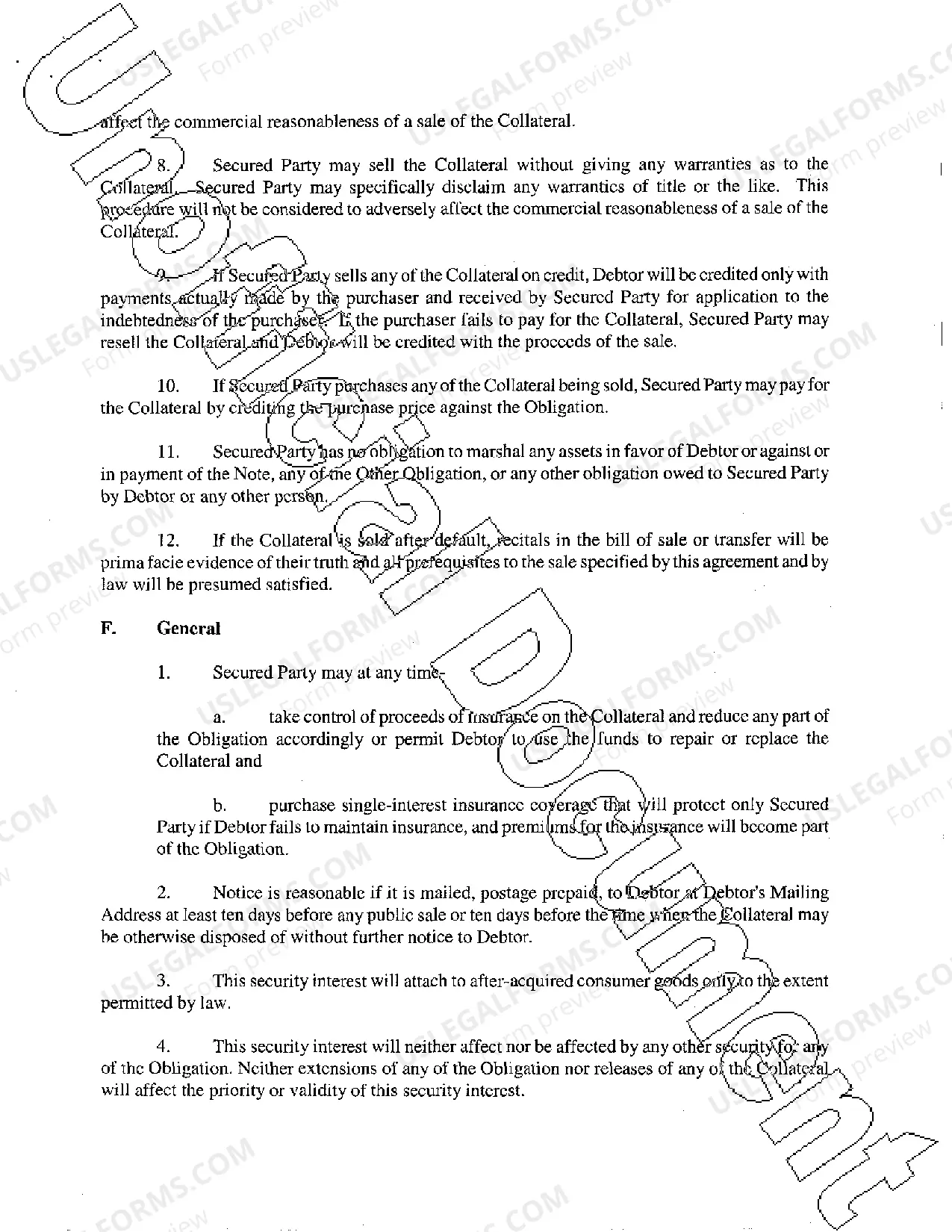

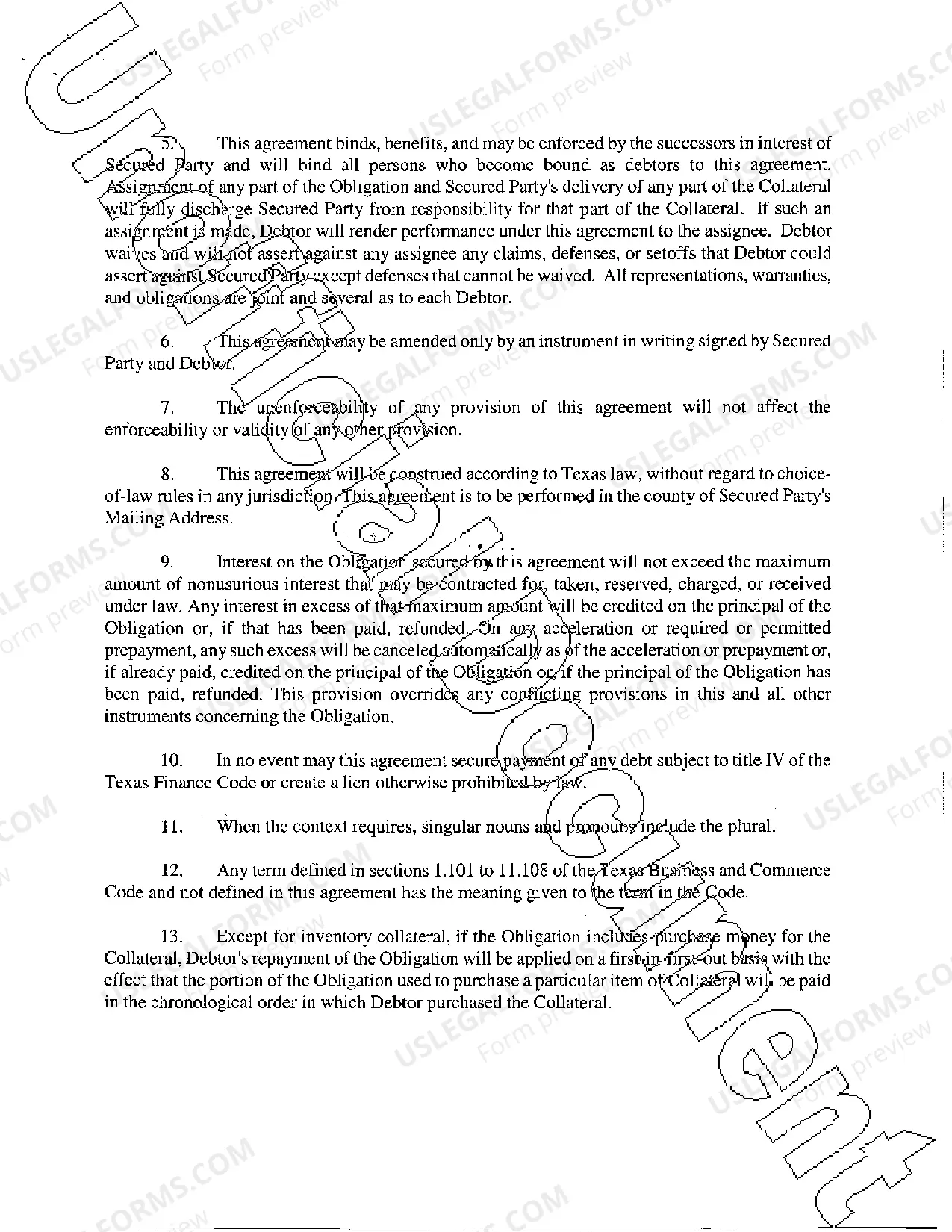

Travis Texas Security Agreement is a legal document designed to establish an agreement between a borrower and a lender regarding the use of specific collateral to secure a loan or debt. This detailed description will outline the key aspects, components, and types of Travis Texas Security Agreement, shedding light on the essential keywords associated with this topic. A Travis Texas Security Agreement serves as a mechanism to ensure that a lender has a right to reclaim specific assets if the borrower fails to repay the loan amount as per the agreed terms and conditions. By entering into such an agreement, the borrower consents to grant the lender a security interest or lien on the specified collateral, which acts as a guarantee for the loan. The content keywords associated with Travis Texas Security Agreement include: 1. Security Agreement: This term refers to the legal contract between the borrower and the lender that outlines the terms and conditions for securing a loan with specific collateral. 2. Collateral: In the context of a Travis Texas Security Agreement, collateral refers to the assets or property agreed upon to secure the debt. It can comprise real estate, vehicles, equipment, investments, or other valuable items. 3. Lender: This term represents the entity or individual that provides the loan or credit to the borrower and is safeguarded through the security agreement. 4. Borrower: The borrower is the entity or individual receiving the loan amount and offering the collateral to secure the debt. 5. Debtor: Often used interchangeably with the borrower, this refers to the party responsible for repaying the loan amount borrowed from the lender. 6. Repayment Terms: These stipulate the agreed-upon conditions and schedule for loan repayment, including interest rates, due dates, and any applicable fees. 7. Default: A default occurs when the borrower fails to meet their repayment obligations or breaches other terms defined in the security agreement, triggering the lender's right to claim the collateral. Different types of Travis Texas Security Agreement include: 1. Real Estate Security Agreement: This type of security agreement pertains to loans in which real estate properties, such as residential or commercial buildings, are used as collateral. 2. Vehicle Security Agreement: In this case, the collateral provided is a vehicle, such as a car, truck, or motorcycle, which guarantees the repayment of the loan. 3. Equipment Security Agreement: This type of security agreement involves using specific equipment, machinery, or technology as collateral to secure a loan. 4. Investment Security Agreement: Investments, such as stocks, bonds, or mutual funds, can be used as collateral to secure a loan with this type of security agreement. 5. General Security Agreement: This type of agreement covers a broad range of collateral, allowing borrowers to secure loans using various types of assets or properties. In conclusion, a Travis Texas Security Agreement is a legally binding tool used to secure loans with collateral. The agreement encompasses terms and conditions related to repayment, collateral, and the consequences of default. Different types include real estate, vehicle, equipment, investment, and general security agreements. Understanding the keywords and types associated with Travis Texas Security Agreement can provide a comprehensive understanding of the topic for borrowers, lenders, and legal professionals.

Travis Texas Security Agreement

State:

Texas

County:

Travis

Control #:

TX-JW-0054

Format:

PDF

Instant download

This form is available by subscription

Description

Security Agreement

Travis Texas Security Agreement is a legal document designed to establish an agreement between a borrower and a lender regarding the use of specific collateral to secure a loan or debt. This detailed description will outline the key aspects, components, and types of Travis Texas Security Agreement, shedding light on the essential keywords associated with this topic. A Travis Texas Security Agreement serves as a mechanism to ensure that a lender has a right to reclaim specific assets if the borrower fails to repay the loan amount as per the agreed terms and conditions. By entering into such an agreement, the borrower consents to grant the lender a security interest or lien on the specified collateral, which acts as a guarantee for the loan. The content keywords associated with Travis Texas Security Agreement include: 1. Security Agreement: This term refers to the legal contract between the borrower and the lender that outlines the terms and conditions for securing a loan with specific collateral. 2. Collateral: In the context of a Travis Texas Security Agreement, collateral refers to the assets or property agreed upon to secure the debt. It can comprise real estate, vehicles, equipment, investments, or other valuable items. 3. Lender: This term represents the entity or individual that provides the loan or credit to the borrower and is safeguarded through the security agreement. 4. Borrower: The borrower is the entity or individual receiving the loan amount and offering the collateral to secure the debt. 5. Debtor: Often used interchangeably with the borrower, this refers to the party responsible for repaying the loan amount borrowed from the lender. 6. Repayment Terms: These stipulate the agreed-upon conditions and schedule for loan repayment, including interest rates, due dates, and any applicable fees. 7. Default: A default occurs when the borrower fails to meet their repayment obligations or breaches other terms defined in the security agreement, triggering the lender's right to claim the collateral. Different types of Travis Texas Security Agreement include: 1. Real Estate Security Agreement: This type of security agreement pertains to loans in which real estate properties, such as residential or commercial buildings, are used as collateral. 2. Vehicle Security Agreement: In this case, the collateral provided is a vehicle, such as a car, truck, or motorcycle, which guarantees the repayment of the loan. 3. Equipment Security Agreement: This type of security agreement involves using specific equipment, machinery, or technology as collateral to secure a loan. 4. Investment Security Agreement: Investments, such as stocks, bonds, or mutual funds, can be used as collateral to secure a loan with this type of security agreement. 5. General Security Agreement: This type of agreement covers a broad range of collateral, allowing borrowers to secure loans using various types of assets or properties. In conclusion, a Travis Texas Security Agreement is a legally binding tool used to secure loans with collateral. The agreement encompasses terms and conditions related to repayment, collateral, and the consequences of default. Different types include real estate, vehicle, equipment, investment, and general security agreements. Understanding the keywords and types associated with Travis Texas Security Agreement can provide a comprehensive understanding of the topic for borrowers, lenders, and legal professionals.

Free preview

How to fill out Travis Texas Security Agreement?

If you’ve already utilized our service before, log in to your account and save the Travis Texas Security Agreement on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to get your file:

- Make certain you’ve found the right document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to find the proper one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Travis Texas Security Agreement. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your individual or professional needs!