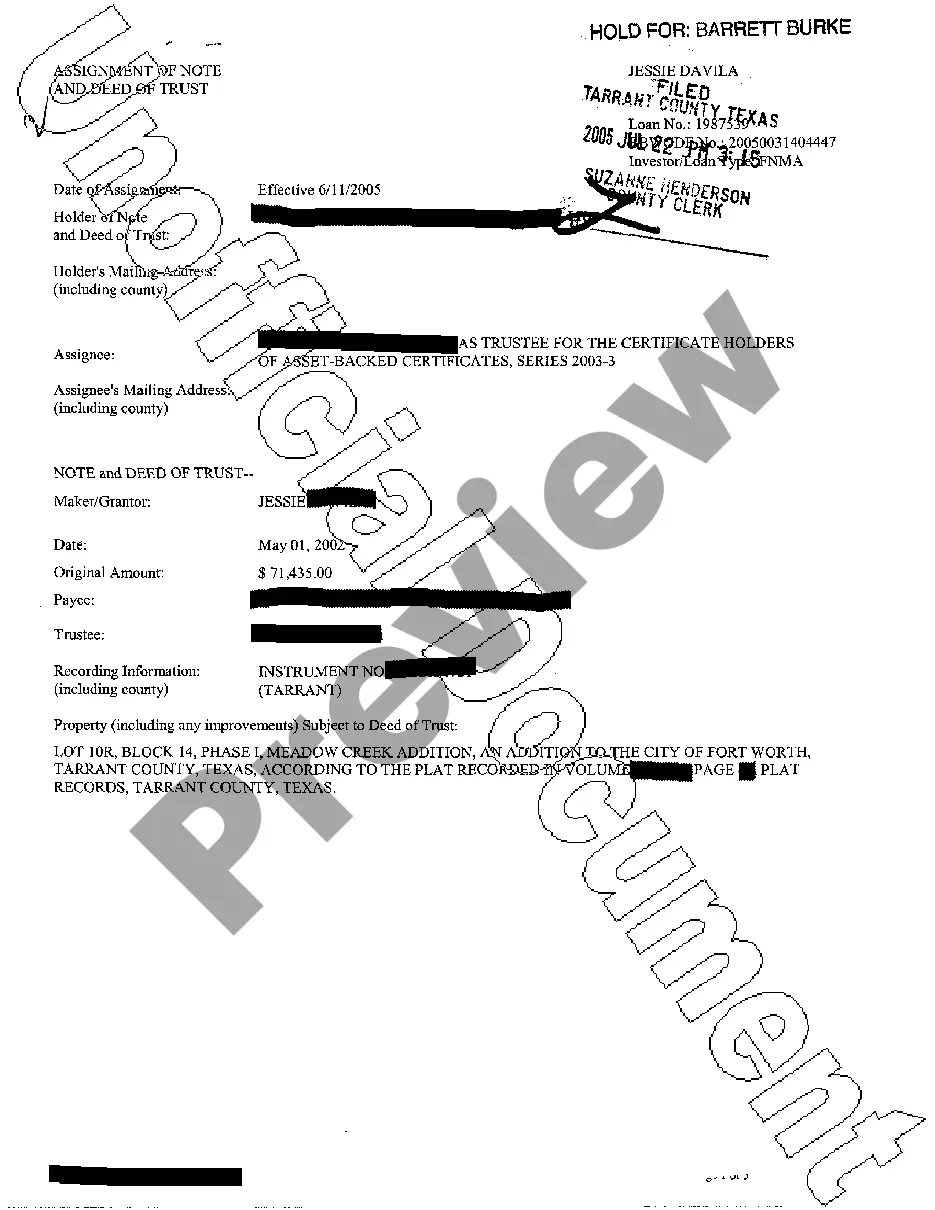

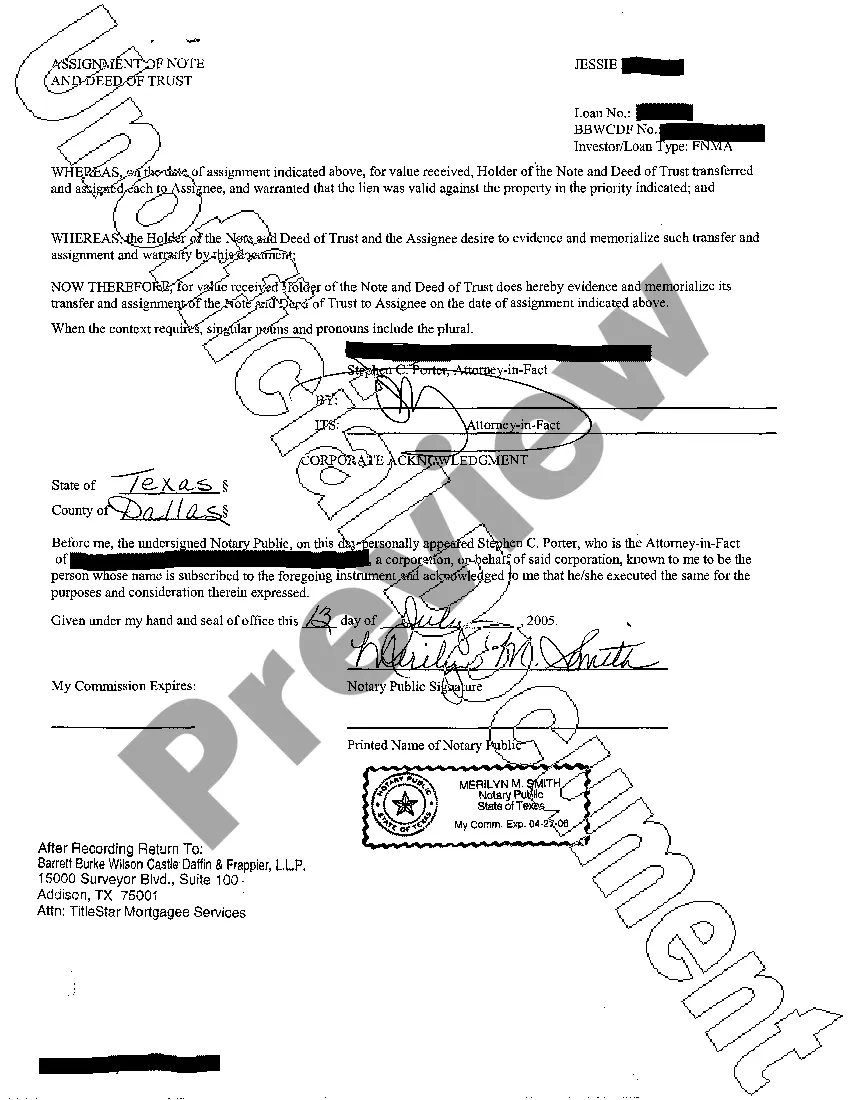

The Houston Texas Assignment of Note and Deed of Trust refers to a legal document involved in real estate transactions. It is commonly used when there is a transfer of ownership or interest in a property in Houston, Texas. The Assignment of Note and Deed of Trust is essentially a written agreement that assigns the rights and responsibilities associated with a promissory note and the accompanying deed of trust. The promissory note outlines the borrower's promise to repay a loan and the terms of repayment, while the deed of trust serves as a security instrument by granting the lender a legal interest in the property as collateral. In the context of Houston, Texas, various types of Assignment of Note and Deed of Trust may exist, depending on specific circumstances or purposes. Some examples include: 1. Assignment of Note and Deed of Trust for Purchase: This type of assignment is often used when a property is being sold, and the existing promissory note and deed of trust need to be transferred to the new owner or lender. It ensures that the new owner or lender assumes the rights and responsibilities associated with the loan. 2. Assignment of Note and Deed of Trust for Refinancing: When a property owner decides to refinance their existing mortgage, a new promissory note and deed of trust are typically created. In this case, the assignment transfers the rights and responsibilities from the original loan to the new loan. 3. Assignment of Note and Deed of Trust for Foreclosure: In cases of foreclosure, where a borrower defaults on their loan payments, the lender may initiate a foreclosure process to recover the unpaid debt. The assignment of note and deed of trust allows the lender to transfer the rights to foreclose on the property and seek repayment from the proceeds of the sale. Overall, the Houston Texas Assignment of Note and Deed of Trust serves as a valuable legal instrument in real estate transactions, ensuring the smooth transfer of ownership or interest in a property while maintaining the rights and obligations associated with the underlying loan.

Houston Texas Assignment of Note and Deed of Trust

Description

How to fill out Houston Texas Assignment Of Note And Deed Of Trust?

If you are looking for a relevant form template, it’s impossible to choose a more convenient service than the US Legal Forms site – probably the most comprehensive libraries on the web. Here you can get a large number of templates for company and individual purposes by types and states, or keywords. With the high-quality search function, getting the latest Houston Texas Assignment of Note and Deed of Trust is as easy as 1-2-3. Additionally, the relevance of each and every document is confirmed by a group of expert lawyers that regularly check the templates on our platform and revise them in accordance with the newest state and county regulations.

If you already know about our platform and have an account, all you need to get the Houston Texas Assignment of Note and Deed of Trust is to log in to your profile and click the Download option.

If you make use of US Legal Forms for the first time, just follow the instructions listed below:

- Make sure you have chosen the sample you require. Check its description and utilize the Preview function to explore its content. If it doesn’t meet your requirements, use the Search option at the top of the screen to discover the appropriate record.

- Affirm your decision. Select the Buy now option. Following that, choose your preferred subscription plan and provide credentials to sign up for an account.

- Process the transaction. Utilize your credit card or PayPal account to complete the registration procedure.

- Get the template. Indicate the format and download it to your system.

- Make modifications. Fill out, revise, print, and sign the obtained Houston Texas Assignment of Note and Deed of Trust.

Every template you add to your profile has no expiry date and is yours forever. You can easily gain access to them via the My Forms menu, so if you want to receive an extra copy for enhancing or printing, you may return and export it once more at any time.

Make use of the US Legal Forms professional collection to gain access to the Houston Texas Assignment of Note and Deed of Trust you were seeking and a large number of other professional and state-specific templates in one place!