Collin Texas Acknowledgment for Proration of Ad Valor em Taxes is a legal document that serves as evidence of the agreement between a buyer and seller regarding the proration of ad valor em taxes in Collin County, Texas. This acknowledgment ensures the fair distribution of property taxes between the parties involved in the sale of real estate. When a property is sold within Collin County, the payment of property taxes can be a complicated matter as they are typically assessed annually. Ad valor em taxes are based on the assessed value of the property and contribute to the funding of public services such as schools, infrastructure, and local government. The Collin Texas Acknowledgment for Proration of Ad Valor em Taxes outlines the specific terms and conditions agreed upon by the buyer and seller to ensure a fair distribution of these taxes. It typically includes details such as the agreed-upon closing date, the method of proration used (e.g., calendar year, fiscal year, or another agreed basis), and the formula for calculating the prorated taxes. Different types of Collin Texas Acknowledgment for Proration of Ad Valor em Taxes can include: 1. Residential Property Acknowledgment: This acknowledgment is specific to residential properties being sold within Collin County, Texas. It considers the unique factors affecting residential property taxes and ensures that the proration is accurate. 2. Commercial Property Acknowledgment: This acknowledgment is designed for commercial real estate transactions within Collin County. Commercial properties have different tax assessments and considerations compared to residential properties. This acknowledgment addresses those specifics to determine a fair proration of ad valor em taxes. 3. Vacant Land Acknowledgment: If the sale involves vacant land in Collin County, Texas, this acknowledgment is used. Vacant land may have different tax implications than developed properties, and this acknowledgment reflects those differences in the proration calculations. 4. Multi-unit Property Acknowledgment: When a property being sold consists of multiple units, such as an apartment complex or a condominium building in Collin County, this acknowledgment is necessary. The proration calculations are more complex, considering the different units and their varying tax assessments. It's important to consult with a real estate attorney or a qualified professional to ensure accurate completion and understanding of the Collin Texas Acknowledgment for Proration of Ad Valor em Taxes. Adhering to the proper guidelines is crucial to avoid any legal issues or disputes arising from the proration of property taxes.

Collin Texas Acknowledgment for Proration of Ad Valorem Taxes

Description

How to fill out Collin Texas Acknowledgment For Proration Of Ad Valorem Taxes?

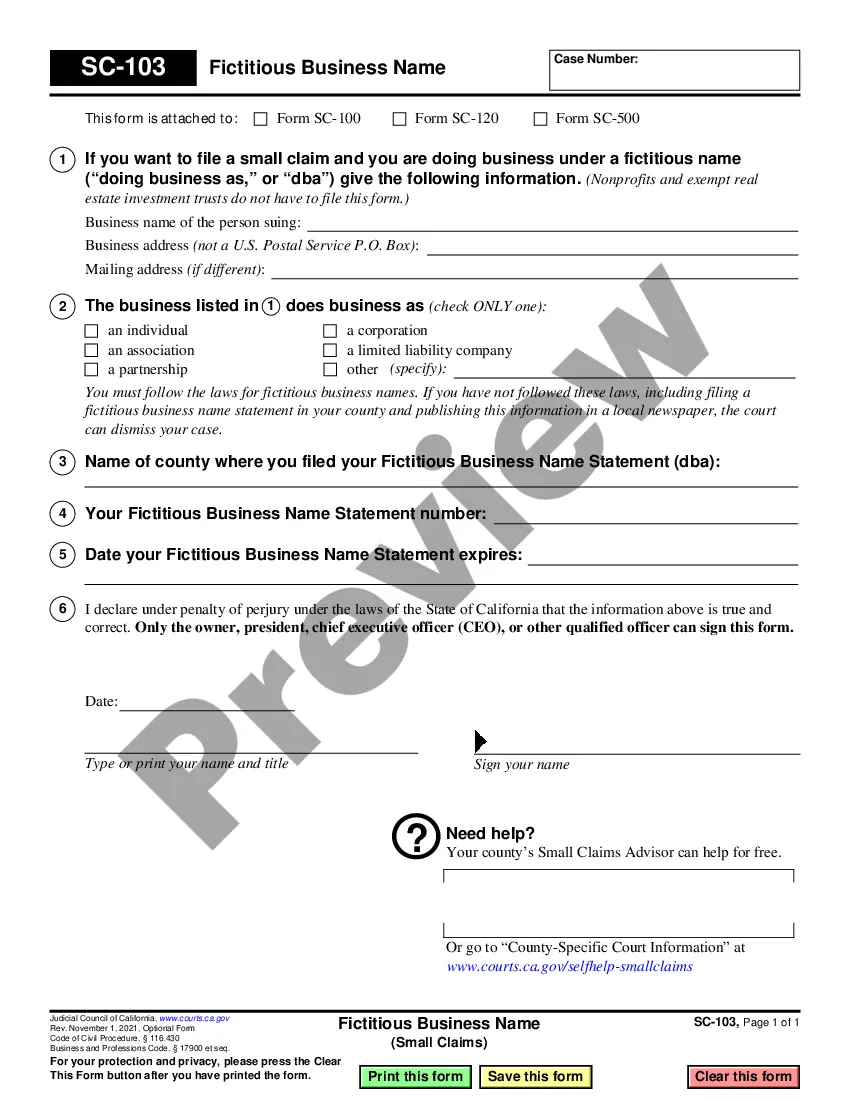

Make use of the US Legal Forms and obtain instant access to any form sample you require. Our beneficial platform with a large number of documents makes it easy to find and get virtually any document sample you require. You can download, fill, and certify the Collin Texas Acknowledgment for Proration of Ad Valorem Taxes in a couple of minutes instead of browsing the web for hours seeking the right template.

Utilizing our library is an excellent strategy to improve the safety of your document filing. Our professional lawyers regularly review all the documents to ensure that the templates are appropriate for a particular state and compliant with new laws and polices.

How can you get the Collin Texas Acknowledgment for Proration of Ad Valorem Taxes? If you already have a subscription, just log in to the account. The Download option will appear on all the documents you look at. Additionally, you can find all the previously saved documents in the My Forms menu.

If you don’t have an account yet, stick to the tips listed below:

- Find the form you need. Make sure that it is the template you were hoping to find: check its name and description, and take take advantage of the Preview feature if it is available. Otherwise, make use of the Search field to find the needed one.

- Start the downloading procedure. Select Buy Now and choose the pricing plan you prefer. Then, create an account and pay for your order with a credit card or PayPal.

- Export the document. Choose the format to obtain the Collin Texas Acknowledgment for Proration of Ad Valorem Taxes and change and fill, or sign it according to your requirements.

US Legal Forms is among the most extensive and trustworthy template libraries on the web. Our company is always happy to help you in any legal case, even if it is just downloading the Collin Texas Acknowledgment for Proration of Ad Valorem Taxes.

Feel free to take full advantage of our platform and make your document experience as straightforward as possible!

Form popularity

FAQ

Does Paying Property Tax Give Ownership In Texas? No. Simply paying property taxes for a piece of real estate is not enough to establish ownership under Texas law. Rather, the property belongs to whoever has ?clear title,? regardless of who pays the taxes.

Texas Property Taxes Property taxes in Texas are the seventh-highest in the U.S., as the average effective property tax rate in the Lone Star State is 1.69%.

The ad valorem tax in Texas, also called property tax, is a type of locally assessed tax where the tax bill depends on the value of the property being taxed. Property tax is imposed on homes, land, commercial properties, and other types of real estate.

What tax rate do I use? The Texas state sales and use tax rate is 6.25 percent, but local taxing jurisdictions (cities, counties, special-purpose districts and transit authorities) also may impose sales and use tax up to 2 percent for a total maximum combined rate of 8.25 percent.

How Much Are Property Taxes in Texas? The Lone Star State's average property tax rate is approximately 1.80%.

For many senior homeowners, rising property taxes can be a threat to their financial stability, even though their mortgages may be paid off. The Texas Tax Code, Section 33.06, allows taxpayers 65 years of age or older to defer their property taxes until their estates are settled after death.

You can find out how much your current taxes are and make your payment by going to the Property Tax Account Lookup application or you may request a statement by calling us at 972-547-5020 during business hours.

Property taxes-also called ad valorem taxes-are locally assessed taxes. The county appraisal district appraises property located in the county, while local taxing units set tax rates and collect property taxes based on those values. Many taxing units outsource collections to a single entity in the county.

Yes. Texas government agencies maintain property records at the county level and provide access to interested public requesters according to the Texas Public Information Act. Unless sealed by a court order or statute, property records in Texas are in the public domain and available upon request.

The ad valorem tax in Texas, also called property tax, is a type of locally assessed tax where the tax bill depends on the value of the property being taxed. Property tax is imposed on homes, land, commercial properties, and other types of real estate.