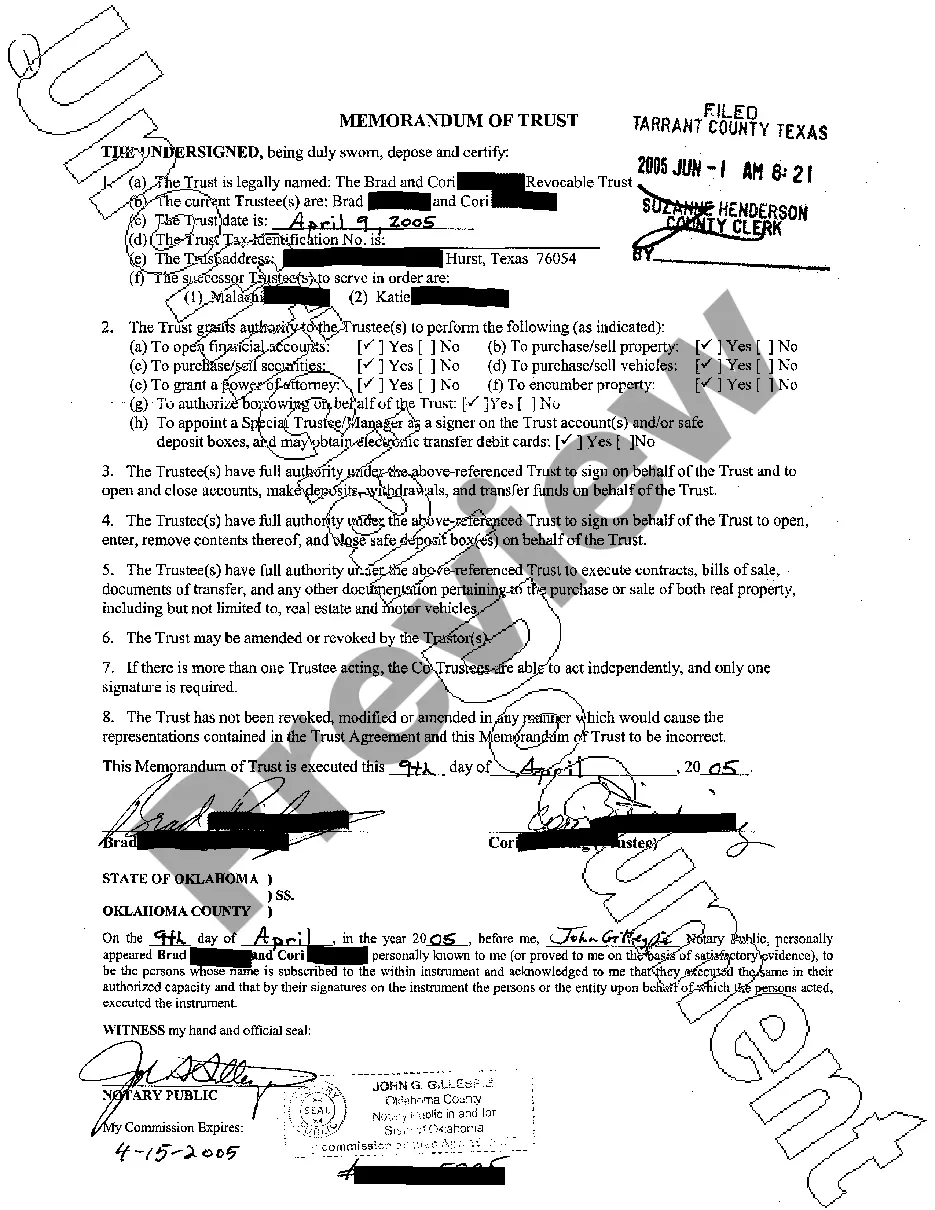

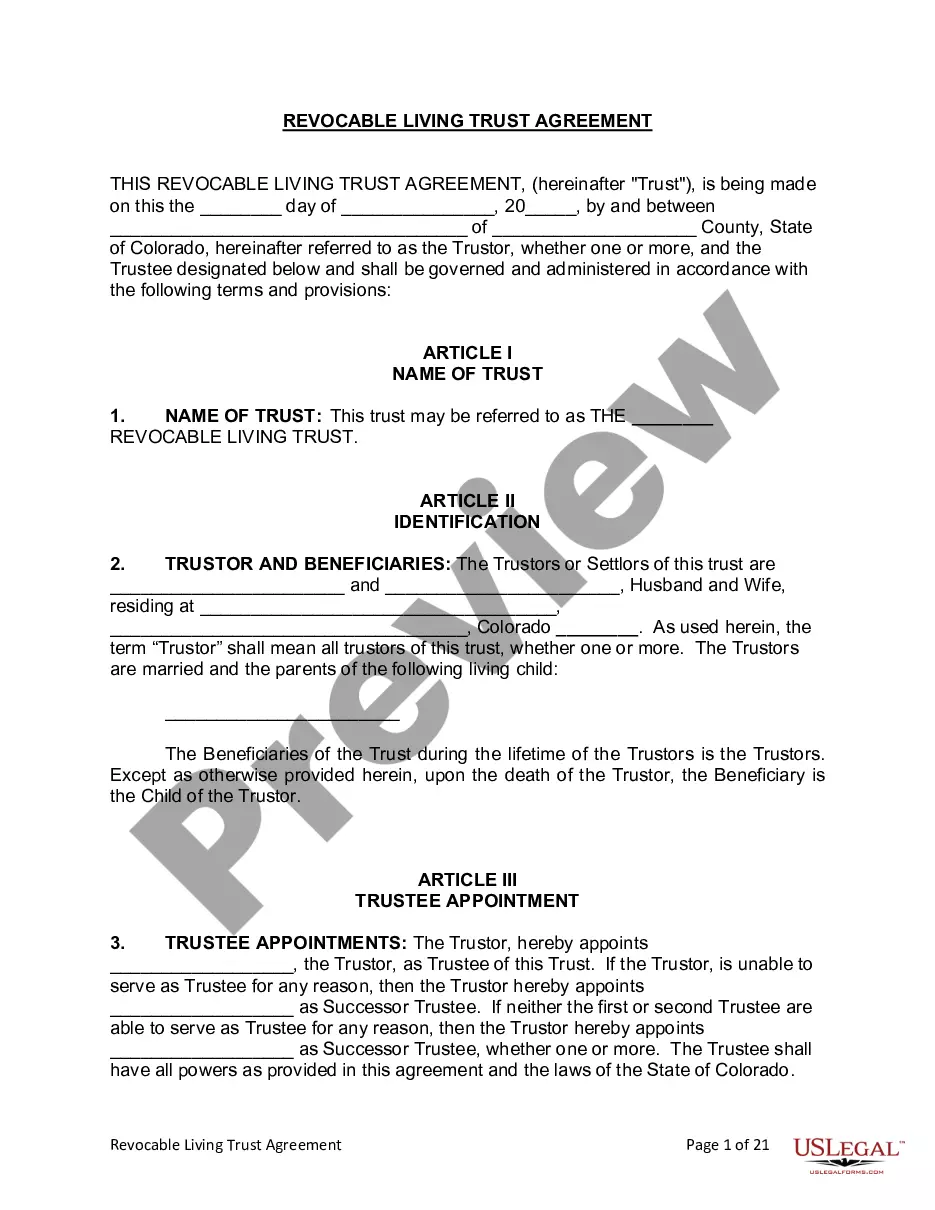

A Harris Texas Memorandum of Trust is a legally binding document that outlines the essential details of a trust agreement. It serves as a condensed version of the trust, providing important information about the trust's purpose, beneficiaries, trustees, and assets. The memorandum is typically used to provide a concise overview of the trust while keeping the rest of the trust details confidential. This document is commonly used in Harris County, Texas, where it is required to be filed with the county clerk's office. There are various types of Harris Texas Memorandum of Trust, depending on the specific purpose and nature of the trust: 1. Revocable Living Trust Memorandum: This type of memorandum is associated with a revocable living trust, which can be modified or terminated by the granter during their lifetime. The memorandum outlines the key terms of the living trust and is often utilized to provide instructions for managing the trust assets after the granter's death. 2. Irrevocable Trust Memorandum: In contrast to the revocable living trust memorandum, an irrevocable trust memorandum relates to an irrevocable trust. Once established, the terms of this trust cannot be altered or revoked without the consent of all interested parties. The memorandum contains crucial information regarding the irrevocable trust and its administration. 3. Testamentary Trust Memorandum: This type of memorandum is connected to a testamentary trust, which is created under a last will and testament and takes effect upon the testator's death. The memorandum outlines specific provisions relating to the testamentary trust and is often utilized to avoid the need for disclosing all details of the trust in the public record. 4. Special Needs Trust Memorandum: This memorandum is associated with a special needs trust, also known as a supplemental needs trust. It is created to provide ongoing financial support and protection for individuals with disabilities while preserving their eligibility for government benefits. The memorandum lays out the critical parameters and instructions for managing the trust's assets for the benefit of the disabled individual. By filing a Harris Texas Memorandum of Trust, individuals can protect their privacy while adhering to legal requirements. This document allows the trust to remain confidential, while still providing relevant information to interested parties such as beneficiaries, trustees, and legal authorities. It serves as an invaluable tool in managing the trust's affairs effectively and maximizing the intended benefits for all involved.

Harris Texas Memorandum of Trust

Description

How to fill out Harris Texas Memorandum Of Trust?

No matter the social or professional status, completing legal forms is an unfortunate necessity in today’s world. Very often, it’s practically impossible for a person without any law education to draft this sort of paperwork cfrom the ground up, mostly due to the convoluted terminology and legal subtleties they entail. This is where US Legal Forms comes in handy. Our service provides a massive collection with over 85,000 ready-to-use state-specific forms that work for practically any legal situation. US Legal Forms also is an excellent resource for associates or legal counsels who want to to be more efficient time-wise using our DYI forms.

Whether you require the Harris Texas Memorandum of Trust or any other paperwork that will be good in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the Harris Texas Memorandum of Trust in minutes employing our trustworthy service. If you are presently a subscriber, you can go on and log in to your account to download the needed form.

However, in case you are new to our platform, ensure that you follow these steps before obtaining the Harris Texas Memorandum of Trust:

- Ensure the template you have chosen is suitable for your area because the regulations of one state or county do not work for another state or county.

- Preview the form and go through a short outline (if available) of scenarios the document can be used for.

- In case the one you chosen doesn’t meet your requirements, you can start again and search for the needed form.

- Click Buy now and pick the subscription option you prefer the best.

- Access an account {using your login information or register for one from scratch.

- Choose the payment method and proceed to download the Harris Texas Memorandum of Trust as soon as the payment is done.

You’re all set! Now you can go on and print the form or complete it online. If you have any problems locating your purchased forms, you can easily find them in the My Forms tab.

Whatever situation you’re trying to solve, US Legal Forms has got you covered. Try it out now and see for yourself.

Form popularity

FAQ

The Heirship Affidavit need only be signed Page 2 and sworn by the disinterested parties. All signatures must be in the presence of a Notary Public. Clerk of the county of decedent's residence, along with an Order for the Judge to sign approving it as conforming with the requirements of TPC §137.

The claimant must file this completed affidavit in the County Clerk's record in the county of the decedent's residence. The claimant must then upload a file stamped copy of the completed affidavit to ClaimItTexas.org.

Harris County Clerk Real Property Department Harris County Civil Courthouse. 201 Caroline, Suite 320. Houston, TX 77002. (713) 274-8680.

Information Contact Us Harris County Civil Courthouse. 201 Caroline, Suite 310. Houston, TX 77002. (713) 274-6390.

Property Records Contact Us Real Property Department. Harris County Civil Courthouse. 201 Caroline, Suite 320. Houston, TX 77002. call:(713) 274-8680. fax:(713) 755-3597.

Texas - Grimes County Recorder Information The County Clerk is responsible for recording and maintaining real property records. Recording Fees, The cost to record a real estate deed is $26 for the first page and $4 for each additional page of the document.

How to File an Assumed Name (DBA) in Harris County, Texas - YouTube YouTube Start of suggested clip End of suggested clip And you can call their office at this number right here if you are going to file the assumed name inMoreAnd you can call their office at this number right here if you are going to file the assumed name in person you would visit this address right here 201 Caroline Houston Texas.

In Texas, you can't add your spouse's name to an existing deed, but you can create a new deed by transferring the property from yourself to you and your spouse jointly. You can do this by using either a deed without warranty or a quit claim deed.

The mailing address is: Harris County Clerk, P.O. Box 1525, Houston, TX 77251-1525.

Harris County Clerk Real Property Department Harris County Civil Courthouse. 201 Caroline, Suite 320. Houston, TX 77002. (713) 274-8680.

Interesting Questions

More info

Warranty deed is executed by the seller, assigns or assigns, with an acknowledgment by the buyer saying, 'I acknowledge this is a genuine deed.' Trustee deed is executed by the buyer, assigns or assigns, is acknowledged by the seller, but is not executed and the buyer's deed is executed. Where Can I Find Other Useful Information on Warranty Deeds? Warranty Deeds are a legal device which protects a purchaser of real property from a seller who will not maintain title to the property for his buyer. A warranty deed (also called a buyer warranted) can be one of the best ways to protect yourself from a deceptive or unscrupulous seller and can provide a valuable alternative for buyers and sellers in Texas without requiring them to take legal action. However, warranty deeds are not a reliable means of protecting yourself from a dishonest or dishonestly undervalued seller.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.