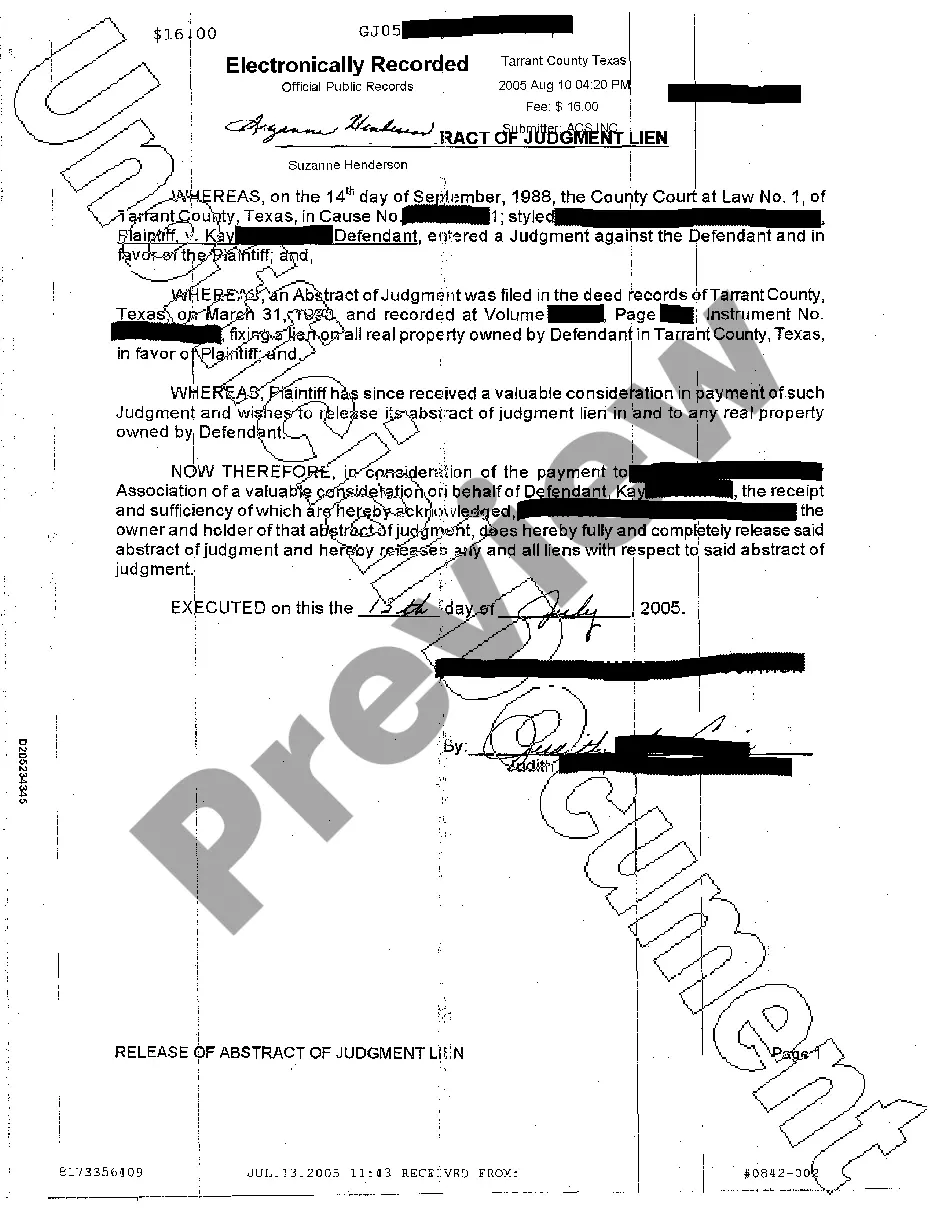

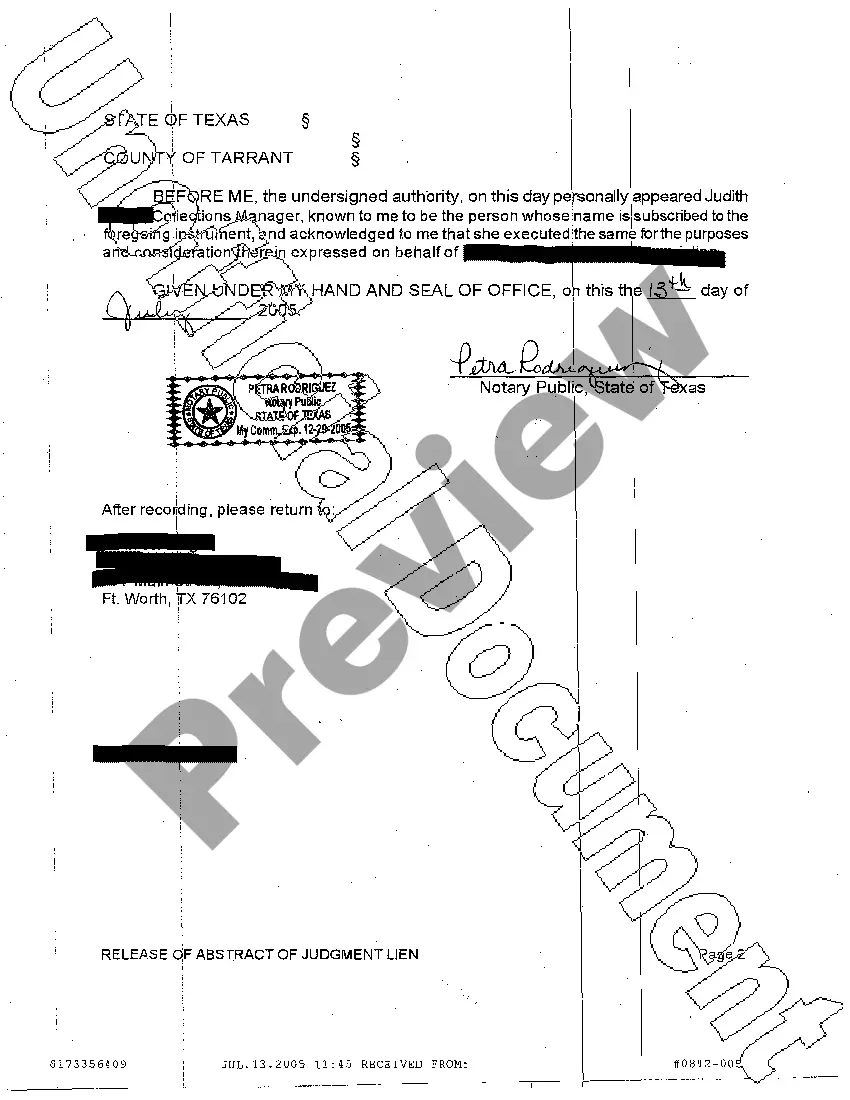

Title: Understanding the Bexar Texas Release of Abstract of Judgment Lien Description: The Bexar Texas Release of Abstract of Judgment Lien is a legal document that serves as proof of the termination or removal of a previously filed Abstract of Judgment Lien in Bexar County, Texas. This important procedure allows individuals, businesses, or entities to formally clear an existing lien, ensuring it no longer burdens the respective property. Keywords: Bexar Texas Release, Abstract of Judgment Lien, termination, removal, Bexar County, Texas, property, clear, burden. Types of Bexar Texas Release of Abstract of Judgment Lien: 1. Full Release of Abstract of Judgment Lien: This type of release indicates that the entire judgment lien has been completely cleared from the property. Once recorded, it signifies the free and clear status of the property and removes any encumbrances associated with the judgment lien. 2. Partial Release of Abstract of Judgment Lien: In certain cases, a partial release may be issued when a portion of the judgment lien has been paid off or settled. This document specifies the amount or percentage by which the lien has been reduced or released, reducing the claim on the property accordingly. 3. Release of Abstract of Judgment Lien Prior to Payment: Sometimes, the party who filed the judgment lien may voluntarily release the lien before it is satisfied in full. This could occur if a settlement or agreement is reached between the parties involved, thereby ensuring the release of the lien earlier than anticipated. 4. Release of Abstract of Judgment Lien due to Payment in Full: When the entire judgment lien is satisfied, this type of release is issued, providing evidence that the lien has been fully settled, and there are no remaining claims on the property. 5. Release of Abstract of Judgment Lien through Judgment Cancellation: If a judgment is successfully overturned or vacated through legal means, this release type is used to remove the judgment lien from the property, erasing any prior claims associated with the judgment. Remember, it is crucial to consult with a legal professional or an authorized entity to understand the specific requirements and procedures for releasing an Abstract of Judgment Lien in Bexar County, Texas.

Title: Understanding the Bexar Texas Release of Abstract of Judgment Lien Description: The Bexar Texas Release of Abstract of Judgment Lien is a legal document that serves as proof of the termination or removal of a previously filed Abstract of Judgment Lien in Bexar County, Texas. This important procedure allows individuals, businesses, or entities to formally clear an existing lien, ensuring it no longer burdens the respective property. Keywords: Bexar Texas Release, Abstract of Judgment Lien, termination, removal, Bexar County, Texas, property, clear, burden. Types of Bexar Texas Release of Abstract of Judgment Lien: 1. Full Release of Abstract of Judgment Lien: This type of release indicates that the entire judgment lien has been completely cleared from the property. Once recorded, it signifies the free and clear status of the property and removes any encumbrances associated with the judgment lien. 2. Partial Release of Abstract of Judgment Lien: In certain cases, a partial release may be issued when a portion of the judgment lien has been paid off or settled. This document specifies the amount or percentage by which the lien has been reduced or released, reducing the claim on the property accordingly. 3. Release of Abstract of Judgment Lien Prior to Payment: Sometimes, the party who filed the judgment lien may voluntarily release the lien before it is satisfied in full. This could occur if a settlement or agreement is reached between the parties involved, thereby ensuring the release of the lien earlier than anticipated. 4. Release of Abstract of Judgment Lien due to Payment in Full: When the entire judgment lien is satisfied, this type of release is issued, providing evidence that the lien has been fully settled, and there are no remaining claims on the property. 5. Release of Abstract of Judgment Lien through Judgment Cancellation: If a judgment is successfully overturned or vacated through legal means, this release type is used to remove the judgment lien from the property, erasing any prior claims associated with the judgment. Remember, it is crucial to consult with a legal professional or an authorized entity to understand the specific requirements and procedures for releasing an Abstract of Judgment Lien in Bexar County, Texas.