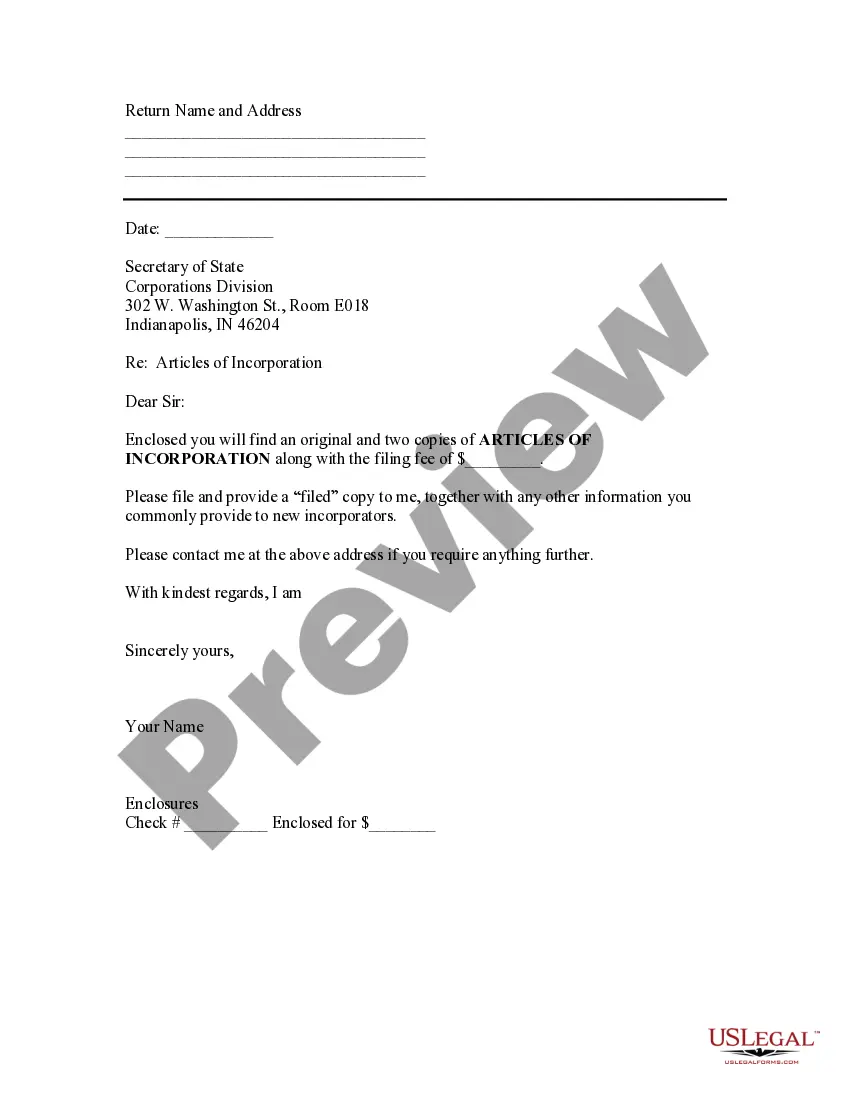

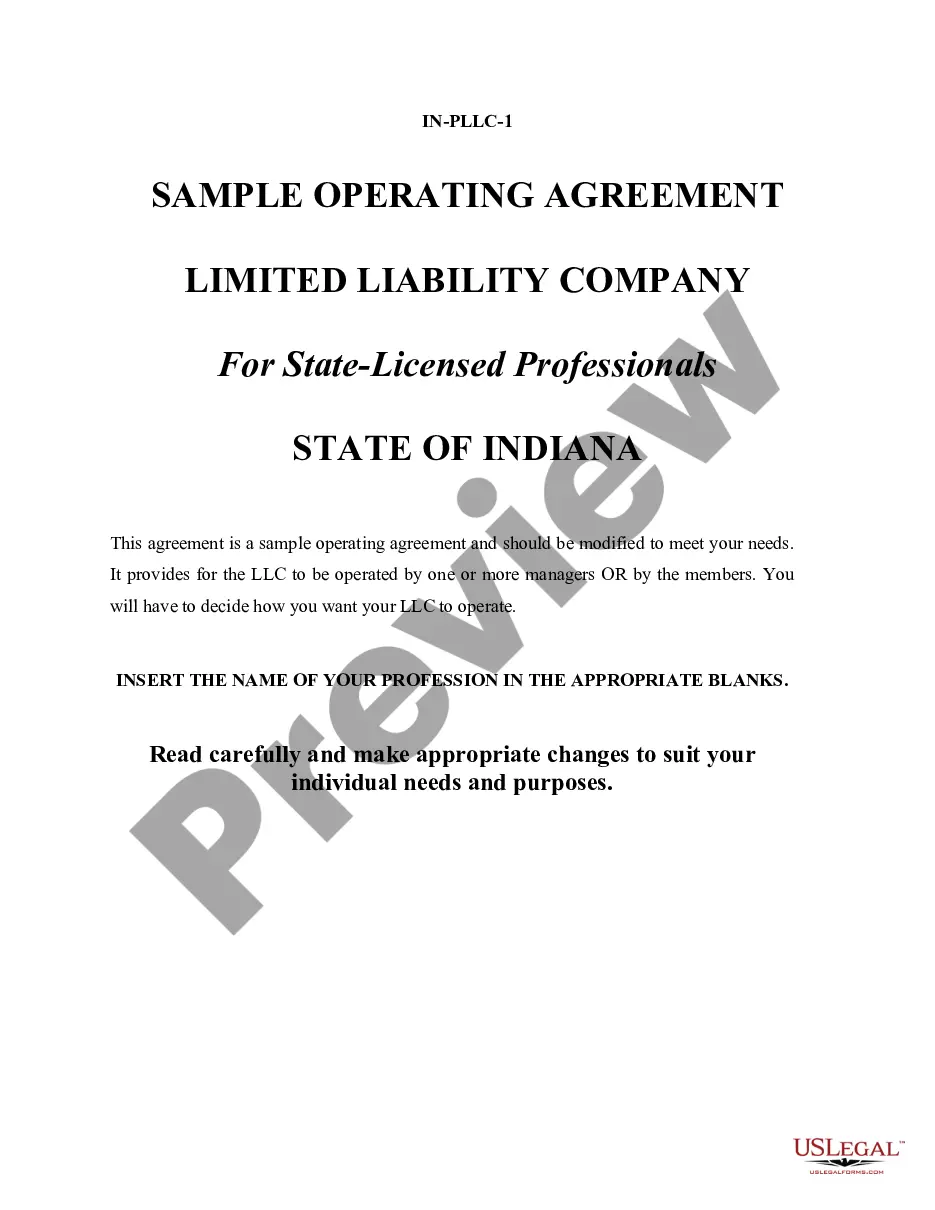

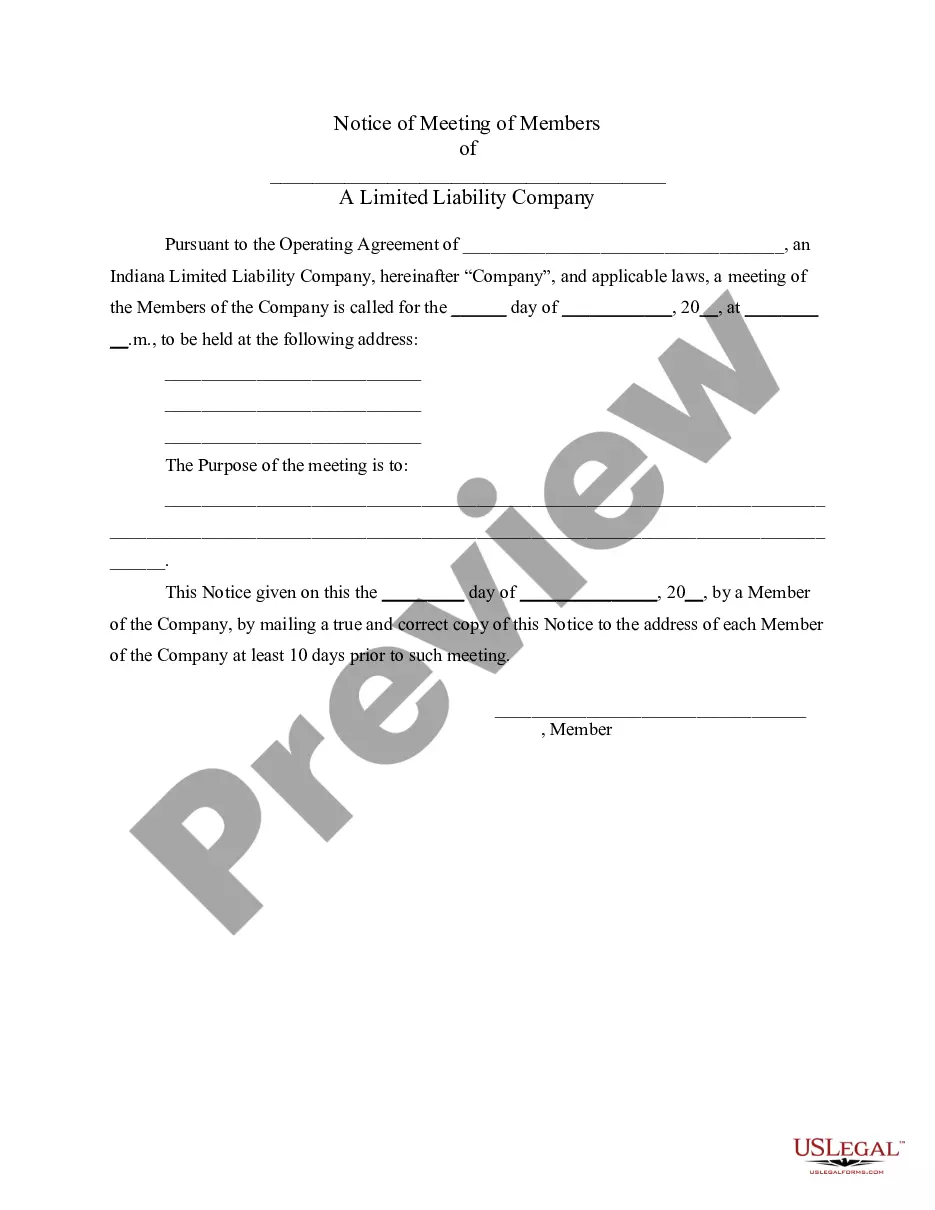

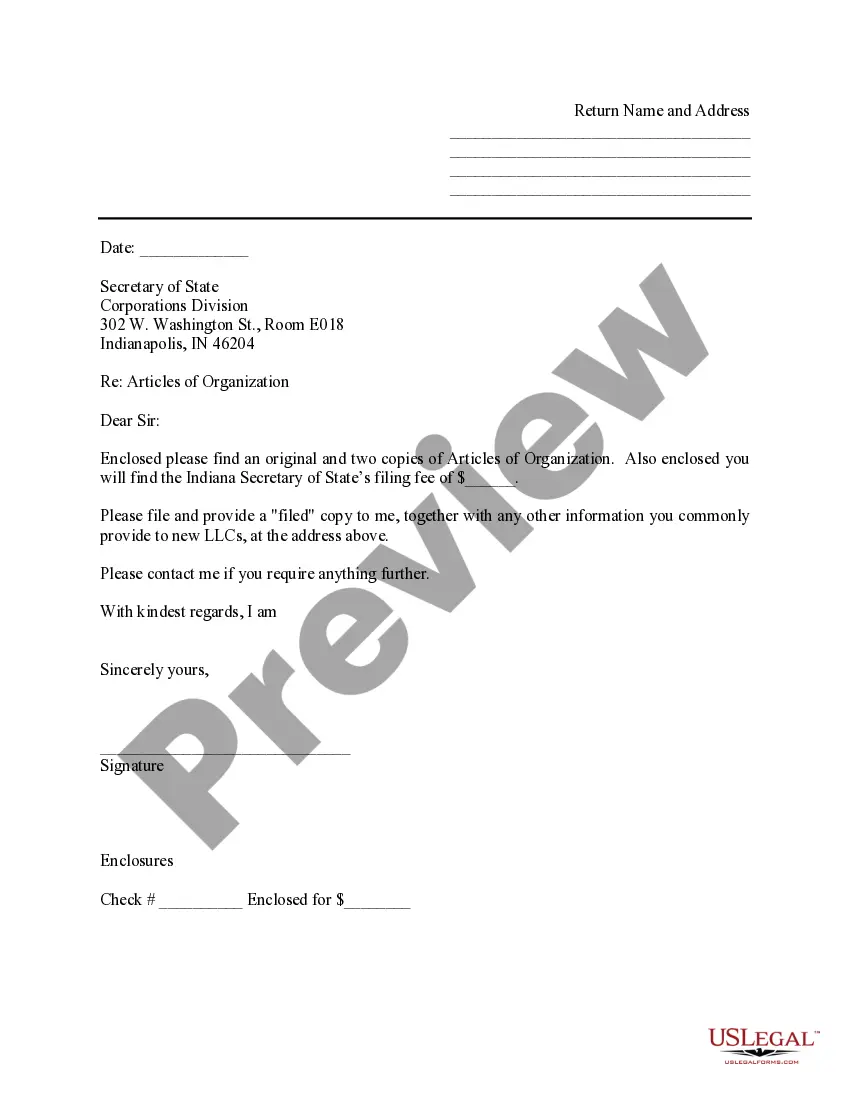

Plano, Texas Acknowledgment for Proration of Ad Valor em Taxes is an essential legal document used in the real estate industry to acknowledge the proration of property taxes between buyers and sellers during the closing process. This acknowledgment guarantees transparency and ensures a fair distribution of tax liability. The Plano Texas Acknowledgment for Proration of Ad Valor em Taxes typically includes crucial details such as the property address, buyer and seller's names, the closing date, and the agreed-upon method for prorating property taxes. This document is important for both parties involved in the transaction, as it outlines their responsibilities and obligations regarding property tax payments. There are two common types of Plano Texas Acknowledgment for Proration of Ad Valor em Taxes: 1. Buyer-Seller Agreement: This type of acknowledgment form is used when the buyer and seller mutually agree on how to prorate property taxes. They discuss and negotiate the allocation of property tax liability based on their respective ownership periods within a given tax year. 2. Escrow Agent Involvement: In some cases, an escrow agent may be appointed to handle the proration of property taxes on behalf of the parties involved. This acknowledgment form details the responsibilities of the escrow agent in calculating and distributing the property tax payments correctly. Keywords: Plano Texas, Acknowledgment, Proration, Ad Valor em Taxes, Real Estate, Closing Process, Property Tax, Transparency, Tax Liability, Buyer, Seller, Closing Date, Prorating Property Taxes, Buyer-Seller Agreement, Escrow Agent.

Plano Texas Acknowledgment for Proration of Ad Valorem Taxes

Description

How to fill out Plano Texas Acknowledgment For Proration Of Ad Valorem Taxes?

Do you need a reliable and inexpensive legal forms supplier to get the Plano Texas Acknowledgment for Proration of Ad Valorem Taxes? US Legal Forms is your go-to choice.

No matter if you need a basic agreement to set regulations for cohabitating with your partner or a set of documents to advance your separation or divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t universal and frameworked in accordance with the requirements of particular state and area.

To download the form, you need to log in account, locate the required form, and click the Download button next to it. Please take into account that you can download your previously purchased document templates at any time in the My Forms tab.

Are you new to our platform? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Check if the Plano Texas Acknowledgment for Proration of Ad Valorem Taxes conforms to the laws of your state and local area.

- Go through the form’s description (if provided) to learn who and what the form is good for.

- Restart the search if the form isn’t suitable for your specific scenario.

Now you can register your account. Then select the subscription option and proceed to payment. As soon as the payment is completed, download the Plano Texas Acknowledgment for Proration of Ad Valorem Taxes in any provided file format. You can return to the website when you need and redownload the form free of charge.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a go now, and forget about spending hours researching legal papers online once and for all.