Title: Understanding the Bexar Texas Notice of Rescission of Acceleration — Types and Detailed Description Introduction: The Bexar Texas Notice of Rescission of Acceleration is an important legal document used in the context of mortgage foreclosure proceedings. This detailed description aims to provide an understanding of this notice, its purpose, and potential types that may exist. 1. Definition and Purpose: The Bexar Texas Notice of Rescission of Acceleration is a formal notice sent by a lender to a borrower, typically in response to a previous Notice of Acceleration. The purpose of this notice is to inform the borrower that the lender is rescinding the acceleration clause contained in the loan agreement, effectively canceling the foreclosure process. 2. Types of Bexar Texas Notice of Rescission of Acceleration: a. Standard Rescission: This is the most common type of notice used in Bexar County, Texas. It is issued when the lender acknowledges certain changes in the borrower's financial situation or a loan modification agreement that indicates the borrower's ability to cure the default, thus allowing the borrower more time to bring their mortgage payments current. b. Conditional Rescission: In some cases, a lender may issue a conditional rescission notice. This type of notice is established when the borrower has met specific conditions that were previously outlined to resolve the default, such as making a lump-sum payment or adhering to a specific payment plan. c. Negotiated Rescission: When the borrower and lender come to an agreement regarding the cancellation of the acceleration clause and foreclosure proceedings, a negotiated rescission notice is issued. This type may occur when both parties seek to explore alternative options, such as loan modification or refinancing. 3. Format and Key Elements: a. Parties Involved: The notice identifies the lender and borrower by their legal names and includes their contact information. b. Statement of Rescission: Clearly states that the lender is rescinding the acceleration clause and cancels the foreclosure proceedings based on specific grounds. c. Effective Date: Specifies the effective date of the rescission, which marks the lender's acknowledgment to halt the foreclosure process. d. Cure or Repayment Terms: If applicable, the notice might outline the specific requirements for the borrower to resolve the default and bring the loan current, such as making a lump-sum payment or adhering to an agreed-upon payment plan. e. Consequences of Non-Compliance: In some cases, the notice may include potential consequences if the borrower fails to comply with the terms outlined in the rescission notice, such as the immediate reinstatement of the foreclosure process. Conclusion: Understanding the Bexar Texas Notice of Rescission of Acceleration is crucial for borrowers facing foreclosure in Bexar County, Texas. The various types of notices discussed here provide insight into the potential scenarios that can lead to the rescission of the acceleration clause and the temporary cancellation of foreclosure proceedings. It is advisable for borrowers to seek legal counsel and comprehensively review the terms and conditions within the notice to protect their rights and financial well-being.

Bexar Texas Notice of Rescission of Acceleration

State:

Texas

County:

Bexar

Control #:

TX-JW-0028

Format:

PDF

Instant download

This form is available by subscription

Description

Notice of Rescission of Acceleration

Title: Understanding the Bexar Texas Notice of Rescission of Acceleration — Types and Detailed Description Introduction: The Bexar Texas Notice of Rescission of Acceleration is an important legal document used in the context of mortgage foreclosure proceedings. This detailed description aims to provide an understanding of this notice, its purpose, and potential types that may exist. 1. Definition and Purpose: The Bexar Texas Notice of Rescission of Acceleration is a formal notice sent by a lender to a borrower, typically in response to a previous Notice of Acceleration. The purpose of this notice is to inform the borrower that the lender is rescinding the acceleration clause contained in the loan agreement, effectively canceling the foreclosure process. 2. Types of Bexar Texas Notice of Rescission of Acceleration: a. Standard Rescission: This is the most common type of notice used in Bexar County, Texas. It is issued when the lender acknowledges certain changes in the borrower's financial situation or a loan modification agreement that indicates the borrower's ability to cure the default, thus allowing the borrower more time to bring their mortgage payments current. b. Conditional Rescission: In some cases, a lender may issue a conditional rescission notice. This type of notice is established when the borrower has met specific conditions that were previously outlined to resolve the default, such as making a lump-sum payment or adhering to a specific payment plan. c. Negotiated Rescission: When the borrower and lender come to an agreement regarding the cancellation of the acceleration clause and foreclosure proceedings, a negotiated rescission notice is issued. This type may occur when both parties seek to explore alternative options, such as loan modification or refinancing. 3. Format and Key Elements: a. Parties Involved: The notice identifies the lender and borrower by their legal names and includes their contact information. b. Statement of Rescission: Clearly states that the lender is rescinding the acceleration clause and cancels the foreclosure proceedings based on specific grounds. c. Effective Date: Specifies the effective date of the rescission, which marks the lender's acknowledgment to halt the foreclosure process. d. Cure or Repayment Terms: If applicable, the notice might outline the specific requirements for the borrower to resolve the default and bring the loan current, such as making a lump-sum payment or adhering to an agreed-upon payment plan. e. Consequences of Non-Compliance: In some cases, the notice may include potential consequences if the borrower fails to comply with the terms outlined in the rescission notice, such as the immediate reinstatement of the foreclosure process. Conclusion: Understanding the Bexar Texas Notice of Rescission of Acceleration is crucial for borrowers facing foreclosure in Bexar County, Texas. The various types of notices discussed here provide insight into the potential scenarios that can lead to the rescission of the acceleration clause and the temporary cancellation of foreclosure proceedings. It is advisable for borrowers to seek legal counsel and comprehensively review the terms and conditions within the notice to protect their rights and financial well-being.

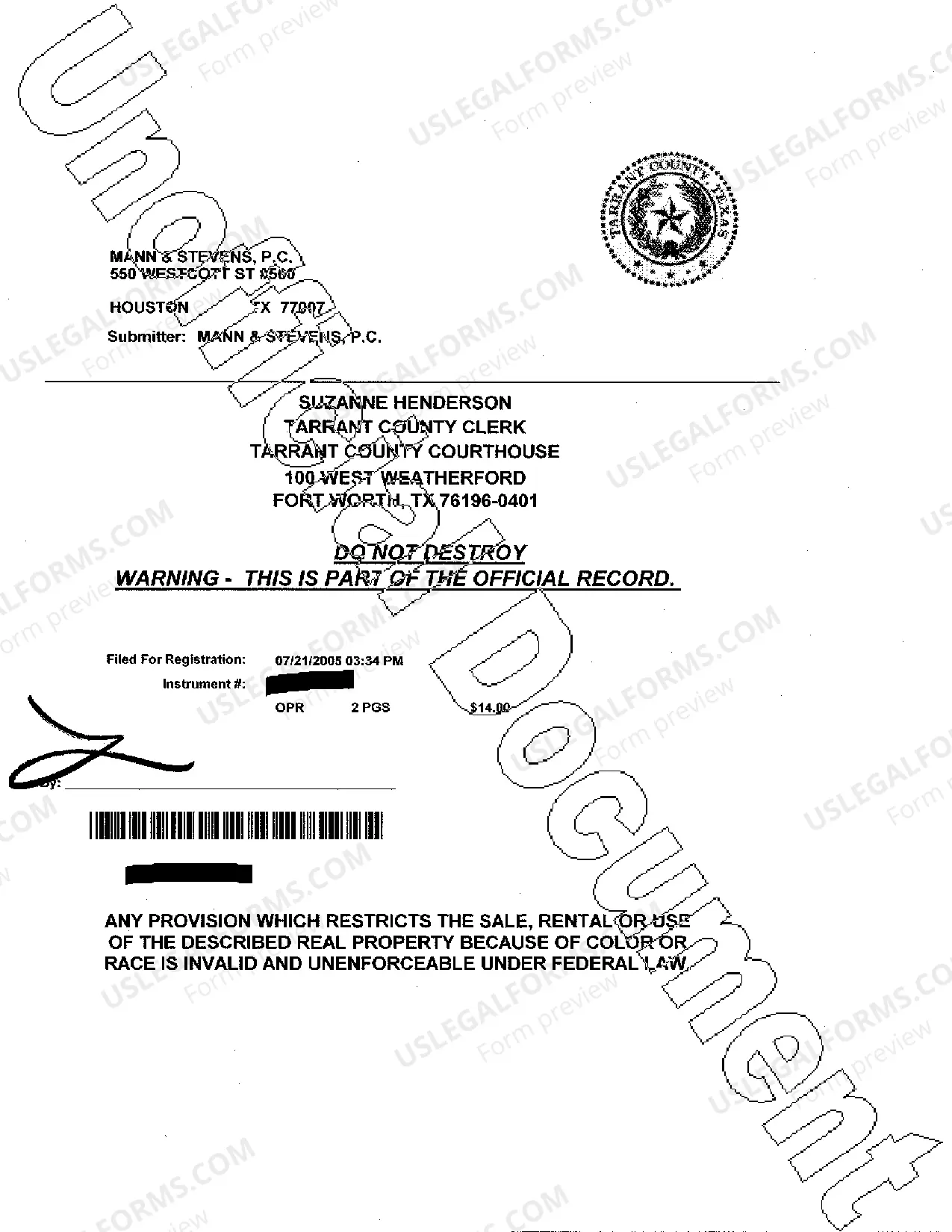

Free preview

How to fill out Bexar Texas Notice Of Rescission Of Acceleration?

If you’ve already utilized our service before, log in to your account and download the Bexar Texas Notice of Rescission of Acceleration on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your document:

- Ensure you’ve found an appropriate document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to obtain the appropriate one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Get your Bexar Texas Notice of Rescission of Acceleration. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your personal or professional needs!