An Oil, Gas and Mineral Lease is an agreement signed by two parties, the Lessor and Lessee. The Lessor agrees to allow the Lessee onto his/her land for the sole reason to search for oil, gas and minerals. USLF amends and updates the forms as is needed in accordance with all state statutes.

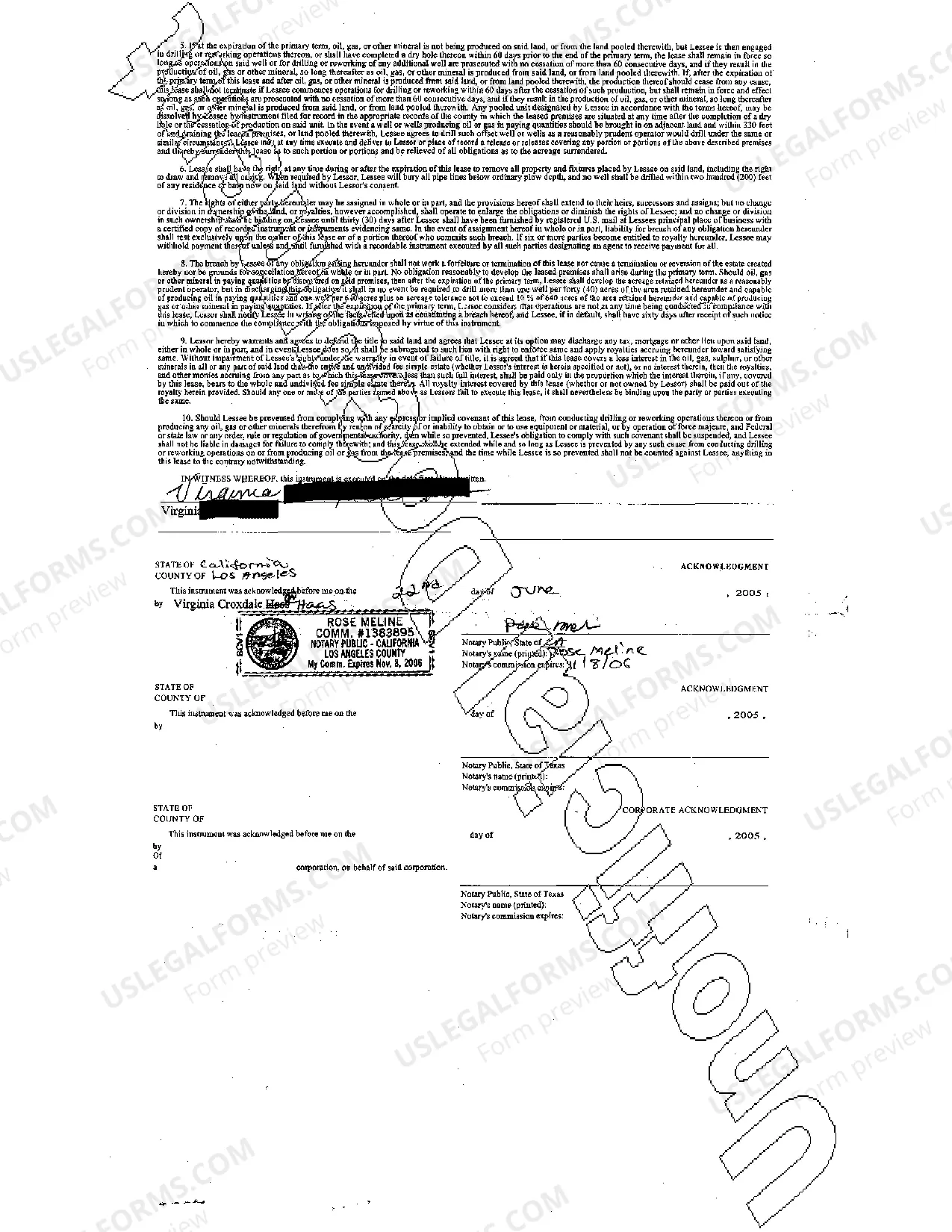

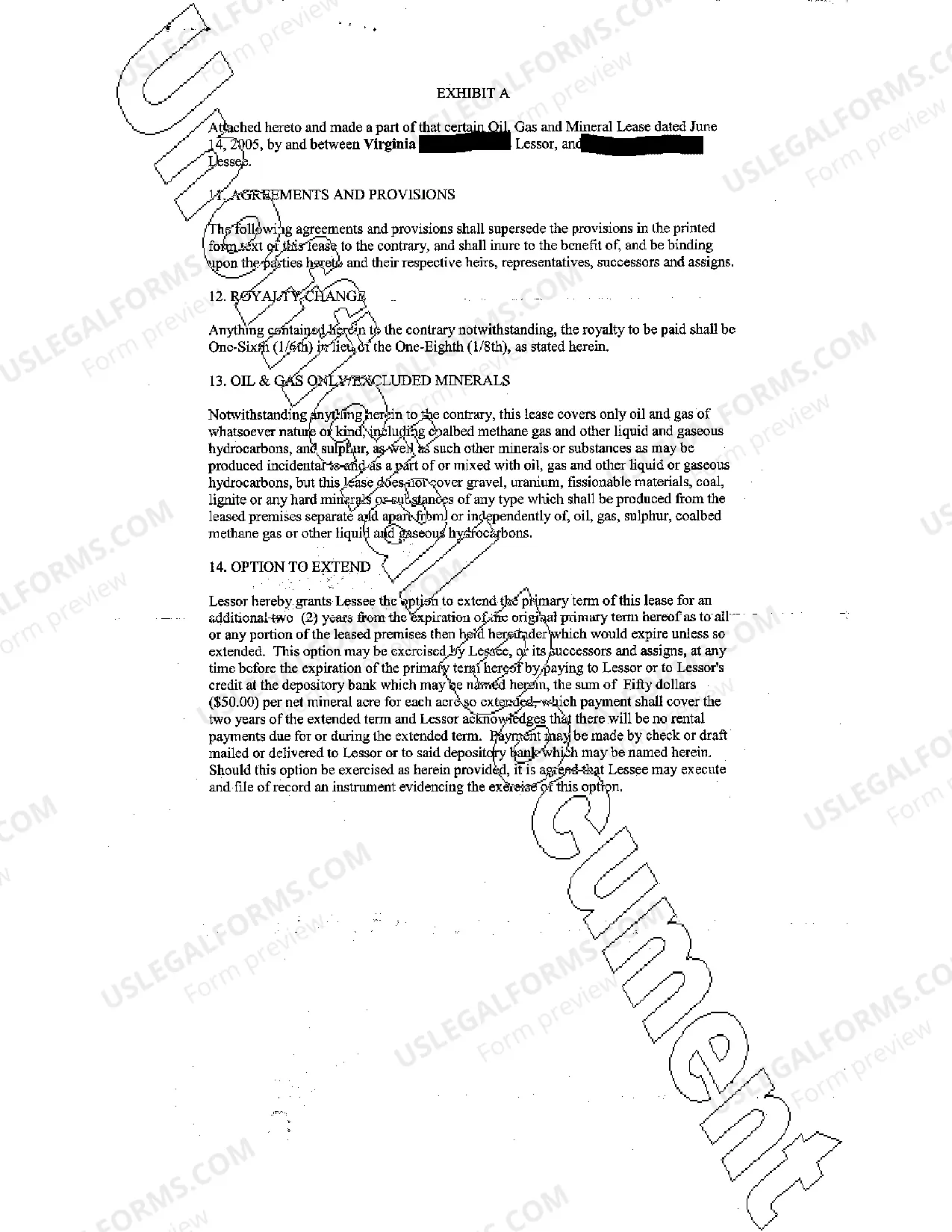

Irving Texas Oil, Gas and Mineral Lease is a legal agreement granting individuals or entities the rights to extract and profit from oil, gas, and minerals located within designated properties in Irving, Texas. This lease plays a crucial role in facilitating the exploration and production of valuable resources within the region. Here are some relevant details and types of Irving Texas Oil, Gas and Mineral Lease: 1. Purpose: The Irving Texas Oil, Gas and Mineral Lease aims to establish a contractual relationship between the property owner (lessor) and the oil, gas, and mineral company (lessee). It outlines the terms and conditions for exploration, development, extraction, and production activities on the leased land. 2. Land Identification: The lease agreement provides a detailed description of the properties involved, including acreage, coordinates, legal descriptions, and any specific restrictions or boundaries. 3. Primary Terms: The lease specifies the duration of the agreement, commonly known as the primary term. This initial period allows the lessee to evaluate the property's potential and commence drilling operations. 4. Bonus Consideration: The lease agreement often includes a bonus payment, also known as a signing bonus. This upfront payment serves as compensation to the lessor for granting access to their property. 5. Royalty Rates: In exchange for giving the lessee access to their land, the lessor is entitled to a share of the revenue generated from the oil, gas, and mineral production. The lease outlines the agreed-upon royalty percentage or fixed rate to be paid to the lessor. 6. Leased Interests: Different types of Irving Texas Oil, Gas, and Mineral Lease exist based on the portion of rights being granted to the lessee. These include: — Full Mineral Lease: Grants the lessee exclusive rights to extract oil, gas, and minerals from the entire leased property. — Partial Lease: Allows the lessee to explore and produce specific minerals or target specific reservoirs identified in the lease agreement. — Non-Participating Royalty InterestNPRRI): The lessor retains a percentage of the revenue generated, but without the ability to make decisions or undertake operations. This type of lease often applies when a landowner wishes to retain a financial interest without directly participating in exploration or production activities. 7. Obligations and Operations: The lease stipulates the lessee's responsibilities, including drilling obligations, maintenance of equipment and infrastructure, environmental protection measures, and adherence to all applicable laws and regulations. 8. Termination and Extension: The lease agreement defines the circumstances under which the contract can be terminated, such as non-compliance with terms, completion of primary term, or expiration of secondary term. It may also outline conditions for potential lease extensions or renewal options. 9. Jurisdiction and Legal Framework: The Irving Texas Oil, Gas, and Mineral Lease adhere to state and federal laws governing mining operations, environmental standards, safety regulations, and dispute resolution procedures. In conclusion, an Irving Texas Oil, Gas, and Mineral Lease is a legally binding contract that grants rights to explore, develop, and extract valuable resources within designated properties in Irving, Texas. It encompasses various types of leases, such as full mineral leases, partial leases, and non-participating royalty interests. The agreement covers terms related to property identification, primary terms, bonus consideration, royalty rates, obligations, termination, and legal frameworks, ensuring a fair and mutually beneficial relationship between lessors and lessees.Irving Texas Oil, Gas and Mineral Lease is a legal agreement granting individuals or entities the rights to extract and profit from oil, gas, and minerals located within designated properties in Irving, Texas. This lease plays a crucial role in facilitating the exploration and production of valuable resources within the region. Here are some relevant details and types of Irving Texas Oil, Gas and Mineral Lease: 1. Purpose: The Irving Texas Oil, Gas and Mineral Lease aims to establish a contractual relationship between the property owner (lessor) and the oil, gas, and mineral company (lessee). It outlines the terms and conditions for exploration, development, extraction, and production activities on the leased land. 2. Land Identification: The lease agreement provides a detailed description of the properties involved, including acreage, coordinates, legal descriptions, and any specific restrictions or boundaries. 3. Primary Terms: The lease specifies the duration of the agreement, commonly known as the primary term. This initial period allows the lessee to evaluate the property's potential and commence drilling operations. 4. Bonus Consideration: The lease agreement often includes a bonus payment, also known as a signing bonus. This upfront payment serves as compensation to the lessor for granting access to their property. 5. Royalty Rates: In exchange for giving the lessee access to their land, the lessor is entitled to a share of the revenue generated from the oil, gas, and mineral production. The lease outlines the agreed-upon royalty percentage or fixed rate to be paid to the lessor. 6. Leased Interests: Different types of Irving Texas Oil, Gas, and Mineral Lease exist based on the portion of rights being granted to the lessee. These include: — Full Mineral Lease: Grants the lessee exclusive rights to extract oil, gas, and minerals from the entire leased property. — Partial Lease: Allows the lessee to explore and produce specific minerals or target specific reservoirs identified in the lease agreement. — Non-Participating Royalty InterestNPRRI): The lessor retains a percentage of the revenue generated, but without the ability to make decisions or undertake operations. This type of lease often applies when a landowner wishes to retain a financial interest without directly participating in exploration or production activities. 7. Obligations and Operations: The lease stipulates the lessee's responsibilities, including drilling obligations, maintenance of equipment and infrastructure, environmental protection measures, and adherence to all applicable laws and regulations. 8. Termination and Extension: The lease agreement defines the circumstances under which the contract can be terminated, such as non-compliance with terms, completion of primary term, or expiration of secondary term. It may also outline conditions for potential lease extensions or renewal options. 9. Jurisdiction and Legal Framework: The Irving Texas Oil, Gas, and Mineral Lease adhere to state and federal laws governing mining operations, environmental standards, safety regulations, and dispute resolution procedures. In conclusion, an Irving Texas Oil, Gas, and Mineral Lease is a legally binding contract that grants rights to explore, develop, and extract valuable resources within designated properties in Irving, Texas. It encompasses various types of leases, such as full mineral leases, partial leases, and non-participating royalty interests. The agreement covers terms related to property identification, primary terms, bonus consideration, royalty rates, obligations, termination, and legal frameworks, ensuring a fair and mutually beneficial relationship between lessors and lessees.