Title: Understanding Tarrant Texas Notice of Rescission of Acceleration and Its Variations Introduction: Tarrant, Texas, implements a legal procedure known as Notice of Rescission of Acceleration, which plays a significant role in certain contractual agreements. This article aims to provide a detailed description of this process, including its meaning, key aspects, and any variations that may exist within Tarrant, Texas. 1. What is Tarrant Texas Notice of Rescission of Acceleration? The Tarrant Texas Notice of Rescission of Acceleration is a legal document used in loan agreements and contracts to revert the acceleration of debt to its original pace. Acceleration refers to the process in which a lender demands the borrower to pay the entire remaining principal amount upon a specific breach of contract terms. 2. Key Elements of Tarrant Texas Notice of Rescission of Acceleration: — Identification of Parties: The notice typically identifies the lender and borrower involved in the agreement. — Effective Date: Specifies the date on which the acceleration of the debt was rescinded. — Reasoning: Outlines the precise grounds on which the acceleration was deemed null and void. — Financial Implications: Clarifies any potential impact on interest rates, payment schedules, or penalties. — Legal Requirements: Indicates compliance with relevant Tarrant, Texas, laws and regulations. 3. Variations of Tarrant Texas Notice of Rescission of Acceleration: a. Residential Property Notice of Rescission of Acceleration: This type of notice specifically relates to mortgage loans or contracts associated with residential properties within Tarrant, Texas. It highlights any unique requirements or considerations relevant to residential properties. b. Commercial Property Notice of Rescission of Acceleration: Designed for contracts involving commercial properties, this variation caters to loan agreements associated with commercial real estate and takes into account specific aspects applicable to such properties within Tarrant, Texas. c. Auto Loan Notice of Rescission of Acceleration: Focusing on vehicle loan agreements, this variation addresses the acceleration rescission process concerning auto loans within Tarrant, Texas. It may consider specific state regulations and requirements applicable to the automobile industry. d. Personal Loan Notice of Rescission of Acceleration: Applicable to personal loans in Tarrant, Texas, this variation deals with acceleration rescission within the context of non-collateralized loans. It may involve different legal considerations compared to property or vehicle-related loans. Conclusion: The Tarrant Texas Notice of Rescission of Acceleration serves as a crucial legal tool in loan agreements, allowing for the reversal of debt acceleration and a return to the original payment schedule. Understanding the variations within Tarrant, Texas, helps ensure compliance with specific legal requirements associated with different types of contracts, including residential, commercial, auto, and personal loans. Seeking legal counsel or referring to the Tarrant, Texas, state statutes is encouraged when drafting or responding to such notices.

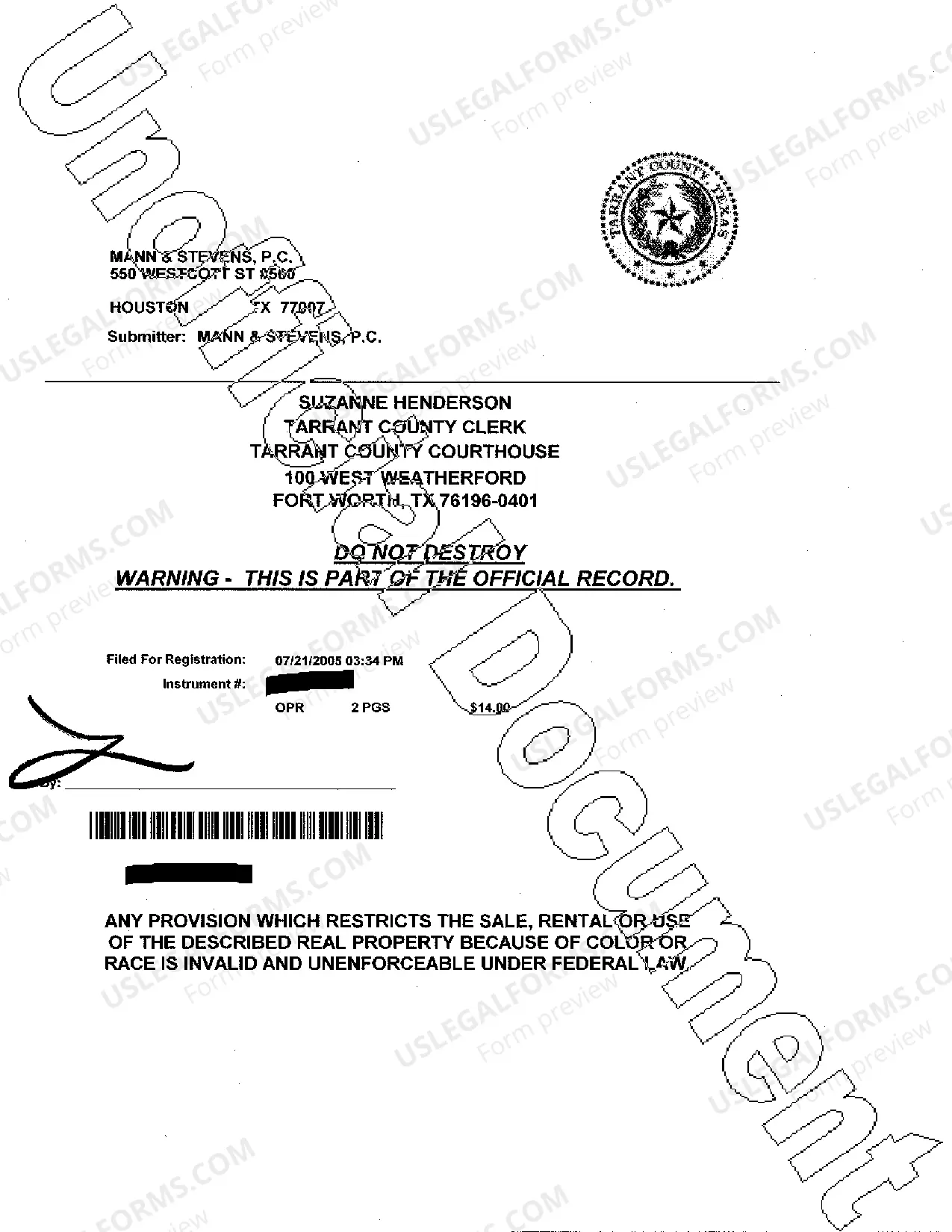

Tarrant Texas Notice of Rescission of Acceleration

Description

How to fill out Tarrant Texas Notice Of Rescission Of Acceleration?

We always want to reduce or avoid legal damage when dealing with nuanced law-related or financial matters. To accomplish this, we apply for attorney solutions that, as a rule, are very expensive. Nevertheless, not all legal matters are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based library of up-to-date DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without using services of an attorney. We provide access to legal document templates that aren’t always openly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Tarrant Texas Notice of Rescission of Acceleration or any other document easily and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always re-download it from within the My Forms tab.

The process is just as easy if you’re new to the platform! You can create your account in a matter of minutes.

- Make sure to check if the Tarrant Texas Notice of Rescission of Acceleration adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s outline (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve made sure that the Tarrant Texas Notice of Rescission of Acceleration is proper for your case, you can pick the subscription option and make a payment.

- Then you can download the document in any available file format.

For more than 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save efforts and resources!