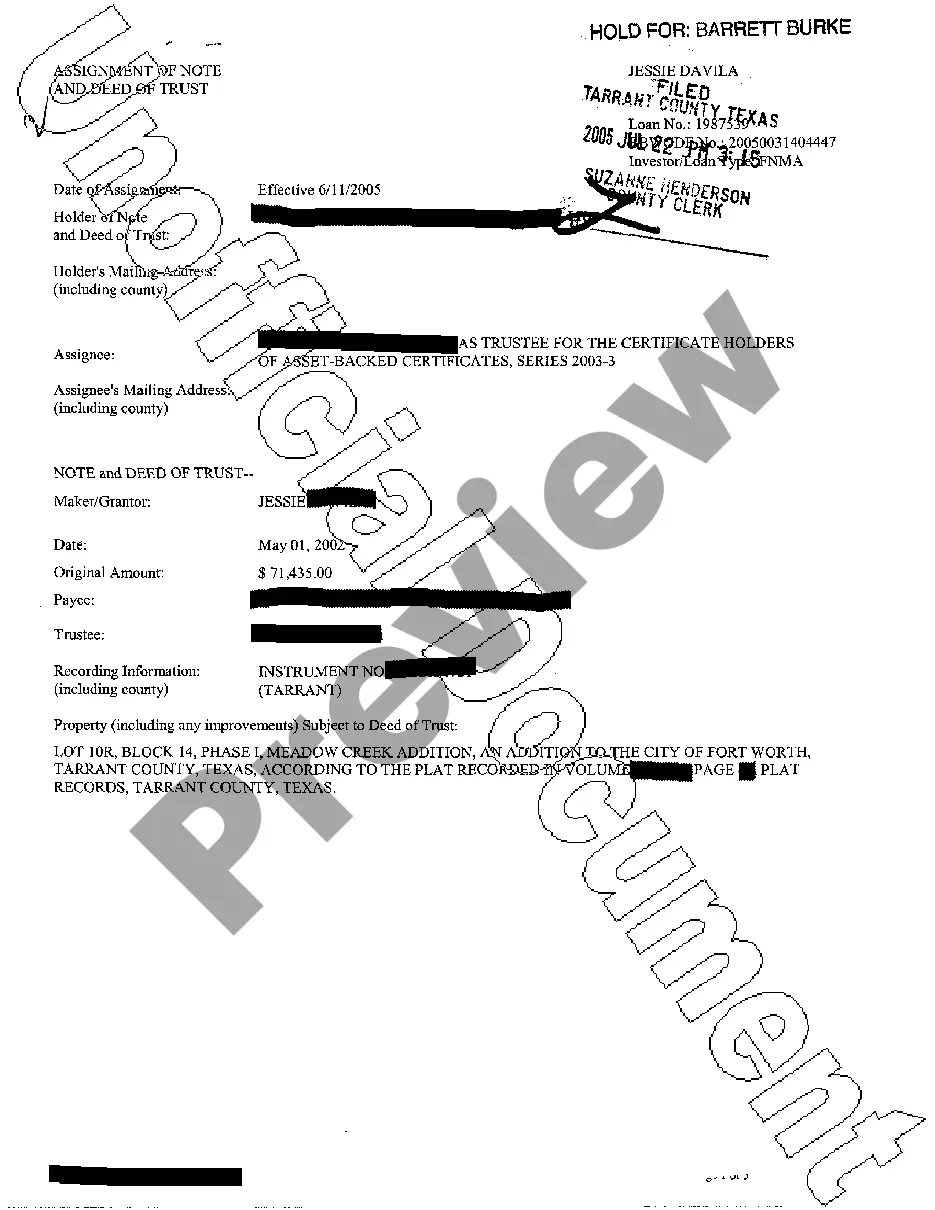

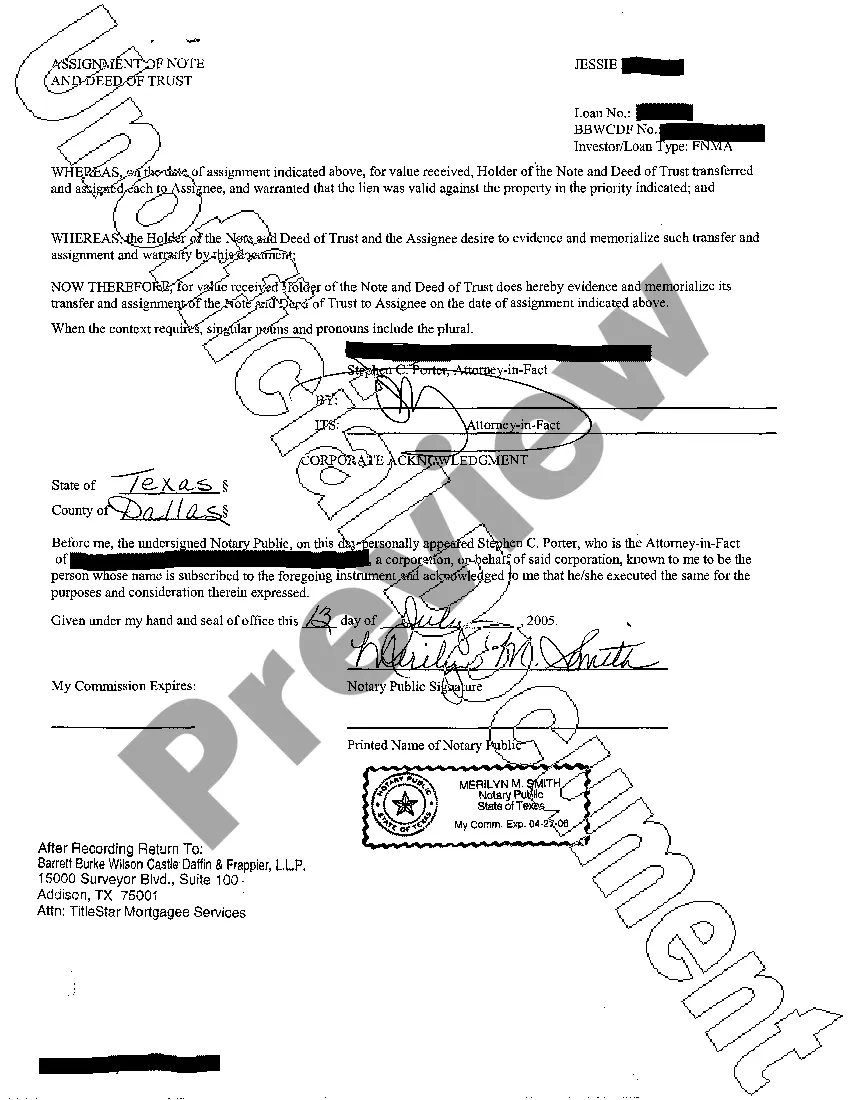

In Brownsville, Texas, an Assignment of Note and Deed of Trust is a legal document used to transfer the rights and obligations of a mortgage loan from one party to another. This transaction often occurs when a mortgage lender decides to sell a loan to another financial institution or investor. The Assignment of Note refers to the transfer of the loan itself, while the Deed of Trust pertains to the transfer of the property's security interest. The Assignment of Note and Deed of Trust is an essential process in the mortgage industry as it ensures the proper transfer of ownership and protects the interests of all parties involved. It is crucial to understand the different types of Assignment of Note and Deed of Trust that exist in Brownsville, Texas: 1. Standard Assignment: This type of Assignment of Note and Deed of Trust occurs when a lender sells their loan to another lender, often in the secondary mortgage market. The borrower is informed of this transfer, and the new lender becomes responsible for servicing the loan. 2. Partial Assignment: In some cases, a lender may choose to transfer only a portion of a loan to another entity. This can happen when the loan amount is too large for one lender to handle or if the lender wishes to diversify their loan portfolio. The borrower will typically receive a notification of this partial assignment. 3. Assignment with Assumption: In certain situations, a borrower may request an assumption of their mortgage loan. This process involves finding a new borrower who qualifies to take over the existing loan, assuming all rights and responsibilities. The original borrower is then released from their obligations, while the new borrower steps in, usually after a thorough credit evaluation and approval process. 4. Assignment due to Default: When a borrower fails to meet their mortgage obligations and enters into foreclosure, the lender may assign the note and deed of trust to a foreclosure trustee or a new lender. This assignment is part of the overall foreclosure process and allows the assignee to initiate legal proceedings to regain possession of the property. Overall, the Assignment of Note and Deed of Trust plays a vital role in the mortgage industry in Brownsville, Texas, ensuring the proper transfer of loan ownership while protecting the interests of lenders, borrowers, and other parties involved. It is important for individuals involved in such transactions to consult with legal professionals to ensure compliance with state laws and to understand their rights and obligations thoroughly.

Brownsville Texas Assignment of Note and Deed of Trust

Description

How to fill out Brownsville Texas Assignment Of Note And Deed Of Trust?

Acquiring verified templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms library.

This is an online repository of over 85,000 legal forms catering to both personal and professional needs and any real-world situations.

All documents are correctly organized by area of application and jurisdiction, making it as quick and simple as ABC to find the Brownsville Texas Assignment of Note and Deed of Trust.

Maintaining paperwork organized and in compliance with legal standards is crucial. Take advantage of the US Legal Forms library to always have vital document templates readily available for any situation!

- Ensure to review the Preview mode and form description.

- Verify that you have selected the correct one that satisfies your needs and fully aligns with your local jurisdiction requirements.

- Search for another template if necessary.

- If you notice any discrepancy, use the Search tab above to find the correct one.

- If it meets your requirements, proceed to the next step.

Form popularity

FAQ

An assignment of Deed of Trust in Texas refers to the transfer of the beneficial interests under a Deed of Trust from one party to another. In the context of a Brownsville Texas Assignment of Note and Deed of Trust, it allows lenders to assign their rights to receive payments or enforce the trust to another lender. This process typically involves a written agreement and must be recorded to ensure its legality. Understanding this can help you navigate your rights and responsibilities in real estate transactions.

Finding the deed to your house in Texas is straightforward. You can either visit your local county clerk's office or use their online service for property records. If you want a more guided approach, uslegalforms can help you navigate the process of retrieving your Brownsville Texas Assignment of Note and Deed of Trust, ensuring you have the right documents at your fingertips.

To look up a deed in Texas online, you can visit your county's appraisal district or clerk's office website. Many counties, including those in Brownsville, Texas, provide online databases to search for property records. For convenience, uslegalforms also offers easy access to resources you need for the Brownsville Texas Assignment of Note and Deed of Trust.

Yes, in Texas, deeds are public records, which means anyone can access them. This transparency allows you to verify property ownership and review mortgage details. If you’re exploring the Brownsville Texas Assignment of Note and Deed of Trust, you can easily obtain this information through your local county office or online services like uslegalforms.

To find the title deed to your house, start by visiting your local county clerk's office in Brownsville, Texas. Often, these records are maintained in their land records division. Additionally, you can utilize online platforms like uslegalforms that provide resources for locating property documents, including the Brownsville Texas Assignment of Note and Deed of Trust.

In Texas, a deed of trust does not convey ownership of the property. Rather, it creates a security interest for the lender while the borrower retains ownership rights. Understanding these details is crucial in the context of the Brownsville Texas Assignment of Note and Deed of Trust, as it clarifies the roles of all parties involved.

While it's not legally required to have a lawyer for transferring a deed in Texas, it is highly recommended. A qualified attorney can help ensure that all documents are correctly filled out and filed, preventing future disputes. Utilizing platforms like USLegalForms can also simplify the process of understanding your options regarding the Brownsville Texas Assignment of Note and Deed of Trust.

To find a deed of trust in Texas, you can search online public records through the county clerk's office or access online databases dedicated to property records. Additionally, various real estate websites compile this information, making it easier for you to locate specific documents. For seamless searches regarding the Brownsville Texas Assignment of Note and Deed of Trust, consider utilizing platforms like US Legal Forms to guide you in the right direction.

While both a deed of assignment and a deed of transfer involve the transfer of rights, they are used in different contexts. A deed of assignment typically pertains to specific rights, like a lease or contract, whereas a deed of transfer generally concerns the ownership of property. When dealing with the Brownsville Texas Assignment of Note and Deed of Trust, it’s crucial to understand which document you need.

A deed of assignment is used to transfer rights or interests in a particular asset to another party. This document formalizes the change in ownership or responsibilities regarding the asset. In scenarios involving the Brownsville Texas Assignment of Note and Deed of Trust, this deed helps clarify who holds the rights to the underlying property and ensures all parties are aware of their obligations.