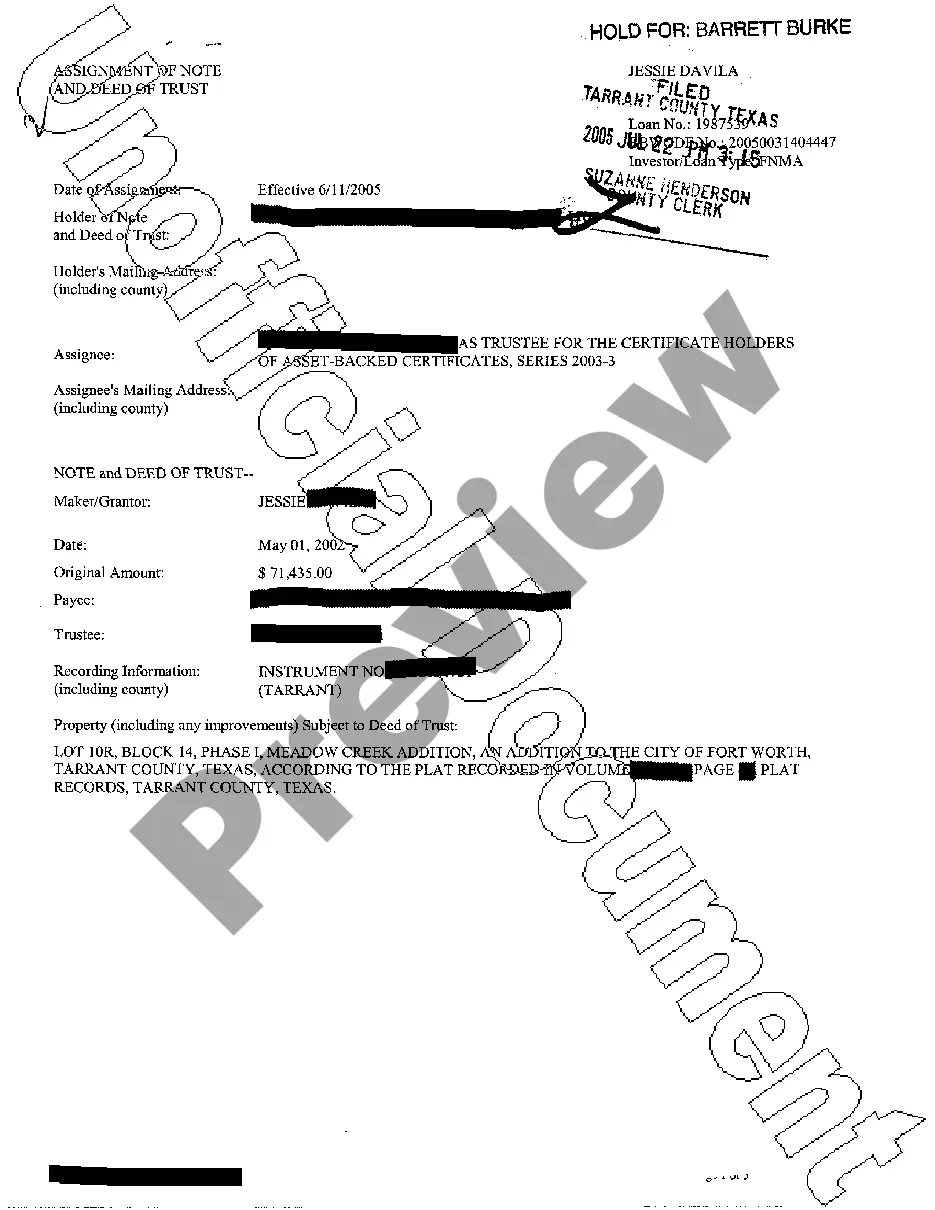

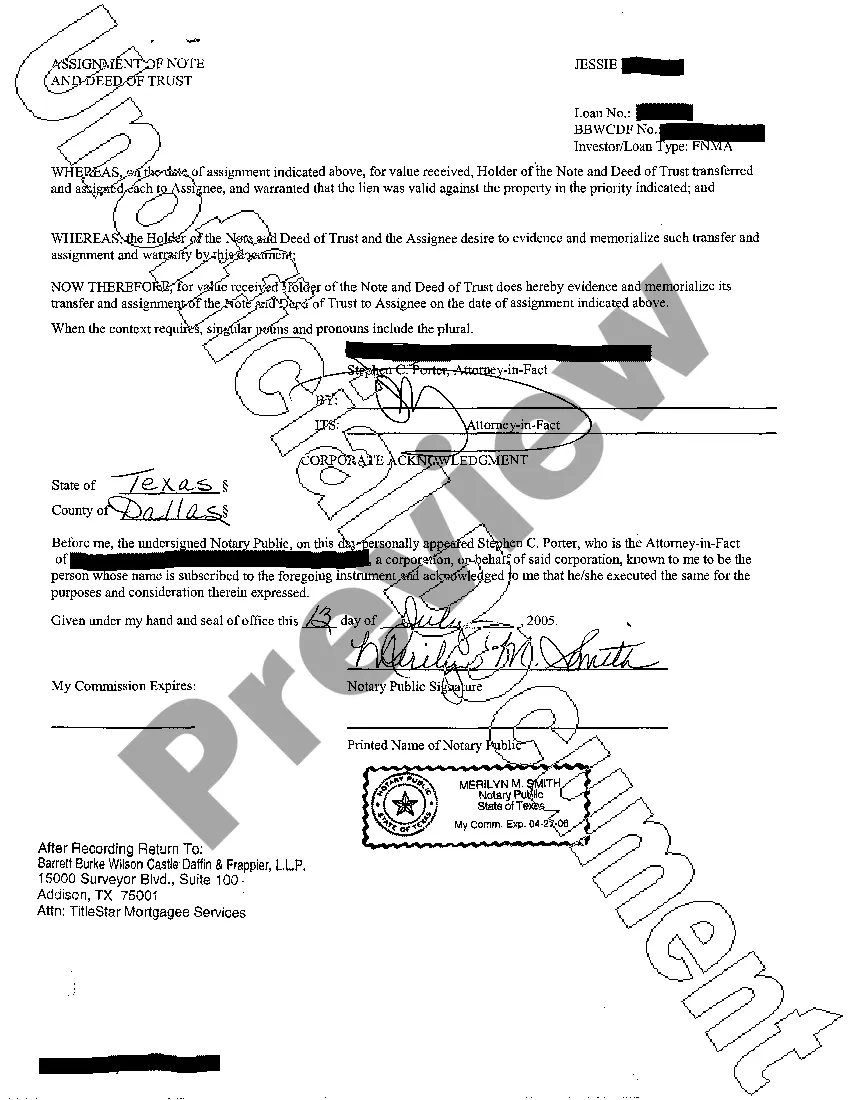

The McKinney Texas Assignment of Note and Deed of Trust is a legal process that is commonly used during real estate transactions in McKinney, Texas. These documents play a crucial role in securing the interests of both the lender and the borrower in a mortgage transaction. The Assignment of Note refers to the transfer of the promissory note, which is the legal document that outlines the terms and conditions of the loan, from the original lender, also known as the assignor, to a new lender or investor, known as the assignee. This is typically done when a loan is sold or transferred to another financial institution. By assigning the note, the assignor relinquishes their rights and interest in the loan to the assignee, who then becomes the new holder and can enforce the terms of the note. On the other hand, the Deed of Trust is a legal instrument that establishes a lien on the property being purchased. It serves as security for the loan, allowing the lender to foreclose on the property if the borrower defaults on their payments. The Deed of Trust typically involves three parties: the borrower, referred to as the trust or, the lender, known as the beneficiary, and a neutral third party, often a title company or attorney, called the trustee. The trustee holds the legal title to the property until the loan is repaid, at which point it is released to the borrower. In McKinney, Texas, there are various types of Assignment of Note and Deed of Trust that may be used depending on the specific circumstances of the transaction. Some common variations include: 1. Open-end or blanket Assignment of Note and Deed of Trust: This type of assignment allows for future advances on an existing loan without the need for additional documentation. It provides flexibility for borrowers who may need additional funds in the future. 2. Partial Assignment of Note and Deed of Trust: In certain situations, the lender may choose to assign only a portion of the note and deed of trust to another lender or investor. This is typically done to diversify risk or secure additional funding from multiple sources. 3. Subordinate Assignment of Note and Deed of Trust: When a borrower obtains a second mortgage or home equity loan, the original lender may agree to subordinate their lien to the new loan. This means that in the event of foreclosure, the second lender would have the first claim on the property. 4. Assignment of Note and Deed of Trust with Vendor's Lien: This type of assignment is commonly used in seller-financed transactions. The seller acts as the lender and retains a vendor's lien on the property until the loan is fully repaid. In conclusion, the McKinney Texas Assignment of Note and Deed of Trust is a vital part of real estate transactions in McKinney, Texas. It ensures the proper transfer of the promissory note and secures the interests of both the lender and borrower. Different variations of these assignments may be used depending on the specific needs and circumstances of the transaction.

The McKinney Texas Assignment of Note and Deed of Trust is a legal process that is commonly used during real estate transactions in McKinney, Texas. These documents play a crucial role in securing the interests of both the lender and the borrower in a mortgage transaction. The Assignment of Note refers to the transfer of the promissory note, which is the legal document that outlines the terms and conditions of the loan, from the original lender, also known as the assignor, to a new lender or investor, known as the assignee. This is typically done when a loan is sold or transferred to another financial institution. By assigning the note, the assignor relinquishes their rights and interest in the loan to the assignee, who then becomes the new holder and can enforce the terms of the note. On the other hand, the Deed of Trust is a legal instrument that establishes a lien on the property being purchased. It serves as security for the loan, allowing the lender to foreclose on the property if the borrower defaults on their payments. The Deed of Trust typically involves three parties: the borrower, referred to as the trust or, the lender, known as the beneficiary, and a neutral third party, often a title company or attorney, called the trustee. The trustee holds the legal title to the property until the loan is repaid, at which point it is released to the borrower. In McKinney, Texas, there are various types of Assignment of Note and Deed of Trust that may be used depending on the specific circumstances of the transaction. Some common variations include: 1. Open-end or blanket Assignment of Note and Deed of Trust: This type of assignment allows for future advances on an existing loan without the need for additional documentation. It provides flexibility for borrowers who may need additional funds in the future. 2. Partial Assignment of Note and Deed of Trust: In certain situations, the lender may choose to assign only a portion of the note and deed of trust to another lender or investor. This is typically done to diversify risk or secure additional funding from multiple sources. 3. Subordinate Assignment of Note and Deed of Trust: When a borrower obtains a second mortgage or home equity loan, the original lender may agree to subordinate their lien to the new loan. This means that in the event of foreclosure, the second lender would have the first claim on the property. 4. Assignment of Note and Deed of Trust with Vendor's Lien: This type of assignment is commonly used in seller-financed transactions. The seller acts as the lender and retains a vendor's lien on the property until the loan is fully repaid. In conclusion, the McKinney Texas Assignment of Note and Deed of Trust is a vital part of real estate transactions in McKinney, Texas. It ensures the proper transfer of the promissory note and secures the interests of both the lender and borrower. Different variations of these assignments may be used depending on the specific needs and circumstances of the transaction.