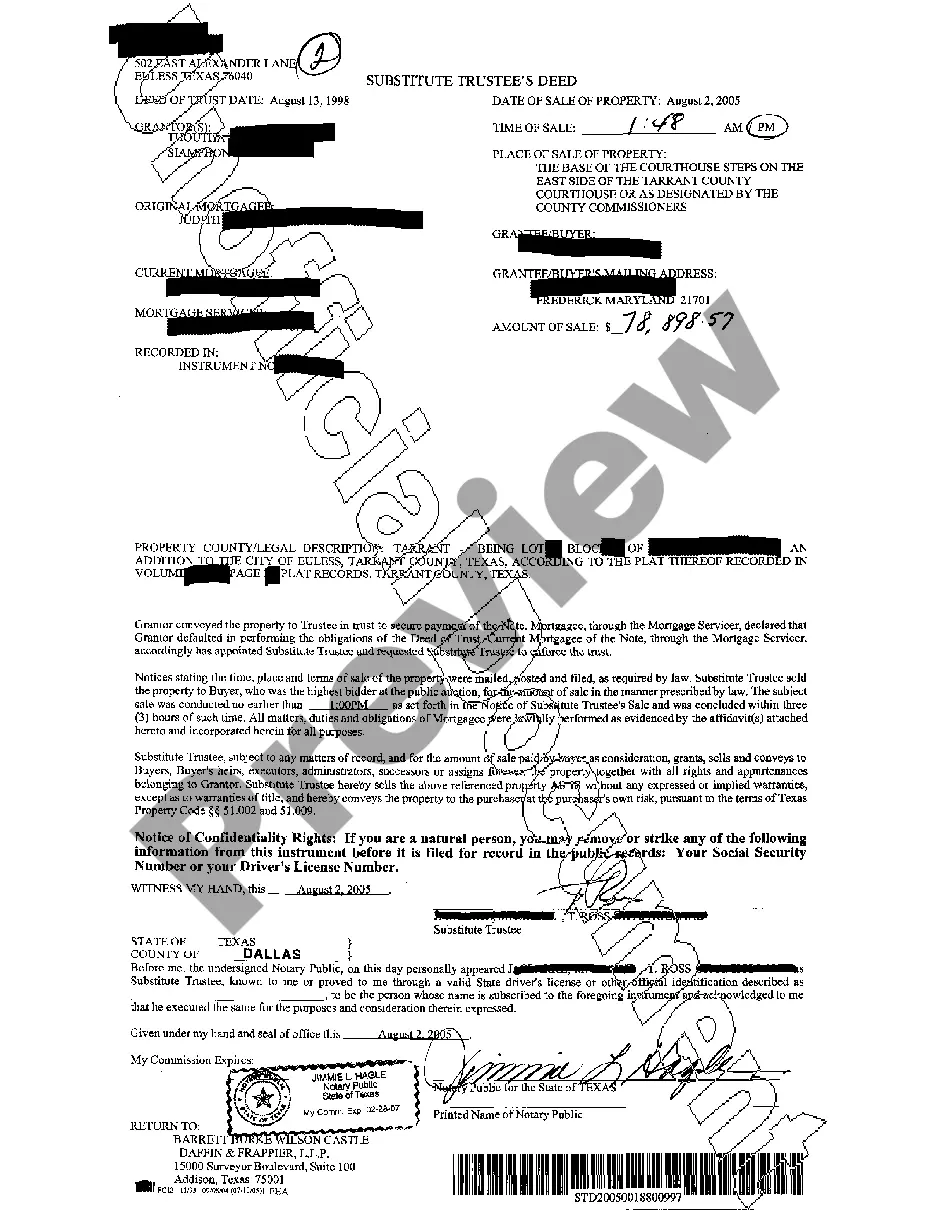

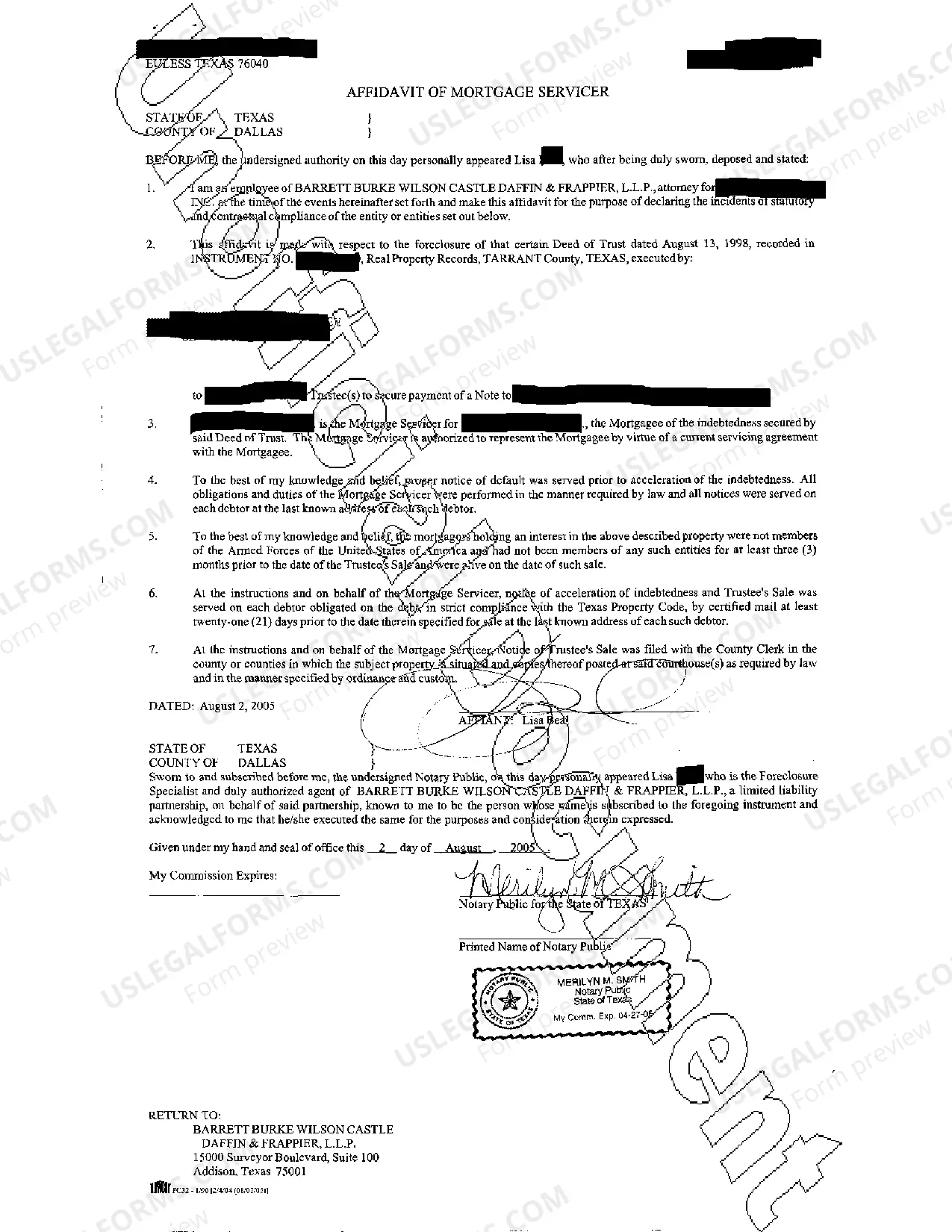

A Pasadena Texas Substitute Trustee's Deed is a legal document used in real estate transactions involving properties located in Pasadena, Texas. It is a type of deed used during foreclosure proceedings when a property owner defaults on their mortgage or loan repayment obligations. This deed allows the lending institution or trustee to protect its interest in the property and transfer ownership to a new buyer or investor. Keywords: Pasadena Texas, Substitute Trustee's Deed, real estate transactions, foreclosure proceedings, mortgage default, loan repayment, lending institution, trustee, property ownership, new buyer, investor. There are different types of Pasadena Texas Substitute Trustee's Deed used depending on specific circumstances. These include: 1. Regular Substitute Trustee's Deed: This type of deed is typically used when the borrower has defaulted on their mortgage payments, and the property is being foreclosed. It allows the trustee or lending institution to transfer the property to a new buyer or investor. 2. Substitute Trustee's Deed in Lieu of Foreclosure: In some cases, when a borrower faces imminent foreclosure, they may negotiate with the lending institution to voluntarily transfer ownership of the property through a deed in lieu of foreclosure. This allows them to avoid foreclosure and the negative impact on their credit history. 3. Substitute Trustee's Deed with Special Warranty: This type of deed offers a limited warranty from the substitute trustee or lending institution, assuring the new buyer of their right to sell the property without any hindrance or claim from the lender. 4. Substitute Trustee's Deed by Sale: A Pasadena Texas property can also be transferred through a substitute trustee's deed by sale when the foreclosure process concludes. In this case, the property is sold at a public auction, and the substitute trustee transfers ownership to the highest bidder. Each type of Pasadena Texas Substitute Trustee's Deed serves a specific purpose within the foreclosure process, aiming to protect the interests of the lending institution or trustee while facilitating the transfer of ownership to a new buyer or investor. It is crucial to consult with legal professionals or experienced real estate agents for guidance when dealing with such deeds to ensure compliance with local laws and regulations.

Pasadena Texas Substitute Trustee's Deed

Description

How to fill out Pasadena Texas Substitute Trustee's Deed?

Do you require a dependable and cost-effective provider of legal forms to purchase the Pasadena Texas Substitute Trustee's Deed? US Legal Forms is your ideal option.

Whether you need a straightforward agreement to establish guidelines for living with your partner or a bundle of papers to facilitate your separation or divorce through the judicial system, we have you covered. Our platform offers over 85,000 current legal document templates for personal and business use. All templates we provide access to are not generic and are tailored according to the regulations of specific states and counties.

To obtain the document, you must Log In to your account, find the necessary template, and click the Download button adjacent to it. Please keep in mind that you can access your previously acquired document templates at any time from the My documents section.

Is this your first visit to our site? No need to fret. You can easily create an account, but first, ensure you do the following.

Now you can register your account. Then select the subscription plan and move forward with payment. Once the payment is completed, download the Pasadena Texas Substitute Trustee's Deed in any format available. You can return to the website at any point and re-download the document at no extra cost.

Locating current legal documents has never been simpler. Try US Legal Forms today, and put an end to spending hours researching legal paperwork online forever.

- Verify that the Pasadena Texas Substitute Trustee's Deed meets the statutes of your state and locality.

- Examine the form’s description (if available) to determine who and what the document is appropriate for.

- Start the search again if the template doesn't fit your particular circumstances.

Form popularity

FAQ

When you set up a living trust as the grantor, you designate both trustees and beneficiaries. You can designate the same person as both a beneficiary and a trustee, and you can even name yourself as a trustee and beneficiary.

A deed of trust has a borrower, lender and a ?trustee.? The trustee is a neutral third party that holds the title to a property until the loan is completely paid off by the borrower. In most cases, the trustee is an escrow If you don't repay your loan, the escrow company's attorney must begin the foreclosure process.

In simple terms, anyone who has the capacity to hold property can be a trustee. It is possible to be both a beneficiary and a trustee, although this may not always be appropriate. A trust may have just professional trustees, just lay trustees or a combination of the two.

Notices are entitled ?Notice of Trustee's Sale? or ?Notice of Substitute Trustee's Sale.? They provide information about the debt, the legal description of the property, and designate a three-hour period during which the sale will be held.

Purchase paper copies of documents without the unofficial watermark in person at any Annex Location. by fax: (713) 437-4868. by email to: ccinfo@cco.hctx.net. by mail to: Teneshia Hudspeth, Harris County Clerk. Attn: Information Department. P.O. Box 1525. Houston, TX. 77251. For Questions Call (713) 274-6390.

The lender and the borrower together designate who will act as the trustee; both parties must agree with the decision before finalizing the deed of trust. Lenders may use a trustee with whom they are acquainted, so long they are not affiliated. The trustee must also agree to the designation.

A trustee sale is the sale of real estate property through a public auction. In most cases, trustee sales are only possible because homeowners are in some financial crisis, such as a homeowner defaulting on their mortgage payments and the property going into foreclosure.

The trustee named in a Texas deed of trust can be any individual person who has the legal capacity to hold and transfer property. Under Texas law, if the named trustee is a corporation, the corporation must be authorized to act as a trustee in Texas.

After the foreclosure sale, if the property sells for a higher price than what is owed, the excess funds would then be used to pay off any additional liens that may be on the property.

Notices are entitled ?Notice of Trustee's Sale? or ?Notice of Substitute Trustee's Sale.? They provide information about the debt, the legal description of the property, and designate a three-hour period during which the sale will be held.