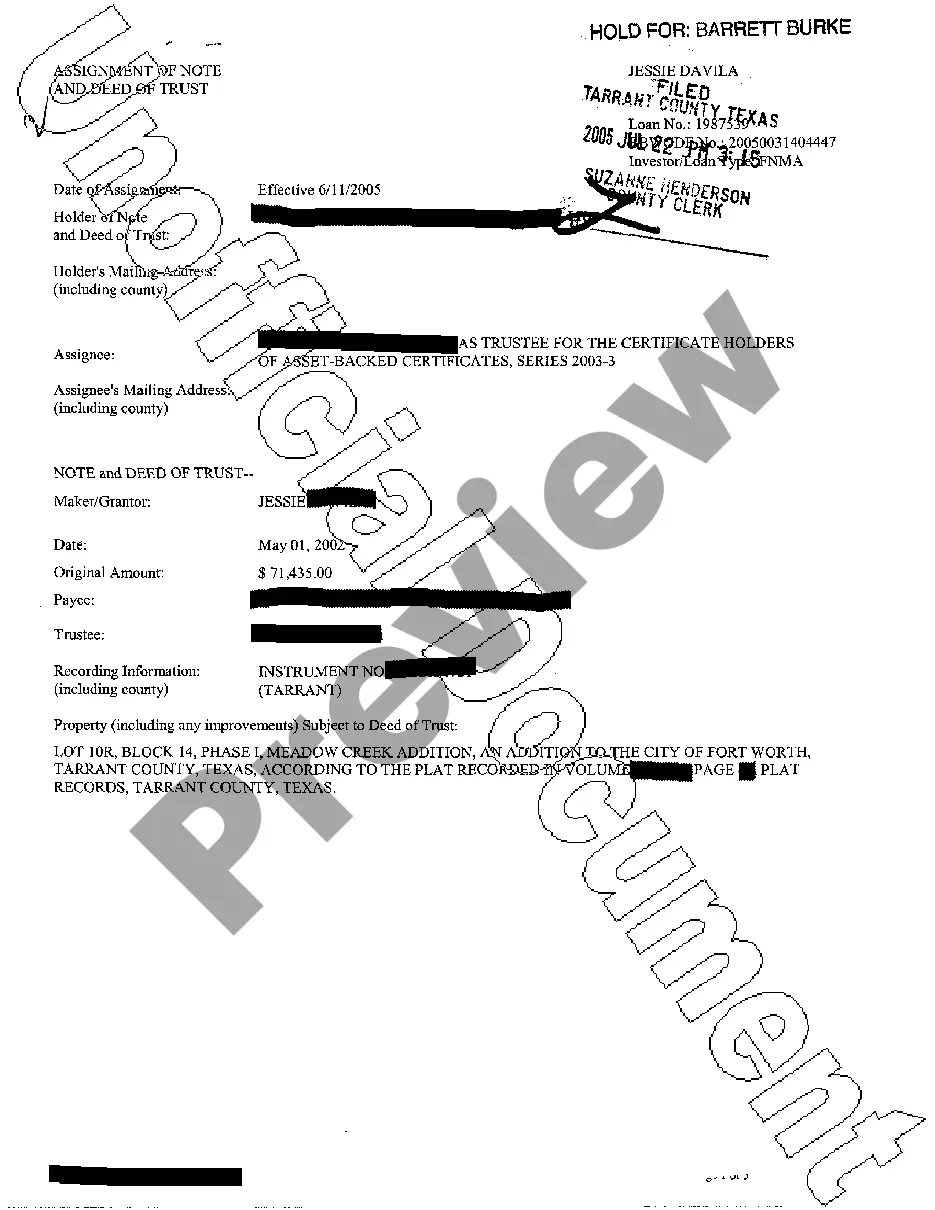

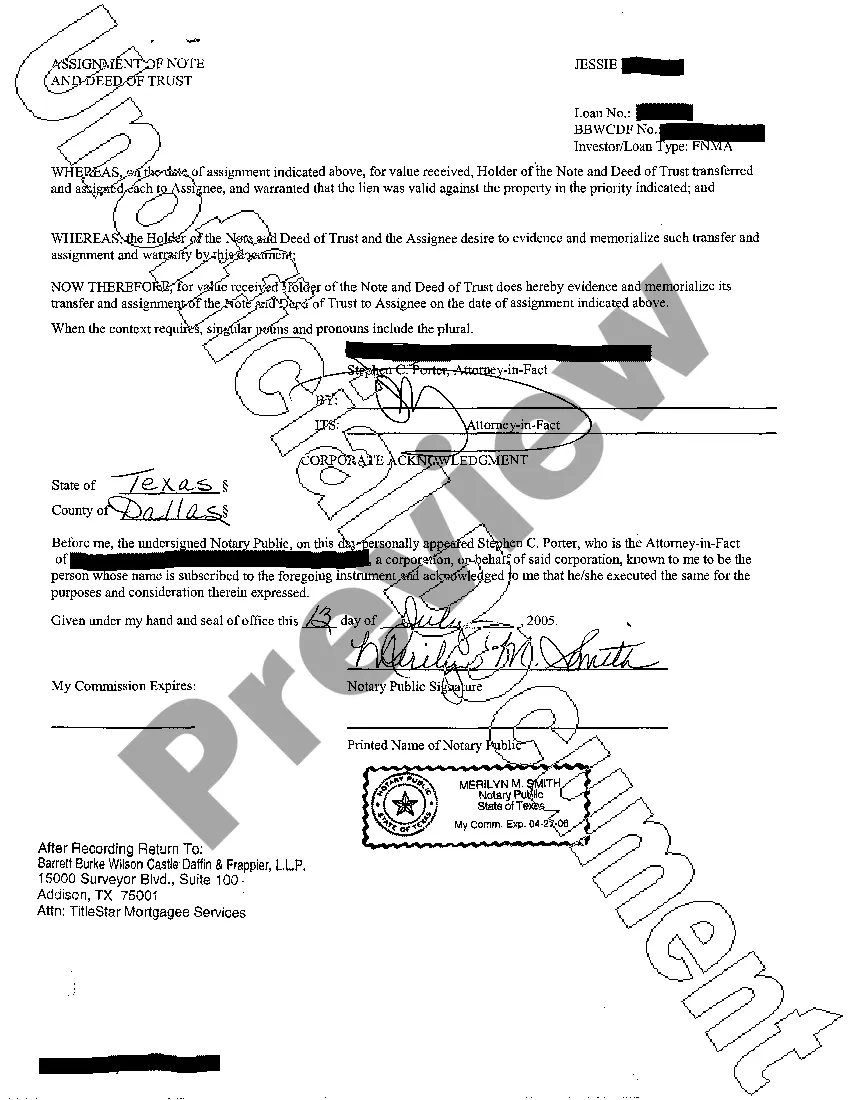

Carrollton, Texas Assignment of Note and Deed of Trust: A Comprehensive Overview In Carrollton, Texas, an Assignment of Note and Deed of Trust plays a crucial role in real estate transactions, offering a legal mechanism for the transfer of ownership rights and obligations. A detailed understanding of this process is essential for both buyers and sellers involved in property transactions in Carrollton. An Assignment of Note refers to the transfer of a promissory note, which is a legal document indicating the existence of a debt and the borrower's promise to repay it. The promissory note represents the borrower's commitment to repay the loan amount borrowed from a lender. In the context of real estate, a promissory note is typically issued by the buyer (borrower) to the seller (lender) as part of the purchase agreement. A Deed of Trust, on the other hand, is a legal instrument that secures the loan by providing the lender with a lien against the property. It is a three-party agreement involving the borrower (also known as the trust or), the lender (also known as the beneficiary), and a third-party trustee who holds the legal title to the property until the loan is fully paid off. In case of default, the lender can initiate foreclosure proceedings to sell the property and recover the outstanding loan amount. Carrollton, Texas offers several types of Assignment of Note and Deed of Trust arrangements, catering to different real estate scenarios: 1. Standard Assignment of Note and Deed of Trust: This is the most common type of arrangement where a buyer and seller enter into a real estate transaction, with the buyer securing a loan from a lender, and the seller acting as the lender. 2. Assignment of Note and Deed of Trust with Assumption: In certain cases, a buyer may assume an existing loan on the property they are purchasing. This type of assignment involves transferring ownership and the associated loan obligations from the original borrower to the buyer. 3. Assignment of Note and Deed of Trust in the case of Substitution of Trustee: When a change needs to be made to the trustee holding the legal title of the property, such as due to retirement or death, this type of assignment facilitates the transfer of trustee responsibility to a new party. 4. Assignment of Note and Deed of Trust in the case of Loan Modification: When modifications are made to the terms of the loan, such as interest rate adjustments or payment restructuring, an assignment of note is executed to reflect the updated terms and ensure legal compliance. In conclusion, a Carrollton, Texas Assignment of Note and Deed of Trust involves the transfer of a promissory note and the associated security interest in the property. Understanding the nuances of these arrangements is crucial for all parties involved in real estate transactions in Carrollton. Whether it's a standard assignment, assumption, substitution of trustee, or loan modification, seeking professional legal advice is highly recommended navigating through the process smoothly and protect the rights and interests of all parties involved.

Carrollton Texas Assignment of Note and Deed of Trust

Description

How to fill out Carrollton Texas Assignment Of Note And Deed Of Trust?

No matter what social or professional status, filling out law-related forms is an unfortunate necessity in today’s professional environment. Too often, it’s practically impossible for a person without any legal education to draft this sort of papers cfrom the ground up, mostly due to the convoluted terminology and legal subtleties they come with. This is where US Legal Forms comes in handy. Our service offers a huge library with more than 85,000 ready-to-use state-specific forms that work for practically any legal scenario. US Legal Forms also is a great resource for associates or legal counsels who want to save time using our DYI forms.

Whether you need the Carrollton Texas Assignment of Note and Deed of Trust or any other document that will be valid in your state or area, with US Legal Forms, everything is on hand. Here’s how you can get the Carrollton Texas Assignment of Note and Deed of Trust quickly using our trusted service. If you are presently an existing customer, you can proceed to log in to your account to get the appropriate form.

Nevertheless, if you are unfamiliar with our platform, make sure to follow these steps before downloading the Carrollton Texas Assignment of Note and Deed of Trust:

- Ensure the template you have chosen is suitable for your area because the rules of one state or area do not work for another state or area.

- Review the form and go through a brief outline (if available) of scenarios the document can be used for.

- If the one you selected doesn’t suit your needs, you can start over and look for the necessary form.

- Click Buy now and pick the subscription plan that suits you the best.

- Log in to your account login information or create one from scratch.

- Pick the payment method and proceed to download the Carrollton Texas Assignment of Note and Deed of Trust once the payment is done.

You’re all set! Now you can proceed to print out the form or fill it out online. If you have any issues locating your purchased forms, you can easily find them in the My Forms tab.

Whatever situation you’re trying to solve, US Legal Forms has got you covered. Give it a try now and see for yourself.