The San Antonio Texas Acknowledgment for Proration of Ad Valor em Taxes is an important document used in real estate transactions in the state of Texas. This specific acknowledgment is used specifically in San Antonio, a major city in Texas known for its rich history, vibrant culture, and growing real estate market. Ad Valor em taxes refer to property taxes that are levied based on the assessed value of real estate. These taxes are a significant source of revenue for local governments and school districts, and they help fund public services such as schools, infrastructure, and emergency services. The acknowledgment for proration of ad valor em taxes is typically used when a property is being sold, and it ensures that the buyer and seller are in agreement regarding the allocation of property taxes. This acknowledgment outlines the proration of ad valor em taxes, which is the division of property taxes between the buyer and seller based on the time each party owns the property during the tax year. By signing this document, both parties acknowledge and accept their responsibility for paying their respective share of the property taxes for the time they own the property during the tax year. This acknowledgment protects the buyer from assuming the full burden of property taxes for the entire year, especially if the sale occurs after the tax year has already begun. Depending on the specific circumstances of the transaction, there may be different types of San Antonio Texas Acknowledgments for Proration of Ad Valor em Taxes. These types could include variations for residential properties, commercial properties, and vacant land. Each type would address the unique considerations and requirements related to the respective property type. It is crucial for both buyers and sellers to carefully review and understand the terms of the San Antonio Texas Acknowledgment for Proration of Ad Valor em Taxes before signing. This document ensures that both parties are aware of their financial obligations and prevents any potential disputes regarding property tax payments. Keywords: San Antonio Texas, acknowledgment, proration, ad valor em taxes, real estate transactions, property taxes, assessed value, local governments, school districts, public services, revenue, infrastructure, emergency services, property sale, allocation, tax year, burden, residential properties, commercial properties, vacant land.

San Antonio Texas Acknowledgment for Proration of Ad Valorem Taxes

Category:

State:

Texas

City:

San Antonio

Control #:

TX-JW-0007

Format:

PDF

Instant download

This form is available by subscription

Description

Acknowledgment for Proration of Ad Valorem Taxes

The San Antonio Texas Acknowledgment for Proration of Ad Valor em Taxes is an important document used in real estate transactions in the state of Texas. This specific acknowledgment is used specifically in San Antonio, a major city in Texas known for its rich history, vibrant culture, and growing real estate market. Ad Valor em taxes refer to property taxes that are levied based on the assessed value of real estate. These taxes are a significant source of revenue for local governments and school districts, and they help fund public services such as schools, infrastructure, and emergency services. The acknowledgment for proration of ad valor em taxes is typically used when a property is being sold, and it ensures that the buyer and seller are in agreement regarding the allocation of property taxes. This acknowledgment outlines the proration of ad valor em taxes, which is the division of property taxes between the buyer and seller based on the time each party owns the property during the tax year. By signing this document, both parties acknowledge and accept their responsibility for paying their respective share of the property taxes for the time they own the property during the tax year. This acknowledgment protects the buyer from assuming the full burden of property taxes for the entire year, especially if the sale occurs after the tax year has already begun. Depending on the specific circumstances of the transaction, there may be different types of San Antonio Texas Acknowledgments for Proration of Ad Valor em Taxes. These types could include variations for residential properties, commercial properties, and vacant land. Each type would address the unique considerations and requirements related to the respective property type. It is crucial for both buyers and sellers to carefully review and understand the terms of the San Antonio Texas Acknowledgment for Proration of Ad Valor em Taxes before signing. This document ensures that both parties are aware of their financial obligations and prevents any potential disputes regarding property tax payments. Keywords: San Antonio Texas, acknowledgment, proration, ad valor em taxes, real estate transactions, property taxes, assessed value, local governments, school districts, public services, revenue, infrastructure, emergency services, property sale, allocation, tax year, burden, residential properties, commercial properties, vacant land.

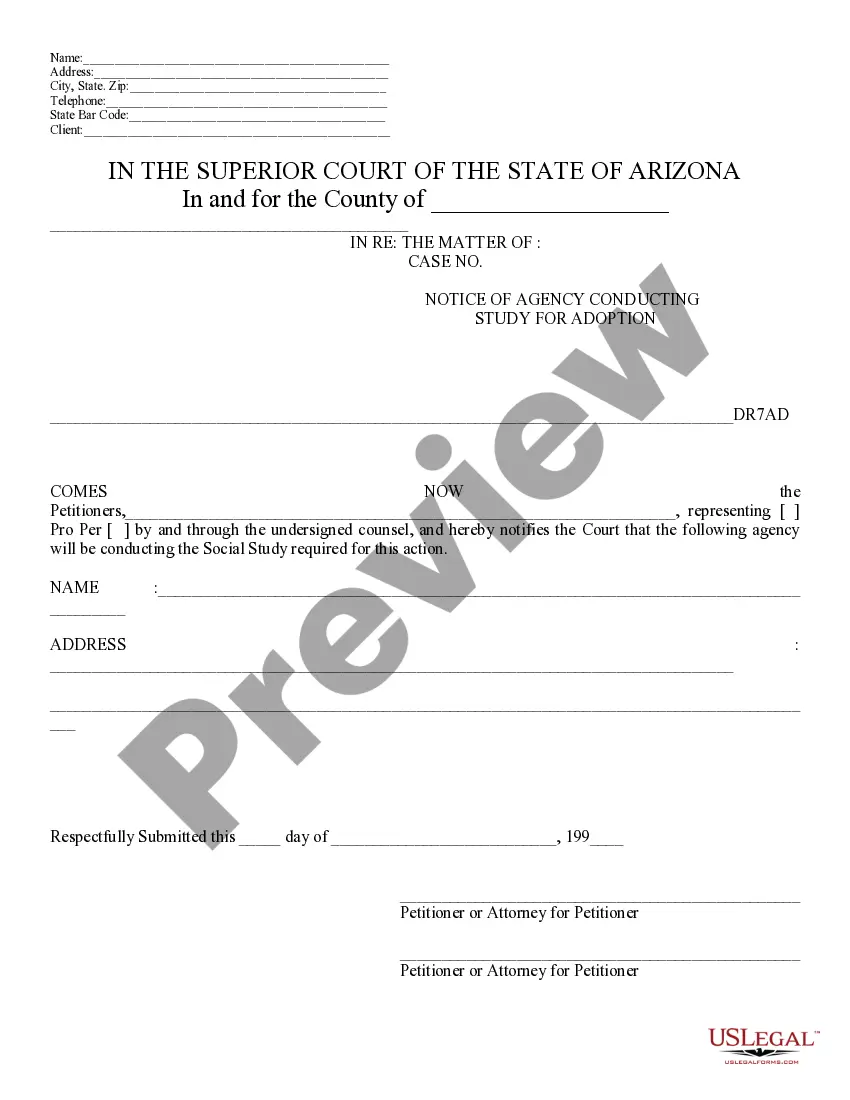

Free preview

How to fill out San Antonio Texas Acknowledgment For Proration Of Ad Valorem Taxes?

If you’ve already utilized our service before, log in to your account and download the San Antonio Texas Acknowledgment for Proration of Ad Valorem Taxes on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your file:

- Make certain you’ve located an appropriate document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to get the appropriate one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your San Antonio Texas Acknowledgment for Proration of Ad Valorem Taxes. Select the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your personal or professional needs!