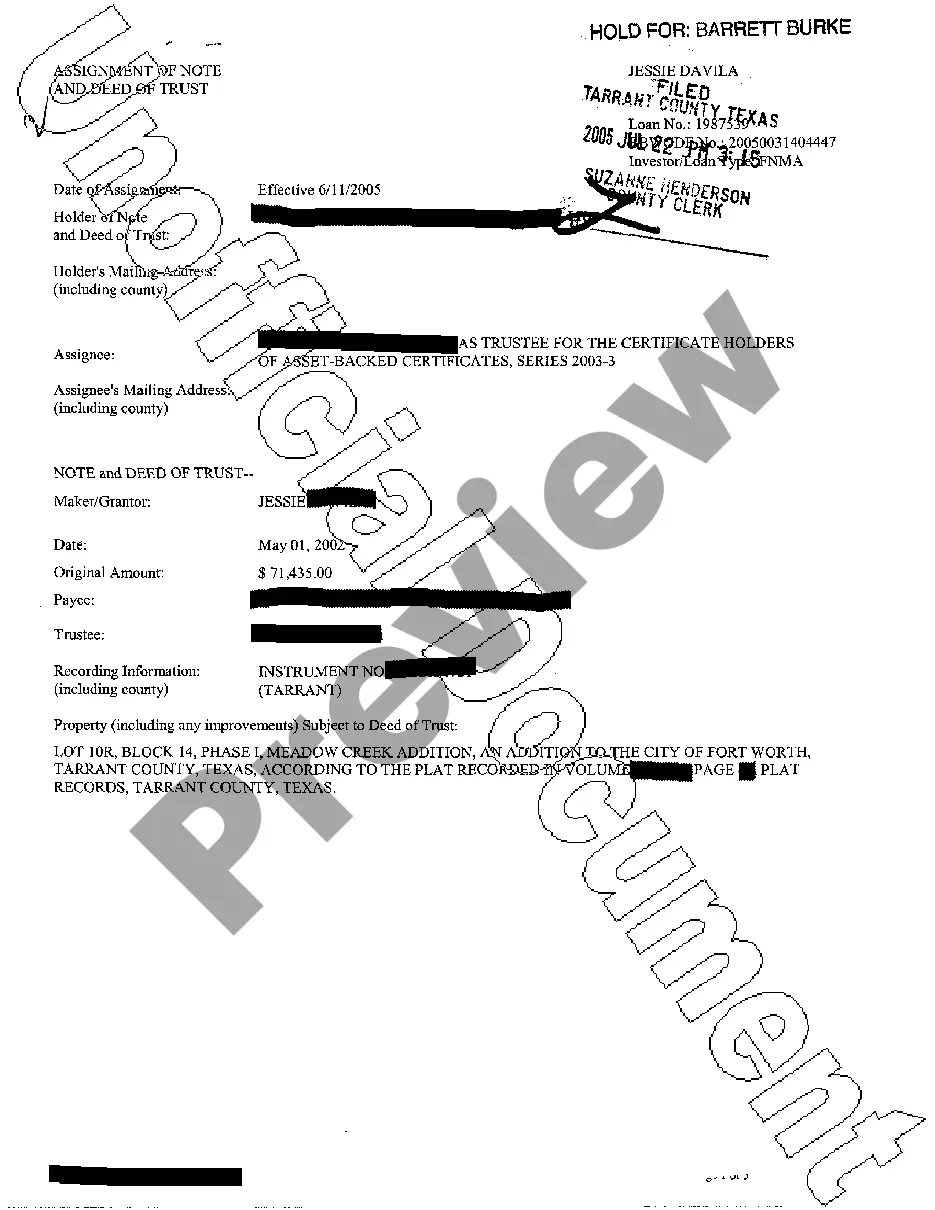

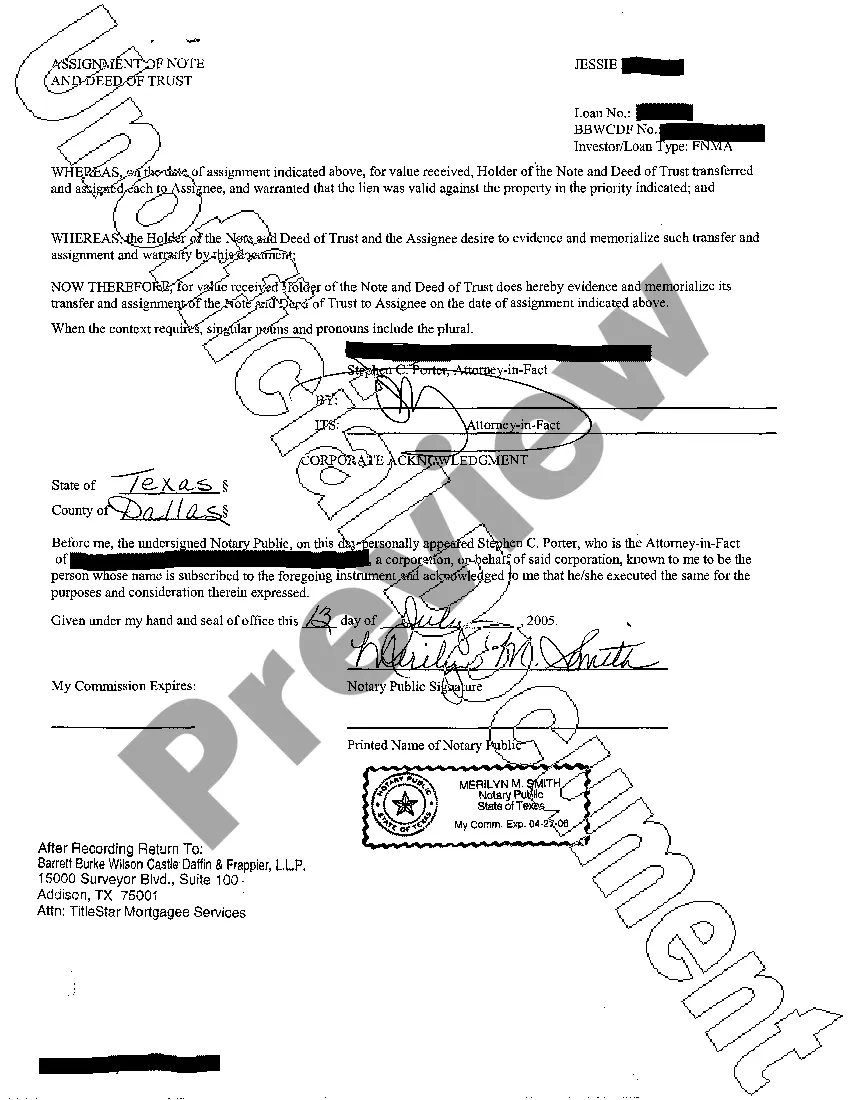

Description: The Mesquite Texas Assignment of Note and Deed of Trust is a legal document used in real estate transactions. It entails the transfer of ownership and rights associated with a promissory note and a deed of trust between parties involved. This document is crucial in ensuring the proper transfer of a debtor's obligation to repay a loan and the corresponding trust instrument that secures the loan with the property involved. In Mesquite, Texas, there are several types of Assignment of Note and Deed of Trust depending on the specific circumstances of the transaction. Some of these variations may include: 1. Mesquite Texas Residential Assignment of Note and Deed of Trust: This type of assignment is used when a residential property is involved in the transaction, such as a single-family home, townhouse, or condominium. 2. Mesquite Texas Commercial Assignment of Note and Deed of Trust: This type of assignment is applicable to commercial properties, including retail spaces, office buildings, warehouses, and other non-residential properties. 3. Mesquite Texas Assumption Assignment of Note and Deed of Trust: This type of assignment occurs when a new borrower takes over the existing promissory note and deed of trust, assuming the responsibilities and benefits associated with the loan. 4. Mesquite Texas Partial Assignment of Note and Deed of Trust: In some cases, a borrower may choose to transfer a portion of their loan obligations to another party while retaining the remaining portion, resulting in a partial assignment of the note and deed of trust. 5. Mesquite Texas Assignment of Note and Deed of Trust with Release: This type of assignment, often seen during refinancing or loan modifications, occurs when the original promissory note and deed of trust are assigned to a new lender, and the previous lender releases their claim on the property. These different types of assignments convey various legal rights and obligations under the Mesquite Texas Assignment of Note and Deed of Trust process. It is essential for all parties involved, including the borrower, lender, and any potential assignees, to have a thorough understanding of the specific type of assignment being used and its implications on their respective positions. As these documents involve complex legal procedures, it is advisable to consult with a qualified attorney or real estate professional familiar with Texas laws to ensure compliance and protect the interests of all parties involved.

Mesquite Texas Assignment of Note and Deed of Trust

Description

How to fill out Mesquite Texas Assignment Of Note And Deed Of Trust?

We always want to reduce or prevent legal damage when dealing with nuanced law-related or financial affairs. To do so, we sign up for legal solutions that, usually, are extremely expensive. However, not all legal matters are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based catalog of up-to-date DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without the need of using services of a lawyer. We offer access to legal document templates that aren’t always publicly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Mesquite Texas Assignment of Note and Deed of Trust or any other document easily and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always re-download it from within the My Forms tab.

The process is just as straightforward if you’re unfamiliar with the website! You can register your account in a matter of minutes.

- Make sure to check if the Mesquite Texas Assignment of Note and Deed of Trust adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s outline (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve made sure that the Mesquite Texas Assignment of Note and Deed of Trust would work for your case, you can choose the subscription option and make a payment.

- Then you can download the document in any suitable file format.

For more than 24 years of our existence, we’ve helped millions of people by providing ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save efforts and resources!