A Round Rock Texas Security Agreement is a legal contract that establishes a priority interest in a property or asset to secure a debt or obligation owed by one party to another. It is an essential aspect of financial transactions that involve lending or borrowing funds, typically used in business or personal loan agreements. Key features of a Round Rock Texas Security Agreement include: 1. Collateral: The agreement identifies and describes the specific collateral or property that the debtor pledges to secure the debt. This collateral can include real estate, vehicles, inventory, accounts receivable, or other valuable assets. 2. Debtor and Creditor: The agreement outlines the roles and responsibilities of both parties involved in the transaction. The debtor is the individual or entity who owes the debt, while the creditor is the lender or party who is owed the debt. 3. Debt or Obligation: The agreement specifies the nature and extent of the debt or obligation that the security interest secures. This could include a loan amount, installment payments, interest rates, or other financial terms agreed upon. 4. Perfection of Security Interest: To ensure the creditor's priority in the collateral, the agreement addresses the steps required to perfect the security interest. This may involve filing necessary documents with the appropriate governmental authority, such as the Texas Secretary of State, to provide public notice of the security interest. Different types of Round Rock Texas Security Agreements may include: 1. Real Estate Security Agreement: This type of agreement is used when the collateral offered as security is real property, such as land, buildings, or homes. 2. Personal Property Security Agreement: This agreement secures a debt or obligation with personal property, including inventory, equipment, accounts receivable, or other movable assets. 3. Floating Lien Security Agreement: In certain cases, a creditor may obtain a security interest in a debtor's present and future assets to secure a revolving line of credit or ongoing financial relationship. 4. Purchase Money Security Agreement: This agreement is executed when a seller provides financing to a buyer to purchase specific goods or equipment, with the purchased items serving as collateral. In conclusion, a Round Rock Texas Security Agreement is a critical legal document that establishes the priority of a creditor's security interest in specified collateral to secure a debt or obligation. Different types of security agreements exist depending on the nature of the collateral and specific circumstances of the transaction. It is crucial for all parties involved to understand the terms, rights, and obligations outlined in this agreement to ensure a successful and legally enforceable transaction.

Round Rock Texas Security Agreement

State:

Texas

City:

Round Rock

Control #:

TX-JW-0054

Format:

PDF

Instant download

This form is available by subscription

Description

Security Agreement

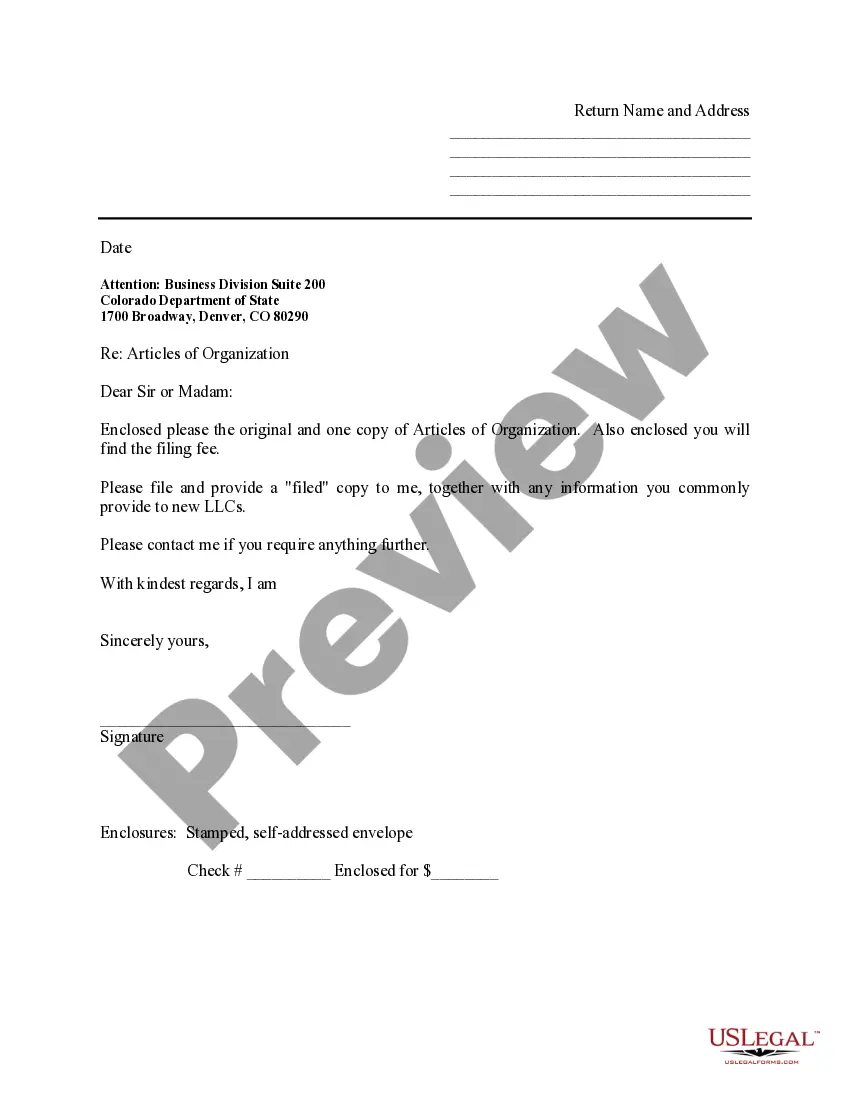

Free preview

How to fill out Round Rock Texas Security Agreement?

If you are looking for an appropriate form template, it’s challenging to select a more user-friendly service than the US Legal Forms site – likely the largest online repositories.

Here you can acquire thousands of document examples for business and personal use by classifications and geographical areas, or keywords.

With our sophisticated search capability, locating the latest Round Rock Texas Security Agreement is as simple as 1-2-3.

Complete the transaction. Employ your credit card or PayPal account to finalize the registration process.

Receive the form. Choose the file format and download it to your device.

- Moreover, the pertinence of each document is validated by a team of proficient attorneys who consistently evaluate the templates on our platform and update them in accordance with the latest state and county regulations.

- If you are familiar with our system and possess a registered account, all you need to obtain the Round Rock Texas Security Agreement is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, simply adhere to the steps outlined below.

- Ensure you have selected the sample you require. Review its description and utilize the Preview feature (if available) to inspect its contents. If it does not meet your criteria, use the Search field at the top of the screen to locate the suitable file.

- Confirm your choice. Click the Buy now button. Next, select your preferred pricing option and provide the information needed to set up an account.

Form popularity

Interesting Questions

More info

What is Off-Campus Living? Resources. Round Rock At-A-Glance.However, once the interest attaches, the creditor has the right to enforce the security interest in the collateral against the debtor. The whole family will have fun at this magical place in the Texas Hill Country! Climbing Enchanted Rock is almost a rite of passage for Texans. United States. Congress. House. Committee on Financial Services. Travis County, Texas. United Heritage Credit Union offers banking services, competitive loan products and personalized service in Austin, in Tyler and throughout Central Texas. Frequently Asked Questions (FAQs) about the ins and outs to a family vacation to Kalahari Resorts and Conventions in Round Rock, TX.