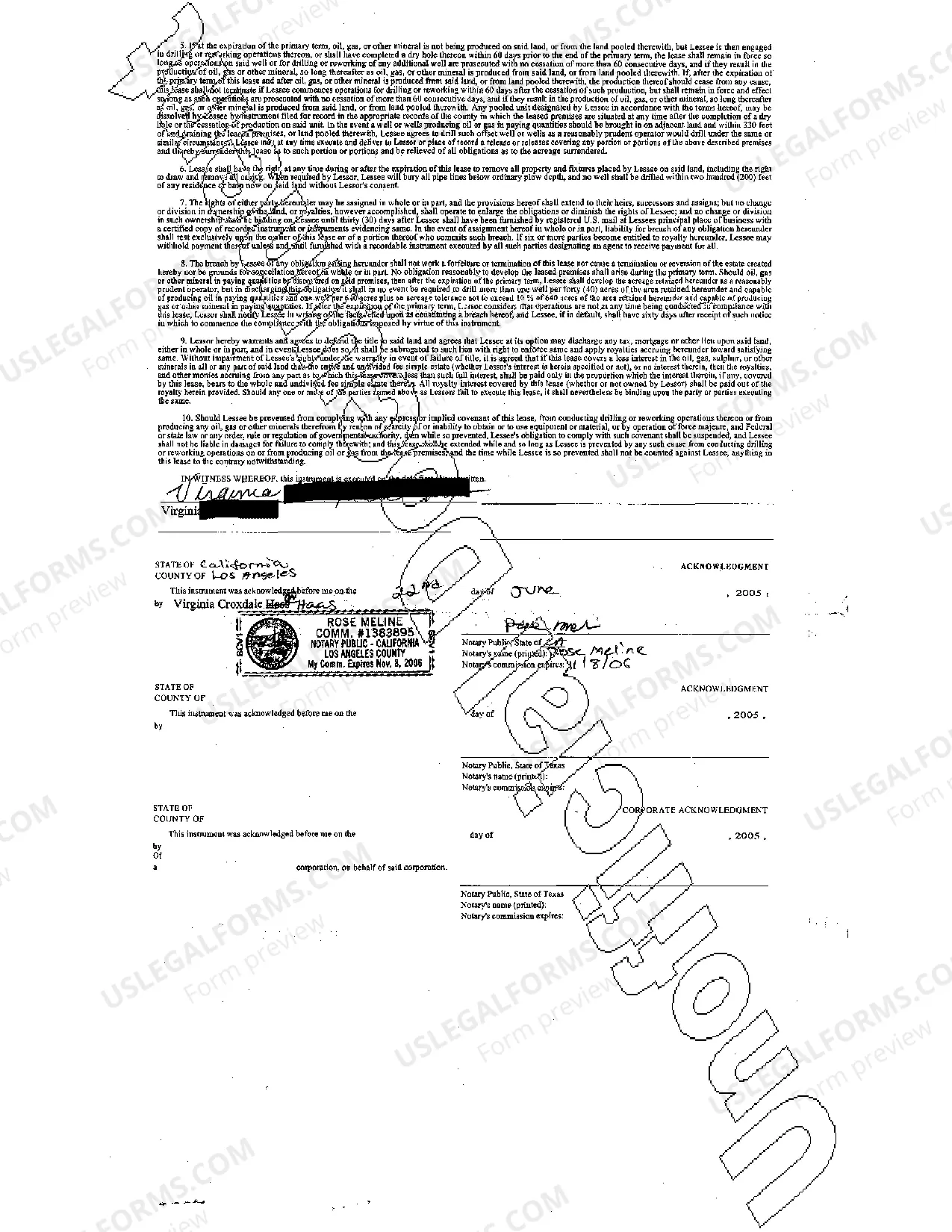

An Oil, Gas and Mineral Lease is an agreement signed by two parties, the Lessor and Lessee. The Lessor agrees to allow the Lessee onto his/her land for the sole reason to search for oil, gas and minerals. USLF amends and updates the forms as is needed in accordance with all state statutes.

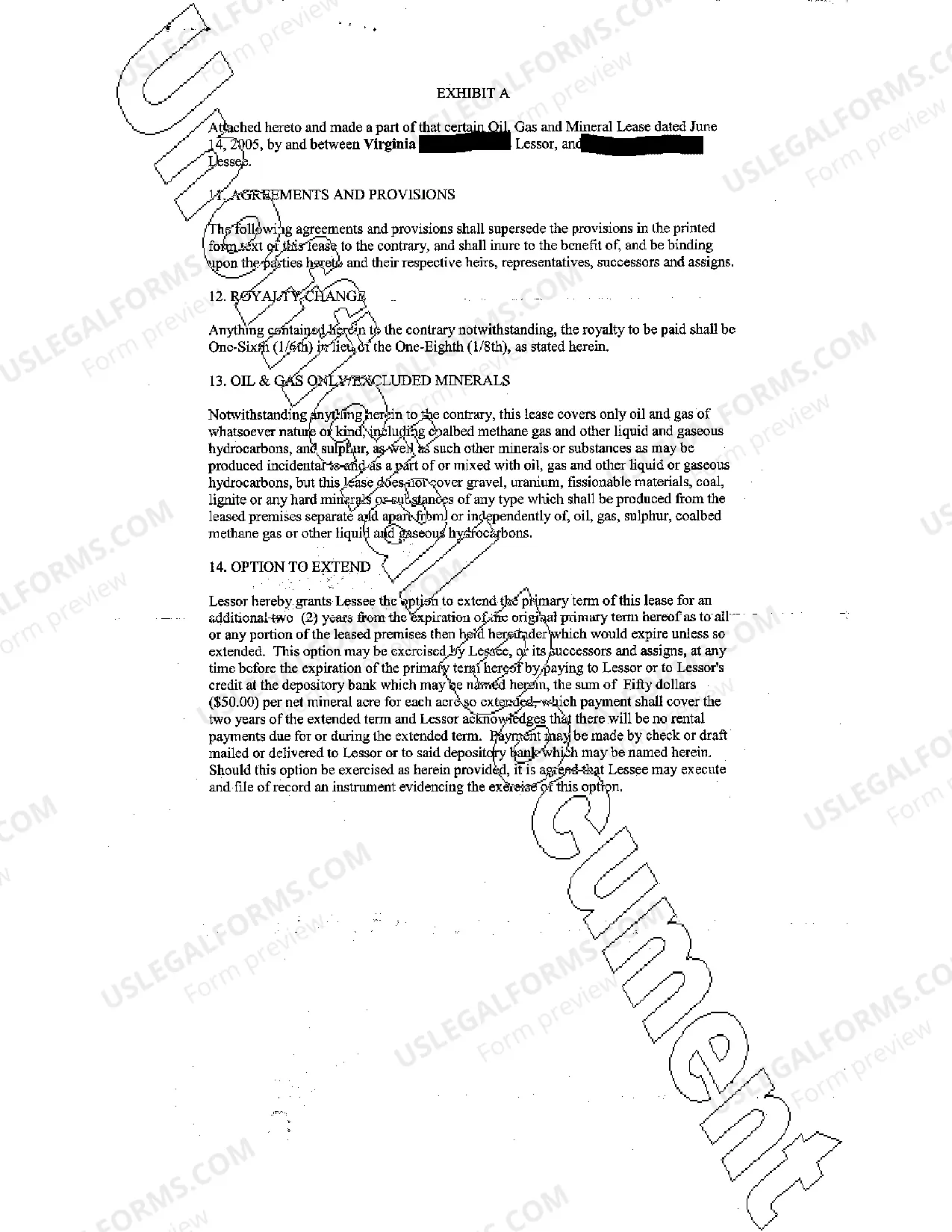

Grand Prairie Texas Oil, Gas, and Mineral Lease is a legally binding agreement between a landowner in Grand Prairie, Texas and a company for the exploration and extraction of oil, gas, and mineral resources on the landowner's property. This lease grants the company the right to explore, drill, and develop the resources beneath the surface of the land, while providing the landowner with financial compensation in the form of royalties or lease bonus payments. Keywords: Grand Prairie, Texas, oil, gas, mineral lease, exploration, extraction, landowner, property, resources, royalties, bonus payments. There are different types of Grand Prairie Texas Oil, Gas, and Mineral Leases that cater to the specific needs and preferences of the parties involved. These variations include: 1. Standard Lease: This is the most common type of lease, where the landowner grants a company the right to explore and extract oil, gas, and minerals for a specified period. Royalties are typically paid to the landowner based on a percentage of the production. 2. Royalty Lease: In this type of lease, the landowner receives a fixed percentage of the value of the extracted oil, gas, or minerals as their compensation for granting access to their land. The lessee carries all the costs and responsibilities, including exploration, extraction, and marketing. 3. Overriding Royalty Interest Lease: Here, the landowner grants a portion of their royalty interest to a third party, usually a professional investor or a land broker. This type of lease allows the landowner to gain additional income upfront by selling a percentage of their future royalty earnings. 4. Working Interest Lease: In this arrangement, the landowner becomes a direct partner in the oil or gas venture. They bear a proportionate share of the costs, risks, and expenses associated with the exploration and extraction but also enjoy a share of the profits. 5. Non-Participating Royalty Lease: This lease grants the landowner a royalty interest but excludes them from any decision-making or operational involvement. The landowner receives a share of the production revenues without being responsible for any costs or risks associated with the project. Regardless of the type of Grand Prairie Texas Oil, Gas, and Mineral Lease, it is vital for both parties to clearly understand the terms, obligations, and rights outlined in the lease agreement. Seeking legal advice and conducting thorough negotiations ensures a fair and mutually beneficial lease arrangement.Grand Prairie Texas Oil, Gas, and Mineral Lease is a legally binding agreement between a landowner in Grand Prairie, Texas and a company for the exploration and extraction of oil, gas, and mineral resources on the landowner's property. This lease grants the company the right to explore, drill, and develop the resources beneath the surface of the land, while providing the landowner with financial compensation in the form of royalties or lease bonus payments. Keywords: Grand Prairie, Texas, oil, gas, mineral lease, exploration, extraction, landowner, property, resources, royalties, bonus payments. There are different types of Grand Prairie Texas Oil, Gas, and Mineral Leases that cater to the specific needs and preferences of the parties involved. These variations include: 1. Standard Lease: This is the most common type of lease, where the landowner grants a company the right to explore and extract oil, gas, and minerals for a specified period. Royalties are typically paid to the landowner based on a percentage of the production. 2. Royalty Lease: In this type of lease, the landowner receives a fixed percentage of the value of the extracted oil, gas, or minerals as their compensation for granting access to their land. The lessee carries all the costs and responsibilities, including exploration, extraction, and marketing. 3. Overriding Royalty Interest Lease: Here, the landowner grants a portion of their royalty interest to a third party, usually a professional investor or a land broker. This type of lease allows the landowner to gain additional income upfront by selling a percentage of their future royalty earnings. 4. Working Interest Lease: In this arrangement, the landowner becomes a direct partner in the oil or gas venture. They bear a proportionate share of the costs, risks, and expenses associated with the exploration and extraction but also enjoy a share of the profits. 5. Non-Participating Royalty Lease: This lease grants the landowner a royalty interest but excludes them from any decision-making or operational involvement. The landowner receives a share of the production revenues without being responsible for any costs or risks associated with the project. Regardless of the type of Grand Prairie Texas Oil, Gas, and Mineral Lease, it is vital for both parties to clearly understand the terms, obligations, and rights outlined in the lease agreement. Seeking legal advice and conducting thorough negotiations ensures a fair and mutually beneficial lease arrangement.