Killeen Texas Notice of Rescission of Acceleration is an important legal document that reverses the acceleration of a loan or mortgage. When a borrower fails to make timely payments on their loan, the lender has the right to accelerate the debt, which means they can demand immediate payment of the entire outstanding balance. However, if the borrower takes corrective actions to remedy the default, they can file a Notice of Rescission of Acceleration to undo the acceleration and revert to the original payment terms. There are several types of Killeen Texas Notice of Rescission of Acceleration, depending on the specific circumstances and the type of loan. 1. Residential Mortgage Notice of Rescission of Acceleration: This type of notice is filed when a borrower defaults on their residential mortgage loan, such as a home loan or a mortgage on a residential property. It allows the borrower to request a rescission of the acceleration and return to the original payment plan. 2. Commercial Loan Notice of Rescission of Acceleration: This notice is applicable to commercial loans, which are taken out for business purposes. If a business owner defaults on their loan payments, they can file this form to reverse the acceleration and negotiate new payment terms with the lender. 3. Auto Loan Notice of Rescission of Acceleration: In the case of an auto loan, if a borrower defaults on their payments, the lender can accelerate the loan and demand full repayment. However, by submitting a Notice of Rescission of Acceleration, the borrower can request a reversal of the acceleration and discuss alternative payment options. When drafting a Killeen Texas Notice of Rescission of Acceleration, it is crucial to include specific information such as the borrower's name, address, loan or mortgage details, the reason for default, and any actions taken to rectify the default. Additionally, the notice should clearly state the borrower's intentions to revert to the original payment terms and any proposed adjustments to the loan. The document should be signed and dated by the borrower and sent to the lender via certified mail to ensure its validity and proper acknowledgement.

Killeen Texas Notice of Rescission of Acceleration

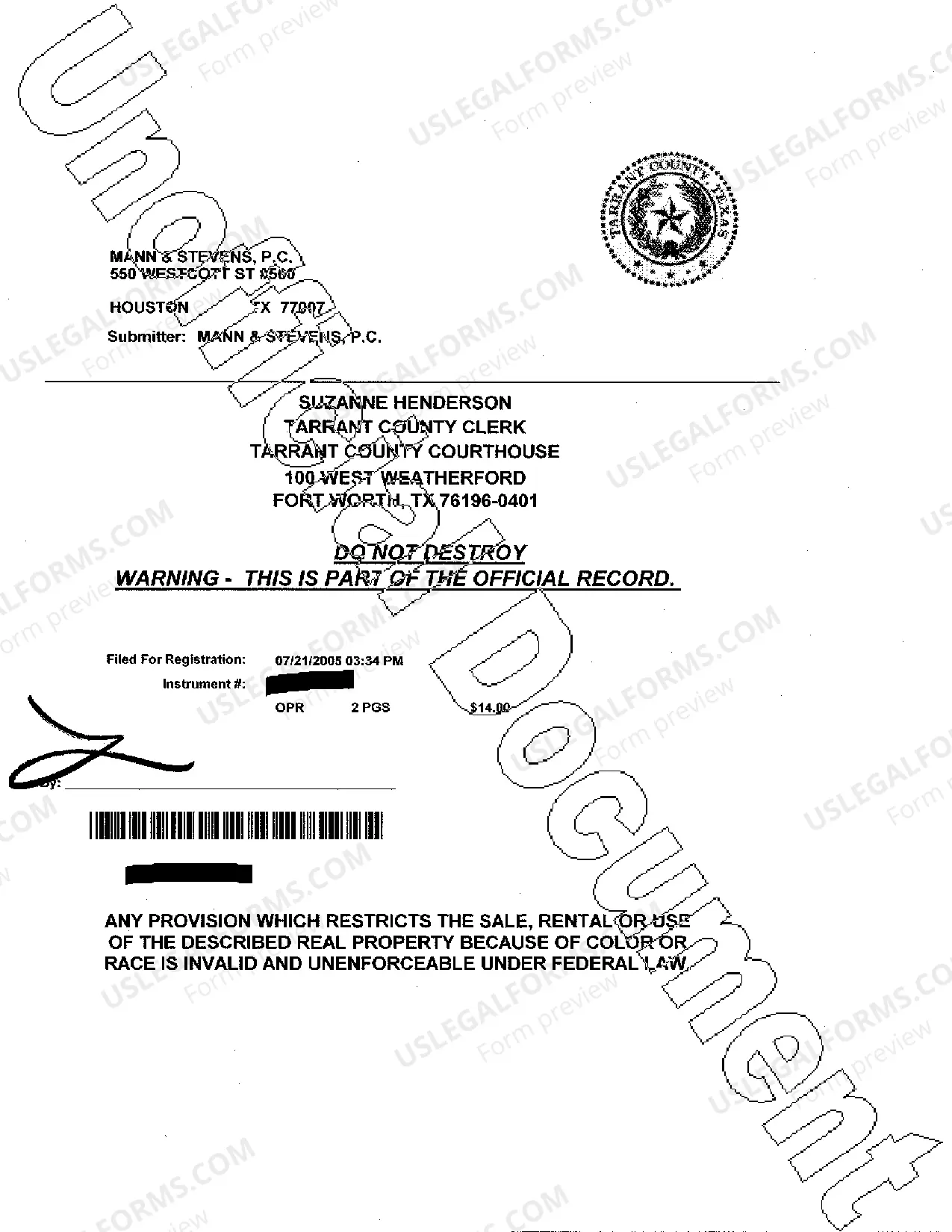

Description

How to fill out Killeen Texas Notice Of Rescission Of Acceleration?

Make use of the US Legal Forms and have immediate access to any form template you want. Our beneficial platform with a large number of templates makes it simple to find and obtain virtually any document sample you need. It is possible to export, fill, and certify the Killeen Texas Notice of Rescission of Acceleration in just a couple of minutes instead of browsing the web for several hours searching for the right template.

Using our library is an excellent strategy to raise the safety of your record submissions. Our professional legal professionals on a regular basis check all the records to ensure that the templates are relevant for a particular region and compliant with new acts and polices.

How can you obtain the Killeen Texas Notice of Rescission of Acceleration? If you have a profile, just log in to the account. The Download option will be enabled on all the samples you look at. Moreover, you can find all the earlier saved documents in the My Forms menu.

If you don’t have a profile yet, stick to the instruction below:

- Open the page with the form you require. Make certain that it is the form you were hoping to find: verify its name and description, and utilize the Preview option if it is available. Otherwise, use the Search field to look for the needed one.

- Start the downloading process. Click Buy Now and select the pricing plan you like. Then, sign up for an account and pay for your order utilizing a credit card or PayPal.

- Save the file. Choose the format to obtain the Killeen Texas Notice of Rescission of Acceleration and modify and fill, or sign it according to your requirements.

US Legal Forms is probably the most extensive and reliable document libraries on the internet. Our company is always ready to help you in any legal case, even if it is just downloading the Killeen Texas Notice of Rescission of Acceleration.

Feel free to take advantage of our form catalog and make your document experience as convenient as possible!