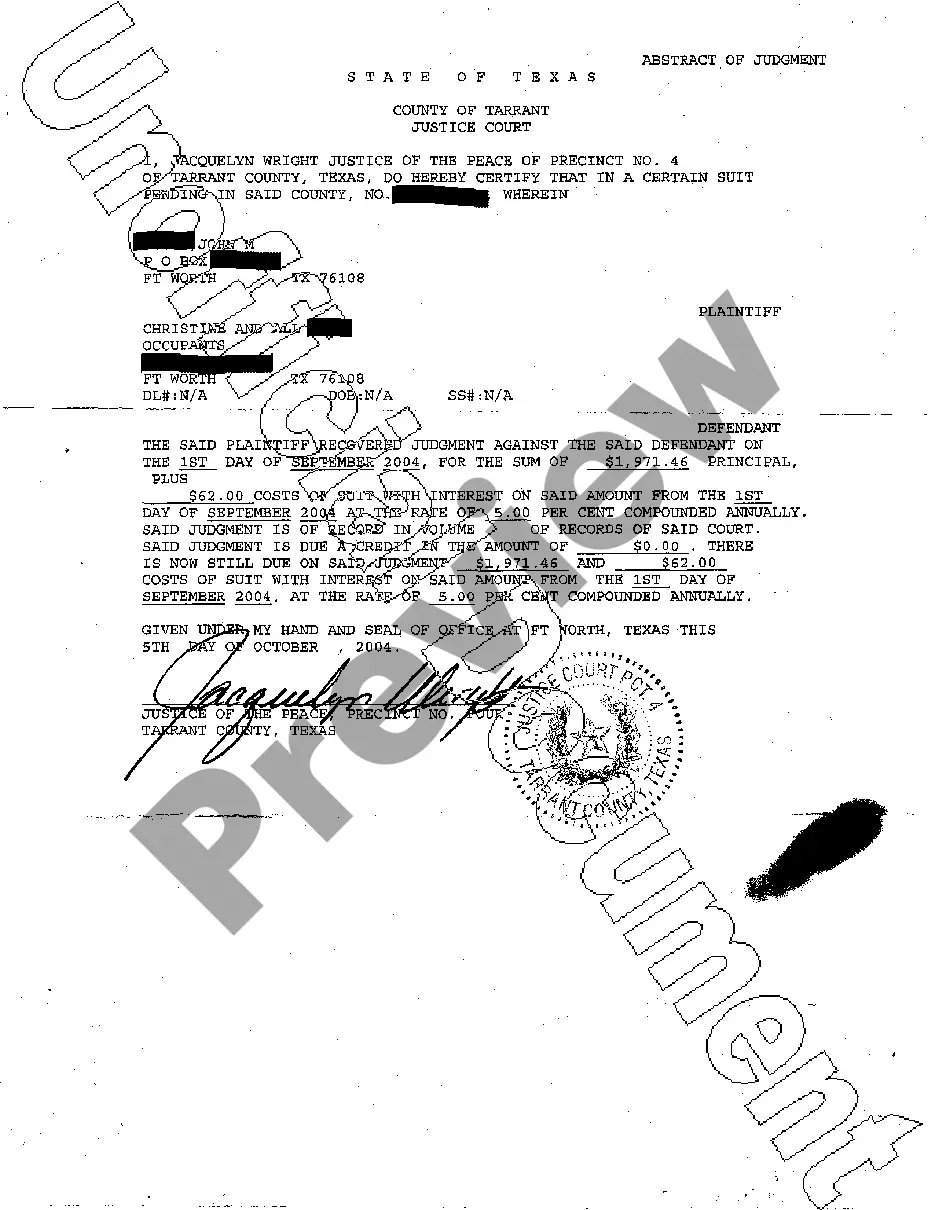

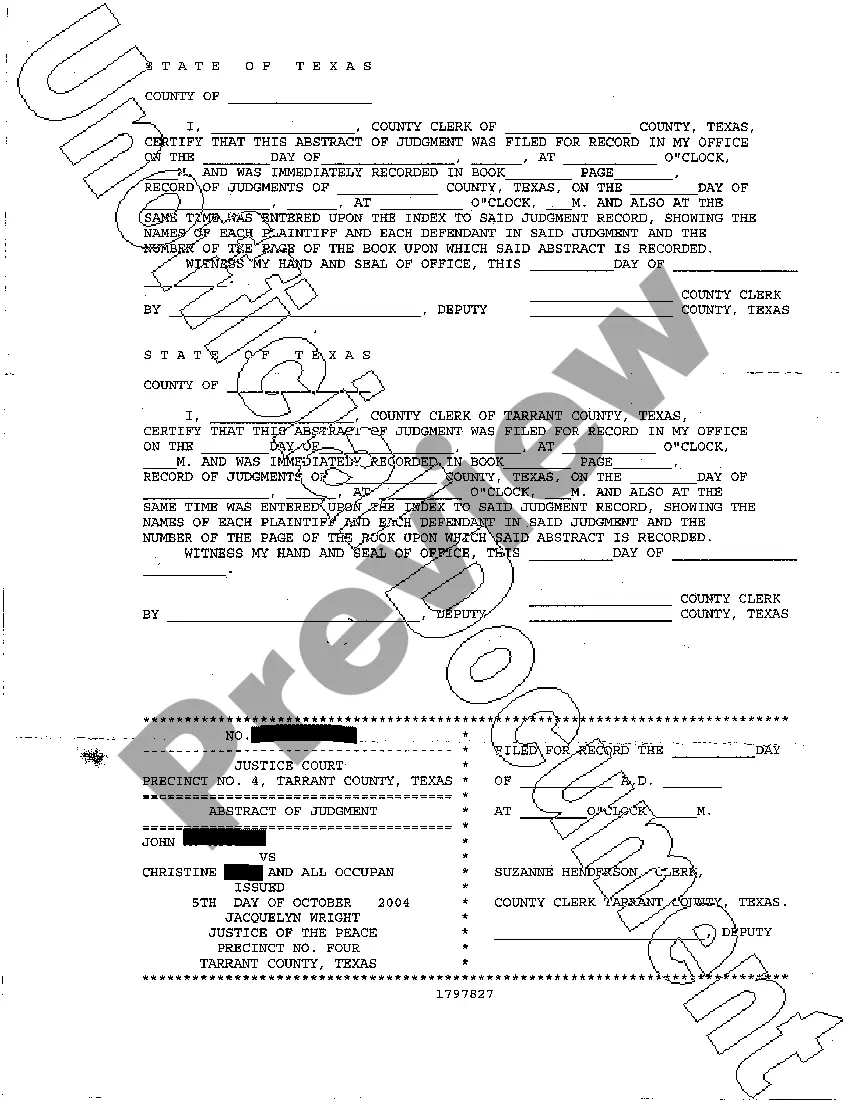

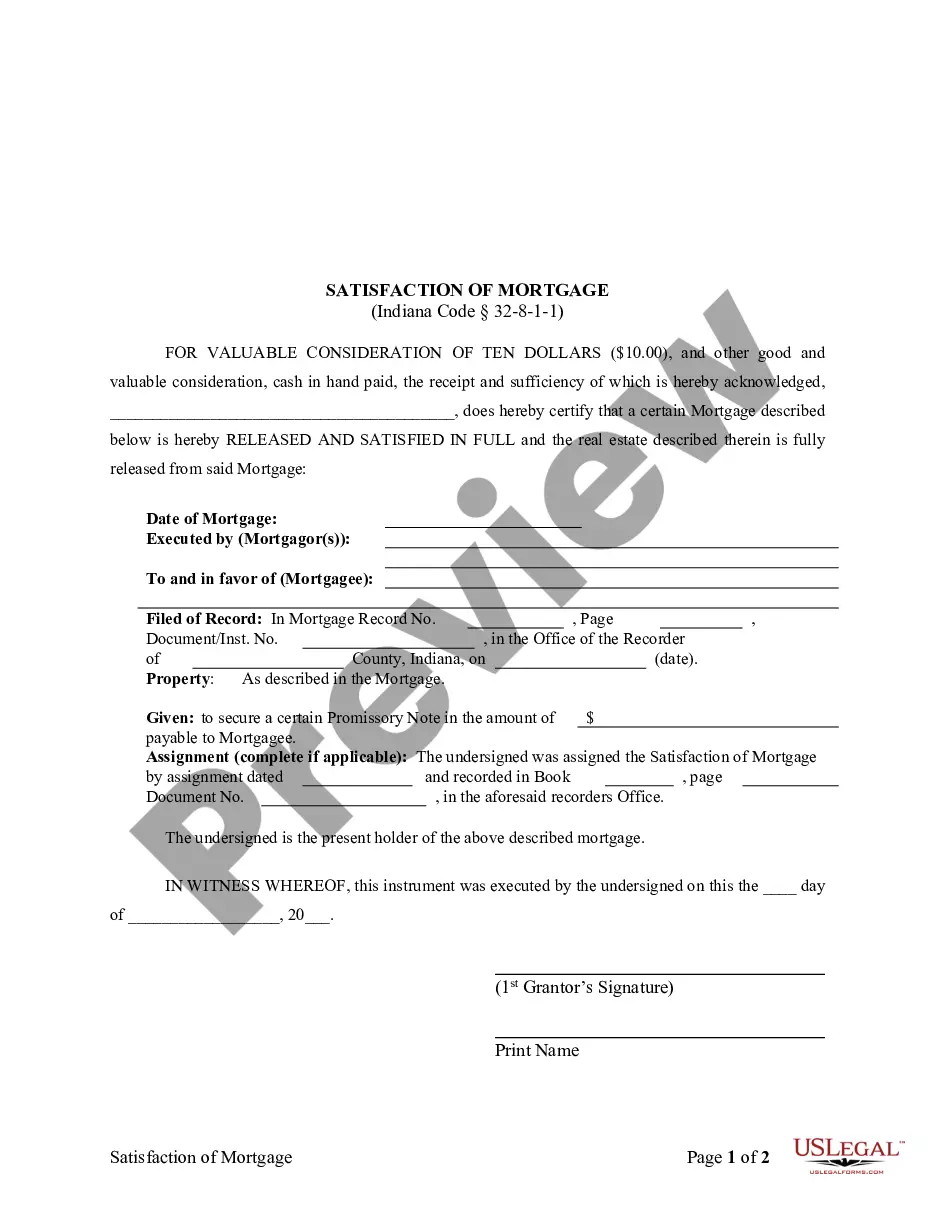

Plano Texas Abstract of Judgment is a legal document that serves as an official record of a court's ruling regarding a monetary judgment obtained in Plano, Texas. An abstract of judgment is typically filed by a judgment creditor to put a lien on the judgment debtor's property, giving the creditor a legal claim on the debtor's assets. The abstract of judgment includes vital details such as the names of the parties involved, the case number, the date of the judgment, and the amount owed by the debtor. It serves as evidence of the debt's existence, ensuring that the creditor can pursue further legal actions to enforce the judgment, such as wage garnishments, bank levies, or property liens. In Plano, Texas, there are different types of abstracts of judgment, based on the specific circumstances of the case. These may include: 1. General Abstract of Judgment: This type of abstract is typically used when the judgment debtor does not own any real property. It is recorded in the county where the debtor resides, alerting potential creditors that the debtor owes a debt. 2. Real Property Abstract of Judgment: When the judgment debtor owns real estate in Plano, Texas, a real property abstract of judgment is filed with the county clerk's office. This type of abstract effectively puts a lien on the debtor's property, preventing them from selling or refinancing it without satisfying the outstanding debt. 3. Personal Property Abstract of Judgment: In cases where the debtor owns personal property, such as vehicles or high-value assets, a personal property abstract of judgment may be filed. This abstract is typically recorded with the Texas Secretary of State and serves as a notice to any potential buyers or creditors of the existing debt. Filing an abstract of judgment in Plano, Texas is a strategic move for judgment creditors to protect their interests. It helps ensure that debtors cannot evade or ignore their obligations by attempting to hide or transfer their assets. However, it is essential for creditors to follow the legal procedures accurately and consult with experienced attorneys to avoid any potential mistakes that may hinder enforcement efforts.

Plano Texas Abstract of Judgment

Description

How to fill out Plano Texas Abstract Of Judgment?

If you are looking for a relevant form template, it’s extremely hard to find a more convenient place than the US Legal Forms site – probably the most extensive libraries on the web. With this library, you can get a huge number of form samples for company and personal purposes by categories and states, or keywords. Using our high-quality search feature, finding the most recent Plano Texas Abstract of Judgment is as easy as 1-2-3. In addition, the relevance of every file is proved by a group of skilled attorneys that on a regular basis review the templates on our website and revise them in accordance with the newest state and county regulations.

If you already know about our system and have an account, all you need to get the Plano Texas Abstract of Judgment is to log in to your account and click the Download button.

If you utilize US Legal Forms the very first time, just refer to the instructions below:

- Make sure you have found the sample you want. Read its information and make use of the Preview option (if available) to explore its content. If it doesn’t meet your needs, utilize the Search option at the top of the screen to get the needed record.

- Confirm your choice. Choose the Buy now button. Next, select your preferred subscription plan and provide credentials to sign up for an account.

- Process the financial transaction. Use your credit card or PayPal account to complete the registration procedure.

- Get the form. Choose the format and download it to your system.

- Make changes. Fill out, modify, print, and sign the obtained Plano Texas Abstract of Judgment.

Each and every form you save in your account does not have an expiration date and is yours permanently. It is possible to gain access to them using the My Forms menu, so if you need to have an additional duplicate for editing or creating a hard copy, you can come back and save it again at any time.

Take advantage of the US Legal Forms professional catalogue to gain access to the Plano Texas Abstract of Judgment you were looking for and a huge number of other professional and state-specific samples on a single platform!