a statement that denies the claims made against you. If you need assistance crafting a compliant general denial related to Frisco Texas General Denial and Notice of Bankruptcy, USLegalForms offers templates and resources that can guide you through the process.

When a respondent enters a general denial, they are effectively contesting all claims without presenting specific defenses. This move signals that the respondent intends to dispute the allegations in court. In cases involving Frisco Texas General Denial and Notice of Bankruptcy, this approach can also impact negotiation and settlement discussions, boosting the respondent's position.

Rule 502.5 deals with discovery procedures in Texas civil cases, offering guidelines on how parties exchange information. It ensures that both sides have access to necessary documentation and evidence for their cases. A thorough understanding of Rule 502.5 can support your strategy when encountering a Frisco Texas General Denial and Notice of Bankruptcy scenario.