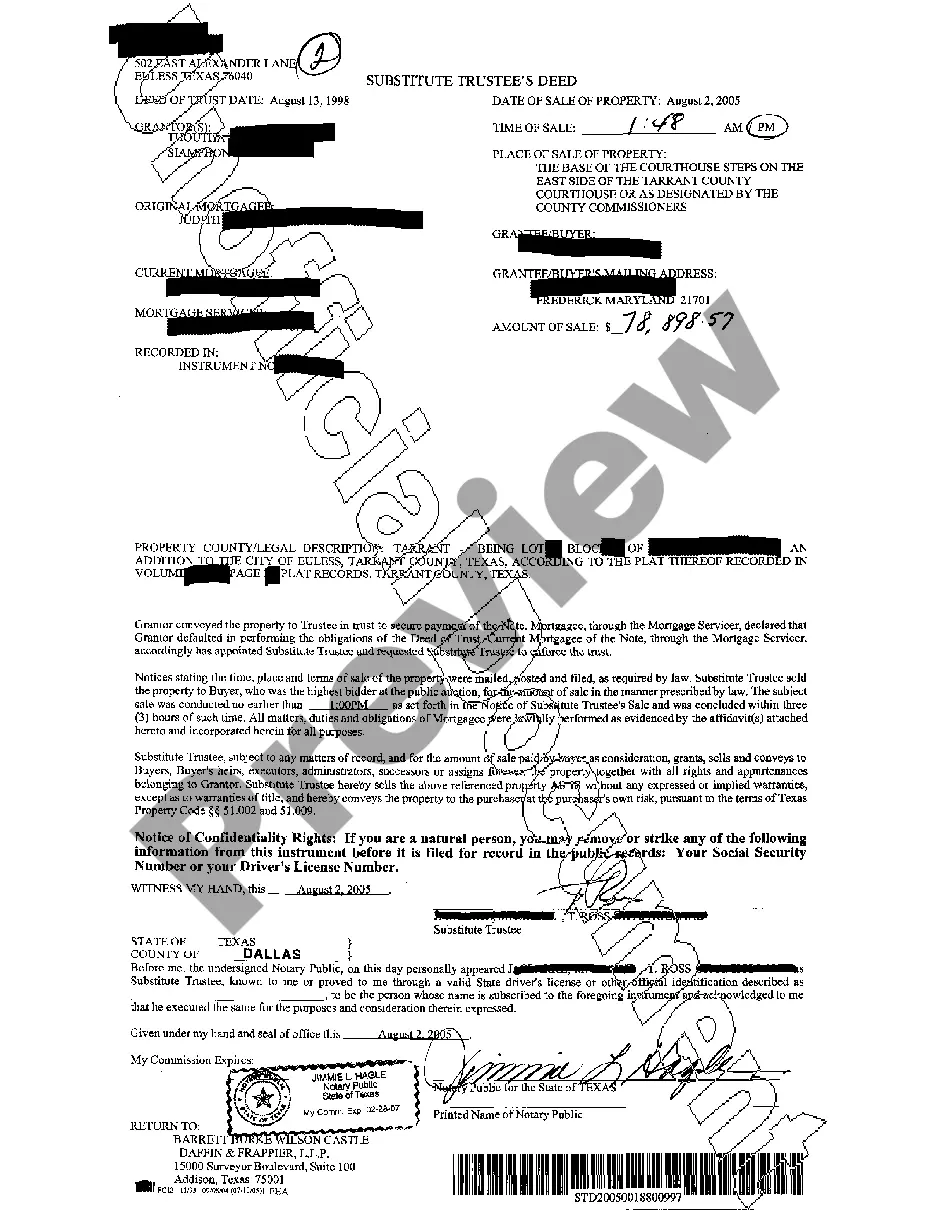

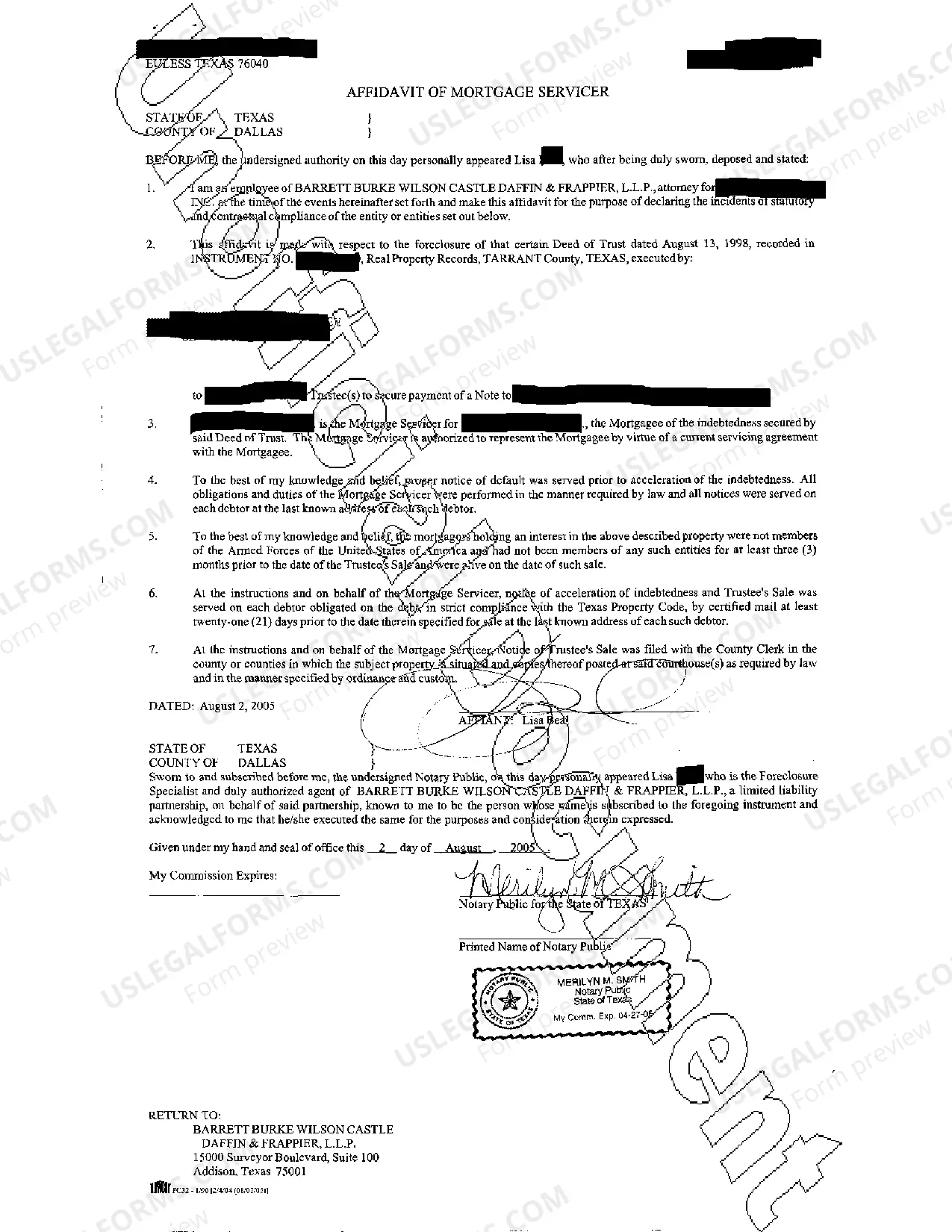

A Houston Texas Substitute Trustee's Deed is a legal document that conveys ownership of property from a borrower to a buyer or a trustee, usually in the context of a foreclosure action. It is commonly used in situations where the borrower has defaulted on their mortgage or loan agreement. This type of deed is often referred to as a "substitute" trustee's deed because it replaces the original trustee who was initially designated in the deed of trust or mortgage agreement. The substitute trustee is usually appointed by the lender or creditor to serve as the new trustee and oversee the foreclosure process. In Houston, Texas, there are two main types of Substitute Trustee's Deeds: 1. Substitute Trustee's Deed after Non-Judicial Foreclosure: This type of deed is used when the foreclosure process is initiated and completed without judicial intervention. Non-judicial foreclosure is a common method in Texas, allowing the lender or trustee to sell the property without going through the court system. Once the foreclosure sale is conducted, the substitute trustee issues the deed to the successful bidder or buyer. 2. Substitute Trustee's Deed after Judicial Foreclosure: In some cases, the foreclosure process may require judicial intervention, typically when certain legal requirements are not met or when the borrower contests the foreclosure. A judicial foreclosure entails filing a lawsuit and going through a court proceeding. If the lender or creditor is successful in obtaining a judgment of foreclosure, the court appoints a substitute trustee who then issues the Substitute Trustee's Deed to transfer ownership to the winning bidder or buyer at the foreclosure sale. These Substitute Trustee's Deeds serve to transfer ownership of the foreclosed property to the buyer, providing them with legal title and ensuring that the property is free of liens, encumbrances, and any interest the borrower or previous owner had in the property. It is important to note that the details and legal requirements for Substitute Trustee's Deeds can vary depending on the specific circumstances, local regulations, and the terms outlined in the original deed of trust or mortgage agreement. It is advisable to consult with a real estate attorney or a qualified professional to ensure the accuracy and legality of the substitute trustee's deed in Houston, Texas.

Houston Texas Substitute Trustee's Deed

Description

How to fill out Houston Texas Substitute Trustee's Deed?

Regardless of social or occupational standing, completing legal forms is an unfortunate requirement in today’s workplace.

Often, it’s nearly impossible for someone without legal expertise to draft such documents from the ground up, primarily due to the complex terminology and legal nuances they entail.

This is where US Legal Forms can be a game-changer.

Ensure that the template you have selected is appropriate for your location, as the regulations of one state or area may not apply to another.

Review the document and read a brief synopsis (if available) of the situations for which the form can be utilized.

- Our platform boasts a vast collection of over 85,000 ready-to-use state-specific templates suitable for nearly every legal situation.

- US Legal Forms is also an invaluable tool for associates or legal advisors looking to save time utilizing our DIY forms.

- Whether you need the Houston Texas Substitute Trustee's Deed or any other document applicable in your area, US Legal Forms has everything you need at your fingertips.

- Here’s how to obtain the Houston Texas Substitute Trustee's Deed in a matter of minutes using our reliable platform.

- If you are currently a subscriber, simply Log In to your account to download the necessary document.

- If you are new to our platform, please follow these steps before downloading the Houston Texas Substitute Trustee's Deed.

Form popularity

FAQ

Texas is one of the few states that is a ?deed of trust? state. While many people take out a mortgage to purchase real estate, which is a loan borrowed from a bank to finance the purchase of a home, in most states, there are only two parties named on this legal document ? the lender (bank) and the borrower (homeowner).

THE TRUSTEES They are appointed by the FOUNDER and are responsible to ensure that the TRUST ASSETS are utilised in accordance with the FOUNDER's intention and to the best advantage of the BENEFICIARIES of the TRUST. Any person, natural or juristic, may be appointed as a TRUSTEE.

There are a variety of deeds that are recognized in Texas, but the four most common deeds seen are general warranty deeds, special warranty deeds, no warranty deeds, and quitclaims.

When you set up a living trust as the grantor, you designate both trustees and beneficiaries. You can designate the same person as both a beneficiary and a trustee, and you can even name yourself as a trustee and beneficiary.

A Deed of Trust in Texas transfers title of real property in trust. It is the equivalent to a mortgage used in other states and provides a secured interest for a lender against real estate. It is often used as part of a real estate transaction that includes a Warranty Deed with a Vendor's Lien and a Promissory Note.

The trustee named in a Texas deed of trust can be any individual person who has the legal capacity to hold and transfer property. Under Texas law, if the named trustee is a corporation, the corporation must be authorized to act as a trustee in Texas.

In a nutshell, the Substitution of Trustee and Deed of Reconveyance is a legal document that evidences security interest is being release by a lender. In most cases, the document shows that a loan has been paid off. Property owners may even receive this document if they have refinanced a loan.

In Texas, a deed of trust, also known as a trust deed, is the commonly used instrument for the purpose of creating mortgage liens on real estate. A mortgage is an executed contract in which the legal or equitable owner of the real property pledges the title thereto as security for performance of an obligation.

Both a warranty deed and deed of trust are used to transfer the title of a property from one person to another. However, the difference between these two contracts is who is protected. As you now know, a deed of trust protects the beneficiary (lender). A warranty deed, on the other hand, protects the property owner.

Deeds of trusts are frequently used in Texas in real estate transactions to create an agreement such as a mortgage.

More info

I) Job Description: Salary will increase by per year. 3-4×, Elementary (Gr. I) Job Description: Salary will increase by per year. 5-6×, Middle (Gr. I) Job Description: Salary will increase by per year. 7-8×, Middle (Gr. II) Job Description: Salary will increase by per year. 9×, High School Teacher Job Description: Salary will increase by per year. 10×, High School Teacher Job Description: Salary will increase by per year. 11×, High School Teacher Job Description: Salary will increase by per year. 12×, High School Teacher Job Description: Salary will increase by per year. 13×, High School Teacher Job Description: Salary will increase by per year. Salary amount is 1255 per month. 13-2×, High School Teacher Job Description: Salary will increase by per year. Salary amount is 1275 per month. 14×, Junior High School Teacher Job Description: Salary will increase by per year. Salary amount is 1250 per month.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.