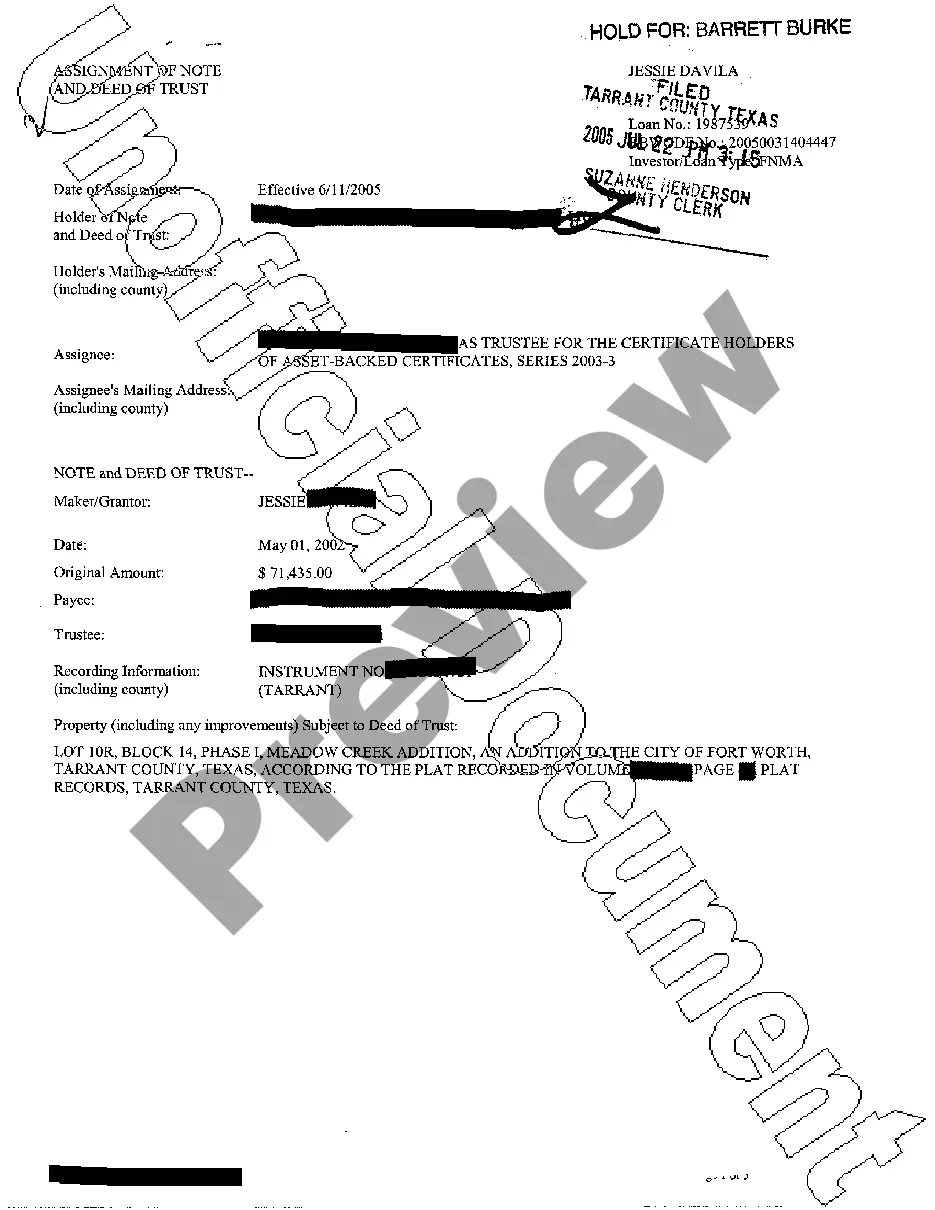

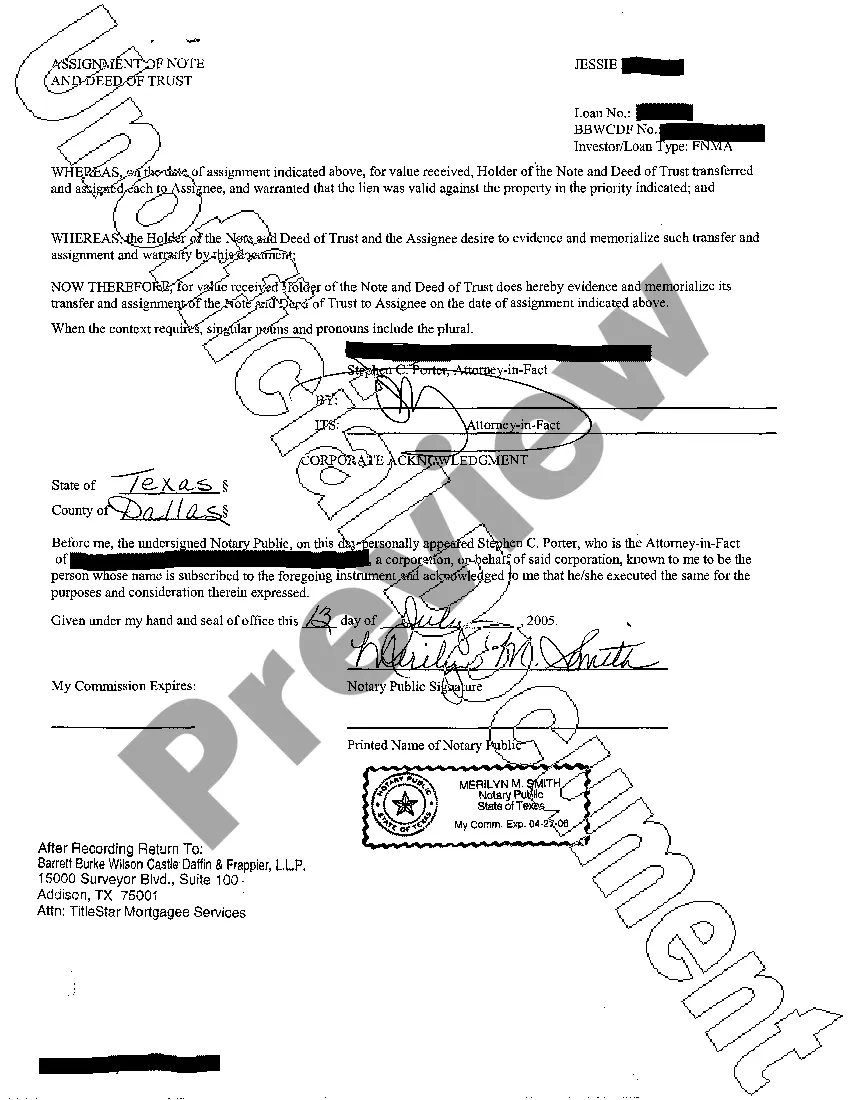

Edinburg, Texas Assignment of Note and Deed of Trust: Comprehensive Guide In Edinburg, Texas, the Assignment of Note and Deed of Trust holds significant value in real estate transactions. This legal document, often used in mortgage financing, establishes the transfer of the mortgage note and accompanying deed of trust from the original lender (assignor) to a new party (assignee). This process ensures that the assignee becomes the beneficiary of the promissory note and holds the right to enforce the security interest, as outlined in the deed of trust. The Edinburg Texas Assignment of Note and Deed of Trust serves several crucial purposes. Firstly, it facilitates the transfer of the loan obligations from the original lender to another party, which is typically a subsequent lender or an investor. This assignment allows the original lender to free up their capital and ensure a more liquid position. Furthermore, it enables the subsequent lender to hold the right to collect payments, enforce foreclosure if necessary, and seek remedies in case of default by the borrower. Different Types of Edinburg Texas Assignment of Note and Deed of Trust: 1. Short-Term Assignment: This type of assignment involves the transfer of the note and deed of trust for a defined period. It could be utilized when the original lender seeks temporary relief from the loan obligations or has a short-term financial arrangement with another party. Upon completion of the assigned period, the original lender resumes their position as the beneficiary. 2. Partial Assignment: In this case, only a portion of the total loan amount is assigned to a new party. The assignee becomes responsible for collecting payments and handling the assigned portion of the loan, while the original lender retains ownership of the remaining portion. This type of assignment is common when multiple lenders jointly finance a loan. 3. Complete Assignment: This is the most common type of assignment, where the entire note and deed of trust are transferred. The assignee assumes complete ownership and control over the loan, including all rights and responsibilities associated with it. They become the primary beneficiary and can exercise all legal remedies if the borrower fails to meet the loan terms. When executing an Edinburg Texas Assignment of Note and Deed of Trust, it is essential to ensure compliance with state and local laws. Working with legal professionals, such as real estate attorneys and title companies, can streamline the process and protect the interests of all parties involved. Additionally, conducting thorough due diligence and obtaining title insurance safeguards the assignee against potential disputes or undisclosed claims on the property. In conclusion, the Edinburg Texas Assignment of Note and Deed of Trust serves as a vital instrument in real estate financing and ensures the smooth transfer of mortgage obligations. With different types available, including short-term, partial, and complete assignments, it provides flexibility for lenders and investors seeking to manage their loan portfolios effectively. Understanding these assignments and working with legal experts can help navigate the complexities of real estate transactions in Edinburg, Texas.

Edinburg Texas Assignment of Note and Deed of Trust

State:

Texas

City:

Edinburg

Control #:

TX-JW-0029

Format:

PDF

Instant download

This form is available by subscription

Description

Assignment of Note and Deed of Trust

Edinburg, Texas Assignment of Note and Deed of Trust: Comprehensive Guide In Edinburg, Texas, the Assignment of Note and Deed of Trust holds significant value in real estate transactions. This legal document, often used in mortgage financing, establishes the transfer of the mortgage note and accompanying deed of trust from the original lender (assignor) to a new party (assignee). This process ensures that the assignee becomes the beneficiary of the promissory note and holds the right to enforce the security interest, as outlined in the deed of trust. The Edinburg Texas Assignment of Note and Deed of Trust serves several crucial purposes. Firstly, it facilitates the transfer of the loan obligations from the original lender to another party, which is typically a subsequent lender or an investor. This assignment allows the original lender to free up their capital and ensure a more liquid position. Furthermore, it enables the subsequent lender to hold the right to collect payments, enforce foreclosure if necessary, and seek remedies in case of default by the borrower. Different Types of Edinburg Texas Assignment of Note and Deed of Trust: 1. Short-Term Assignment: This type of assignment involves the transfer of the note and deed of trust for a defined period. It could be utilized when the original lender seeks temporary relief from the loan obligations or has a short-term financial arrangement with another party. Upon completion of the assigned period, the original lender resumes their position as the beneficiary. 2. Partial Assignment: In this case, only a portion of the total loan amount is assigned to a new party. The assignee becomes responsible for collecting payments and handling the assigned portion of the loan, while the original lender retains ownership of the remaining portion. This type of assignment is common when multiple lenders jointly finance a loan. 3. Complete Assignment: This is the most common type of assignment, where the entire note and deed of trust are transferred. The assignee assumes complete ownership and control over the loan, including all rights and responsibilities associated with it. They become the primary beneficiary and can exercise all legal remedies if the borrower fails to meet the loan terms. When executing an Edinburg Texas Assignment of Note and Deed of Trust, it is essential to ensure compliance with state and local laws. Working with legal professionals, such as real estate attorneys and title companies, can streamline the process and protect the interests of all parties involved. Additionally, conducting thorough due diligence and obtaining title insurance safeguards the assignee against potential disputes or undisclosed claims on the property. In conclusion, the Edinburg Texas Assignment of Note and Deed of Trust serves as a vital instrument in real estate financing and ensures the smooth transfer of mortgage obligations. With different types available, including short-term, partial, and complete assignments, it provides flexibility for lenders and investors seeking to manage their loan portfolios effectively. Understanding these assignments and working with legal experts can help navigate the complexities of real estate transactions in Edinburg, Texas.

Free preview

How to fill out Edinburg Texas Assignment Of Note And Deed Of Trust?

If you’ve already used our service before, log in to your account and save the Edinburg Texas Assignment of Note and Deed of Trust on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to get your document:

- Make sure you’ve found a suitable document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, use the Search tab above to get the proper one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Edinburg Texas Assignment of Note and Deed of Trust. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your individual or professional needs!