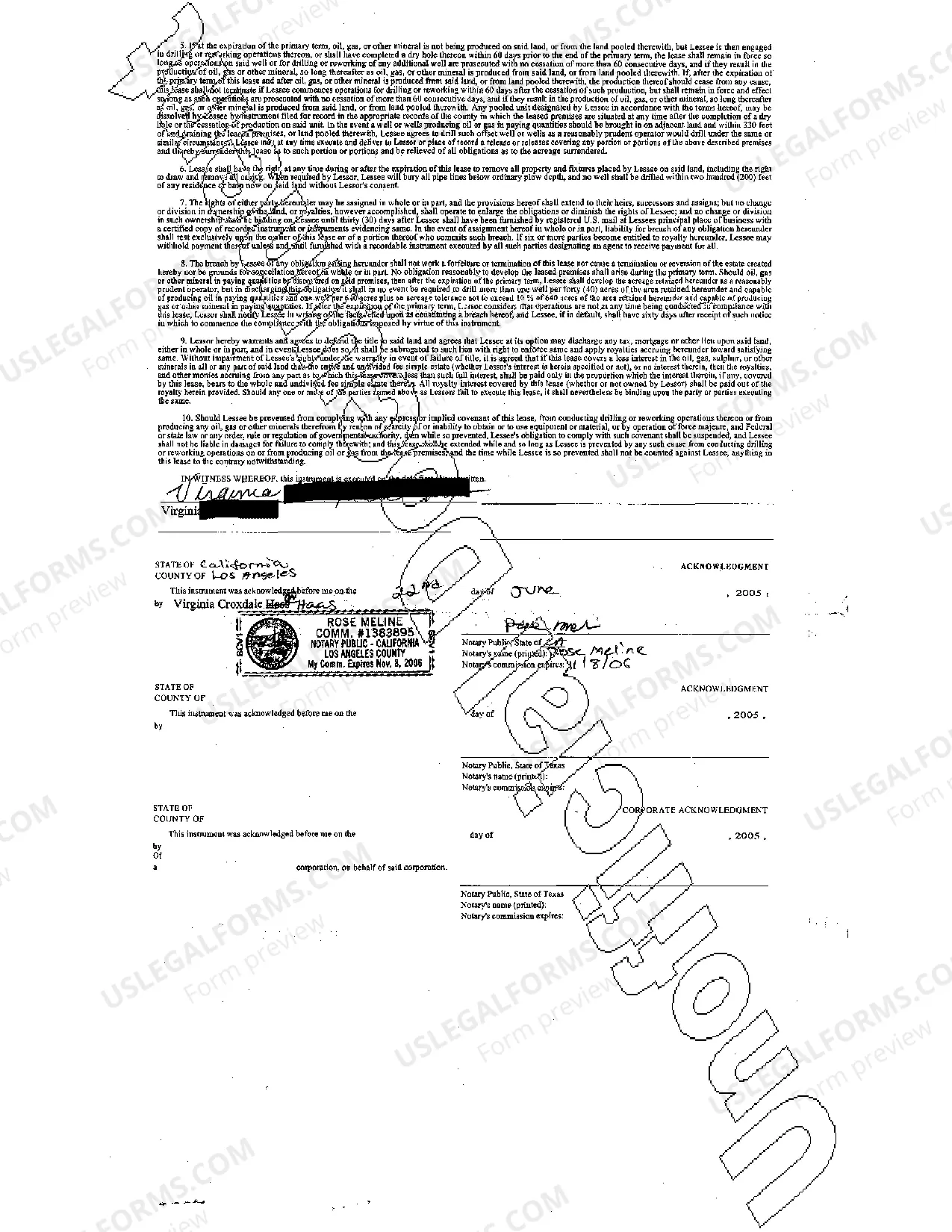

An Oil, Gas and Mineral Lease is an agreement signed by two parties, the Lessor and Lessee. The Lessor agrees to allow the Lessee onto his/her land for the sole reason to search for oil, gas and minerals. USLF amends and updates the forms as is needed in accordance with all state statutes.

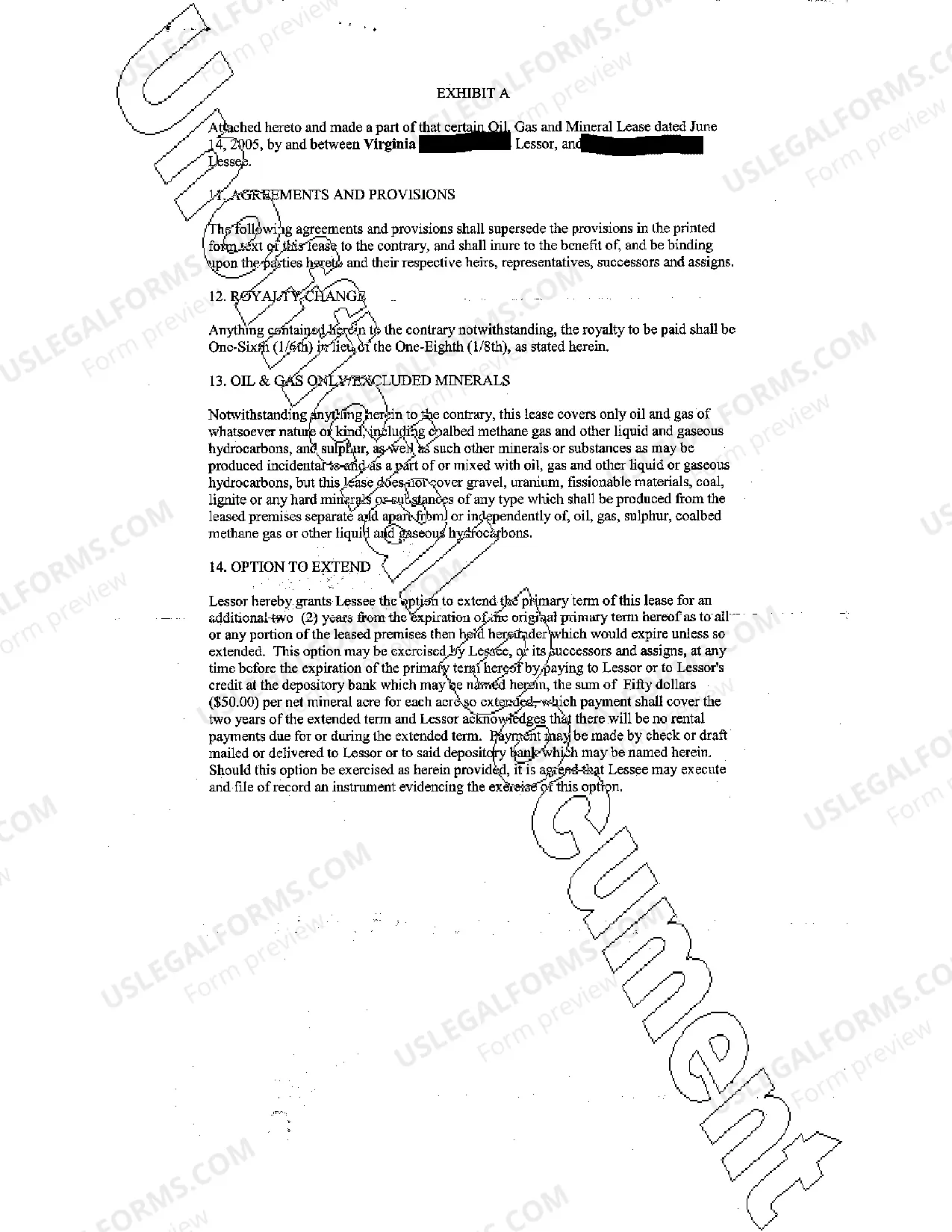

Keywords: Corpus Christi, Texas, oil lease, gas lease, mineral lease, oil and gas exploration, landowner, drilling operations, royalties, lease agreements Corpus Christi Texas Oil, Gas and Mineral Lease refers to a legal and binding agreement entered into by landowners in the Corpus Christi area of Texas, granting exclusive rights to oil, gas, and minerals located below the surface of the leased property. This lease provides opportunities for oil and gas exploration, extraction, and production, while ensuring mutually beneficial relationships between landowners and energy companies. There are various types of Corpus Christi Texas Oil, Gas and Mineral Leases, each with specific characteristics based on their purpose and terms: 1. Standard Lease: This is the most common type of lease, typically granting the lessee the right to explore, lease, and produce oil, gas, and minerals within a specified area. The lease includes provisions related to drilling operations, royalties, and duration. 2. Royalty Lease: It focuses primarily on the payment of royalties to the landowner. In this type of lease, the lessee pays a percentage of production as a royalty, providing the landowner a share of the profits from the extracted resources. 3. Non-Participating Royalty Interest: This lease offers landowners a fixed royalty payment but excludes them from any cost or operation-related decisions or responsibilities. The landowner does not have the right to be involved in future leasing negotiations or operations. 4. Overriding Royalty Interest: This type of lease grants a landowner a set percentage of production revenues, often higher than the royalty specified in the primary lease. It is usually found in situations involving multiple leaseholders or shared interests. 5. Term Lease: A lease with a predetermined time period during which the lessee has the exclusive right to explore and extract oil, gas, and minerals. The terms can range from several months to several years. 6. Commission Lease: This lease type allows the owner of the property to retain a specific percentage of the production proceeds or sell the extracted resources at a set price. The landowner acts as a commission holder, receiving a portion of the revenue generated. 7. Surface Lease: A lease specifically focused on granting access and right of use to the surface of the property, for activities such as constructing roads, drilling equipment set-up, pipeline installation, and other necessary operations. Corpus Christi Texas Oil, Gas, and Mineral Leases play a significant role in facilitating the responsible exploration and utilization of natural resources, ensuring that landowners receive fair compensation for the use of their properties. These diverse lease types cater to specific needs and preferences of both landowners and lessees, fostering mutually beneficial partnerships in the development of the thriving oil and gas industry in Corpus Christi, Texas.Keywords: Corpus Christi, Texas, oil lease, gas lease, mineral lease, oil and gas exploration, landowner, drilling operations, royalties, lease agreements Corpus Christi Texas Oil, Gas and Mineral Lease refers to a legal and binding agreement entered into by landowners in the Corpus Christi area of Texas, granting exclusive rights to oil, gas, and minerals located below the surface of the leased property. This lease provides opportunities for oil and gas exploration, extraction, and production, while ensuring mutually beneficial relationships between landowners and energy companies. There are various types of Corpus Christi Texas Oil, Gas and Mineral Leases, each with specific characteristics based on their purpose and terms: 1. Standard Lease: This is the most common type of lease, typically granting the lessee the right to explore, lease, and produce oil, gas, and minerals within a specified area. The lease includes provisions related to drilling operations, royalties, and duration. 2. Royalty Lease: It focuses primarily on the payment of royalties to the landowner. In this type of lease, the lessee pays a percentage of production as a royalty, providing the landowner a share of the profits from the extracted resources. 3. Non-Participating Royalty Interest: This lease offers landowners a fixed royalty payment but excludes them from any cost or operation-related decisions or responsibilities. The landowner does not have the right to be involved in future leasing negotiations or operations. 4. Overriding Royalty Interest: This type of lease grants a landowner a set percentage of production revenues, often higher than the royalty specified in the primary lease. It is usually found in situations involving multiple leaseholders or shared interests. 5. Term Lease: A lease with a predetermined time period during which the lessee has the exclusive right to explore and extract oil, gas, and minerals. The terms can range from several months to several years. 6. Commission Lease: This lease type allows the owner of the property to retain a specific percentage of the production proceeds or sell the extracted resources at a set price. The landowner acts as a commission holder, receiving a portion of the revenue generated. 7. Surface Lease: A lease specifically focused on granting access and right of use to the surface of the property, for activities such as constructing roads, drilling equipment set-up, pipeline installation, and other necessary operations. Corpus Christi Texas Oil, Gas, and Mineral Leases play a significant role in facilitating the responsible exploration and utilization of natural resources, ensuring that landowners receive fair compensation for the use of their properties. These diverse lease types cater to specific needs and preferences of both landowners and lessees, fostering mutually beneficial partnerships in the development of the thriving oil and gas industry in Corpus Christi, Texas.