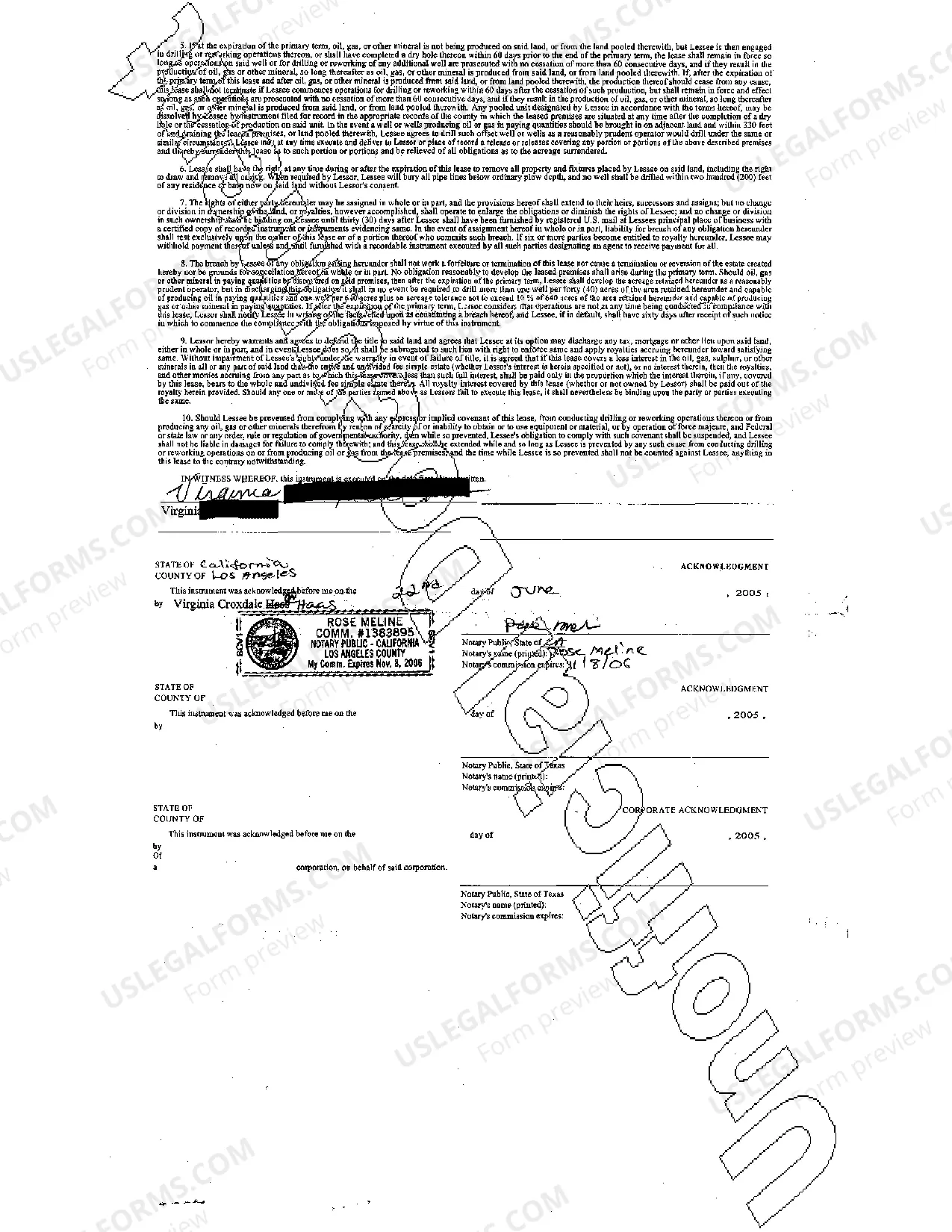

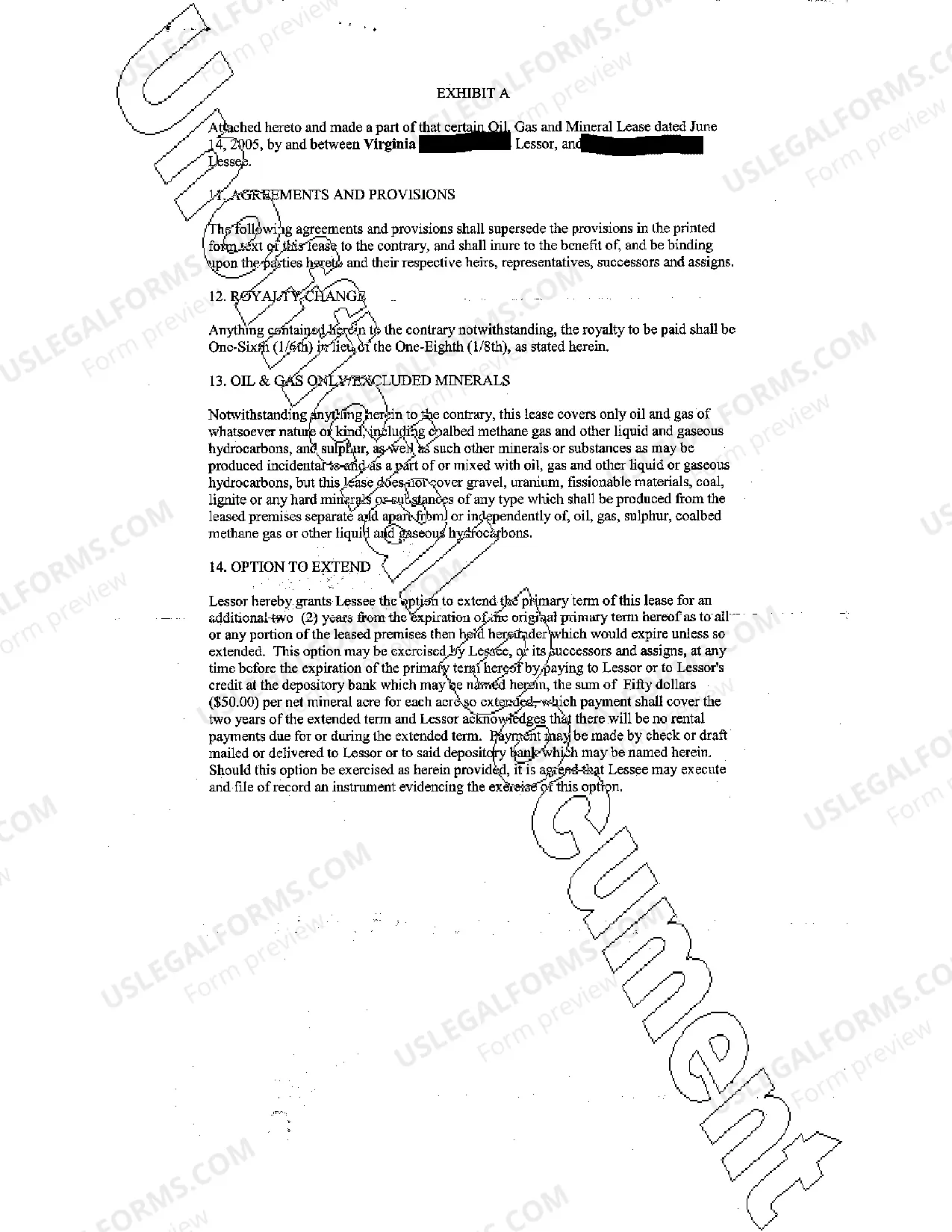

An Oil, Gas and Mineral Lease is an agreement signed by two parties, the Lessor and Lessee. The Lessor agrees to allow the Lessee onto his/her land for the sole reason to search for oil, gas and minerals. USLF amends and updates the forms as is needed in accordance with all state statutes.

A Houston Texas Oil, Gas and Mineral Lease is a legal agreement between the owner of an oil, gas, or mineral property (known as the lessor) and a company or individual (known as the lessee) that grants the lessee the right to explore, develop, and extract oil, gas, or minerals from the lessor's property. This lease is specific to the Houston, Texas area and follows the regulations and guidelines set forth by the state and local authorities. The primary purpose of a Houston Texas Oil, Gas and Mineral Lease is to outline the terms and conditions under which the lessee can explore and extract natural resources from the lessor's property. This includes details such as the duration of the lease, the specific area covered by the lease, and the obligations of both parties during the lease term. There can be different types of Houston Texas Oil, Gas and Mineral Leases, depending on the specific terms agreed upon by the lessor and lessee. Some common types include: 1. Exploration Lease: This type of lease grants the lessee the right to explore the lessor's property for oil, gas, or minerals. It typically includes a specified initial term during which the lessee conducts various exploration activities to determine the presence and viability of natural resources on the property. 2. Production Lease: Once the lessee determines that there are viable oil, gas, or mineral deposits on the property, a production lease may be negotiated. In this type of lease, the lessee has the right to extract and produce the natural resources for commercial purposes. The lease often includes provisions for royalty payments to the lessor based on the volume or value of the resources extracted. 3. Royalty Lease: A royalty lease is where the lessor receives a percentage of the production revenues or a fixed amount per unit of resources extracted, rather than being involved in the exploration or production activities itself. This type of lease is common when the lessor does not have the technical expertise or resources to engage directly in oil, gas, or mineral extraction. 4. Overriding Royalty Interest Lease: In this type of lease, the lessor retains a certain percentage of royalty interest even if they have sold or transferred the property. The lessor is entitled to a share of the production revenues over and above any royalties paid to the current property owner. It is important to note that the specific terms and conditions of each Houston Texas Oil, Gas and Mineral Lease can vary depending on factors such as the size and value of the property, market conditions, industry standards, and negotiations between the lessor and lessee. It is recommended for both parties to seek legal advice to ensure a comprehensive and fair lease agreement.A Houston Texas Oil, Gas and Mineral Lease is a legal agreement between the owner of an oil, gas, or mineral property (known as the lessor) and a company or individual (known as the lessee) that grants the lessee the right to explore, develop, and extract oil, gas, or minerals from the lessor's property. This lease is specific to the Houston, Texas area and follows the regulations and guidelines set forth by the state and local authorities. The primary purpose of a Houston Texas Oil, Gas and Mineral Lease is to outline the terms and conditions under which the lessee can explore and extract natural resources from the lessor's property. This includes details such as the duration of the lease, the specific area covered by the lease, and the obligations of both parties during the lease term. There can be different types of Houston Texas Oil, Gas and Mineral Leases, depending on the specific terms agreed upon by the lessor and lessee. Some common types include: 1. Exploration Lease: This type of lease grants the lessee the right to explore the lessor's property for oil, gas, or minerals. It typically includes a specified initial term during which the lessee conducts various exploration activities to determine the presence and viability of natural resources on the property. 2. Production Lease: Once the lessee determines that there are viable oil, gas, or mineral deposits on the property, a production lease may be negotiated. In this type of lease, the lessee has the right to extract and produce the natural resources for commercial purposes. The lease often includes provisions for royalty payments to the lessor based on the volume or value of the resources extracted. 3. Royalty Lease: A royalty lease is where the lessor receives a percentage of the production revenues or a fixed amount per unit of resources extracted, rather than being involved in the exploration or production activities itself. This type of lease is common when the lessor does not have the technical expertise or resources to engage directly in oil, gas, or mineral extraction. 4. Overriding Royalty Interest Lease: In this type of lease, the lessor retains a certain percentage of royalty interest even if they have sold or transferred the property. The lessor is entitled to a share of the production revenues over and above any royalties paid to the current property owner. It is important to note that the specific terms and conditions of each Houston Texas Oil, Gas and Mineral Lease can vary depending on factors such as the size and value of the property, market conditions, industry standards, and negotiations between the lessor and lessee. It is recommended for both parties to seek legal advice to ensure a comprehensive and fair lease agreement.