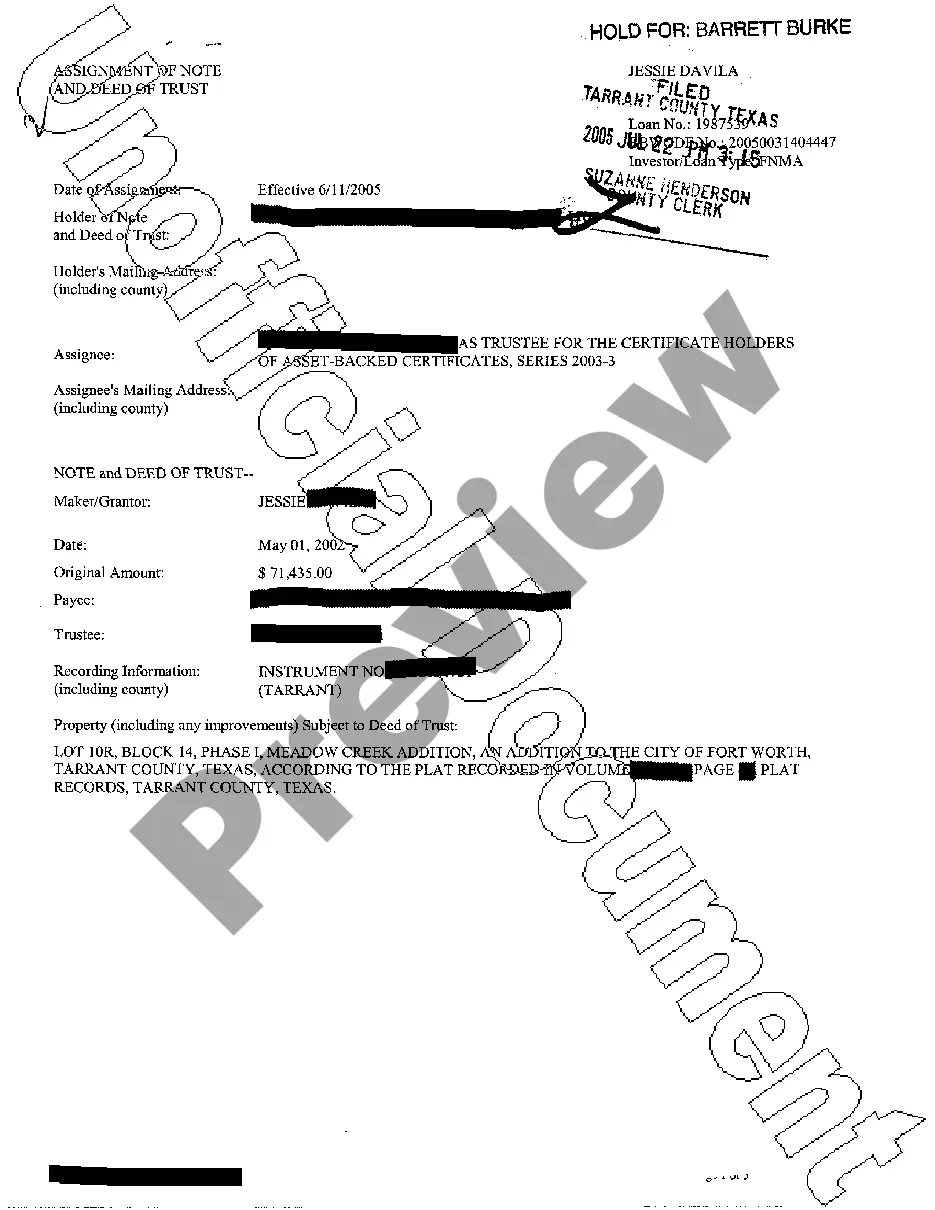

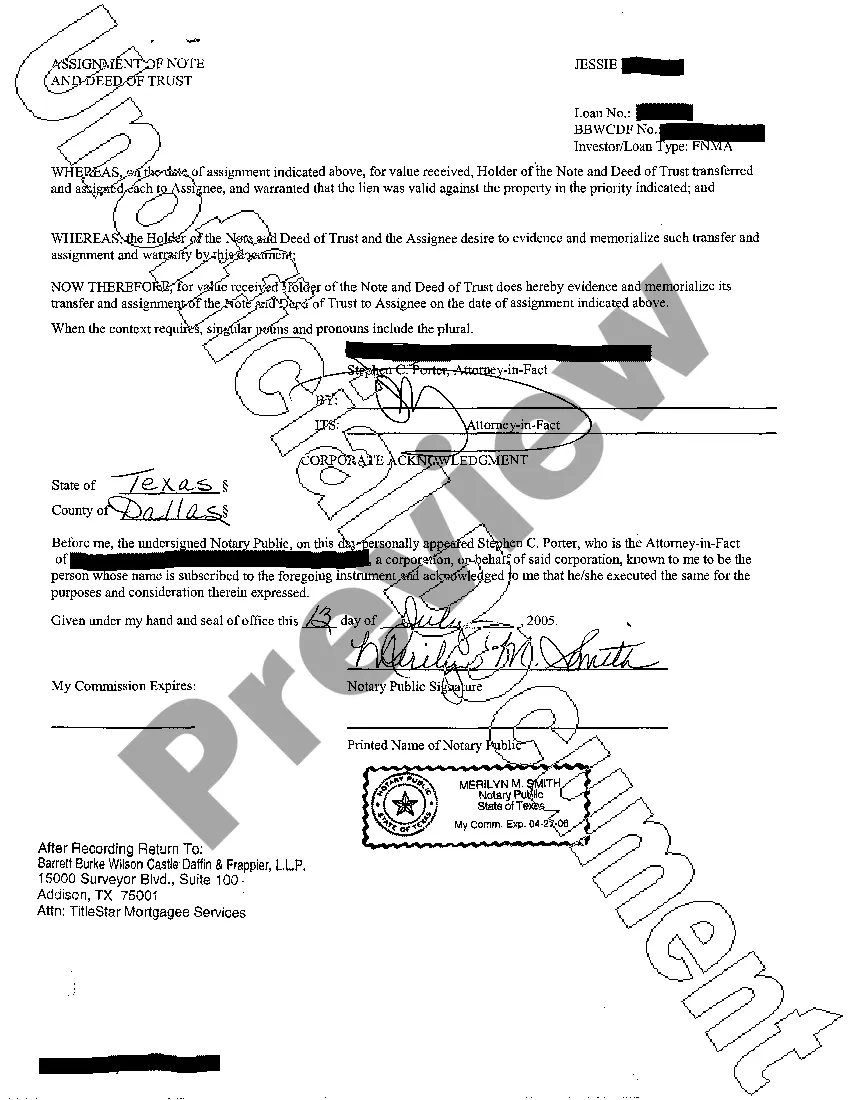

Collin Texas Assignment of Note and Deed of Trust is a legal document used in real estate transactions to transfer the rights and obligations of a mortgage from one party to another. This assignment allows the lender to transfer the existing mortgage loan and associated security instrument (deed of trust) to a new owner or entity. The Collin Texas Assignment of Note and Deed of Trust is a crucial step in the loan assumption process, enabling the new owner to become the official holder of the mortgage. It is typically executed when a property is sold, refinanced, or when there's a change in the ownership structure. There are various types of Collin Texas Assignment of Note and Deed of Trust, depending on the specific situation and the needs of the parties involved. Some common types include: 1. Collateral Assignment: This type of assignment occurs when the lender assigns the mortgage as collateral for a separate debt. It allows the lender to secure multiple loans using the same property as security. 2. Assignment of Note: In this case, only the promissory note associated with the mortgage is assigned to a new party. The deed of trust remains unchanged, and the new note holder becomes the recipient of the monthly mortgage payments. 3. Partial Assignment: A partial assignment occurs when the lender assigns only a portion of the mortgage to another party. This is common when a lender wants to sell a fractional interest in a loan. 4. Complete Assignment: This type of assignment involves the transfer of the entire mortgage loan and deed of trust to a new owner. All rights, obligations, and interests associated with the loan are fully transferred to the assignee. It is important to note that the Collin Texas Assignment of Note and Deed of Trust must be recorded in the county where the property is located. This recording ensures public notice of the transfer and provides legal protection to all parties involved. Overall, the Collin Texas Assignment of Note and Deed of Trust is a critical document in real estate transactions, facilitating the transfer of mortgage rights and obligations from one party to another. It allows for seamless ownership changes while ensuring the integrity and legal protection of the mortgage loan.

Collin Texas Assignment of Note and Deed of Trust is a legal document used in real estate transactions to transfer the rights and obligations of a mortgage from one party to another. This assignment allows the lender to transfer the existing mortgage loan and associated security instrument (deed of trust) to a new owner or entity. The Collin Texas Assignment of Note and Deed of Trust is a crucial step in the loan assumption process, enabling the new owner to become the official holder of the mortgage. It is typically executed when a property is sold, refinanced, or when there's a change in the ownership structure. There are various types of Collin Texas Assignment of Note and Deed of Trust, depending on the specific situation and the needs of the parties involved. Some common types include: 1. Collateral Assignment: This type of assignment occurs when the lender assigns the mortgage as collateral for a separate debt. It allows the lender to secure multiple loans using the same property as security. 2. Assignment of Note: In this case, only the promissory note associated with the mortgage is assigned to a new party. The deed of trust remains unchanged, and the new note holder becomes the recipient of the monthly mortgage payments. 3. Partial Assignment: A partial assignment occurs when the lender assigns only a portion of the mortgage to another party. This is common when a lender wants to sell a fractional interest in a loan. 4. Complete Assignment: This type of assignment involves the transfer of the entire mortgage loan and deed of trust to a new owner. All rights, obligations, and interests associated with the loan are fully transferred to the assignee. It is important to note that the Collin Texas Assignment of Note and Deed of Trust must be recorded in the county where the property is located. This recording ensures public notice of the transfer and provides legal protection to all parties involved. Overall, the Collin Texas Assignment of Note and Deed of Trust is a critical document in real estate transactions, facilitating the transfer of mortgage rights and obligations from one party to another. It allows for seamless ownership changes while ensuring the integrity and legal protection of the mortgage loan.