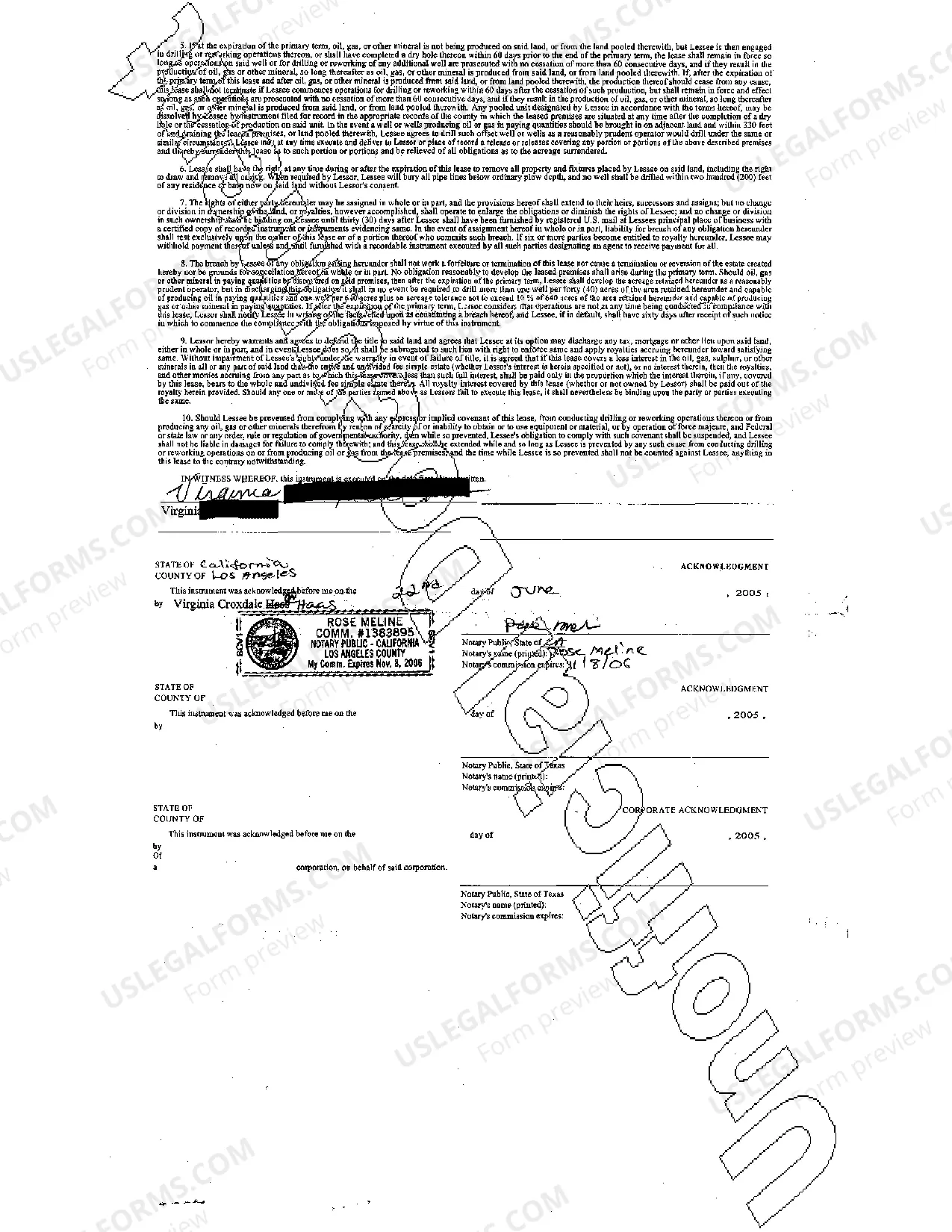

An Oil, Gas and Mineral Lease is an agreement signed by two parties, the Lessor and Lessee. The Lessor agrees to allow the Lessee onto his/her land for the sole reason to search for oil, gas and minerals. USLF amends and updates the forms as is needed in accordance with all state statutes.

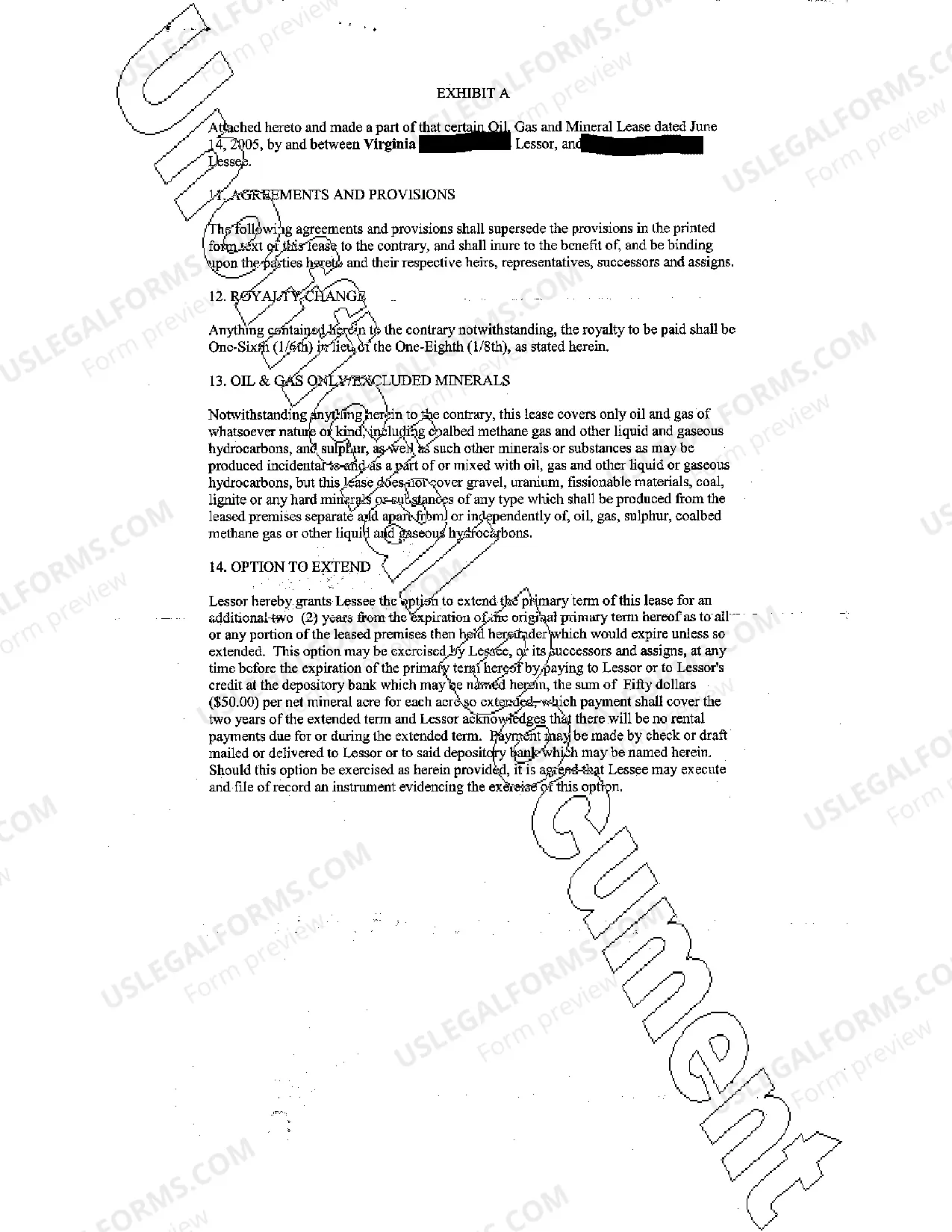

Carrollton, Texas Oil, Gas, and Mineral Lease: A Detailed Description Introduction: The Carrollton, Texas Oil, Gas, and Mineral Lease provides individuals or entities with the rights to explore, develop, and produce oil, gas, and minerals within the city of Carrollton, located in the state of Texas, United States. This lease agreement encompasses various types and terms, each offering distinct opportunities and provisions for both lessors and lessees. Types of Carrollton, Texas Oil, Gas, and Mineral Lease: 1. Standard Lease: The standard lease is a common type of arrangement where the lessor grants the lessee the right to explore, drill, and produce oil, gas, and minerals on the leased property. This lease typically includes specific provisions related to royalty payments, drilling depth, lease duration, and conditions for extension or termination. 2. Royalty Lease: In a royalty lease, the landowner, known as the lessor, receives a percentage of the revenue generated from the production of oil, gas, and minerals on their property. This type of lease offers a more straightforward approach, as the landowner does not bear the financial burden and risks associated with exploration and production activities. 3. Overriding Royalty Interest (ORRIS) Lease: An ORRIS lease allows a third party, such as an individual or an entity, to acquire a fractional percentage interest in the gross proceeds generated from the oil, gas, and mineral production. Unlike a royalty lease, the ORRIS holder will not directly own the land but will receive a percentage of the revenue generated from the leases within the specified area. 4. Non-Participating Royalty Interest (NPR) Lease: NPR leases pertain to the mineral rights owned by individuals or entities who do not possess the rights to explore, develop, or produce oil, gas, and minerals without the consent of the other parties involved. NPR holders receive a share of the revenue generated by leaseholders as a royalty payment. Key Provisions and Terms: — Primary Term: The primary term is the initial duration of the lease agreement, during which the lessee is granted the right to explore, drill, and produce oil, gas, and minerals. It is typically specified in years or months. — Royalty Payment: Royalty payments refer to the allocation of revenue generated from the production of oil, gas, and minerals to the lessor. The percentage or fractional amount is determined by the lease agreement and is usually negotiable. — Drilling Obligations: The lease may outline the lessee's responsibilities regarding drilling operations, including the number of wells to be drilled within a specified timeframe and the depth to which the wells should be drilled. — Pooling and Unitization: Pooling and unitization allow for the consolidation of multiple leases and properties to maximize production efficiency and reduce costs. These provisions enable the lessee to combine leased areas with adjacent properties to form drilling units for shared production. — Surface Use Agreement: A surface use agreement addresses the rights of the lessee to use the surface land for necessary oil and gas operations, compensation for damages, and restoration after the lease term ends. Closing Remarks: Understanding the different types of Carrollton, Texas Oil, Gas, and Mineral Lease options is crucial for both those seeking to lease their mineral rights and those looking for opportunities in exploration and production. Each type offers unique advantages and obligations, allowing individuals or entities to make informed decisions aligned with their desired involvement in the oil, gas, and mineral industry.Carrollton, Texas Oil, Gas, and Mineral Lease: A Detailed Description Introduction: The Carrollton, Texas Oil, Gas, and Mineral Lease provides individuals or entities with the rights to explore, develop, and produce oil, gas, and minerals within the city of Carrollton, located in the state of Texas, United States. This lease agreement encompasses various types and terms, each offering distinct opportunities and provisions for both lessors and lessees. Types of Carrollton, Texas Oil, Gas, and Mineral Lease: 1. Standard Lease: The standard lease is a common type of arrangement where the lessor grants the lessee the right to explore, drill, and produce oil, gas, and minerals on the leased property. This lease typically includes specific provisions related to royalty payments, drilling depth, lease duration, and conditions for extension or termination. 2. Royalty Lease: In a royalty lease, the landowner, known as the lessor, receives a percentage of the revenue generated from the production of oil, gas, and minerals on their property. This type of lease offers a more straightforward approach, as the landowner does not bear the financial burden and risks associated with exploration and production activities. 3. Overriding Royalty Interest (ORRIS) Lease: An ORRIS lease allows a third party, such as an individual or an entity, to acquire a fractional percentage interest in the gross proceeds generated from the oil, gas, and mineral production. Unlike a royalty lease, the ORRIS holder will not directly own the land but will receive a percentage of the revenue generated from the leases within the specified area. 4. Non-Participating Royalty Interest (NPR) Lease: NPR leases pertain to the mineral rights owned by individuals or entities who do not possess the rights to explore, develop, or produce oil, gas, and minerals without the consent of the other parties involved. NPR holders receive a share of the revenue generated by leaseholders as a royalty payment. Key Provisions and Terms: — Primary Term: The primary term is the initial duration of the lease agreement, during which the lessee is granted the right to explore, drill, and produce oil, gas, and minerals. It is typically specified in years or months. — Royalty Payment: Royalty payments refer to the allocation of revenue generated from the production of oil, gas, and minerals to the lessor. The percentage or fractional amount is determined by the lease agreement and is usually negotiable. — Drilling Obligations: The lease may outline the lessee's responsibilities regarding drilling operations, including the number of wells to be drilled within a specified timeframe and the depth to which the wells should be drilled. — Pooling and Unitization: Pooling and unitization allow for the consolidation of multiple leases and properties to maximize production efficiency and reduce costs. These provisions enable the lessee to combine leased areas with adjacent properties to form drilling units for shared production. — Surface Use Agreement: A surface use agreement addresses the rights of the lessee to use the surface land for necessary oil and gas operations, compensation for damages, and restoration after the lease term ends. Closing Remarks: Understanding the different types of Carrollton, Texas Oil, Gas, and Mineral Lease options is crucial for both those seeking to lease their mineral rights and those looking for opportunities in exploration and production. Each type offers unique advantages and obligations, allowing individuals or entities to make informed decisions aligned with their desired involvement in the oil, gas, and mineral industry.