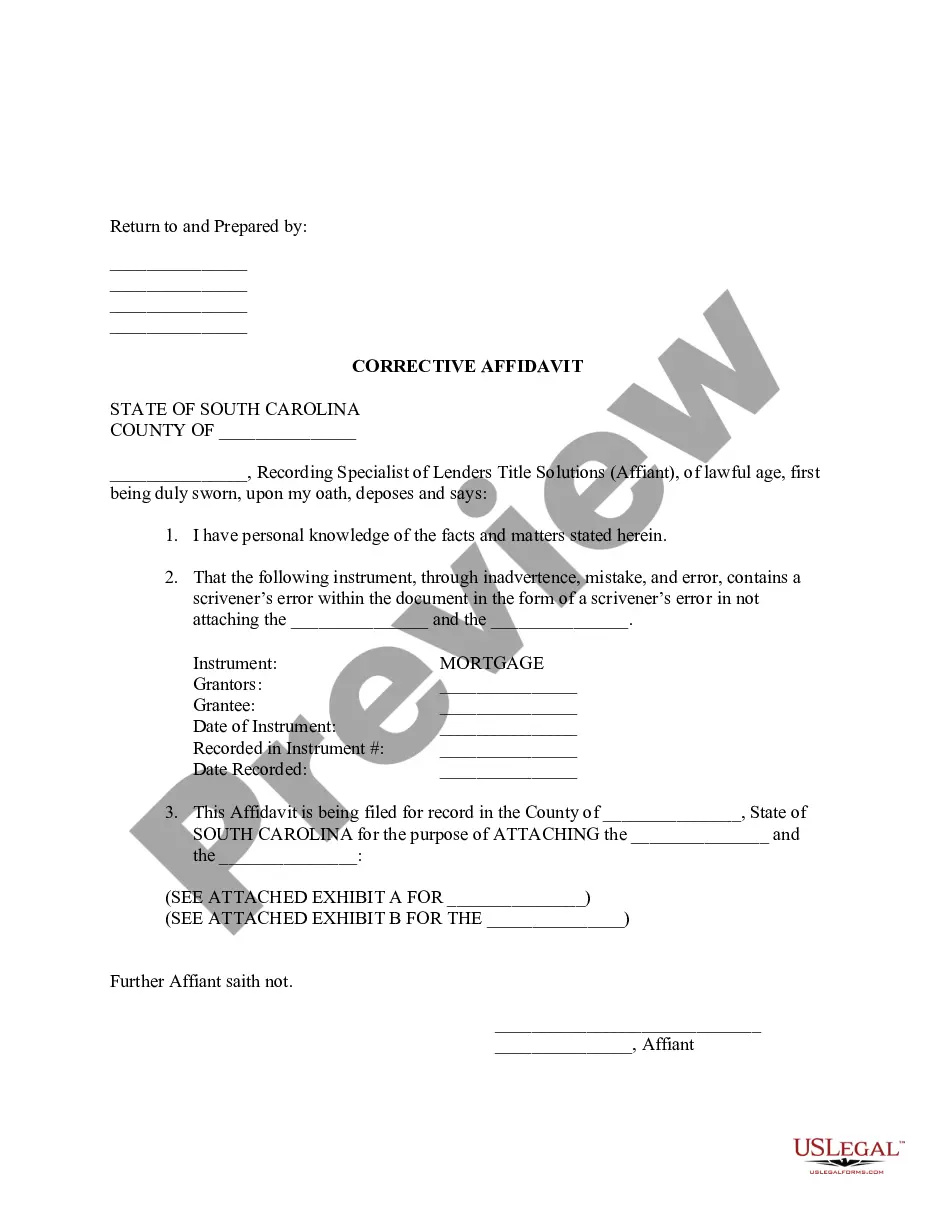

Dallas Texas Security Agreement is a legally binding document that outlines the terms and conditions related to the collateral provided by a borrower to a lender to secure a loan or debt. It serves as a protection for the lender in case the borrower defaults on the loan payments. A security agreement is commonly used in various financial transactions, such as real estate mortgages, business loans, or personal loans. In Dallas, Texas, there are different types of security agreements that serve specific purposes based on the nature of the transaction or loan involved. Some commonly known types include: 1. Real Estate Security Agreement: This agreement is used when the collateral for the loan is real property, such as a house or land. It establishes a lien on the property, giving the lender the right to foreclose and sell the property to recover their funds if the borrower fails to meet the agreed-upon loan terms. 2. Business Security Agreement: This type of agreement is utilized when a borrower pledges business assets, such as inventory, equipment, accounts receivable, or intellectual property, as collateral for a loan. It ensures that the lender can seize and sell the pledged assets to recover their investment if the borrower defaults. 3. Personal Security Agreement: Often utilized for personal loans, this agreement allows an individual borrower to secure a loan with personal assets like a car, jewelry, or other valuable possessions. The lender can take possession of these assets in case the borrower fails to repay the loan as agreed. 4. Debenture: This is a specific type of security agreement used by businesses to secure long-term loans. It pledges the company's assets as collateral and provides the lender with a legal claim over the assets if the company defaults. 5. UCC-1 Financing Statement: While not technically a security agreement itself, it is a crucial part of the documentation process. A UCC-1 Financing Statement is filed by the lender with the Secretary of State's office to publicly record their security interest in the borrower's assets. It provides notice to other potential creditors that a specific asset has already been pledged as collateral. Dallas Texas Security Agreements are essential in protecting both lenders and borrowers. They define the rights and obligations of each party and ensure that the collateral provided is properly documented and legally enforceable. It is advisable for all parties involved in financial transactions in Dallas, Texas, to consult with legal professionals to ensure the proper drafting and execution of security agreements specific to their needs and circumstances.

Dallas Texas Security Agreement

Description

How to fill out Dallas Texas Security Agreement?

If you are looking for a valid form template, it’s impossible to choose a better place than the US Legal Forms website – one of the most considerable libraries on the web. With this library, you can get a large number of document samples for business and individual purposes by types and regions, or keywords. With the advanced search feature, discovering the latest Dallas Texas Security Agreement is as easy as 1-2-3. Additionally, the relevance of each and every record is verified by a group of skilled attorneys that regularly review the templates on our platform and update them according to the latest state and county laws.

If you already know about our platform and have an account, all you need to get the Dallas Texas Security Agreement is to log in to your account and click the Download button.

If you utilize US Legal Forms for the first time, just refer to the instructions listed below:

- Make sure you have chosen the sample you require. Check its description and make use of the Preview function (if available) to check its content. If it doesn’t meet your needs, utilize the Search field at the top of the screen to discover the appropriate document.

- Affirm your decision. Click the Buy now button. Next, pick the preferred pricing plan and provide credentials to sign up for an account.

- Process the financial transaction. Make use of your bank card or PayPal account to finish the registration procedure.

- Obtain the template. Select the format and save it on your device.

- Make modifications. Fill out, revise, print, and sign the obtained Dallas Texas Security Agreement.

Each and every template you add to your account does not have an expiry date and is yours forever. It is possible to gain access to them using the My Forms menu, so if you want to receive an extra duplicate for modifying or printing, feel free to come back and save it once again anytime.

Make use of the US Legal Forms professional library to get access to the Dallas Texas Security Agreement you were looking for and a large number of other professional and state-specific templates on one website!