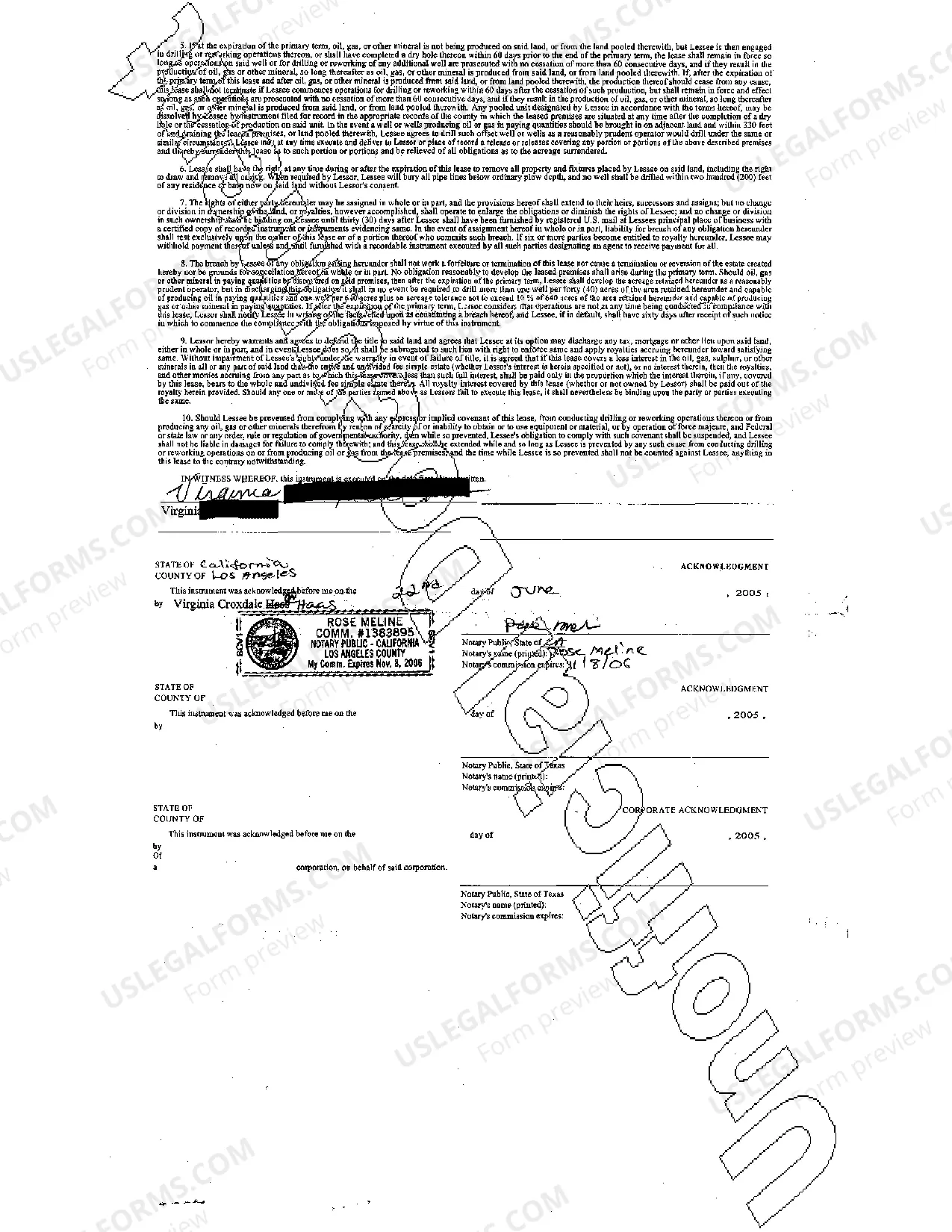

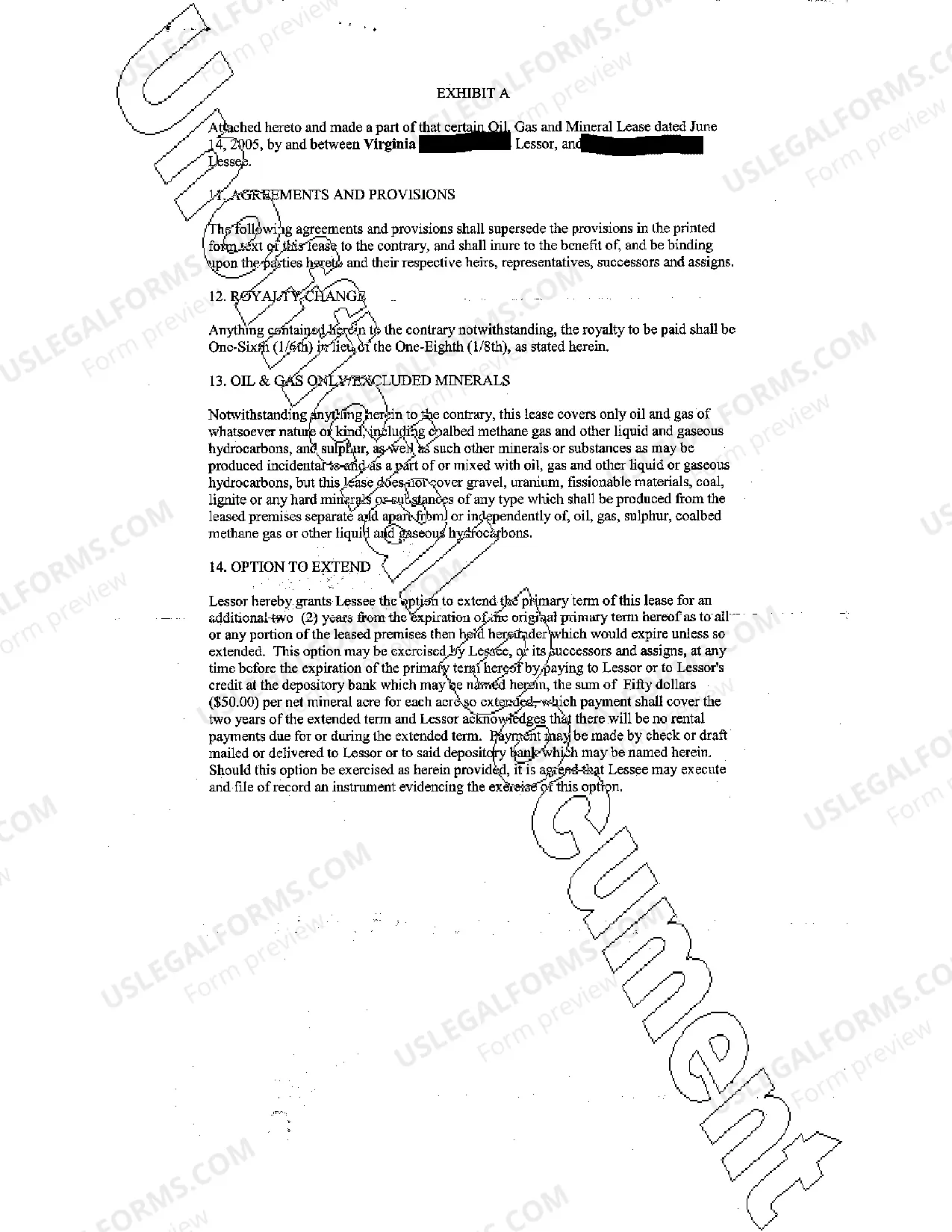

An Oil, Gas and Mineral Lease is an agreement signed by two parties, the Lessor and Lessee. The Lessor agrees to allow the Lessee onto his/her land for the sole reason to search for oil, gas and minerals. USLF amends and updates the forms as is needed in accordance with all state statutes.

Sugar Land Texas Oil, Gas and Mineral Lease

Description

How to fill out Texas Oil, Gas And Mineral Lease?

If you are searching for a legitimate document, it's challenging to find a more user-friendly service than the US Legal Forms website – likely the most comprehensive collections available online.

With this collection, you can acquire a vast array of templates for both commercial and personal uses categorized by types and regions, or keywords.

With the superior search functionality, obtaining the latest Sugar Land Texas Oil, Gas and Mineral Lease is as straightforward as 1-2-3.

Complete the payment transaction. Use your credit card or PayPal account to finalize the registration process.

Acquire the document. Specify the file format and store it on your device.

- Moreover, the accuracy of each document is confirmed by a team of professional attorneys who consistently review the forms on our site and update them in accordance with the most recent state and county laws.

- If you are already acquainted with our platform and possess an account, all you need to do to acquire the Sugar Land Texas Oil, Gas and Mineral Lease is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, just follow the instructions outlined below.

- Ensure you have located the document you require. Review its description and utilize the Preview feature to examine its content. If it does not meet your requirements, utilize the Search box at the top of the page to find the desired document.

- Verify your choice. Hit the Buy now button. Then, choose your desired subscription plan and enter your details to register an account.

Form popularity

FAQ

The value of an acre of mineral rights in Texas can vary significantly based on location, resources, and market conditions. For instance, areas near active drilling operations may command higher prices. To get an accurate valuation of Sugar Land Texas Oil, Gas and Mineral Leases, it's advisable to seek expert appraisal services or consult with industry professionals.

Yes, you can buy land that includes mineral rights in Texas. When purchasing such land, it is crucial to confirm that the mineral rights are bundled with the property. Understanding the details around Sugar Land Texas Oil, Gas and Mineral Leases can enhance your investment choices and inform you about potential future returns.

Finding oil and gas leases in Texas can involve several steps, including consulting land records and exploring regional listings. You can access government databases or consult networks of landmen and brokers who specialize in Sugar Land Texas Oil, Gas and Mineral Leases. Additionally, consider using online platforms like uslegalforms to help navigate through legal requirements and lease agreements.

To obtain an oil and gas lease, start by researching the specific terms and conditions required in Texas. You may need to negotiate directly with the mineral rights owner or through a landman, who can facilitate the process. It’s also beneficial to work with professionals familiar with Sugar Land Texas Oil, Gas and Mineral Leases to ensure that you secure favorable terms.

Yes, you can own mineral rights in Texas. Owning mineral rights gives you the ability to extract natural resources like oil and gas from your property. It's important to understand that these rights can be separated from the surface rights, meaning someone can own the land but not the minerals beneath it. If you're interested in the Sugar Land Texas Oil, Gas and Mineral Lease, be sure to research the implications of owning these rights.

Mineral lease income should be reported on IRS Schedule E, just like rental income. If you receive payments from a Sugar Land Texas oil, gas, and mineral lease, including this income on your tax return is imperative. Accurate reporting ensures compliance with tax regulations and provides a clear financial picture.

Passive rental income is reported on IRS Schedule E as well. If your Sugar Land Texas oil, gas, and mineral lease represents an investment, any income derived should be included on this schedule. Be diligent about recording all income and expenses to provide a comprehensive overview of your investments.

For reporting your lease for oil and gas income, you can use IRS Schedule E, which is dedicated to reporting income or loss from rental property and royalties. If your Sugar Land Texas oil, gas, and mineral lease yields income, it's essential to complete this schedule accurately. Proper documentation and reporting make your tax obligations clearer.

To report oil and gas lease income, you should use IRS Schedule E, where you list your income from the Sugar Land Texas oil, gas, and mineral lease. Ensure that you indicate any associated costs and deductions correctly to display your net income. This thorough reporting helps in managing your tax liabilities effectively.

The taxation of oil and gas leases depends on the income generated from the lease. In general, revenue from a Sugar Land Texas oil, gas, and mineral lease qualifies as taxable income. You may also be able to deduct certain expenses related to the lease, which can help lower your overall tax burden.