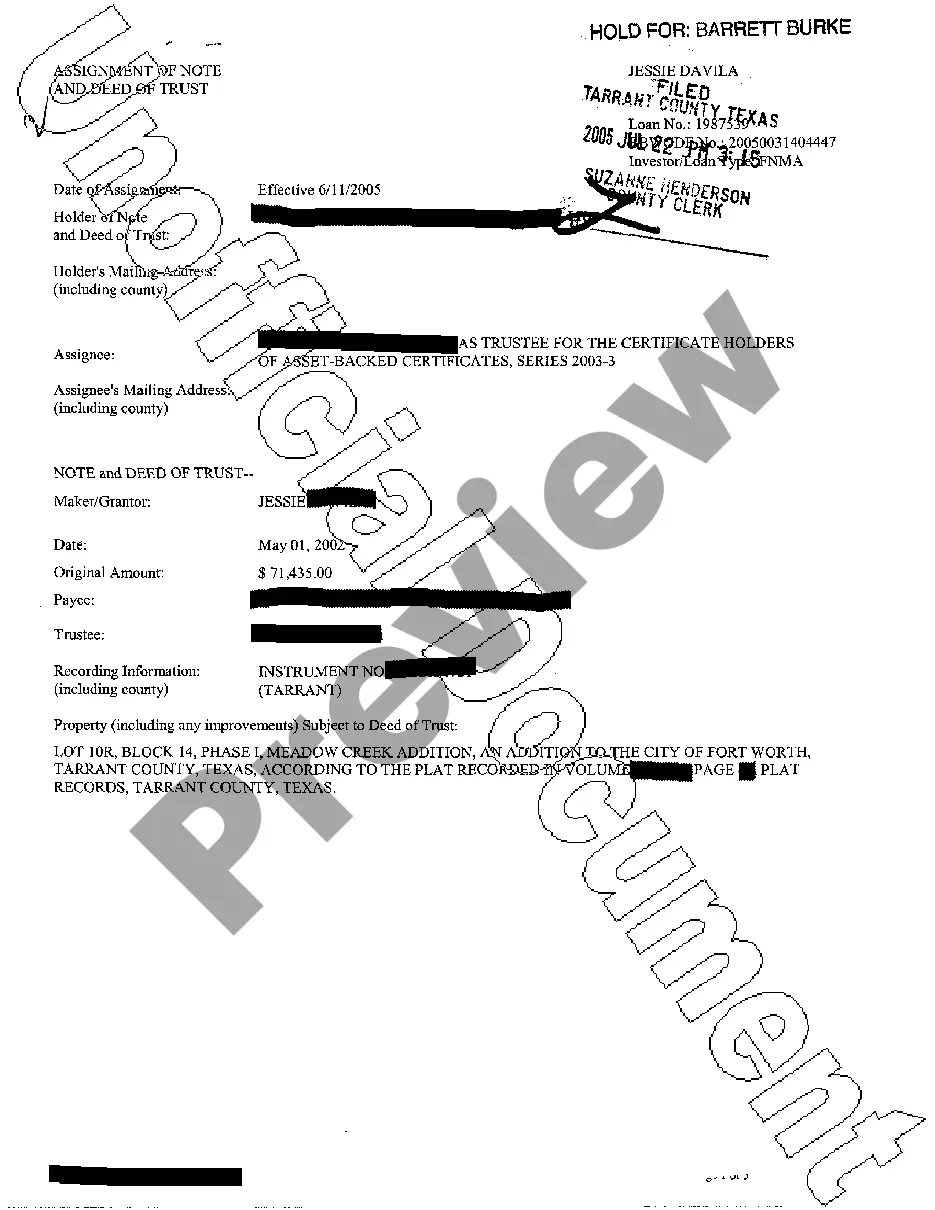

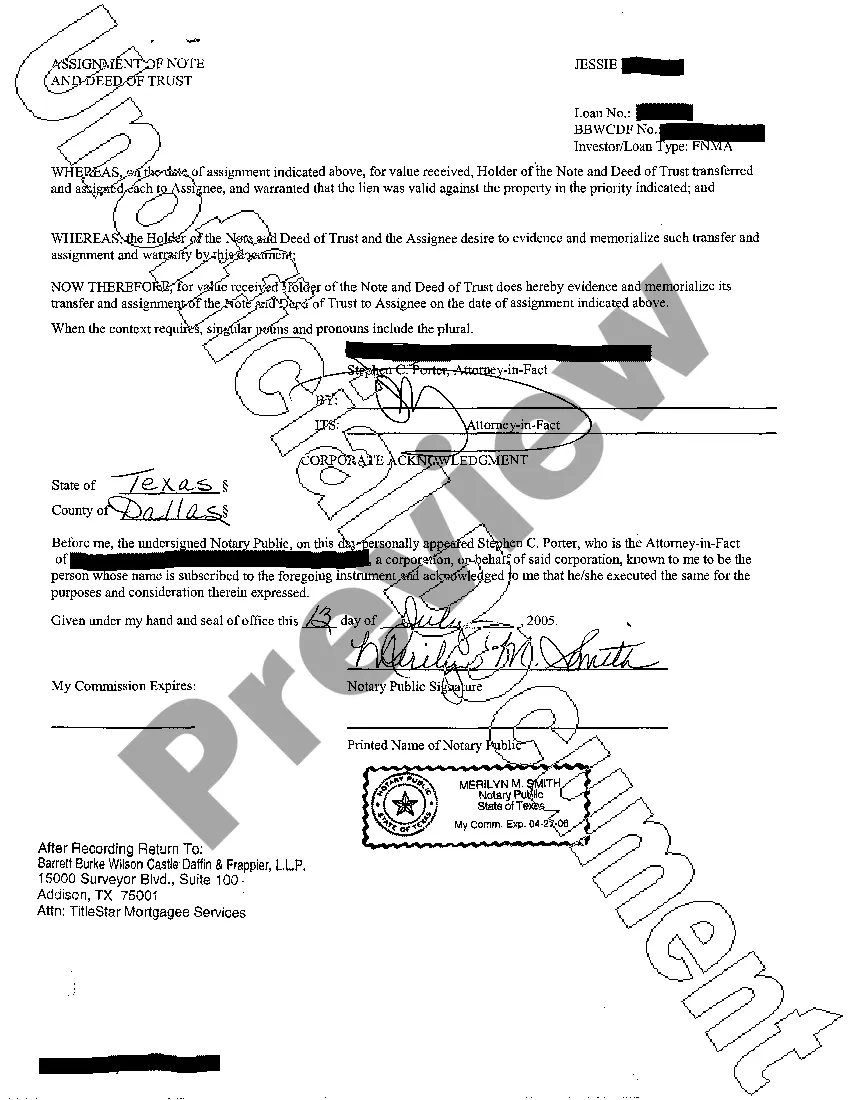

The McAllen Texas Assignment of Note and Deed of Trust is an essential legal document used in real estate transactions. It signifies the transfer of the borrower's obligations and the security interest from one party to another. This document is crucial for both lenders and borrowers in McAllen, Texas, as it outlines the terms and conditions of the loan and offers protection to all involved parties. Keywords: McAllen Texas, Assignment of Note, Deed of Trust, real estate transactions, transfer of obligations, security interest, lenders, borrowers, terms and conditions, loan, protection. There are different types of Assignments of Note and Deed of Trust in McAllen Texas, each serving a specific purpose. Let's explore some of them: 1. Complete Assignment of Note and Deed of Trust: This type involves the full transfer of both the promissory note and the deed of trust from the original lender to a new party. It includes all rights, title, and interest in the loan, securing the new holder as the beneficiary. 2. Partial Assignment of Note and Deed of Trust: In this type, the lender assigns only a portion of the promissory note and the deed of trust to another party. The original lender remains the primary beneficiary, and the assignee receives a fractional interest in the loan. 3. Assignment of Note: This type involves the transfer of the promissory note alone, without the accompanying deed of trust. The assignee gains the rights to collect payments and enforce the terms of the loan, whereas the original lender maintains the security interest. 4. Assignment of Deed of Trust: Unlike the previous type, here, only the deed of trust is assigned to a new beneficiary while retaining the original promissory note. The assignee becomes responsible for enforcing the security and may step in as the lender, receiving any future payments. 5. Assumed Assignment of Note and Deed of Trust: This type occurs when the original borrower transfers their obligations to another party, often with the lender's approval. The new party assumes the responsibility for the loan, including making repayments and complying with the terms outlined in the deed of trust. These various types of McAllen Texas Assignments of Note and Deed of Trust give lenders and borrowers flexibility in structuring their agreements and allow for transfers of obligations when necessary. It is crucial for all parties involved to consult with legal professionals to ensure compliance with local laws and protect their interests throughout the transaction.

McAllen Texas Assignment of Note and Deed of Trust

Description

How to fill out McAllen Texas Assignment Of Note And Deed Of Trust?

No matter the social or professional status, filling out legal documents is an unfortunate necessity in today’s world. Very often, it’s practically impossible for a person with no legal background to create this sort of paperwork cfrom the ground up, mostly due to the convoluted terminology and legal subtleties they entail. This is where US Legal Forms can save the day. Our platform provides a massive collection with more than 85,000 ready-to-use state-specific documents that work for practically any legal scenario. US Legal Forms also is an excellent resource for associates or legal counsels who want to save time utilizing our DYI tpapers.

No matter if you want the McAllen Texas Assignment of Note and Deed of Trust or any other paperwork that will be valid in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how you can get the McAllen Texas Assignment of Note and Deed of Trust quickly employing our trusted platform. In case you are already a subscriber, you can go ahead and log in to your account to get the appropriate form.

Nevertheless, if you are a novice to our library, ensure that you follow these steps before obtaining the McAllen Texas Assignment of Note and Deed of Trust:

- Ensure the template you have chosen is good for your area since the regulations of one state or area do not work for another state or area.

- Preview the document and go through a brief description (if available) of cases the document can be used for.

- In case the form you selected doesn’t meet your requirements, you can start again and look for the suitable document.

- Click Buy now and pick the subscription plan that suits you the best.

- Log in to your account login information or register for one from scratch.

- Choose the payment gateway and proceed to download the McAllen Texas Assignment of Note and Deed of Trust as soon as the payment is through.

You’re all set! Now you can go ahead and print the document or fill it out online. If you have any problems getting your purchased documents, you can quickly access them in the My Forms tab.

Regardless of what case you’re trying to sort out, US Legal Forms has got you covered. Try it out now and see for yourself.