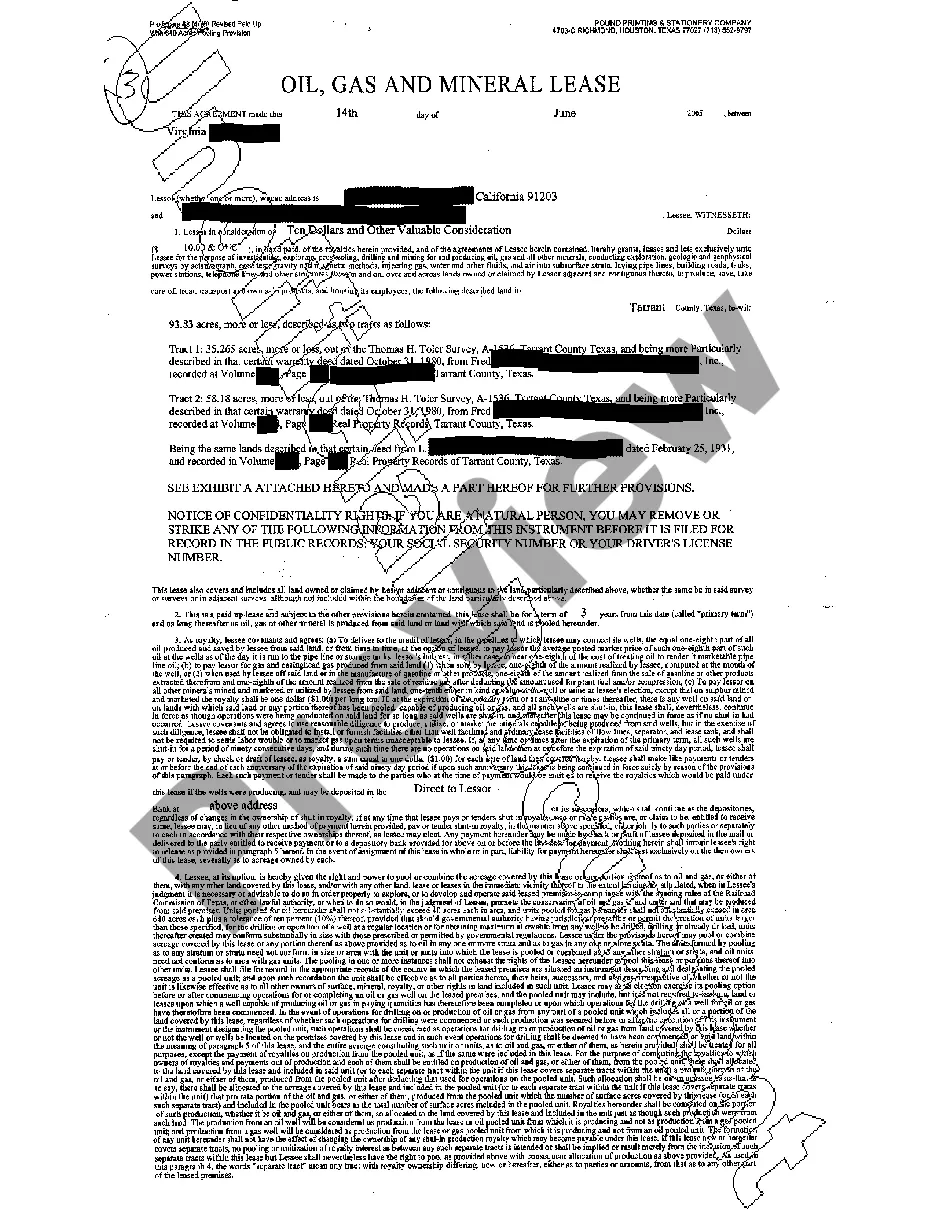

An Oil, Gas and Mineral Lease is an agreement signed by two parties, the Lessor and Lessee. The Lessor agrees to allow the Lessee onto his/her land for the sole reason to search for oil, gas and minerals. USLF amends and updates the forms as is needed in accordance with all state statutes.

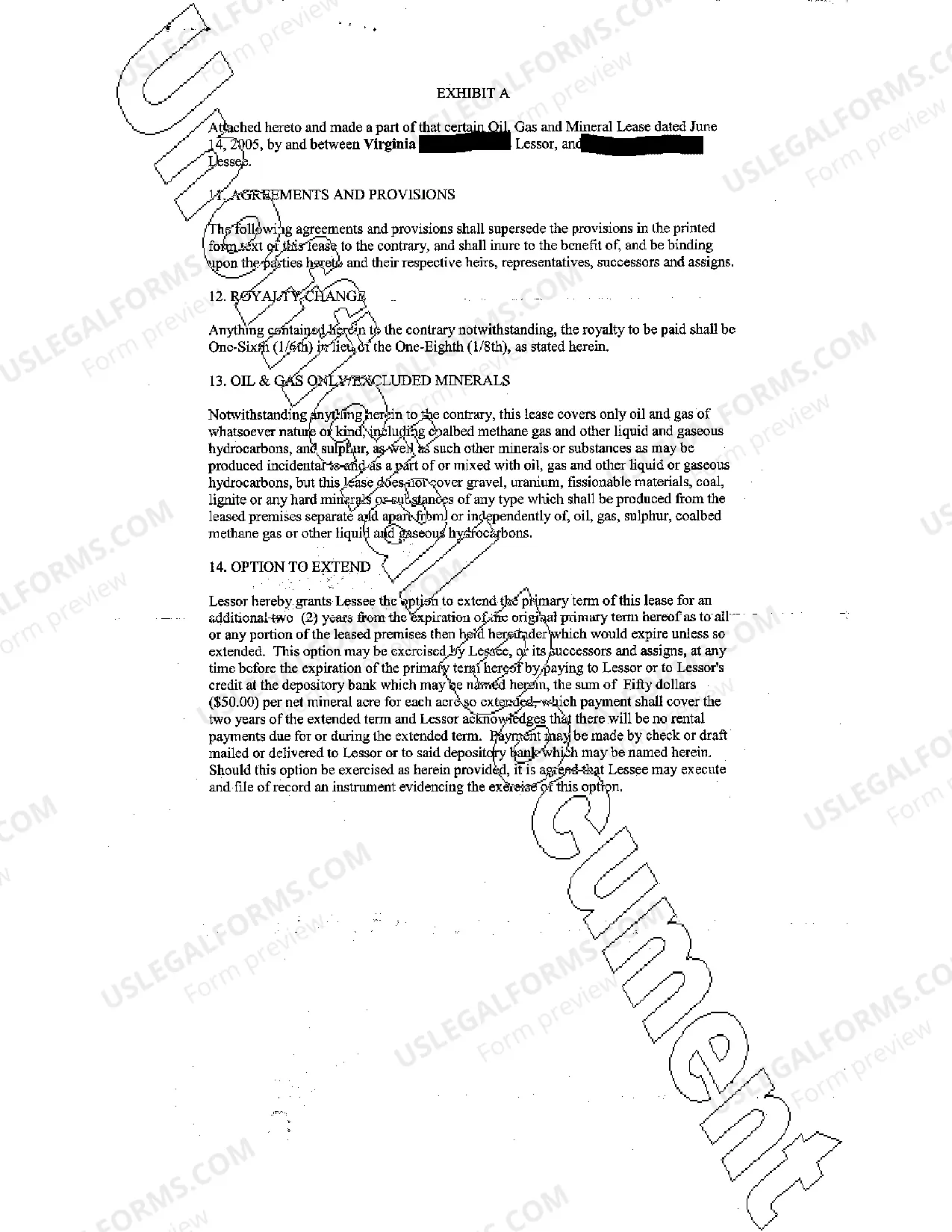

Travis Texas Oil, Gas, and Mineral Lease is a legal agreement between a landowner in Travis County, Texas, and an oil and gas company. This lease grants the company the right to explore, drill, extract, and produce oil, gas, and other valuable minerals found beneath the surface of the designated property. The Travis Texas Oil, Gas, and Mineral Lease typically specify the obligations and rights of both the landowner, known as the lessor, and the oil and gas company, known as the lessee. It outlines important terms such as the lease duration, royalty rates, payment terms, drilling provisions, and environmental considerations. This type of lease allows the lessee to access and exploit the subsurface resources, including oil, natural gas, coaled methane, and various mineral deposits, such as limestone, sand, gravel, or even uranium, if found on the property. The lease may also cover related activities like seismic exploration, water usage, and infrastructure development associated with oil and gas extraction. There can be different types of Travis Texas Oil, Gas, and Mineral Leases, depending on the negotiation between the parties involved. Some common variations include: 1. Primary Term Lease: This type of lease specifies a fixed term during which the lessee has the exclusive right to explore, drill, and produce, usually ranging from one to five years. If the lessee discovers oil, gas, or minerals within the primary term, they can continue production during the secondary term. 2. Secondary Term Lease: Once the primary term lease expires, the lease may enter into the secondary term if production is ongoing. The secondary term is often extended until production ceases or the lease is terminated due to non-compliance with agreed-upon conditions. 3. Royalty Lease: In a royalty lease, the lessor receives a percentage of the revenue generated from the sale of oil, gas, or minerals. The royalty rate is negotiated between the parties and typically ranges from 12% to 25%. 4. Paid-Up Lease: A paid-up lease is a single lump-sum payment made by the lessee at the beginning of the lease term. This upfront payment usually covers the entire lease period and relieves the lessee from making any further payments to the lessor during that term. 5. Non-Development Lease: A non-development lease grants the lessee the right to hold onto the mineral rights without any obligation to drill or produce until they decide to develop the property. This type of lease is often used by companies during periods of low oil and gas prices or when further exploration is not economically viable. 6. Surface Use Agreement: In addition to the core lease agreement, a surface use agreement may be required to address the surface activities associated with oil, gas, and mineral extraction. This agreement covers matters such as road construction, site access, reclamation, and damage compensation for any disturbances caused to the surface property during drilling or extraction activities. Understanding these different types of Travis Texas Oil, Gas, and Mineral Leases is vital for both landowners and oil and gas companies to ensure fair terms and conditions are agreed upon while maximizing the potential benefits for all parties involved.Travis Texas Oil, Gas, and Mineral Lease is a legal agreement between a landowner in Travis County, Texas, and an oil and gas company. This lease grants the company the right to explore, drill, extract, and produce oil, gas, and other valuable minerals found beneath the surface of the designated property. The Travis Texas Oil, Gas, and Mineral Lease typically specify the obligations and rights of both the landowner, known as the lessor, and the oil and gas company, known as the lessee. It outlines important terms such as the lease duration, royalty rates, payment terms, drilling provisions, and environmental considerations. This type of lease allows the lessee to access and exploit the subsurface resources, including oil, natural gas, coaled methane, and various mineral deposits, such as limestone, sand, gravel, or even uranium, if found on the property. The lease may also cover related activities like seismic exploration, water usage, and infrastructure development associated with oil and gas extraction. There can be different types of Travis Texas Oil, Gas, and Mineral Leases, depending on the negotiation between the parties involved. Some common variations include: 1. Primary Term Lease: This type of lease specifies a fixed term during which the lessee has the exclusive right to explore, drill, and produce, usually ranging from one to five years. If the lessee discovers oil, gas, or minerals within the primary term, they can continue production during the secondary term. 2. Secondary Term Lease: Once the primary term lease expires, the lease may enter into the secondary term if production is ongoing. The secondary term is often extended until production ceases or the lease is terminated due to non-compliance with agreed-upon conditions. 3. Royalty Lease: In a royalty lease, the lessor receives a percentage of the revenue generated from the sale of oil, gas, or minerals. The royalty rate is negotiated between the parties and typically ranges from 12% to 25%. 4. Paid-Up Lease: A paid-up lease is a single lump-sum payment made by the lessee at the beginning of the lease term. This upfront payment usually covers the entire lease period and relieves the lessee from making any further payments to the lessor during that term. 5. Non-Development Lease: A non-development lease grants the lessee the right to hold onto the mineral rights without any obligation to drill or produce until they decide to develop the property. This type of lease is often used by companies during periods of low oil and gas prices or when further exploration is not economically viable. 6. Surface Use Agreement: In addition to the core lease agreement, a surface use agreement may be required to address the surface activities associated with oil, gas, and mineral extraction. This agreement covers matters such as road construction, site access, reclamation, and damage compensation for any disturbances caused to the surface property during drilling or extraction activities. Understanding these different types of Travis Texas Oil, Gas, and Mineral Leases is vital for both landowners and oil and gas companies to ensure fair terms and conditions are agreed upon while maximizing the potential benefits for all parties involved.