When homeowners in Sugar Land, Texas face difficulties in making their mortgage payments, their lenders have the right to initiate a foreclosure process in order to recoup the outstanding debt. However, if the borrowers are able to resolve the payment issues and meet the terms of their mortgage once again, they may be entitled to a Sugar Land Texas Notice of Rescission of Acceleration. This legal document serves as a cancellation of the acceleration clause that was triggered during the foreclosure process. The Notice of Rescission of Acceleration essentially means that the lender is revoking the acceleration clause, which is a contractual provision allowing them to demand the entire balance of the loan if the borrower defaults on their mortgage payments. By rescinding this acceleration, the lender acknowledges that the borrower has successfully resolved the default issue and is back on track with their mortgage payments. It is important to note that a Notice of Rescission of Acceleration specifically pertains to foreclosures in Sugar Land, Texas. Different types of this notice may include: 1. Voluntary Rescission: This type of Notice of Rescission of Acceleration is initiated by the lender voluntarily. It typically occurs when the borrower has rectified the mortgage default and fulfilled the lender's requirements to reinstate the loan. 2. Judicial Rescission: When a foreclosure lawsuit is filed by the lender, a Notice of Rescission of Acceleration may be issued by the court if the borrower provides evidence of resolving the default issue and complying with any necessary legal obligations. 3. Agreement-based Rescission: Sometimes, the homeowner and lender may agree to a rescission of acceleration through negotiation or mediation. This type of rescission may involve modifications to the loan terms or other arrangements that allow the borrower to resume their mortgage payments and avoid foreclosure. In conclusion, a Sugar Land Texas Notice of Rescission of Acceleration is a legal document that signals the lender's decision to cancel the acceleration clause triggered during a foreclosure process. This typically occurs when the borrower has resolved their default issues and complied with the necessary requirements. Different types of this notice may include voluntary, judicial, and agreement-based rescission.

Sugar Land Texas Notice of Rescission of Acceleration

State:

Texas

City:

Sugar Land

Control #:

TX-JW-0028

Format:

PDF

Instant download

This form is available by subscription

Description

Notice of Rescission of Acceleration

When homeowners in Sugar Land, Texas face difficulties in making their mortgage payments, their lenders have the right to initiate a foreclosure process in order to recoup the outstanding debt. However, if the borrowers are able to resolve the payment issues and meet the terms of their mortgage once again, they may be entitled to a Sugar Land Texas Notice of Rescission of Acceleration. This legal document serves as a cancellation of the acceleration clause that was triggered during the foreclosure process. The Notice of Rescission of Acceleration essentially means that the lender is revoking the acceleration clause, which is a contractual provision allowing them to demand the entire balance of the loan if the borrower defaults on their mortgage payments. By rescinding this acceleration, the lender acknowledges that the borrower has successfully resolved the default issue and is back on track with their mortgage payments. It is important to note that a Notice of Rescission of Acceleration specifically pertains to foreclosures in Sugar Land, Texas. Different types of this notice may include: 1. Voluntary Rescission: This type of Notice of Rescission of Acceleration is initiated by the lender voluntarily. It typically occurs when the borrower has rectified the mortgage default and fulfilled the lender's requirements to reinstate the loan. 2. Judicial Rescission: When a foreclosure lawsuit is filed by the lender, a Notice of Rescission of Acceleration may be issued by the court if the borrower provides evidence of resolving the default issue and complying with any necessary legal obligations. 3. Agreement-based Rescission: Sometimes, the homeowner and lender may agree to a rescission of acceleration through negotiation or mediation. This type of rescission may involve modifications to the loan terms or other arrangements that allow the borrower to resume their mortgage payments and avoid foreclosure. In conclusion, a Sugar Land Texas Notice of Rescission of Acceleration is a legal document that signals the lender's decision to cancel the acceleration clause triggered during a foreclosure process. This typically occurs when the borrower has resolved their default issues and complied with the necessary requirements. Different types of this notice may include voluntary, judicial, and agreement-based rescission.

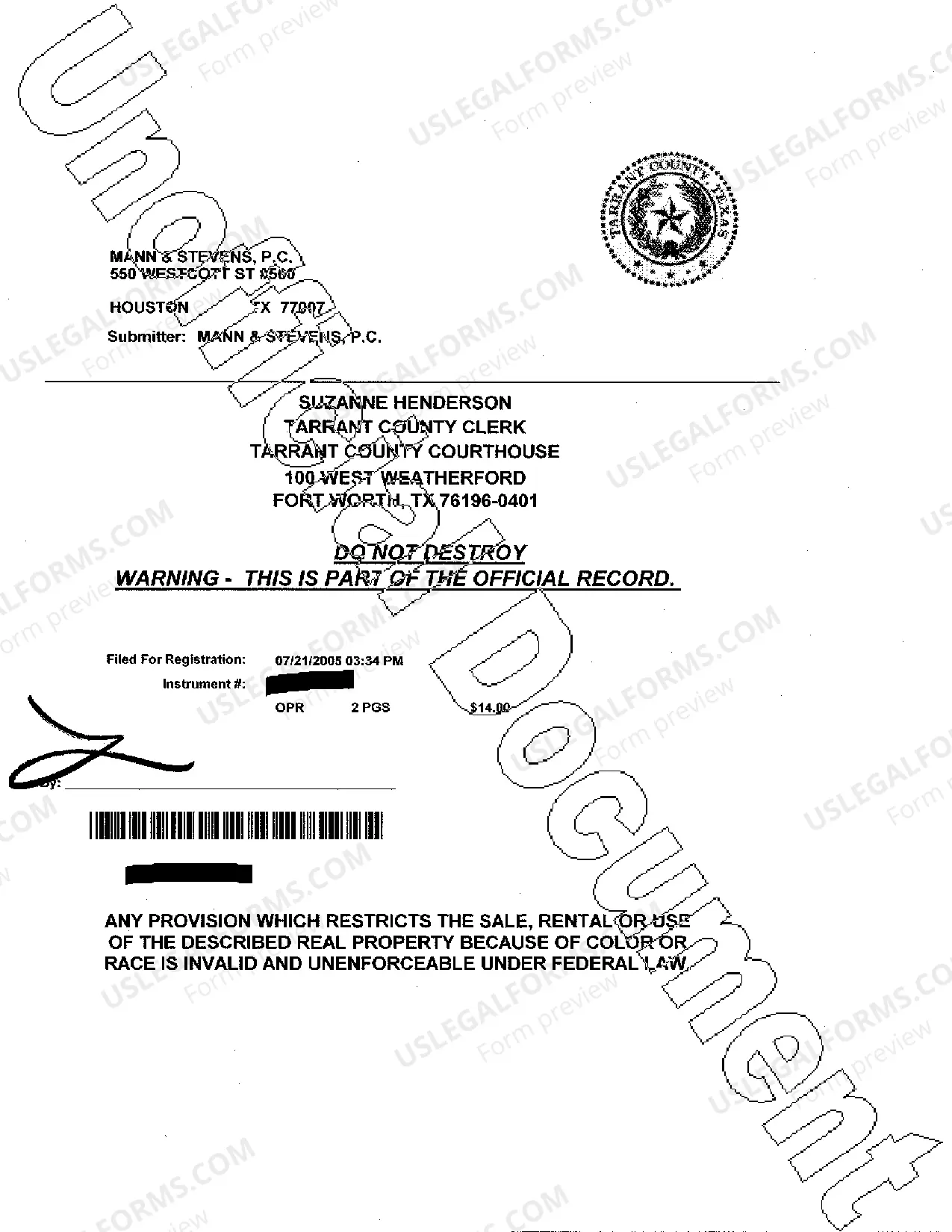

Free preview

How to fill out Sugar Land Texas Notice Of Rescission Of Acceleration?

If you’ve already used our service before, log in to your account and download the Sugar Land Texas Notice of Rescission of Acceleration on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your document:

- Ensure you’ve located a suitable document. Look through the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, use the Search tab above to obtain the appropriate one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your Sugar Land Texas Notice of Rescission of Acceleration. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your personal or professional needs!