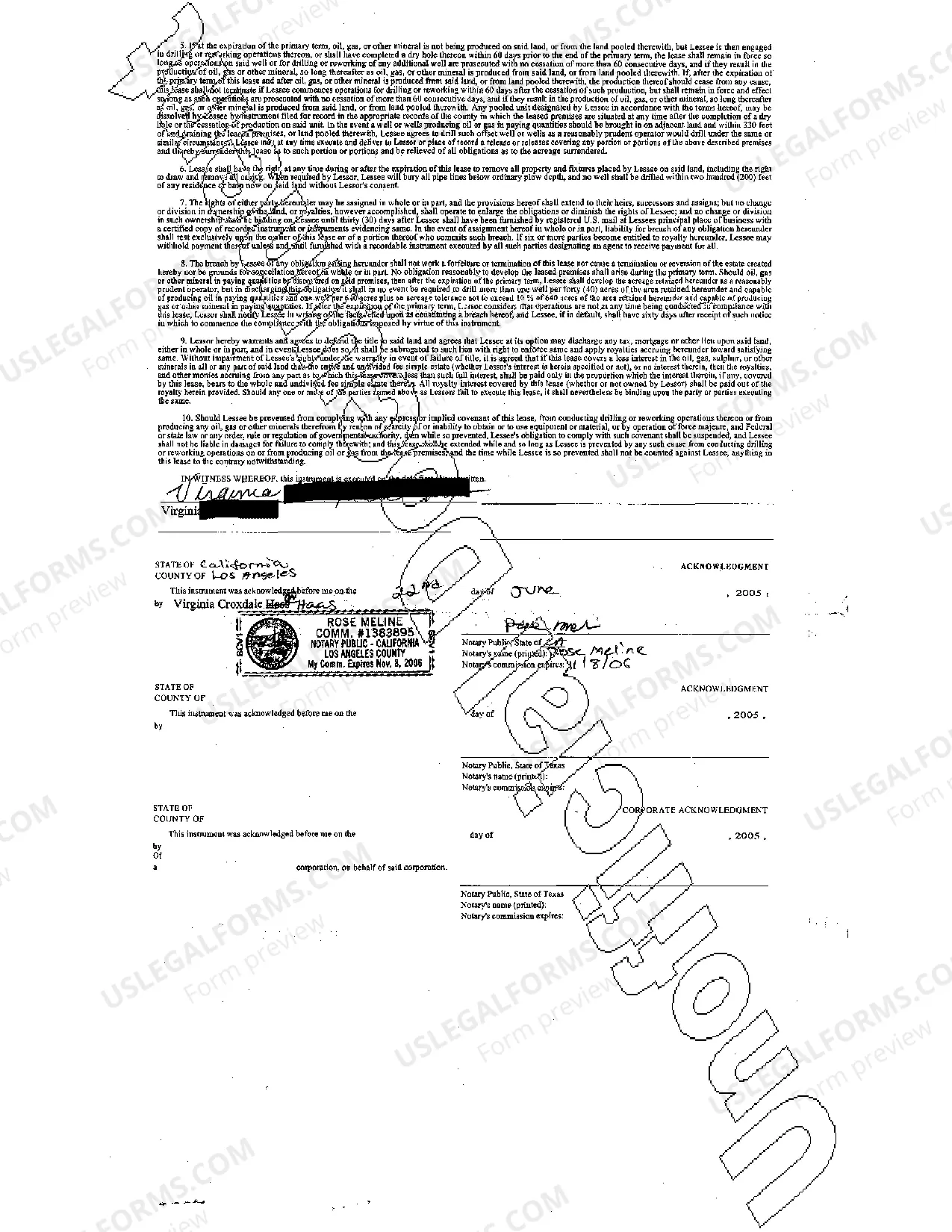

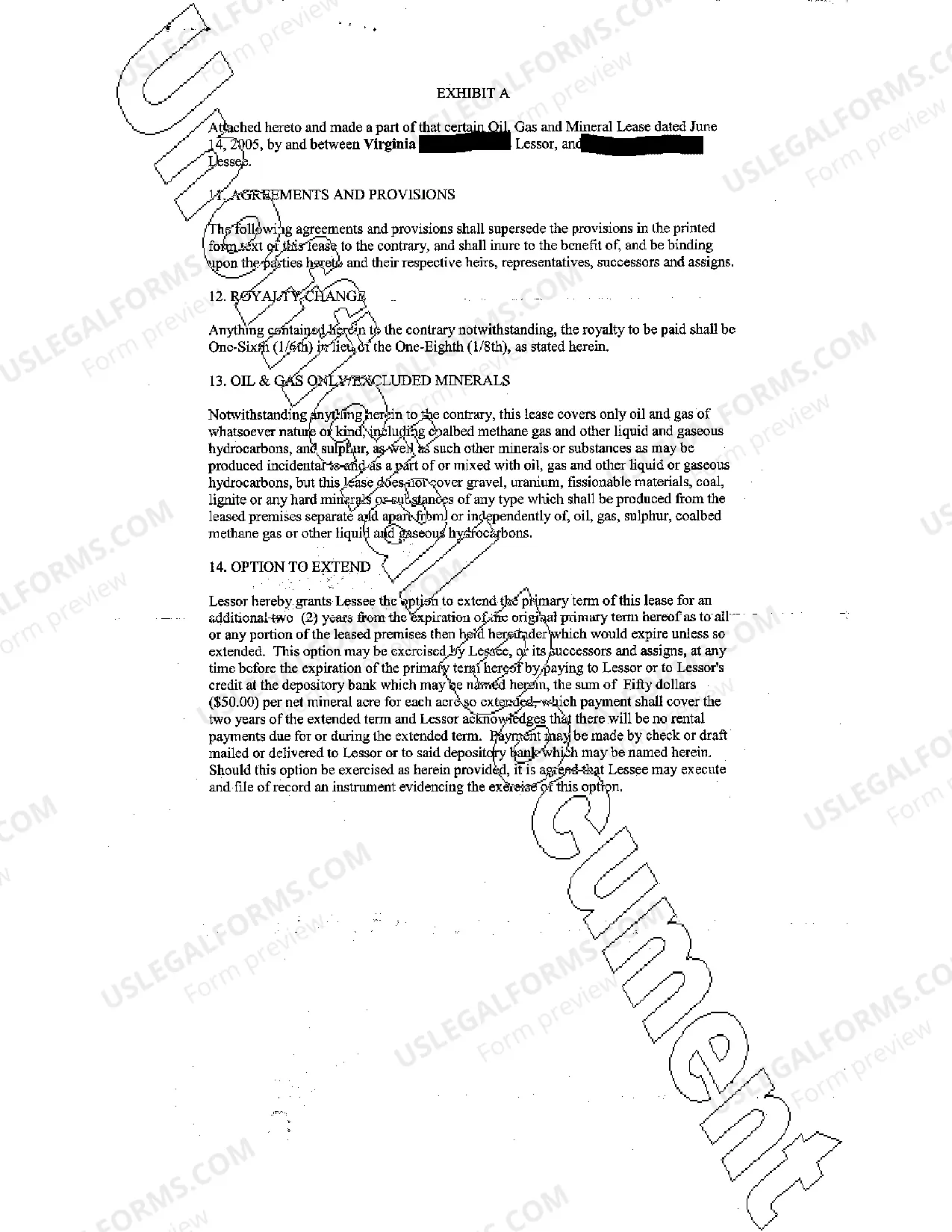

An Oil, Gas and Mineral Lease is an agreement signed by two parties, the Lessor and Lessee. The Lessor agrees to allow the Lessee onto his/her land for the sole reason to search for oil, gas and minerals. USLF amends and updates the forms as is needed in accordance with all state statutes.

Plano, Texas is booming with opportunities in the oil, gas, and mineral industries. The Plano Texas Oil, Gas, and Mineral Lease provides individuals and companies with access to valuable resources beneath the surface of their land. This detailed description aims to provide an overview of the lease, its types, and its significance in Plano, Texas. Keywords: Plano Texas, oil, gas, mineral lease, types, benefits, regulations, exploration, extraction, royalties, drilling, leasing company. The Plano Texas Oil, Gas, and Mineral Lease is a legal agreement between a property owner (lessor) and an oil and gas company (lessee). It permits the lessee to explore, extract, and produce oil, gas, and minerals from the lessor's land. These leases are integral to Plano's energy sector and contribute to job creation, economic growth, and resource development. There are several types of Plano Texas Oil, Gas, and Mineral Leases available: 1. Exploration Lease: — An initial step where lessees have the right to explore the leased area for potential oil, gas, and mineral deposits. — The lessee typically conducts surveys, tests, and seismic studies to assess the resource potential. 2. Production Lease: — Granted after the successful exploration phase, allowing the lessee to extract and produce oil, gas, or minerals from the leased property. — It involves drilling wells and implementing extraction methods to access the resources. 3. Royalty Lease: — In this type, the lessor receives a percentage of the revenue generated from the production of oil, gas, or minerals. — The lessor is entitled to a fixed portion (royalty) based on the production and actual market prices. 4. Non-Participating Royalty Interest (NPR) Lease: — Similar to a royalty lease, but the lessor doesn't have the right to participate directly in operations or decisions related to extraction. — The lessor only receives a predetermined share of the financial benefits. The Plano Texas Oil, Gas, and Mineral Lease offer numerous benefits for property owners and the local community. Apart from potential financial gains, landowners contribute to the development of domestic energy resources, reducing dependence on foreign oil and gas. The lease also facilitates job creation, supports related industries like transportation and construction, and generates tax revenue for the city. However, it is important to note that the Plano Texas Oil, Gas, and Mineral Lease must adhere to certain regulations and compliance standards. These regulations ensure environmental protection, safety protocols, and fair compensation for lessors. The lease agreement typically includes provisions governing operations, surface use restrictions, reclamation obligations, and dispute resolution mechanisms. In conclusion, the Plano Texas Oil, Gas, and Mineral Lease is a vital component of the energy sector in Plano, Texas. It allows for the exploration, extraction, and production of valuable resources while benefiting property owners, local economy, and national energy security. Multiple lease types cater to different stages and interests, ensuring a fair and regulated partnership between lessors and lessees.