McAllen Texas Notice of Rescission of Acceleration is a legal document used in the state of Texas to cancel or reverse the acceleration of a loan. This notice is typically issued by a mortgage lender or service in response to a default by the borrower. It serves as an official communication notifying the borrower that the lender is rescinding their decision to accelerate the loan, which would have required immediate payment of the entire remaining balance. This notice provides relief to the borrower by allowing them to revert to their original payment schedule. There are various types of McAllen Texas Notice of Rescission of Acceleration, depending on the circumstances and terms of the loan agreement. These may include: 1. Statutory Rescission: This type of rescission is initiated by the lender or service in compliance with specific state laws in Texas. It allows the lender to reverse the acceleration when the borrower rectifies the default or fulfills certain conditions outlined in the loan agreement. 2. Amended Rescission: In certain cases, the lender may issue an amended notice of rescission, modifying the original terms of the acceleration. This occurs when both parties agree to new repayment terms or when the borrower provides adequate proof of their ability to resolve the default issue. 3. Conditional Rescission: When a borrower’s circumstances change unexpectedly, such as a sudden loss of income or unforeseen expenses, the lender may offer a conditional rescission. This enables the borrower to demonstrate their ability to resume regular payments within a prearranged period, thus reversing the acceleration. 4. Mutual Consent Rescission: In situations where both the lender and the borrower mutually agree to reverse the acceleration, a mutual consent rescission is issued. This type of rescission is typically associated with negotiated settlements or loan modifications. It is crucial for borrowers to carefully review and understand the terms outlined in the McAllen Texas Notice of Rescission of Acceleration. This notice should provide detailed information regarding the conditions for rescission, the deadline to comply with any required actions, and any potential consequences for failing to meet the specified terms. It is recommended that borrowers consult with legal professionals or housing counselors to ensure they navigate the complex legal process of loan rescission effectively. So, it is essential for borrowers to respond promptly to the notice and communicate with the lender to resolve any outstanding issues and reinstate their mortgage loan according to the agreed-upon terms.

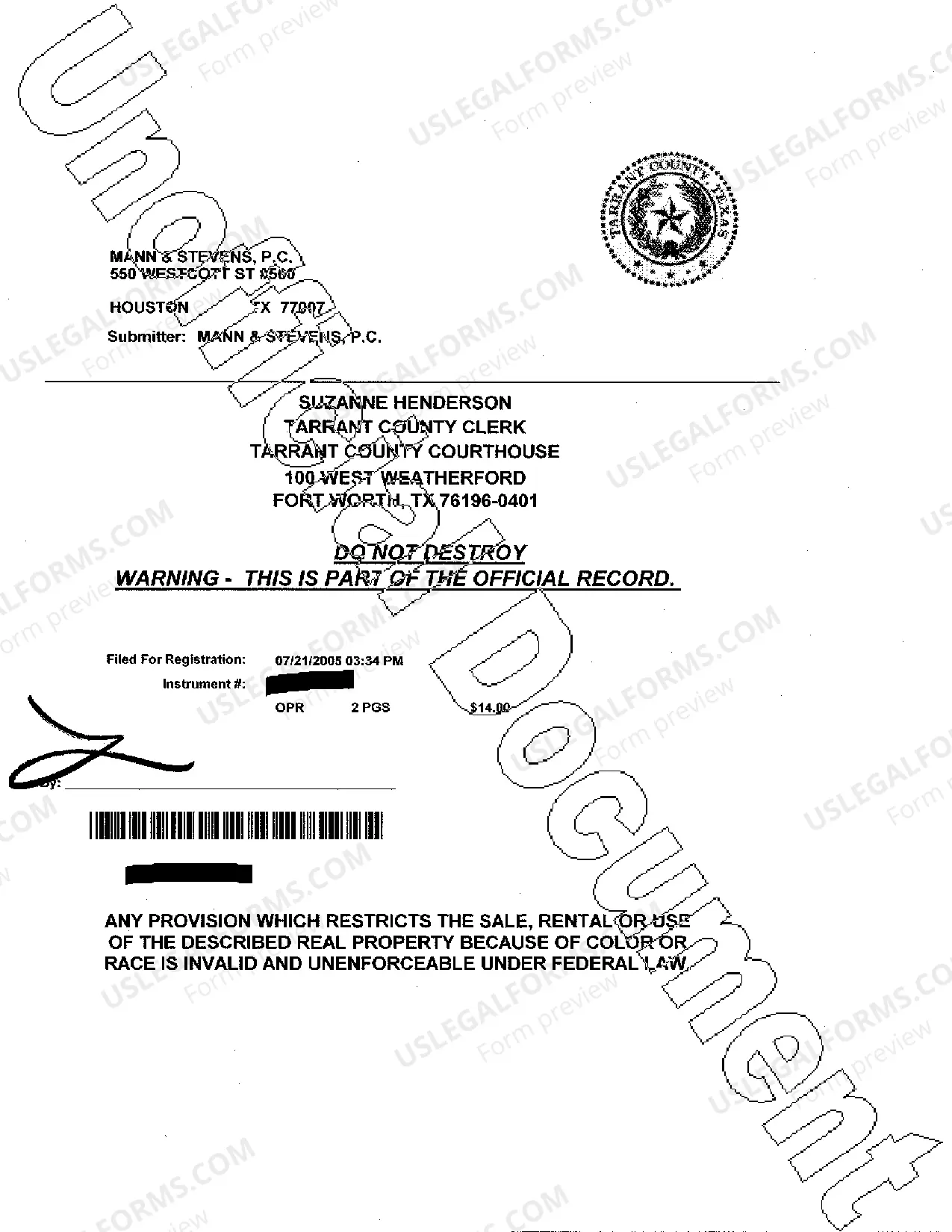

McAllen Texas Notice of Rescission of Acceleration

Description

How to fill out McAllen Texas Notice Of Rescission Of Acceleration?

Regardless of social or professional status, completing legal forms is an unfortunate necessity in today’s world. Too often, it’s practically impossible for a person with no law education to create such papers cfrom the ground up, mainly due to the convoluted terminology and legal nuances they entail. This is where US Legal Forms comes in handy. Our service provides a huge catalog with more than 85,000 ready-to-use state-specific forms that work for pretty much any legal scenario. US Legal Forms also is a great asset for associates or legal counsels who want to save time using our DYI forms.

Whether you want the McAllen Texas Notice of Rescission of Acceleration or any other paperwork that will be good in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how to get the McAllen Texas Notice of Rescission of Acceleration quickly using our reliable service. If you are already a subscriber, you can go on and log in to your account to get the appropriate form.

However, if you are a novice to our platform, ensure that you follow these steps before downloading the McAllen Texas Notice of Rescission of Acceleration:

- Be sure the template you have found is specific to your location because the rules of one state or area do not work for another state or area.

- Review the document and read a brief outline (if provided) of scenarios the paper can be used for.

- In case the one you selected doesn’t meet your requirements, you can start over and search for the necessary document.

- Click Buy now and choose the subscription option you prefer the best.

- with your credentials or register for one from scratch.

- Select the payment gateway and proceed to download the McAllen Texas Notice of Rescission of Acceleration as soon as the payment is completed.

You’re all set! Now you can go on and print the document or fill it out online. Should you have any issues getting your purchased forms, you can quickly access them in the My Forms tab.

Regardless of what case you’re trying to sort out, US Legal Forms has got you covered. Give it a try today and see for yourself.