Odessa Texas Substitute Trustee's Deed

Description

How to fill out Texas Substitute Trustee's Deed?

Are you seeking a trustworthy and economical legal forms provider to acquire the Odessa Texas Substitute Trustee's Deed? US Legal Forms is your primary choice.

Whether you require a straightforward agreement to establish guidelines for living together with your partner or a collection of forms to expedite your divorce proceedings in court, we've got you covered. Our platform offers over 85,000 current legal document templates for both personal and business applications. All templates we provide are not generic but tailored based on the needs of specific states and regions.

To download the form, you must Log In to your account, locate the desired template, and click the Download button adjacent to it. Please note that you can retrieve your previously acquired document templates at any time from the My documents section.

Is this your first visit to our website? No problem. You can easily create an account, but first, ensure to do the following.

Now you can register for your account. Then select a subscription plan and proceed with the payment. Once the payment is finalized, download the Odessa Texas Substitute Trustee's Deed in any available format. You can return to the website whenever needed and redownload the form at no additional cost.

Obtaining current legal forms has never been simpler. Try US Legal Forms today, and stop wasting your precious time searching for legal documents online.

- Verify if the Odessa Texas Substitute Trustee's Deed complies with the laws of your state and locality.

- Review the form’s description (if available) to understand who and what the form is suitable for.

- Restart the search if the template isn’t appropriate for your particular situation.

Form popularity

FAQ

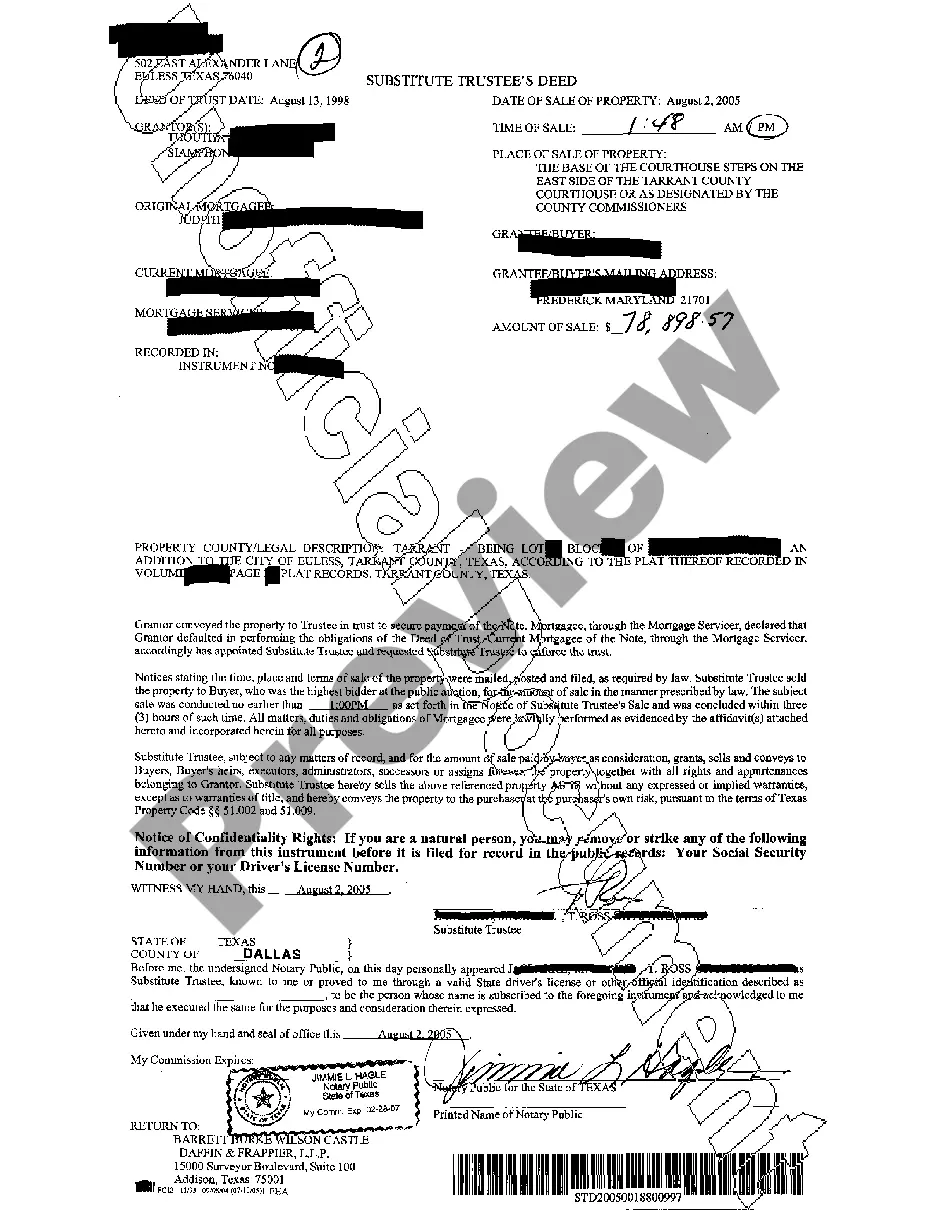

Notices are entitled ?Notice of Trustee's Sale? or ?Notice of Substitute Trustee's Sale.? They provide information about the debt, the legal description of the property, and designate a three-hour period during which the sale will be held.

This is required by the Texas Property Code. The borrower must own legal title to the property that is being pledged to secure the borrowed money.

A trustee sale is the sale of real estate property through a public auction. In most cases, trustee sales are only possible because homeowners are in some financial crisis, such as a homeowner defaulting on their mortgage payments and the property going into foreclosure.

In simple terms, anyone who has the capacity to hold property can be a trustee. It is possible to be both a beneficiary and a trustee, although this may not always be appropriate. A trust may have just professional trustees, just lay trustees or a combination of the two.

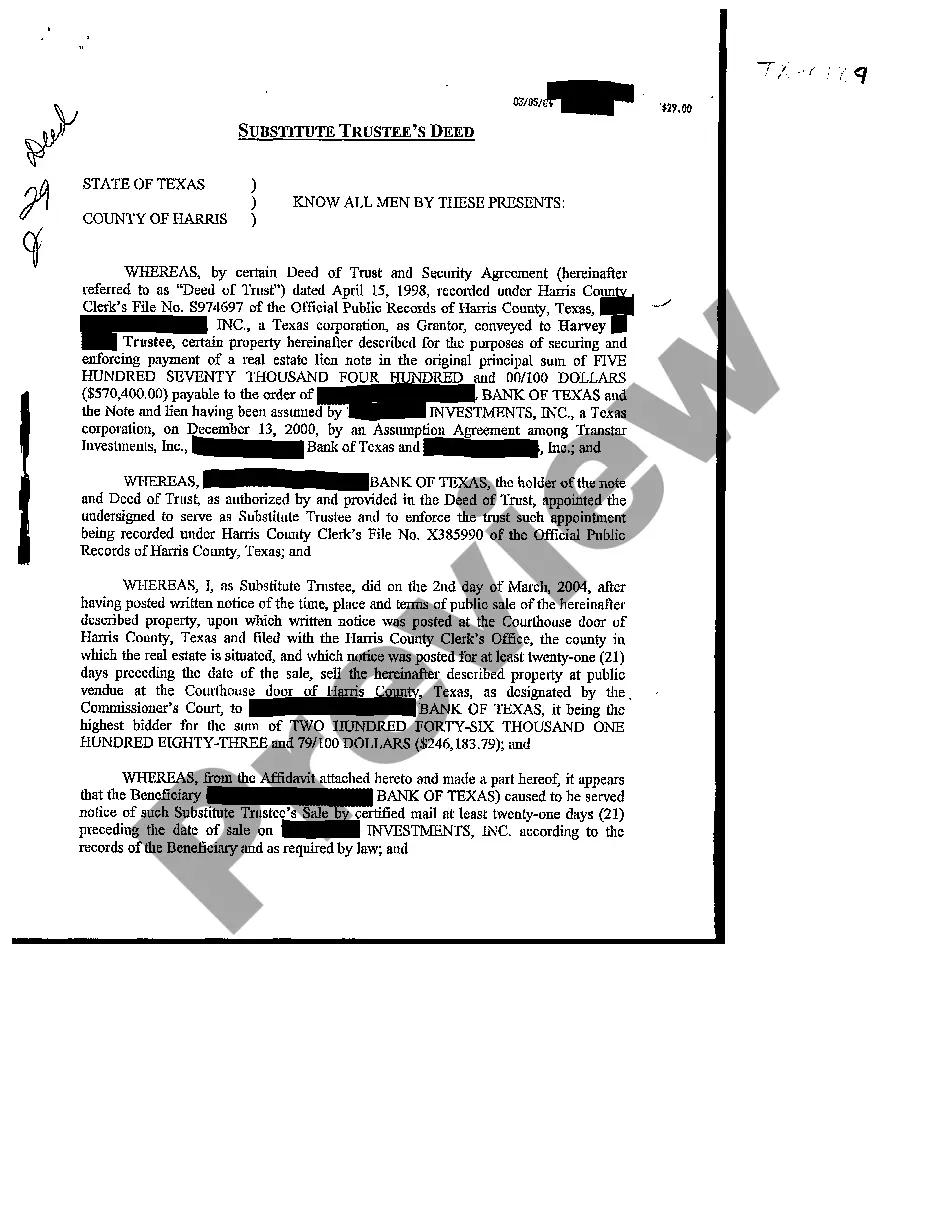

In Texas, a deed of trust, also known as a trust deed, is the commonly used instrument for the purpose of creating mortgage liens on real estate. A mortgage is an executed contract in which the legal or equitable owner of the real property pledges the title thereto as security for performance of an obligation.

A deed of trust has a borrower, lender and a ?trustee.? The trustee is a neutral third party that holds the title to a property until the loan is completely paid off by the borrower. In most cases, the trustee is an escrow If you don't repay your loan, the escrow company's attorney must begin the foreclosure process.

The trustee named in a Texas deed of trust can be any individual person who has the legal capacity to hold and transfer property. Under Texas law, if the named trustee is a corporation, the corporation must be authorized to act as a trustee in Texas.

After the foreclosure sale, if the property sells for a higher price than what is owed, the excess funds would then be used to pay off any additional liens that may be on the property.

When you set up a living trust as the grantor, you designate both trustees and beneficiaries. You can designate the same person as both a beneficiary and a trustee, and you can even name yourself as a trustee and beneficiary.

Notices are entitled ?Notice of Trustee's Sale? or ?Notice of Substitute Trustee's Sale.? They provide information about the debt, the legal description of the property, and designate a three-hour period during which the sale will be held.