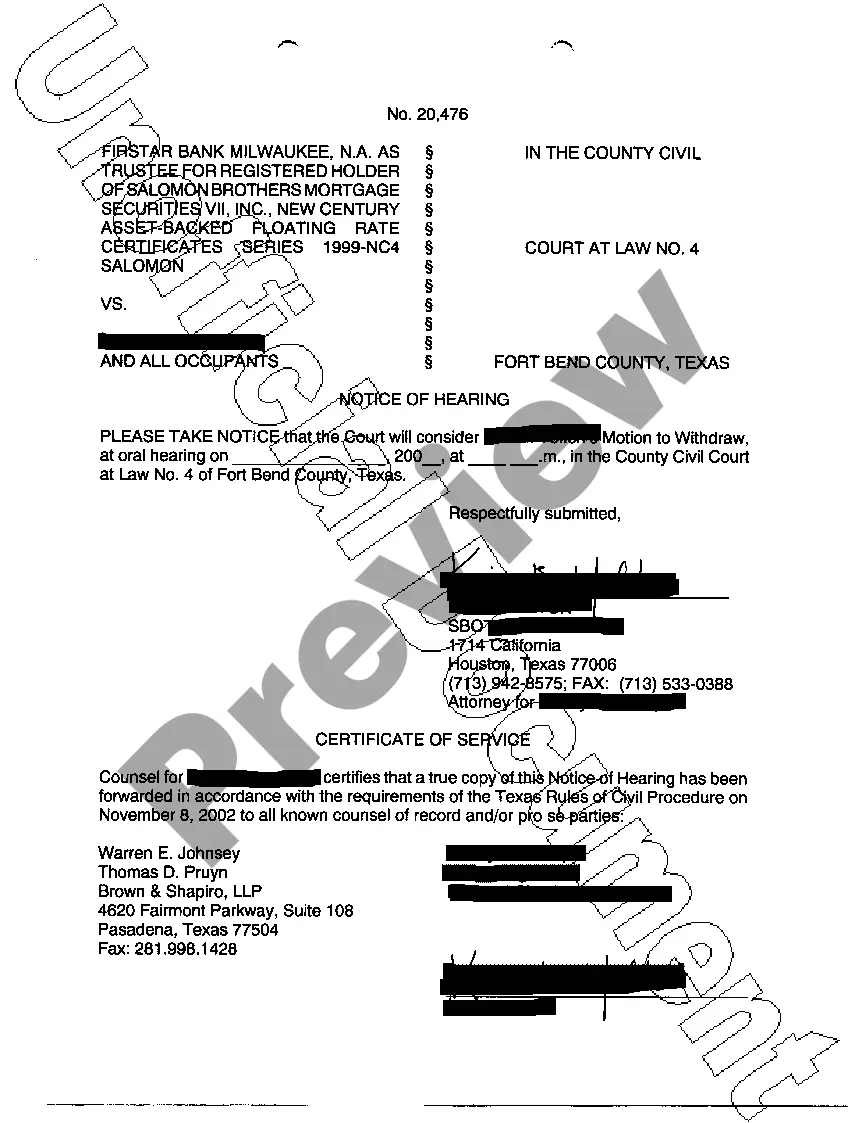

This form is an official Texas form which complies with all applicable state codes and statutes. This form allows for exemption from property tax to some extent depending on the individual circumstances. This form also allows for an exemption from the homestead being sold at foreclosure, up to a certain amount in value, as provided in the Texas statutes. The form must be signed and dated.

Edinburg Texas Application for Residence Homestead Exemption is a significant tax-saving opportunity available for homeowners in the city of Edinburg. This application allows eligible residents to apply for exemptions on their property taxes, reducing the overall tax burden on their primary residence. The Edinburg Texas Application for Residence Homestead Exemption is designed to provide financial relief to homeowners who make their homes in the city. By granting this exemption, the government aims to make homeownership more affordable and encourage individuals to establish their residences in Edinburg. To apply for the Edinburg Texas Application for Residence Homestead Exemption, homeowners must meet certain criteria, including: 1. Own the property as a primary residence: The exemption is only applicable to properties where the homeowner resides permanently. 2. Deadline for filing: The application must be filed with the appropriate tax office within the specified timeframe to be eligible for consideration. It is crucial to be aware of the deadlines and submit the application promptly. 3. Proof of ownership: Applicants must provide documentation proving their ownership of the property, such as a deed or title. 4. Proof of residency: Additional documentation, like utility bills, a driver's license, or voter registration, may be required to establish proof of residency. By applying for the Edinburg Texas Application for Residence Homestead Exemption, eligible homeowners can potentially benefit from reduced property taxes. This exemption can result in substantial savings, making homeownership more affordable and allowing individuals to allocate their resources to other essential expenses. There are no different types of Edinburg Texas Application for Residence Homestead Exemption per se. However, it is worth mentioning that qualifying homeowners may be eligible for additional exemptions or reductions on their property taxes based on various factors. These additional exemptions could include exemptions for seniors, disabled individuals, veterans, or surviving spouses. It is advisable to consult with the appropriate tax office or a tax professional to understand all the possible exemptions one may be eligible for based on their circumstances. Overall, the Edinburg Texas Application for Residence Homestead Exemption is a valuable opportunity for homeowners in Edinburg to reduce their property tax burden and make homeownership more affordable.Edinburg Texas Application for Residence Homestead Exemption is a significant tax-saving opportunity available for homeowners in the city of Edinburg. This application allows eligible residents to apply for exemptions on their property taxes, reducing the overall tax burden on their primary residence. The Edinburg Texas Application for Residence Homestead Exemption is designed to provide financial relief to homeowners who make their homes in the city. By granting this exemption, the government aims to make homeownership more affordable and encourage individuals to establish their residences in Edinburg. To apply for the Edinburg Texas Application for Residence Homestead Exemption, homeowners must meet certain criteria, including: 1. Own the property as a primary residence: The exemption is only applicable to properties where the homeowner resides permanently. 2. Deadline for filing: The application must be filed with the appropriate tax office within the specified timeframe to be eligible for consideration. It is crucial to be aware of the deadlines and submit the application promptly. 3. Proof of ownership: Applicants must provide documentation proving their ownership of the property, such as a deed or title. 4. Proof of residency: Additional documentation, like utility bills, a driver's license, or voter registration, may be required to establish proof of residency. By applying for the Edinburg Texas Application for Residence Homestead Exemption, eligible homeowners can potentially benefit from reduced property taxes. This exemption can result in substantial savings, making homeownership more affordable and allowing individuals to allocate their resources to other essential expenses. There are no different types of Edinburg Texas Application for Residence Homestead Exemption per se. However, it is worth mentioning that qualifying homeowners may be eligible for additional exemptions or reductions on their property taxes based on various factors. These additional exemptions could include exemptions for seniors, disabled individuals, veterans, or surviving spouses. It is advisable to consult with the appropriate tax office or a tax professional to understand all the possible exemptions one may be eligible for based on their circumstances. Overall, the Edinburg Texas Application for Residence Homestead Exemption is a valuable opportunity for homeowners in Edinburg to reduce their property tax burden and make homeownership more affordable.