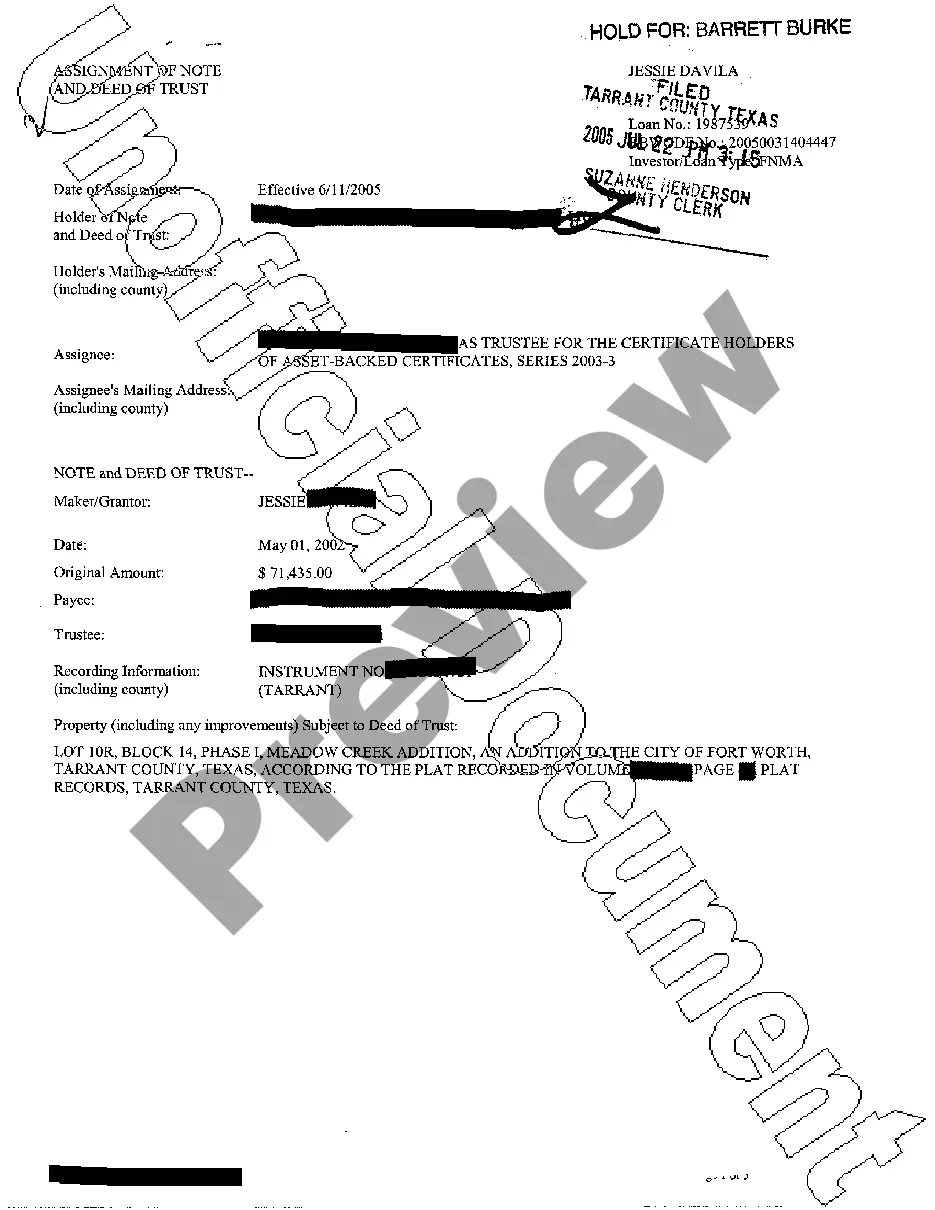

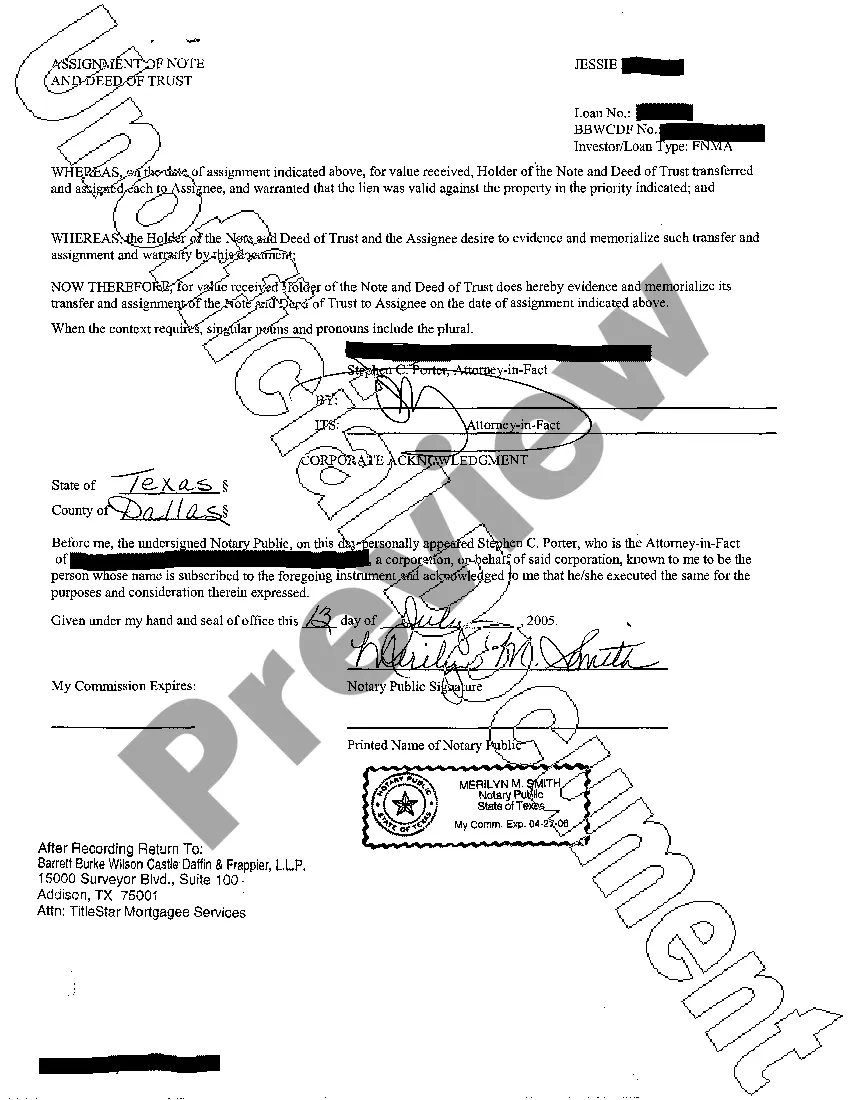

Wichita Falls Texas Assignment of Note and Deed of Trust is a legal document that serves as a transfer of the ownership rights and interests of a promissory note along with accompanying security instrument, known as a deed of trust. This assignment occurs when the original lender, also referred to as the beneficiary, transfers their rights to a third party, identified as the assignee. This transaction allows the assignee to assume the position of the lender, becoming the recipient of the monthly mortgage payments and holder of the security interest. The assignment of note involves the promissory note, a legal agreement between the borrower and the lender, which details the terms and conditions of the loan. It outlines the amount borrowed, interest rates, repayment schedule, late payment penalties, and other critical provisions. When the note is assigned, the borrower's obligation to make payments remains the same; however, the payments are redirected to the assignee instead of the original lender. Simultaneously, the deed of trust, a security instrument, is assigned. It is essentially a lien placed on the property being purchased with the loan. The deed of trust serves as security for the repayment of the promissory note. In the event of default, the assignee has the right to foreclose on the property and sell it to recover the outstanding debt. There might be different types of Wichita Falls Texas Assignment of Note and Deed of Trust, depending on the specific circumstances and requirements. Some common variants include: 1. Partial Assignment of Note and Deed of Trust: This type of assignment occurs when only a portion of the loan amount is transferred to the assignee, such as a partial sale of a mortgage-backed security. 2. Assignment of Note and Deed of Trust with Recourse: In this scenario, the original lender (beneficiary) retains certain obligations in case of default by the borrower. If the property's value is insufficient to cover the outstanding loan balance, the assignee can seek recovery from the original lender. 3. Assignment of Note and Deed of Trust without Recourse: In contrast to the previous type, this assignment relieves the original lender of any liability for default. In case of an inadequate loan repayment, the assignee can solely rely on the property's value as collateral to recover the debt. 4. All-Inclusive Assignment of Note and Deed of Trust: This variant involves the assignment of multiple loans or mortgages under a single promissory note and deed of trust. It consolidates different loans into a comprehensive, unified agreement. When executing a Wichita Falls Texas Assignment of Note and Deed of Trust, it is crucial to seek legal counsel to ensure compliance with applicable laws and regulations. Both parties involved should carefully review the terms and implications of the assignment before proceeding with the transfer of rights and responsibilities.

Wichita Falls Texas Assignment of Note and Deed of Trust is a legal document that serves as a transfer of the ownership rights and interests of a promissory note along with accompanying security instrument, known as a deed of trust. This assignment occurs when the original lender, also referred to as the beneficiary, transfers their rights to a third party, identified as the assignee. This transaction allows the assignee to assume the position of the lender, becoming the recipient of the monthly mortgage payments and holder of the security interest. The assignment of note involves the promissory note, a legal agreement between the borrower and the lender, which details the terms and conditions of the loan. It outlines the amount borrowed, interest rates, repayment schedule, late payment penalties, and other critical provisions. When the note is assigned, the borrower's obligation to make payments remains the same; however, the payments are redirected to the assignee instead of the original lender. Simultaneously, the deed of trust, a security instrument, is assigned. It is essentially a lien placed on the property being purchased with the loan. The deed of trust serves as security for the repayment of the promissory note. In the event of default, the assignee has the right to foreclose on the property and sell it to recover the outstanding debt. There might be different types of Wichita Falls Texas Assignment of Note and Deed of Trust, depending on the specific circumstances and requirements. Some common variants include: 1. Partial Assignment of Note and Deed of Trust: This type of assignment occurs when only a portion of the loan amount is transferred to the assignee, such as a partial sale of a mortgage-backed security. 2. Assignment of Note and Deed of Trust with Recourse: In this scenario, the original lender (beneficiary) retains certain obligations in case of default by the borrower. If the property's value is insufficient to cover the outstanding loan balance, the assignee can seek recovery from the original lender. 3. Assignment of Note and Deed of Trust without Recourse: In contrast to the previous type, this assignment relieves the original lender of any liability for default. In case of an inadequate loan repayment, the assignee can solely rely on the property's value as collateral to recover the debt. 4. All-Inclusive Assignment of Note and Deed of Trust: This variant involves the assignment of multiple loans or mortgages under a single promissory note and deed of trust. It consolidates different loans into a comprehensive, unified agreement. When executing a Wichita Falls Texas Assignment of Note and Deed of Trust, it is crucial to seek legal counsel to ensure compliance with applicable laws and regulations. Both parties involved should carefully review the terms and implications of the assignment before proceeding with the transfer of rights and responsibilities.