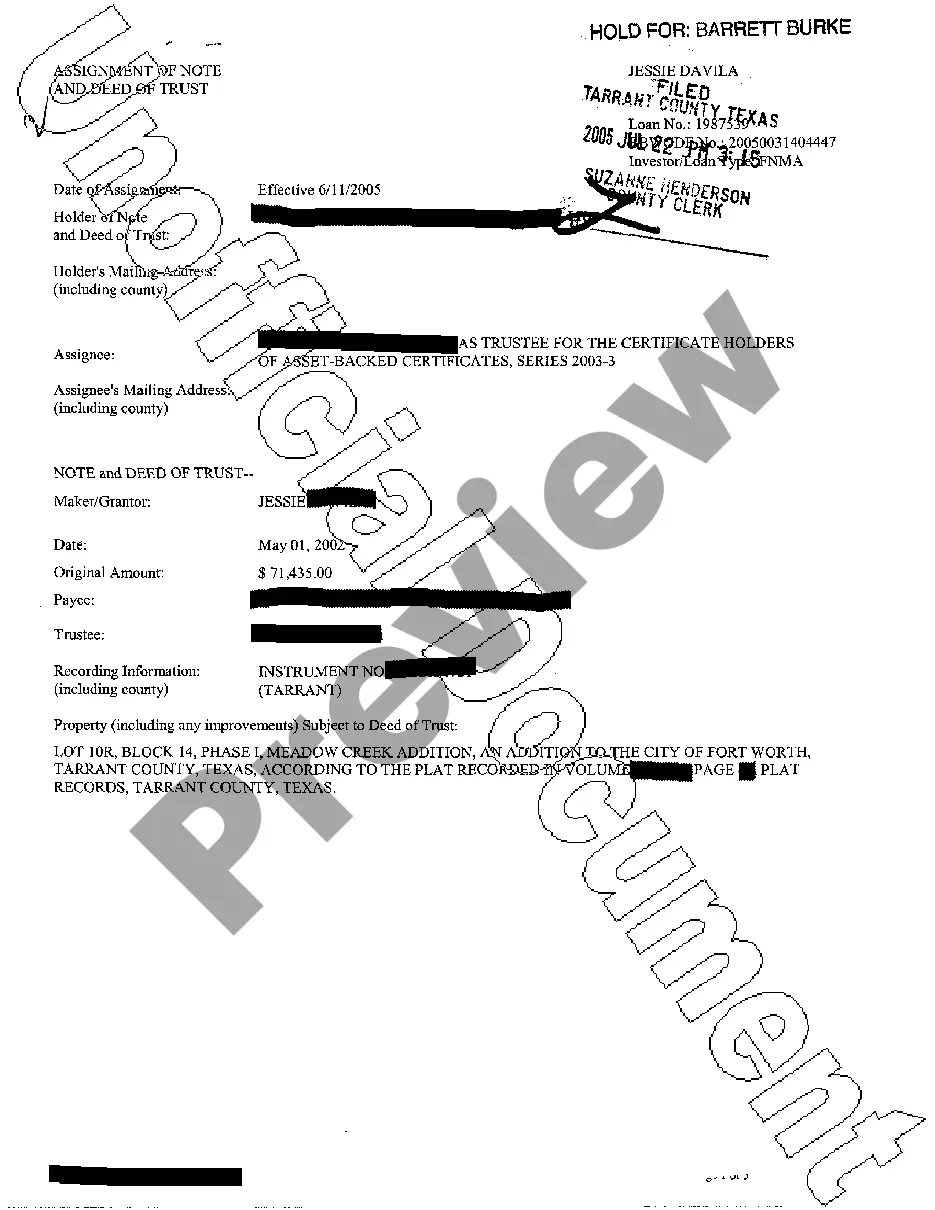

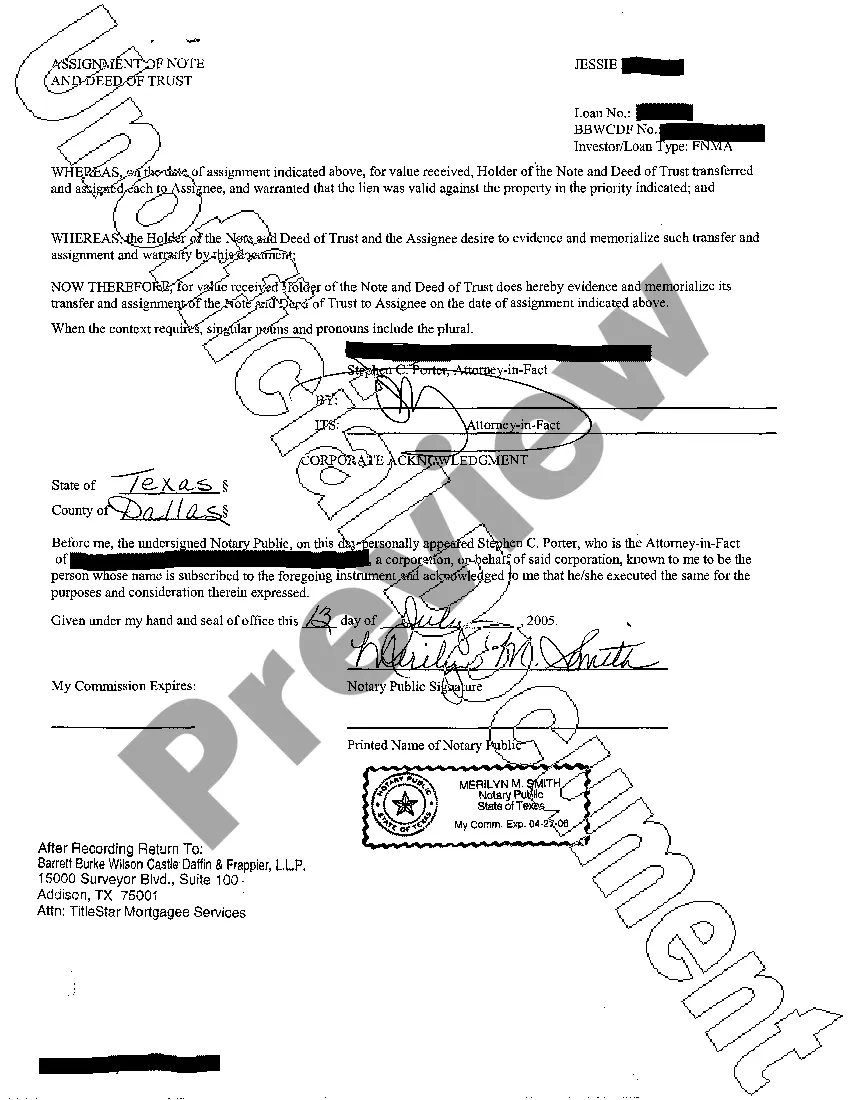

Amarillo Texas Assignment of Note and Deed of Trust is a legal process that involves the transfer of a mortgage debt, known as a promissory note, from one party to another, along with the associated security interest in a property through a deed of trust. This assignment is commonly utilized in real estate transactions in Amarillo, Texas, and serves as a means to protect the rights of the lender and borrower. The Amarillo Texas Assignment of Note and Deed of Trust involves three parties: the lender (assignor), the borrower (assignee), and the assignee of the deed of trust. The lender, who holds the promissory note, assigns it to the assignee, with the assignee becoming the new note holder. Simultaneously, the assignor transfers the associated deed of trust to the new assignee, granting them a security interest in the property until the debt is fulfilled. There are two significant types of Amarillo Texas Assignment of Note and Deed of Trust: 1. Absolute Assignment: This type of assignment involves a complete transfer of the promissory note, including all the rights and obligations conferred by it, to the assignee. The assignee assumes all responsibilities and benefits related to the mortgage debt, such as collecting payments and enforcing the terms of the loan. 2. Collateral Assignment: In this type of assignment, the lender (assignor) retains ownership of the promissory note but assigns the deed of trust to the assignee. While the assignee does not possess the right to collect payments directly, they still hold a security interest in the property securing the mortgage loan. In case of default, the assignee gains the ability to foreclose on the property and recover their investment. Amarillo Texas Assignment of Note and Deed of Trust plays a crucial role in real estate financing and ensures the proper transfer and protection of mortgage debt obligations. It is essential for all parties involved to carefully review and understand the terms of the assignment to avoid any legal complications and ensure a smooth transaction. Consulting with a qualified attorney or real estate professional is recommended to ensure compliance with relevant laws and regulations.

Amarillo Texas Assignment of Note and Deed of Trust

Description

How to fill out Amarillo Texas Assignment Of Note And Deed Of Trust?

No matter the social or professional status, completing legal documents is an unfortunate necessity in today’s professional environment. Very often, it’s practically impossible for a person without any legal background to draft this sort of paperwork cfrom the ground up, mostly because of the convoluted jargon and legal subtleties they involve. This is where US Legal Forms comes in handy. Our platform provides a huge catalog with over 85,000 ready-to-use state-specific documents that work for practically any legal case. US Legal Forms also serves as a great resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

Whether you want the Amarillo Texas Assignment of Note and Deed of Trust or any other paperwork that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Amarillo Texas Assignment of Note and Deed of Trust quickly employing our trusted platform. In case you are already a subscriber, you can proceed to log in to your account to get the appropriate form.

Nevertheless, in case you are unfamiliar with our platform, ensure that you follow these steps before obtaining the Amarillo Texas Assignment of Note and Deed of Trust:

- Ensure the template you have chosen is good for your area considering that the regulations of one state or county do not work for another state or county.

- Preview the document and read a short outline (if provided) of scenarios the document can be used for.

- If the one you selected doesn’t suit your needs, you can start again and look for the necessary form.

- Click Buy now and choose the subscription plan that suits you the best.

- utilizing your login information or register for one from scratch.

- Pick the payment method and proceed to download the Amarillo Texas Assignment of Note and Deed of Trust once the payment is done.

You’re all set! Now you can proceed to print the document or fill it out online. Should you have any issues locating your purchased documents, you can easily find them in the My Forms tab.

Whatever case you’re trying to sort out, US Legal Forms has got you covered. Give it a try today and see for yourself.