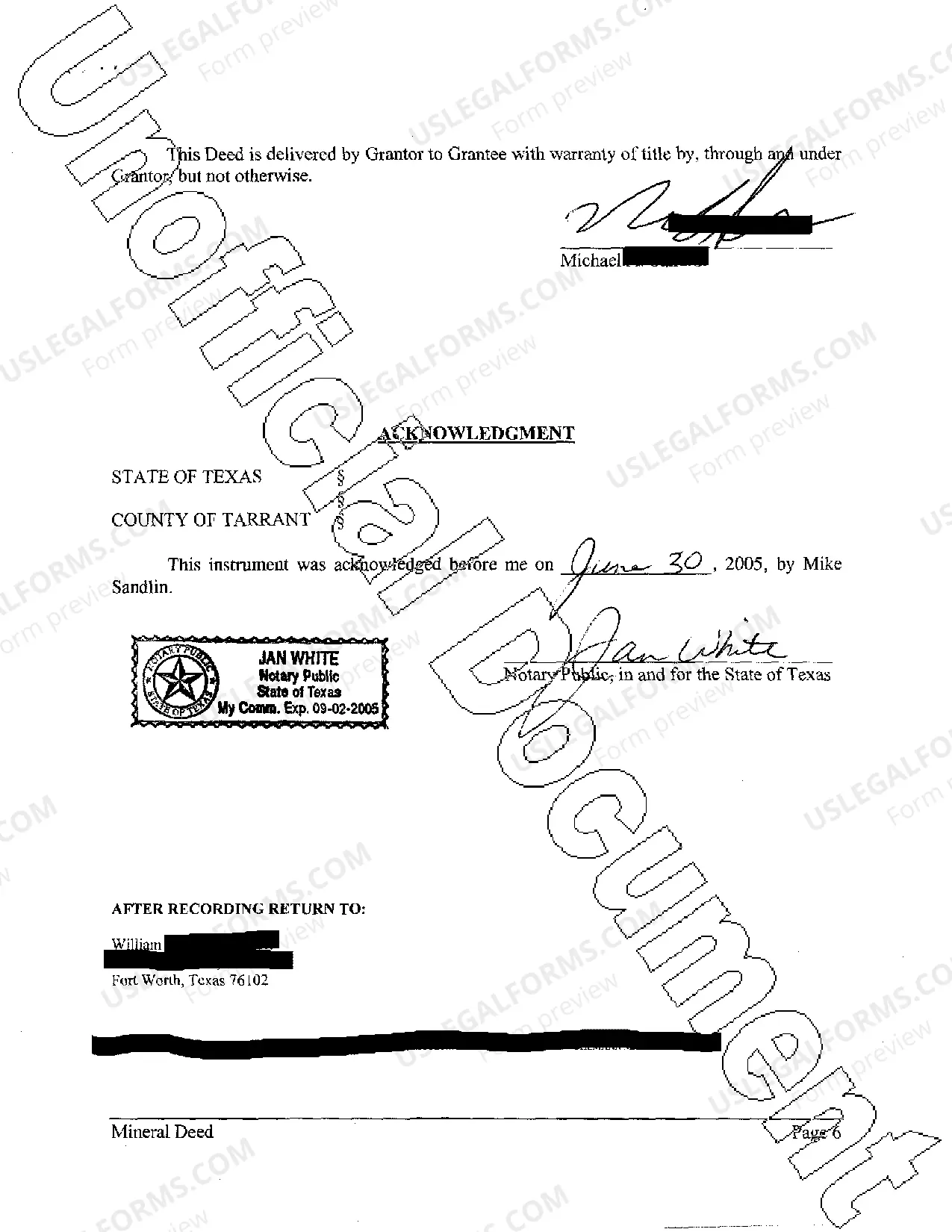

This deed grants, bargains, sells, conveys, and transfers to Grantee an undivided ten percent interest in and to all of Grantor's right, title, and interest in the oil, gas, and other minerals in, on, and under that may be produced from the agreed upon land.

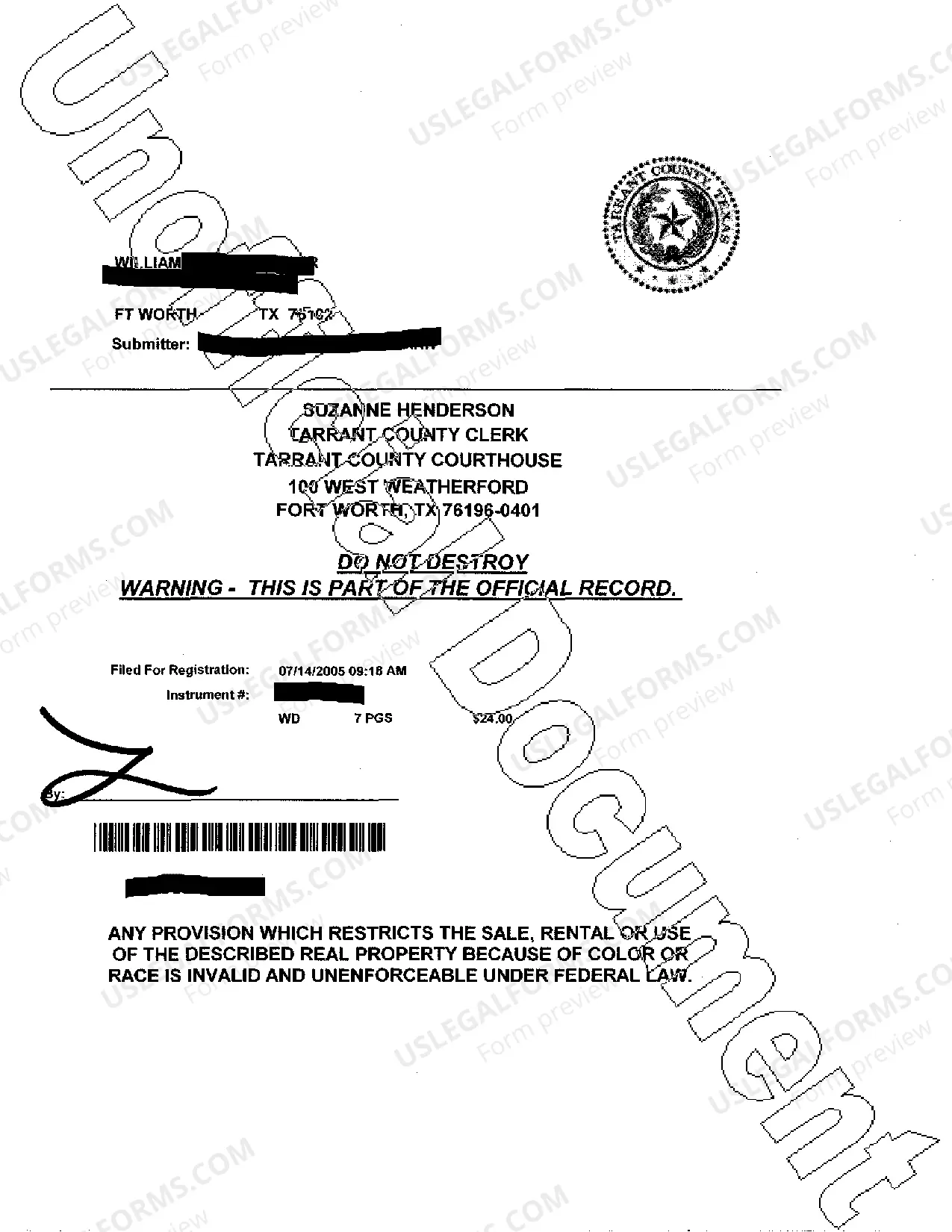

The Bexar Texas Mineral Deed is a legal document that transfers ownership rights of mineral interests located within Bexar County, Texas. This deed serves as proof of ownership for individuals or entities who wish to assert control over the mineral resources found on a particular property. The Bexar Texas Mineral Deed is an essential document in the oil and gas industry as it grants the holder the right to explore, extract, and profit from the minerals located within the boundaries of the property. These minerals include oil, natural gas, coal, gravel, and other valuable subsurface resources. There are two common types of Bexar Texas Mineral Deeds: 1. General Mineral Deed: This type of deed transfers the entire mineral interest from the granter to the grantee without any reservations or restrictions. It provides the grantee with complete control and ownership of all minerals present in the property. 2. Special Mineral Deed: A special mineral deed, on the other hand, may contain specific reservations or limitations that grant only a part of the mineral interest to the grantee. These limitations may include a specific percentage or fraction of ownership, or they may be based on a particular type of mineral or resource. Keywords: Bexar Texas, mineral deed, ownership rights, Bexar County, Texas, mineral interests, proof of ownership, control, mineral resources, property, oil and gas industry, explore, extract, profit, minerals, oil, natural gas, coal, gravel, subsurface resources, general mineral deed, special mineral deed, reservations, restrictions, complete control, ownership, granter, grantee, limited interest.