Sugar Land Texas Acknowledgment for Proration of Ad Valor em Taxes is a legal document that outlines the process of prorating ad valor em taxes in Sugar Land, Texas. Ad valor em taxes, also known as property taxes, are a significant source of revenue for the local government, and the acknowledgment ensures fair distribution of tax liability between buyers and sellers during property transactions. The Sugar Land Texas Acknowledgment for Proration of Ad Valor em Taxes typically includes the following key elements: 1. Purpose: This acknowledgment is designed to establish a fair and transparent method for prorating ad valor em taxes between the buyer and seller during a real estate transaction in Sugar Land, Texas. 2. Parties Involved: The acknowledgment identifies the buyer (purchaser) and the seller (vendor) involved in the property transaction. It is essential to ensure that both parties agree upon the terms and conditions stated in the acknowledgment. 3. Property Description: The acknowledgment contains a detailed description of the property, including the address, legal description, parcel number, and any other relevant details that uniquely identify the property. 4. Proration Formula: The acknowledgment outlines the proration formula to calculate the property tax liability based on the closing date of the transaction. It may include the number of days each party is responsible for paying property taxes, considering the closing date and the tax assessment period in Sugar Land, Texas. 5. Tax Data: This section includes the current year's tax rates, assessed value, and any outstanding taxes due on the property. It provides critical information for calculating the prorated taxes accurately. 6. Payment Responsibility: The acknowledgment clearly defines the buyer's and seller's responsibilities concerning the payment of prorated taxes. It may include instructions for disbursing the tax payments at the closing of the transaction. Different types of Sugar Land Texas Acknowledgment for Proration of Ad Valor em Taxes may vary based on specific circumstances or additional clauses necessary to address unique situations. However, the general purpose and content of the acknowledgment remain consistent. Other possible types or variations of Sugar Land Texas Acknowledgment for Proration of Ad Valor em Taxes may include: 1. Commercial Property Acknowledgment: This type of acknowledgment may have specific provisions tailored for commercial property transactions, taking into account different assessment methods or tax rates applicable to commercial properties in Sugar Land, Texas. 2. Residential Property Acknowledgment: This variation may address proration calculations specific to residential properties, such as homestead exemptions or any tax incentives available for homeowners in Sugar Land, Texas. 3. Delinquent Taxes Acknowledgment: In cases where there are outstanding or delinquent taxes on the property, this acknowledgment may outline how the responsibility for payment and proration will be handled, ensuring a clear understanding between the parties involved. In conclusion, the Sugar Land Texas Acknowledgment for Proration of Ad Valor em Taxes is a crucial legal document that ensures a fair division of property tax liability between buyers and sellers during real estate transactions in Sugar Land, Texas. By providing a comprehensive description of the property, clarifying payment responsibilities, and utilizing accurate tax data, this acknowledgment helps streamline transactions and promotes transparency in the proration process.

Sugar Land Texas Acknowledgment for Proration of Ad Valorem Taxes

Description

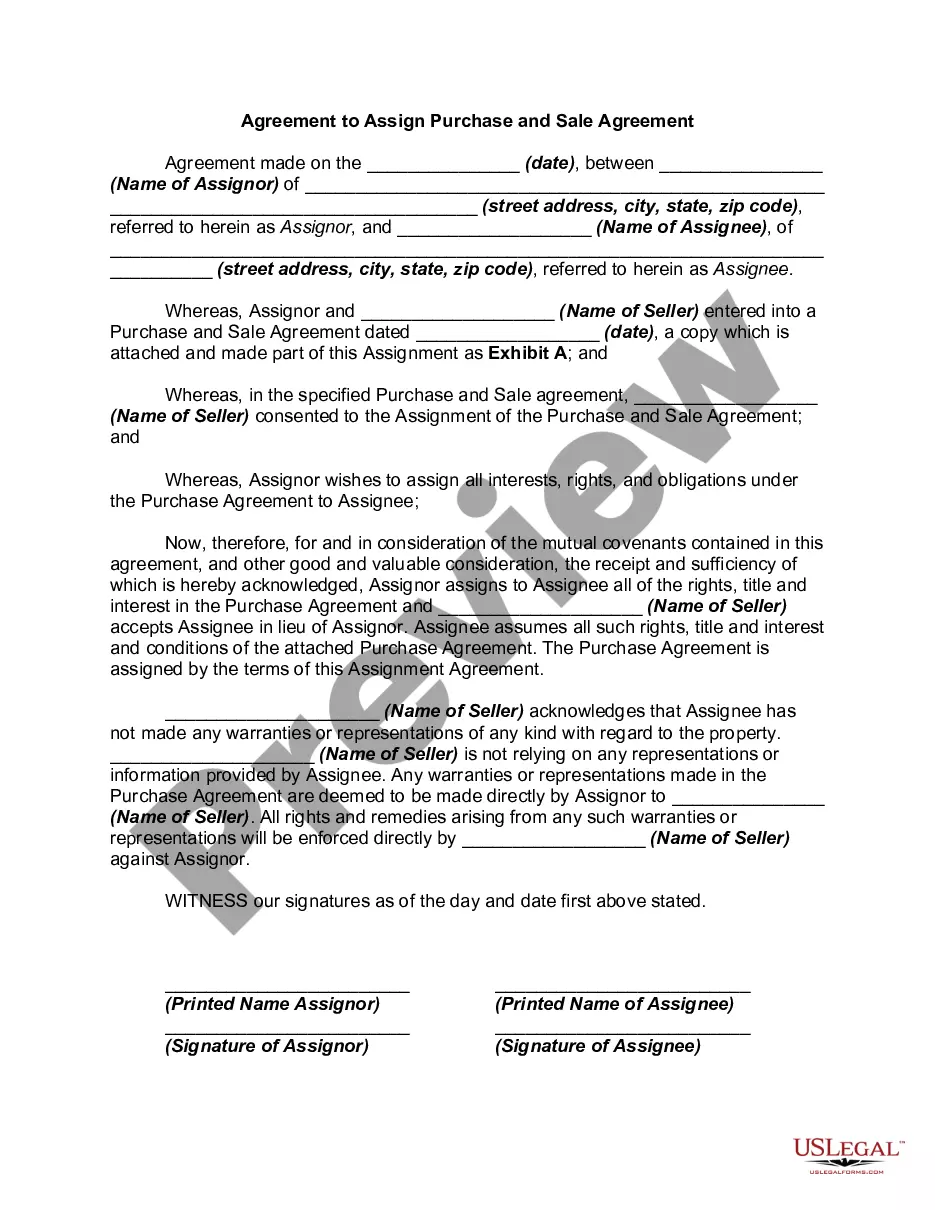

How to fill out Sugar Land Texas Acknowledgment For Proration Of Ad Valorem Taxes?

Locating verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Sugar Land Texas Acknowledgment for Proration of Ad Valorem Taxes gets as quick and easy as ABC.

For everyone already acquainted with our library and has used it before, getting the Sugar Land Texas Acknowledgment for Proration of Ad Valorem Taxes takes just a few clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. The process will take just a few more actions to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form collection:

- Check the Preview mode and form description. Make sure you’ve picked the correct one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, use the Search tab above to find the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Sugar Land Texas Acknowledgment for Proration of Ad Valorem Taxes. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!