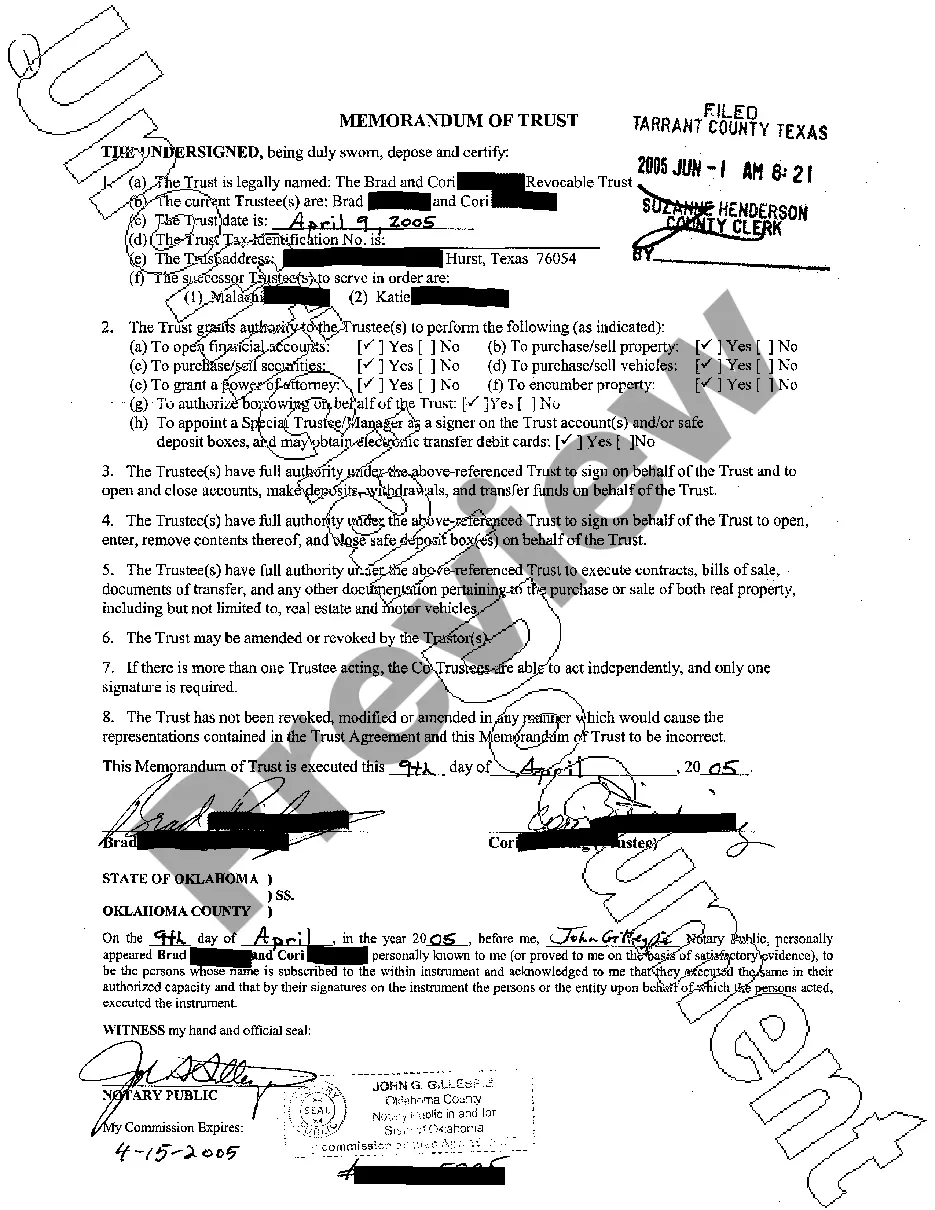

The Sugar Land Texas Memorandum of Trust is a legal document that outlines the specific terms and conditions regarding the establishment and management of a trust in Sugar Land, Texas. It serves as a crucial component in the larger framework of estate planning and asset management, providing a clear blueprint for trustees, beneficiaries, and other involved parties. This memorandum is tailored to the unique requirements set forth by the laws and regulations of Sugar Land, Texas, ensuring compliance and adherence to local legal standards. It offers a comprehensive overview of the trust's purpose, objectives, and specific provisions, allowing for seamless execution and administration. The specificity of the Sugar Land Texas Memorandum of Trust lies in the diverse array of trust types it encompasses. These include: 1. Revocable Living Trust: This type of trust allows the granter, who initiates the trust, to modify or terminate it during their lifetime. It offers flexibility and control while allowing for the seamless transfer of assets to beneficiaries upon the granter's demise. 2. Irrevocable Trust: Conversely, an irrevocable trust cannot be modified or terminated without the consent of the beneficiaries. This type of trust provides enhanced asset protection, tax benefits, and can facilitate long-term wealth preservation. 3. Charitable Remainder Trust: This trust enables individuals to contribute assets to a designated charitable organization while retaining the right to receive income from those assets during their lifetime. Following the granter's passing, the remaining assets are then transferred to the charity. 4. Special Needs Trust: A special needs trust is designed to provide financial support and asset management for individuals with disabilities, without compromising their eligibility for government assistance programs such as Medicaid. 5. Testamentary Trust: Created as part of a last will and testament, a testamentary trust ensures that specified assets are protected and managed within a trust structure after the granter's death. This offers a structured platform for the efficient distribution of assets to beneficiaries. The Sugar Land Texas Memorandum of Trust safeguards the interests of all parties involved and defines key considerations such as trustee responsibilities, successor trustees, distribution guidelines, duration, and termination provisions. It also addresses any unique provisions or specific instructions provided by the granter, tailored to their individual circumstances and objectives. In summary, the Sugar Land Texas Memorandum of Trust serves as a vital legal tool in the establishment, management, and eventual distribution of assets within Sugar Land, Texas. Its flexibility and adaptability to various trust types cater to the diverse needs of individuals seeking guidance in preserving wealth for themselves and future generations.

Sugar Land Texas Memorandum of Trust

Description

How to fill out Sugar Land Texas Memorandum Of Trust?

If you are looking for a relevant form template, it’s extremely hard to find a better place than the US Legal Forms website – probably the most comprehensive libraries on the web. Here you can get thousands of document samples for company and individual purposes by types and regions, or key phrases. With the advanced search option, getting the most recent Sugar Land Texas Memorandum of Trust is as easy as 1-2-3. Additionally, the relevance of each record is verified by a group of skilled lawyers that regularly check the templates on our platform and update them according to the latest state and county laws.

If you already know about our platform and have an account, all you need to receive the Sugar Land Texas Memorandum of Trust is to log in to your user profile and click the Download button.

If you use US Legal Forms for the first time, just refer to the instructions below:

- Make sure you have chosen the form you require. Read its explanation and make use of the Preview feature to see its content. If it doesn’t meet your requirements, utilize the Search field at the top of the screen to find the proper record.

- Affirm your choice. Click the Buy now button. After that, pick your preferred subscription plan and provide credentials to sign up for an account.

- Process the purchase. Make use of your bank card or PayPal account to finish the registration procedure.

- Receive the template. Indicate the format and save it on your device.

- Make modifications. Fill out, modify, print, and sign the acquired Sugar Land Texas Memorandum of Trust.

Every template you save in your user profile does not have an expiry date and is yours forever. You can easily gain access to them using the My Forms menu, so if you need to get an extra version for modifying or printing, you may come back and save it once more at any time.

Take advantage of the US Legal Forms extensive library to get access to the Sugar Land Texas Memorandum of Trust you were looking for and thousands of other professional and state-specific templates in one place!