The Abilene Texas Acknowledgment for Proration of Ad Valor em Taxes is a legal document used in the city of Abilene, Texas, to record the agreement between parties involved in a real estate transaction regarding the proration of ad valor em taxes. Ad valor em taxes are taxes based on the assessed value of a property, usually levied by local government authorities. This acknowledgment is crucial in ensuring that both the buyer and the seller are aware of their respective responsibilities in regard to the payment of ad valor em taxes. The document outlines the agreed-upon method of proration, which involves dividing the tax liability between the parties based on the time each party owns the property during the tax year. Keywords: Abilene Texas, Acknowledgment, Proration, Ad Valor em Taxes, Real Estate Transaction. Types of Abilene Texas Acknowledgment for Proration of Ad Valor em Taxes: 1. Standard Residential Transaction Acknowledgment: This type of acknowledgment is used for prorating ad valor em taxes in a typical residential real estate transaction in Abilene, Texas. It outlines the agreed-upon terms for proration and helps ensure a smooth transfer of tax liability from the seller to the buyer. 2. Commercial Property Transaction Acknowledgment: The commercial property transaction acknowledgment is tailored for real estate deals involving commercial properties in Abilene, Texas. As commercial properties often have different tax considerations compared to residential properties, this type of acknowledgment addresses the specific requirements and regulations related to prorating ad valor em taxes for commercial transactions. 3. Rental Property Transaction Acknowledgment: Rental properties have unique tax considerations since the property owner is responsible for the payment of ad valor em taxes. This acknowledgment is used when a rental property in Abilene, Texas, is sold, and it outlines the rules and agreements for prorating the taxes between the seller and the buyer, taking into account the rental income and period of ownership for each party. 4. Multi-Unit Property Transaction Acknowledgment: In the case of multi-unit properties, such as apartment complexes or condominiums, each unit may have different tax liabilities. The multi-unit property transaction acknowledgment addresses these complexities by outlining specific proration guidelines for each unit involved in the transaction. 5. Vacant Land Transaction Acknowledgment: Vacant land transactions require special consideration when prorating ad valor em taxes since there are no structures on the property that generate rental income or other factors usually considered. This acknowledgment caters to the unique circumstances of vacant land transactions in Abilene, Texas. By utilizing the appropriate type of acknowledgment for prorating ad valor em taxes, all parties involved can ensure that the tax obligations are fairly distributed and that the property transfer takes place in compliance with the laws and regulations of Abilene, Texas.

Abilene Texas Acknowledgment for Proration of Ad Valorem Taxes

Description

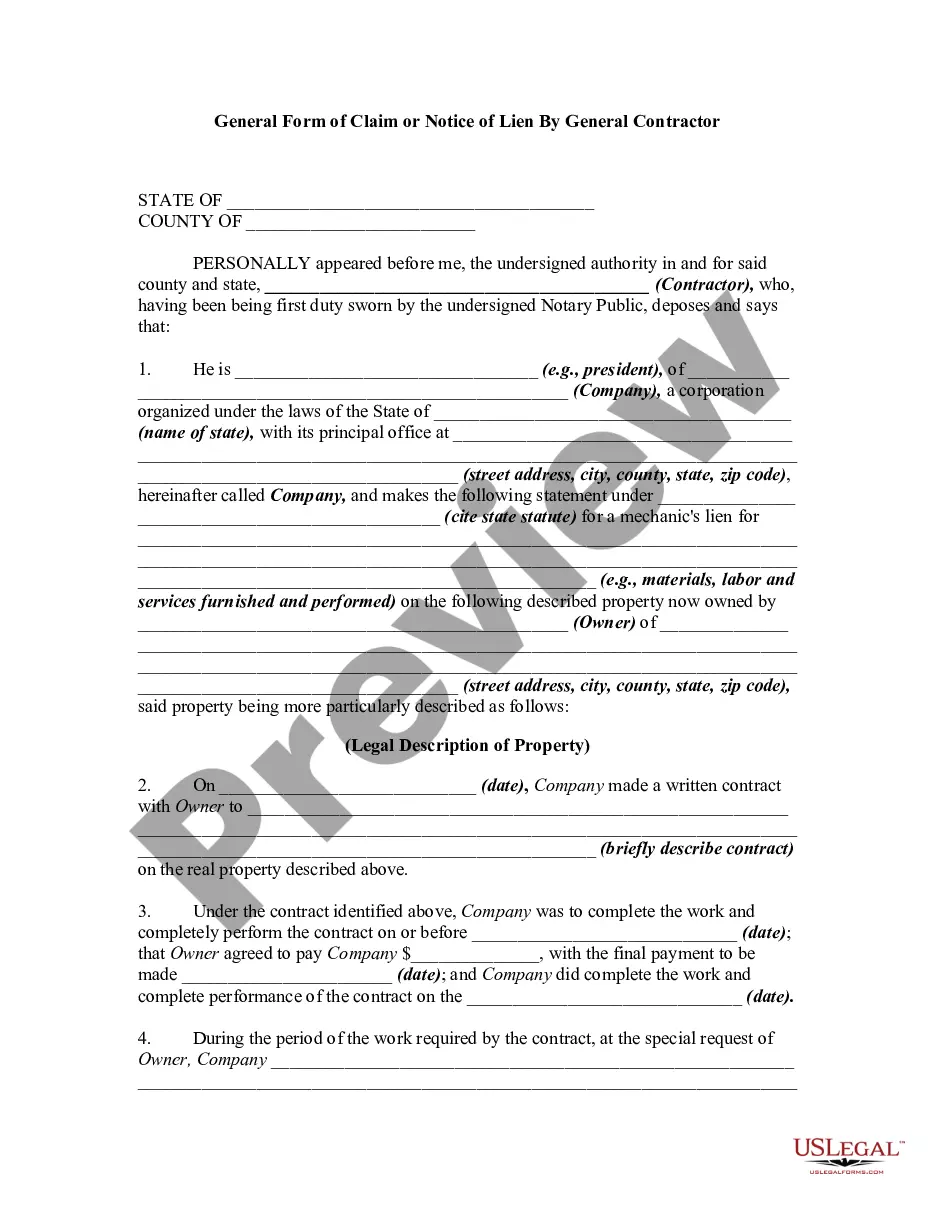

How to fill out Abilene Texas Acknowledgment For Proration Of Ad Valorem Taxes?

Getting verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Abilene Texas Acknowledgment for Proration of Ad Valorem Taxes becomes as quick and easy as ABC.

For everyone already familiar with our catalogue and has used it before, obtaining the Abilene Texas Acknowledgment for Proration of Ad Valorem Taxes takes just a couple of clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. The process will take just a couple of more actions to make for new users.

Follow the guidelines below to get started with the most extensive online form collection:

- Look at the Preview mode and form description. Make certain you’ve picked the right one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, utilize the Search tab above to obtain the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Abilene Texas Acknowledgment for Proration of Ad Valorem Taxes. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!